Last updated on Feb 17, 2026

Repayment Plan Agreement Template free printable template

Show details

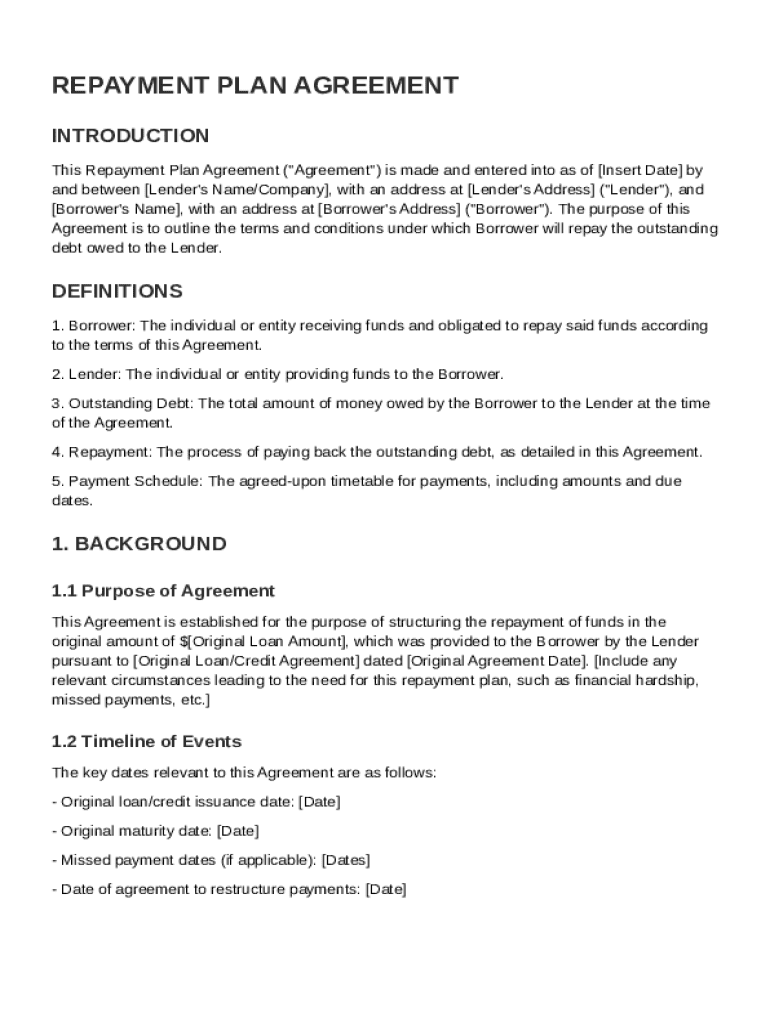

This document outlines the terms and conditions under which a Borrower will repay the outstanding debt owed to a Lender.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Repayment Plan Agreement Template

A Repayment Plan Agreement Template is a formal document outlining the terms and conditions for repaying a debt in installments over a specified period.

pdfFiller scores top ratings on review platforms

Still working my way through my first document, but so far seems FAIRLY simple to use

It takes a minute to get use to but I think I'm getting it. Trying to use to send files to the government.

I was trying to figure out how to just save a pdf filled out.... there are so many pop up windows.

Great, works well. Only complaint is hard to save versions

Great application for getting forms filled out quickly and efficiently. Love the feature of being able to mail directly from the application and have used that several times.

The website was a little confusing as to where the documents are, I think I got it figured out though.

Simple to use and gives the ability to 'fill' otherwise inaccessible PDF documents.

Who needs Repayment Plan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Repayment Plan Agreement Template

How do you fill out a repayment plan agreement form?

Filling out a repayment plan agreement form involves clearly defining the terms between the borrower and lender regarding repayment. It's essential to state the total amount owed, establish a payment schedule, and include critical personal details. This guide will walk you through each step to ensure clarity and mutual agreement.

