Risk Transfer Agreement Template free printable template

Show details

This document outlines the terms and conditions for the transfer of certain risks from one party to another, detailing the responsibilities of both parties, payment terms, and dispute resolution mechanisms.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

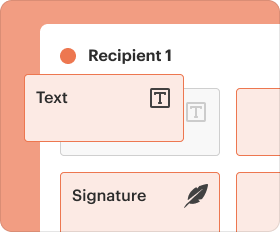

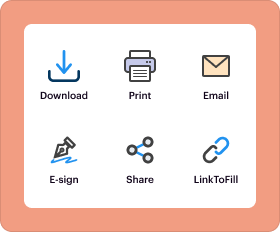

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Risk Transfer Agreement Template

A Risk Transfer Agreement Template outlines the process by which one party transfers the risk of loss to another party, often used in insurance and contractual situations.

pdfFiller scores top ratings on review platforms

i like the customer service and appears the form or fillable works great for me.

Suggestion to let folks know upfront that the printing is payable. Have more to do. So far, excellent. Kind thanks.

I've always wondered if there wasn't an easier way to fill PDF's out and now I've found it!

Has proven immeasurably helpful on several occasions. Excellent product.

I like the actual PDF filler. I'm having trouble finding the forms I need.

Haven't been able to add a blank page to the 3 page form I was working. The instructional video indicated I should see a "Pages" icon on the Edit line. I didn't.

Who needs Risk Transfer Agreement Template?

Explore how professionals across industries use pdfFiller.

Risk Transfer Agreement Template Guide

How to fill out a Risk Transfer Agreement Template form

Completing a Risk Transfer Agreement Template form involves understanding your business's risk landscape, identifying the parties involved, and accurately detailing the specific terms in the agreement. Use our step-by-step guide for an efficient process.

What are risk transfer agreements?

A Risk Transfer Agreement is a legal document designed to shift the risk of potential losses from one party to another. This agreement is essential not only for businesses but also for individuals who want to protect themselves from financial liabilities resulting from unforeseen events.

-

A Risk Transfer Agreement delineates the responsibility for risk between parties, enhancing clarity and security in business transactions.

-

Such agreements play a critical role for both individuals and businesses, offering a structured method to manage risks.

-

By formally transferring risk, the agreement helps safeguard the interests of the parties involved, minimizing potential exposures.

What key components make up the agreement?

A comprehensive Risk Transfer Agreement should include several key components to ensure that it serves its intended purpose effectively. Each component provides clarity and reduces ambiguity.

-

Clearly identify the Transferor (the party transferring the risk) and the Transferee (the party accepting the risk) in the agreement.

-

Include definitions for crucial terms such as 'Risk,' 'Indemnity,' and 'Effective Date' to avoid misunderstandings.

-

Provide background information concerning the agreement and the businesses or individuals involved, laying the groundwork for understanding the terms.

How do fill out the template?

Filling out your Risk Transfer Agreement Template involves a straightforward process. Here’s a step-by-step guide to help you through the details.

-

Begin by filling in the personal and company information of both parties, including names and addresses.

-

Focus on common fields like obligations, risks, and indemnifications, and ensure accurate representations of the involved business activities.

-

Double-check all entered information to ensure consistency and compliance with your business agreements.

How can edit and customize my agreement?

Customizing your Risk Transfer Agreement to suit specific business needs is crucial for effectiveness. Using tools available through pdfFiller, you can edit easily.

-

Utilize pdfFiller to modify the template efficiently, ensuring you tailor it to fit your exact business circumstances.

-

Feel free to add or modify terms as required, addressing unique aspects of the transaction or specific industry regulations.

-

Ensure that your customized agreement aligns with local laws and industry regulations, providing legal protection.

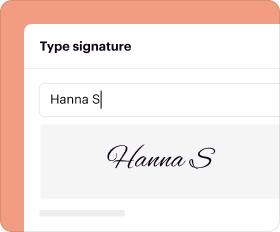

Why is eSigning important for the agreement?

