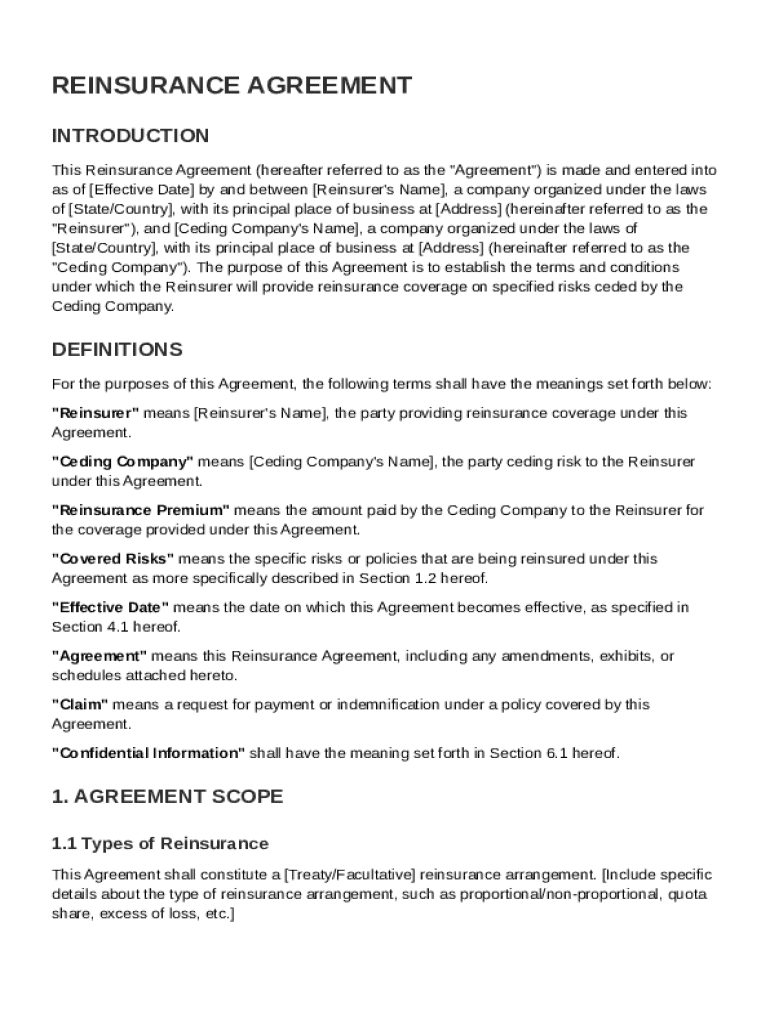

Reinsurance Agreement Template free printable template

Show details

This document establishes the terms and conditions under which a Reinsurer provides reinsurance coverage to a Ceding Company on specified risks.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Reinsurance Agreement Template

A Reinsurance Agreement Template is a standardized document that outlines the terms and conditions under which one insurance company (the reinsurer) agrees to indemnify another insurance company from risk.

pdfFiller scores top ratings on review platforms

Good Service

I use pdffiller from time to time. I find it really useful and have had really good service from them.

Helps me a lot to fill out CMS 1500.

best

best site and very easy

struggles a bit in beginning to get…

struggles a bit in beginning to get signature. Entering initials is still a problem.

really useful

great

great, awesome program

Who needs Reinsurance Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to Reinsurance Agreement Template on pdfFiller

How do you define a reinsurance agreement?

A reinsurance agreement is a contract between an insurance company and a reinsurer, which allows the insurer to transfer some of its risk in exchange for a fee, known as a premium. This agreements include key components such as covered risks, payment terms, and duration of coverage.

-

The main elements include the parties involved, definition of covered risks, premium costs, and duration of the contract.

-

Having a structured reinsurance agreement helps mitigate risks effectively and ensures compliance with regulatory standards.

What fields are essential in the reinsurance agreement?

Essential fields in a reinsurance agreement provide clarity and security for both the reinsurer and the ceding company. These fields ensure that both parties have a mutual understanding of their obligations.

-

Details about the reinsurer must be clearly provided to establish credibility and accountability.

-

This includes the names, addresses, and registration numbers to identify the parties involved.