Understanding a repayment plan agreement

A repayment plan agreement is a document that outlines the terms under which a borrower will repay their debt to a lender. It serves the dual purpose of protecting both parties while providing a clear framework to avoid misunderstandings. The agreement often features specific details like payment amounts and timelines.

-

The primary aim of this agreement is to promote transparency and accountability during the repayment process.

-

The borrower agrees to make payments using the outlined schedule, and the lender commits to structure and communicate any changes.

-

A clear plan eliminates ambiguity and can significantly reduce stress for both parties.

What are the key components of a repayment plan agreement?

Understanding the core components of a repayment plan agreement will ensure that you create a complete and legally binding document. This includes all necessary details about the debt and the payment structure between both parties.

-

Essential for identification purposes and to ensure that the agreement is clear about whom it involves.

-

This section clarifies the total amount that remains unpaid, eliminating ambiguity.

-

A precise schedule instills discipline and sets clear expectations for when payments will be made.

How to draft your repayment plan agreement?

Drafting your repayment plan agreement can be straightforward if you follow a structured process. Utilize online tools like pdfFiller to facilitate editing and ensure all necessary sections are adequately covered.

-

Begin with the borrower and lender details, then list the terms of payment.

-

Don't forget the loan amount, repayment dates, and any specific terms that apply.

-

This online tool can greatly simplify document preparation, allowing seamless editing and collaboration.

What are the standard terms in a repayment plan agreement?

Standard terms in a repayment agreement are vital for protecting the interests of both borrowers and lenders. Clear definitions around payment amounts, total debts, and conditions for default can help maintain a healthy borrowing relationship.

-

Borrowers must know the entire amount before entering an agreement to avoid future confusion.

-

Establishing affordable payment terms ensures the borrower can meet their obligations.

-

Essential for lenders, this clause allows them to take action if payments are not made on time.

What is the background and context for agreeing on repayment plans?

Understanding the background behind repayment plans can provide insight into why restructuring loans is often necessary. Common financial hardships prompt borrowers to seek alterations in their payment schedules.

-

Common reasons include job loss, medical emergencies, or unexpected expenses.

-

Knowing key dates in the repayment process can help both parties stay on track.

-

Various regions have different laws surrounding repayment agreements, making it vital to be informed.

What are the best practices for managing your repayment plan?

Management of your repayment plan is crucial for ensuring that both parties remain on the same page. Regular updates and reminders can significantly enhance communication and organization.

-

Use apps or calendars to remind you of upcoming payments to avoid late fees.

-

These tools can help borrowers track agreements easily, adding to the optimization of the repayment process.

-

Keeping the lender informed of any changes in circumstances is crucial to maintaining a good relationship.

How do you finalize and sign your repayment plan agreement?

Finalizing a repayment plan agreement is just as important as drafting it. Understanding the submission process and the significance of digital signatures can expedite the approval and execution of the agreement.

-

Using e-signatures makes the signing process faster and more secure.

-

Knowing where to send the finalized document is essential to ensure it is actionable.

-

Post-signing contact ensures that both parties remain engaged and informed about any necessary modifications.

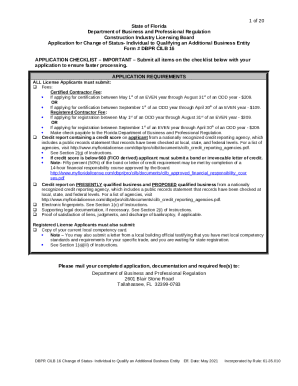

How to fill out the Repayment Plan Agreement Template

-

1.Open the Repayment Plan Agreement Template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and addresses of both the debtor and creditor in the designated fields.

-

4.Specify the total amount owed in the corresponding section.

-

5.Outline the repayment schedule, including the amount due per installment and the due dates for each payment.

-

6.Detail any interest rates or fees applicable to the repayment plan as necessary.

-

7.Include sections for signatures, ensuring both parties agree to the terms outlined in the agreement.

-

8.Review all entered information for accuracy and completeness before finalizing the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.