Restricted Stock Purchase Agreement Template free printable template

Show details

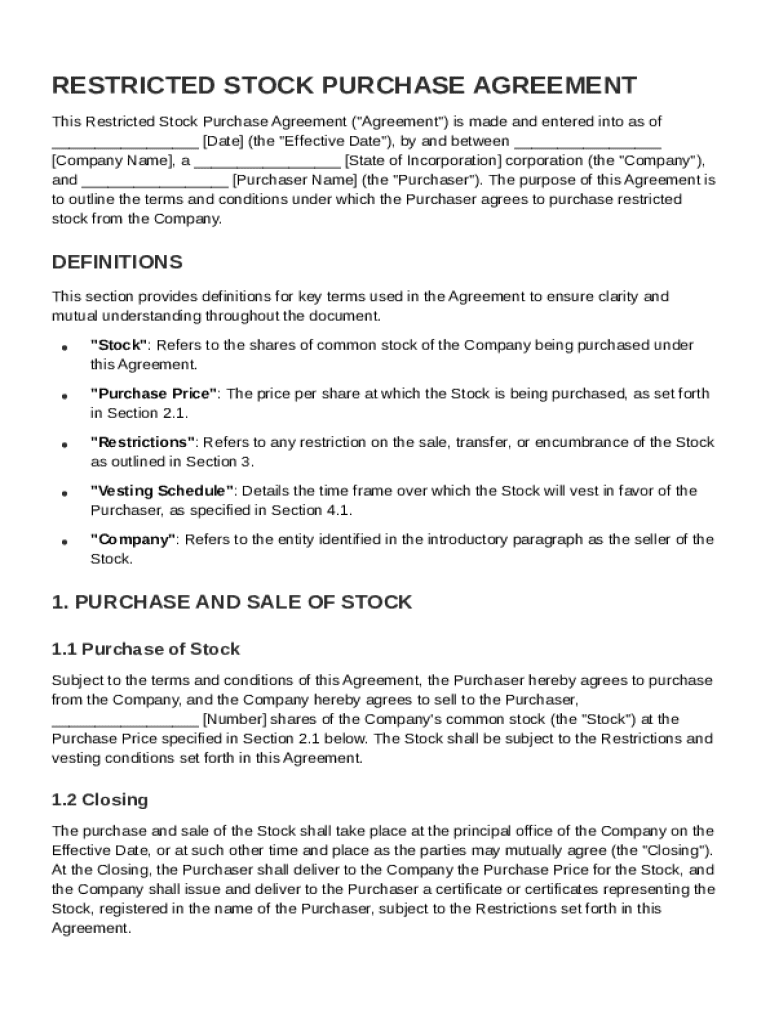

This Agreement outlines the terms and conditions under which a Purchaser agrees to purchase restricted stock from a Company, including purchase price, vesting, and transfer restrictions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Restricted Stock Purchase Agreement Template

A Restricted Stock Purchase Agreement Template is a legal document outlining the terms and conditions under which an investor can purchase restricted stock from a company.

pdfFiller scores top ratings on review platforms

undecided

worth every penny!

Lots of forms, very easy.

easy to use

IM SATISTFIED SO FAR

very convenient will definitely come in use.

Who needs Restricted Stock Purchase Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Restricted Stock Purchase Agreement Template form

What is a Restricted Stock Purchase Agreement?

A Restricted Stock Purchase Agreement (RSPA) is a legal document that outlines the terms under which an individual purchases stock from a company. Its primary purpose is to protect the interests of both the company and the purchaser by specifying the rights, obligations, and restrictions associated with the stock. This document is especially important in startups or companies planning to offer equity as part of their compensation packages.

Why is the agreement important?

The RSPA is crucial for both parties involved in the transaction. For companies, it provides a clear framework that governs the issuance of stock and helps to prevent misunderstandings or disputes in the future. For purchasers, it offers a sense of security regarding their investment and the conditions under which they can benefit from the stock.

What are the key components of the agreement?

-

The agreement should clearly identify the company and the purchaser, ensuring both parties are legally recognized in the document.

-

Key terms including 'Stock', 'Purchase Price', 'Restrictions', 'Vesting Schedule', and 'Company' must be defined to eliminate ambiguity.

-

Both parties' rights and obligations, including what happens in the event of a stock sale or transfer, should be clearly articulated.

How are stock purchases executed?

Understanding the transaction process is vital in executing a stock purchase. The process typically begins with negotiations on the purchase price and the number of shares. Once these terms are agreed upon, the purchaser must be aware of any restrictions placed on the stock, such as limitations on sale, transfer, or encumbrance.

What is a vesting schedule?

A vesting schedule outlines when the purchaser gains ownership of the stocks as per the agreement terms. Two common types of vesting schedules are time-based, where shares are vested over a specific period, and performance-based, where vesting depends on reaching certain milestones. Understanding commission's impact on vesting is essential for both the company and the purchaser.

What steps are involved in the closing process?

-

The closing process involves finalizing the stock purchase agreement, conducting due diligence, and performing any required financial audits.

-

Documents that may be needed include the signed RSPA, stock certificates, and compliance certification.

-

Both the purchaser and the company have designated responsibilities at closing, including ensuring that all documents are in order.

How to fill out the agreement using pdfFiller?

Using pdfFiller provides a seamless solution for filling out a Restricted Stock Purchase Agreement Template form. The platform features user-friendly tools for editing and collaborating on the document, making it easier to manage. To enhance the document management process, users can take advantage of options such as eSigning and real-time collaboration tips.

What legal considerations should you keep in mind?

-

Understanding the legal requirements for Restricted Stock Purchase Agreements in various states is essential for compliance and protection.

-

Failing to comply with the terms of the agreement can lead to penalties including financial loss and jeopardized ownership rights.

-

To ensure compliance, consult with legal professionals and regularly review and update the agreement as necessary.

How to fill out the Restricted Stock Purchase Agreement Template

-

1.Download the Restricted Stock Purchase Agreement Template from a reliable source.

-

2.Open the template using pdfFiller or upload it if necessary.

-

3.Begin by filling in the names and addresses of the buyer and seller in the designated fields.

-

4.Specify the number of shares being purchased and the price per share in the relevant sections.

-

5.Fill out the vesting schedule, including any performance milestones or time constraints that apply.

-

6.Review the terms regarding the transfer of shares and any restrictions that will be in place.

-

7.Include details about any rights accompanying the shares, such as voting rights or dividends.

-

8.Sign and date the agreement in the provided areas once all information is complete.

-

9.Ensure that all parties involved receive a signed copy of the agreement for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.