-

Specifying when the agreement takes effect and how long it will last is crucial for continuity.

-

Clearly outline how premiums will be calculated and paid to avoid disputes.

-

This section should specify what types of risks are included in the reinsurance coverage.

What types of reinsurance arrangements exist?

Understanding the types of reinsurance arrangements is crucial for effective risk management. The two primary arrangements can be broadly classified into treaty and facultative reinsurance.

-

Treaty reinsurance involves automatic coverage on a portfolio basis, while facultative reinsurance is negotiated for individual risks.

-

Proportional reinsurance involves sharing the premiums and losses, whereas non-proportional reinsurance only kicks in once losses exceed a certain threshold.

-

Quota share reinsurance provides a fixed percentage of the policy to the reinsurer, while excess of loss arrangements cover losses that exceed a specified limit.

What are the steps to fill out the reinsurance agreement template?

Filling out a reinsurance agreement template accurately is essential to ensure all vital information is captured correctly. Follow the steps below to complete the template.

-

Be meticulous when entering names and addresses to avoid future confusion.

-

Identify and list all risks that the agreement will cover to prevent misinterpretation.

-

Calculate the premium based on the agreed terms and outline the payment schedule.

How can interactive tools help manage your reinsurance agreement?

Utilizing interactive tools within pdfFiller can streamline the management of your reinsurance agreements significantly. These features enhance collaboration and efficiency.

-

With robust editing tools, you can easily modify terms and conditions as required.

-

Sign documents electronically to expedite the approval process.

-

Invite team members to contribute, ensuring all perspectives are considered.

How do you ensure compliance in your reinsurance agreement?

Compliance with legal requirements and industry standards is critical when drafting a reinsurance agreement. This helps minimize future complications.

-

Familiarize yourself with local laws governing reinsurance in your region.

-

Ensure that your agreements align with best practices followed in the insurance sector.

-

Be aware of common errors such as vague terms or incomplete information that could lead to disputes.

What are finalization and management steps for the reinsurance agreement?

After drafting, conducting a thorough review ensures that the reinsurance agreement is exhaustive and meets all requirements before finalization.

-

Double-check all fields for accuracy and completeness.

-

Utilize pdfFiller for secure storage, allowing anytime access to your agreement.

-

Establish clear processes for revising agreements as your risks evolve.

How to fill out the Reinsurance Agreement Template

-

1.Open the Reinsurance Agreement Template on pdfFiller.

-

2.Enter the date of the agreement at the top of the document.

-

3.Fill in the names and contact information of both parties involved: the ceding insurer and the reinsurer.

-

4.Specify the type of reinsurance being offered, such as proportional or non-proportional.

-

5.Detail the risks being reinsured, including limits and exclusions.

-

6.Include the premium payment terms and conditions.

-

7.Add any special clauses relevant to the agreement, such as arbitration or jurisdiction clauses.

-

8.Review the entire document for accuracy and completeness.

-

9.Once all fields are filled, save a copy for your records and share it with the involved parties before finalizing the agreement.

What is a reinsurance agreement?

Issue: Reinsurance, often referred to as “insurance for insurance companies,” is a contract between a reinsurer and an insurer. In this contract, the insurance company — the cedent — transfers risk to the reinsurance company, and the latter assumes all or part of one or more insurance policies issued by the cedent.

What are the three types of reinsurance?

Types of Reinsurance Facultative Reinsurance. This is the oldest form of reinsurance. Statutory Reinsurance. Statutory reinsurance or obligatory reinsurance is a form of reinsurance that insurers in certain territories are required to cede, as defined by law in a defined territory. Reinsurance Underwriting Pools.

What is the 9 month rule for reinsurance contracts?

The 9-month rule, which comes out of Part 23 of SSAP 62, requires that the reinsurance contract be finalized — reduced to written form and signed within 9 months after commencement of the policy period — but allows the contract to incept before the contract is finalized.

What is the six month rule for reinsurance?

Procedural requirements for contracts This rule requires that within six months of inception, an insurer has in place fully signed and stamped reinsurance treaty contract wordings, and within two months of inception the insurer has appropriate placing slips or cover notes in place.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.