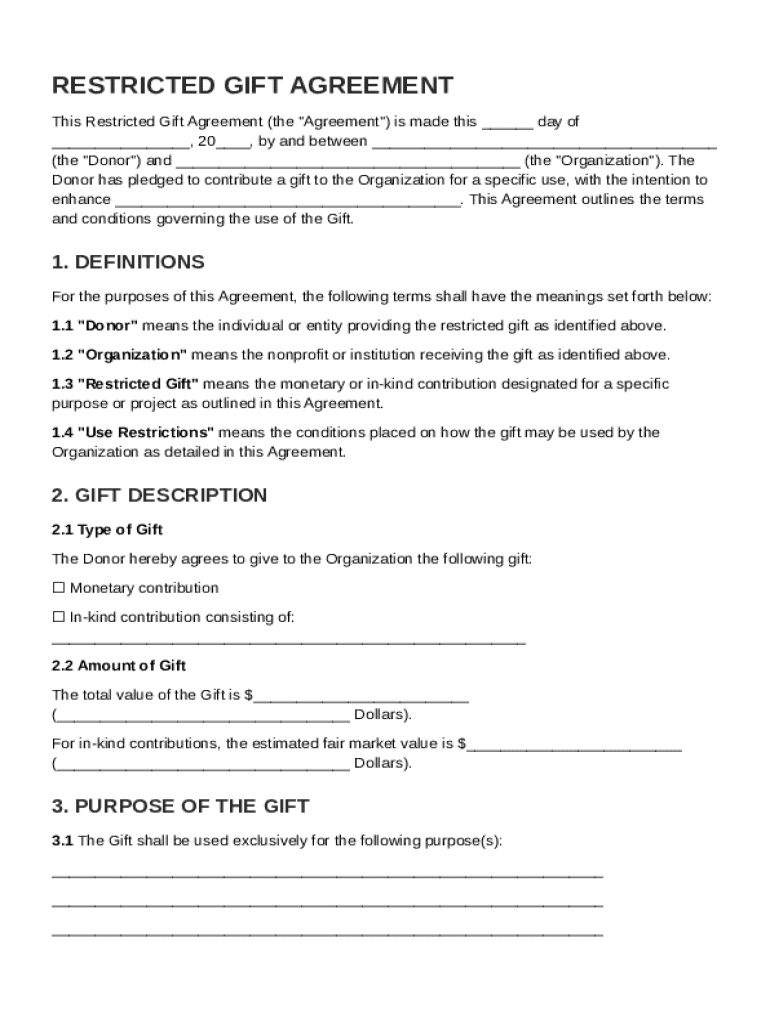

Restricted Gift Agreement Template free printable template

Show details

This document outlines the terms and conditions of a gift pledged by a donor to a nonprofit organization for a specific use, detailing how the gift can be used and what restrictions apply.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Restricted Gift Agreement Template

A Restricted Gift Agreement Template is a legal document outlining specific terms and conditions for donations that are earmarked for particular purposes.

pdfFiller scores top ratings on review platforms

Was a little hard but after I uploaded the forms I wanted it made it good

Great program. Makes it easy to find and fill out contracts. Simple and easy to use.

Like that it remembers where I was in filling in the forms. Filling in was a little awkward on the government forms I was working with. Would help to have a built in tracking mechanism to determine progress.

My work requires Acords and having some trouble locating.

I found that PDFfiller helped me with my taxes

Fast and efficient way of getting legal Framework documents to Support you in all Business matters.

Who needs Restricted Gift Agreement Template?

Explore how professionals across industries use pdfFiller.