Electronic signing (eSigning) enhances the efficiency and integrity of the agreement signing process. Utilizing platforms like pdfFiller ensures a smoother transaction.

-

eSigning affirms the intention of the parties to enter into the agreement, offering legal validation.

-

Initiate the eSigning directly through the pdfFiller platform for secure document handling and enhanced traceability.

-

eSigned documents are legally binding, providing assurance that all parties have consented to the terms.

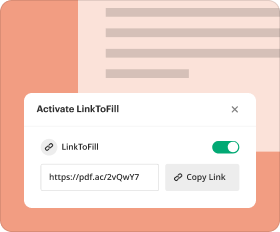

How do manage my Risk Transfer Agreement?

Proper management of your Risk Transfer Agreement is vital for maintaining its effectiveness and reliability over time. pdfFiller provides tools that facilitate this process.

-

Store and organize your documents seamlessly using pdfFiller's integrated document management features.

-

Collaborate with your teams for reviews, ensuring that everyone is on the same page regarding the agreement's terms.

-

Track changes made to the agreement, keeping updated and aligned with all stakeholders.

What are common scenarios for using risk transfer agreements?

Risk Transfer Agreements are used across various industries to protect parties involved in numerous transactions. Understanding their application is essential for better risk management.

-

From construction to service provision, these agreements play a pivotal role by allocating risk effectively.

-

Service providers often benefit from these agreements, which help mitigate financial liabilities.

-

Studying instances of effective risk transfer can provide insights into best practices in contract negotiations.

How does this compare with related document templates?

When considering legal documentation, understanding how a Risk Transfer Agreement differs from other related templates is useful for making informed decisions.

-

Considering other documents such as Insurance Guidelines or Indemnification Templates can help clarify which document best suits your needs.

-

Ensure you understand the specific requirements of your situation to select the appropriate document.

-

Leverage pdfFiller to manage various document templates simultaneously for streamlined operations.

Conclusion

In summary, a properly executed Risk Transfer Agreement Template form is fundamental for effective risk management in any business transaction. Implementing this guide through pdfFiller's advanced features ensures you have a seamless and compliant process. Relying on these agreements provides substantial protection for the parties involved and aligns with best practices in risk management.

How to fill out the Risk Transfer Agreement Template

-

1.Download the Risk Transfer Agreement Template in PDF format.

-

2.Open the template in pdfFiller.

-

3.Begin by entering the names of the parties involved in the designated fields.

-

4.Next, fill in the specific details of the risks being transferred, ensuring clarity.

-

5.Specify the effective date of the agreement and duration of the risk transfer.

-

6.Include any compensation terms or considerations related to the risk transfer.

-

7.Review the agreement for accuracy and completeness.

-

8.Add signatures in the provided fields, ensuring all parties are represented.

-

9.Save the completed document and download it for distribution or filing.

What is a risk transfer contract?

Through a legal agreement, contractual risk transfer places the financial responsibility of a loss on the organization or contractor that has the best ability to prevent or control the actions or incidents that led to damage or injury.

What is the 10 10 rule for risk transfer?

The most commonly cited is the "10/10 rule." This rule states that a contract passes the threshold if there is at least a 10 percent probability of sustaining a 10 percent or greater present value loss (expressed as a percentage of the ceded premium for the contract).

What happens under a risk transfer agreement?

- Risk transfer takes place where an insurer lets a broker hold insurance monies on its behalf and by doing so transfers the 'credit risk' from the broker to the insurer. - Monies held under this arrangement by the broker are referred to as 'risk transfer money'.

What is an example of a risk transfer?

Transferring risk examples include commercial property tenants assuming the risk for keeping sidewalks clear, an apartment complex transferring the risk of theft to a security company and subcontractors assuming the risk for the work they perform for a contractor on a property.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.