How to create a Restricted Gift Agreement Template

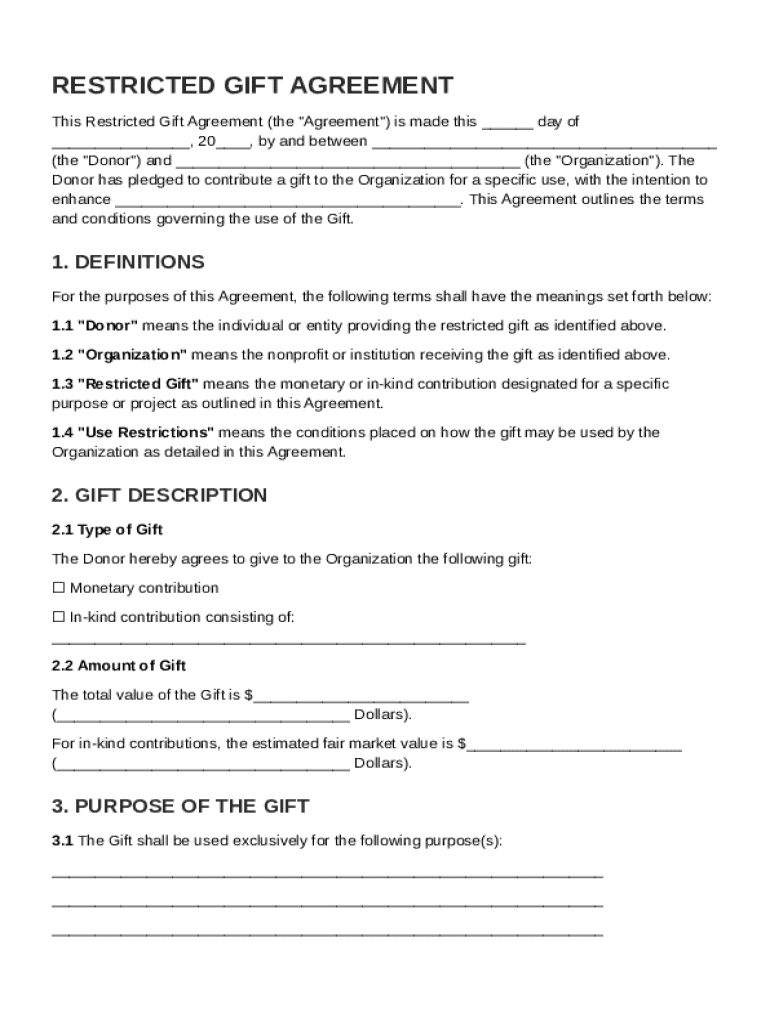

What is a Restricted Gift Agreement?

A Restricted Gift Agreement is a formal contract that delineates how a donation can be used by a recipient organization. It's crucial for donors and nonprofits to understand the terms of the gift, including restrictions on use, to ensure compliance with donor intent and legal standards.

What is the significance of a formal agreement?

Having a formal Restricted Gift Agreement helps safeguard the interests of both the donor and the recipient organization. It ensures clarity regarding the intent of the gift and promotes transparency and trust.

How do restricted and unrestricted gifts differ?

-

These gifts come with specific conditions or limitations as outlined in the agreement.

-

These can be used by the recipient organization for any purpose, providing greater flexibility.

What are the key components of a Restricted Gift Agreement?

-

Clearly stating who the donor is and which organization is set to receive the gift is vital.

-

The agreement should spell out what the funds are designated for, ensuring donor intent is honored.

-

It's important to set clear stipulations on how the funds can be utilized.

How to craft your Restricted Gift Agreement?

Drafting a Restricted Gift Agreement involves several crucial steps to ensure legal and functional integrity.

-

Follow templates or guidelines to create your agreement, ensuring you capture all necessary details.

-

Determine whether the gift will be cash, property, or services.

-

Make sure to detail the financial aspects and intent clearly.

How should you allocate gift funds properly?

Effective allocation of gift funds is important for maintaining the trust of both the donor and the organization.

-

Identify how each portion of the funds will be used within the organization.

-

A clear budget helps illustrate how funds contribute to the organization's goals.

-

Provide specific case studies or scenarios to demonstrate effective fund use.

What are reporting and accountability practices?

Transparency in reporting is necessary to uphold donor trust and ensure adherence to the agreement.

-

Different intervals may be required depending on the organization’s policy and donor's preference.

-

Implement measures such as regular audits to keep everyone informed.

-

Regular updates promote transparency and show the donor the difference their contribution is making.

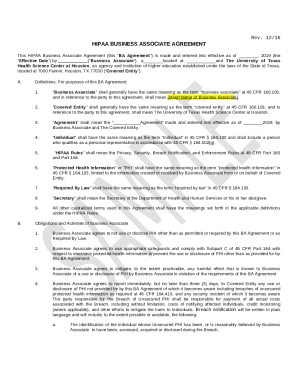

What legal and compliance considerations should be navigated?

Understanding legalities around Restricted Gift Agreements is paramount to avoid future complications.

-

Legal requirements can vary significantly based on locality and the type of organization.

-

Incorporate essential legal phrases to ensure clarity and enforceability.

-

Utilize legal experts and resources to verify that your agreement meets all necessary standards.

How can pdfFiller assist in your Gift Agreement needs?

pdfFiller offers a powerful all-in-one tool to facilitate the editing, management, and signing of Restricted Gift Agreements.

-

With pdfFiller, modifying documents becomes straightforward, ensuring you can tailor your Agreement to meet your needs.

-

Easily collect signatures electronically, saving time and facilitating remote collaboration.

-

Work with colleagues to review and refine the Agreement through shared access.

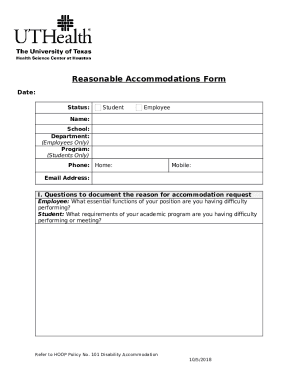

How to fill out the Restricted Gift Agreement Template

-

1.Open the Restricted Gift Agreement Template in pdfFiller.

-

2.Review the document to understand the sections that require input.

-

3.Begin filling in the donor's information, including name, address, and contact details.

-

4.Specify the purpose of the donation explicitly in the designated field.

-

5.Indicate any restrictions or conditions associated with the gift clearly.

-

6.Complete the section detailing the timeline for fund utilization if applicable.

-

7.Have the donor sign and date the agreement in the provided signature fields.

-

8.If necessary, include a witness signature section according to your organization's requirements.

-

9.Review the completed agreement for accuracy and ensure all necessary fields are filled before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.