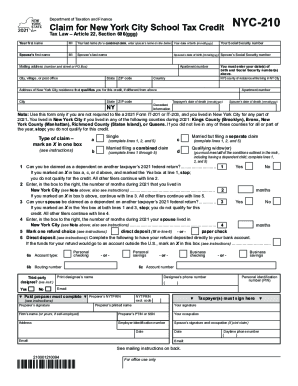

Safe Agreement Template free printable template

Show details

This document outlines the terms and agreements between a corporation (the Company) and an Investor concerning the purchase of a Simple Agreement for Future Equity (SAFE) and the rights to future

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Safe Agreement Template

A Safe Agreement Template is a legal document that outlines the terms of an investment agreement between a startup company and an investor, granting the investor the right to convert their investment into equity at a future date.

pdfFiller scores top ratings on review platforms

I love that your documents are professional

It has made my Grad course work look more professional than what the other students are using! I feel it has set me up for success

Not sure yet. I've used it now and it was very good. Easy to use-great results

Easy to use so far, as I just downloaded and started.

I am very satisfied we the result of my complaint, i will highly recommande your product.

to my frends and family your the best.

jean yahia

It is easy to set up documents, and something I have needed for a long time. The potential is limitless.

Who needs Safe Agreement Template?

Explore how professionals across industries use pdfFiller.

Safe Agreement Template Guide

How to fill out a Safe Agreement Template form

Filling out a Safe Agreement Template form is a straightforward process that involves understanding key components, completing essential details, and ensuring compliance with local regulations. Utilize our guide for detailed steps and best practices to streamline your agreement process.

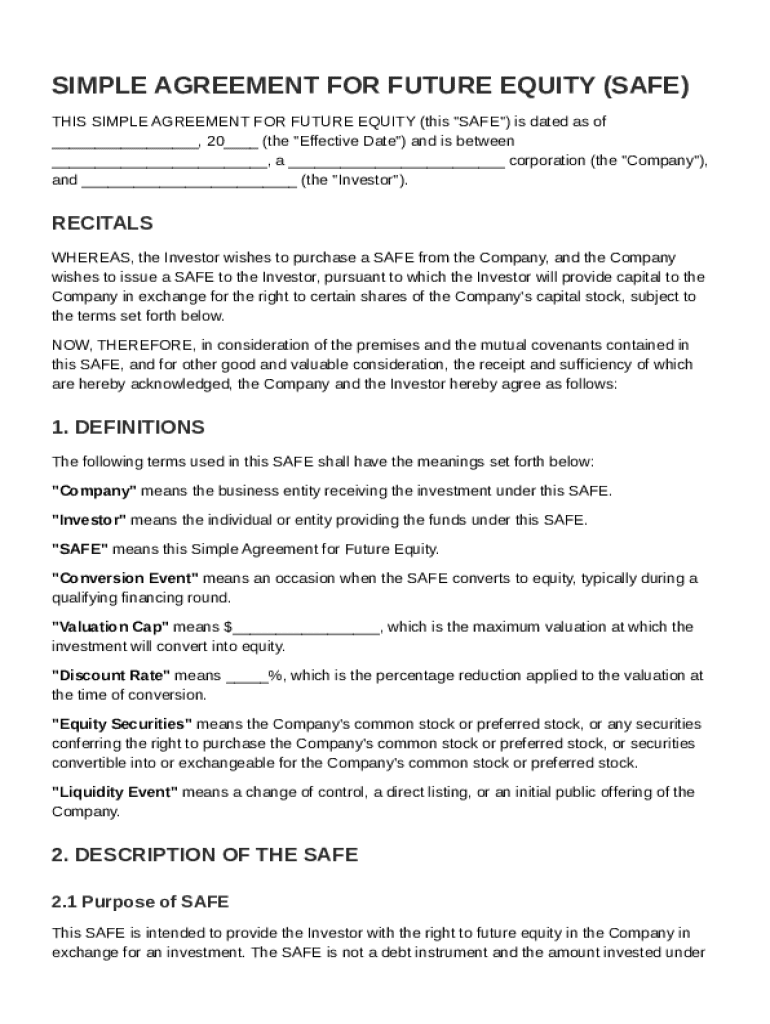

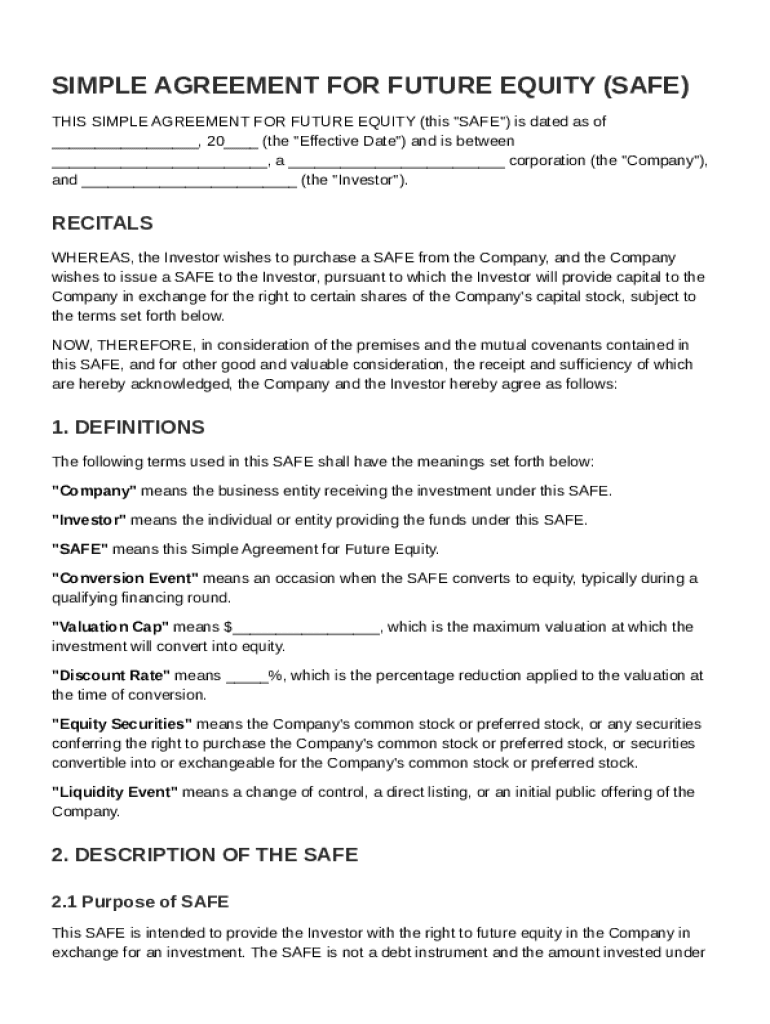

What is a SAFE Agreement?

A Simple Agreement for Future Equity (SAFE) is a financial instrument used primarily by startups to raise capital. Unlike traditional equity financing, SAFEs allow startups to offer investors a promise for future shares based on the company's valuation at the time of an equity round.

SAFEs are typically uncomplicated and do not involve debt obligations, making them attractive for both investors and startups eager to simplify funding. This approach eliminates the need for extensive negotiations often seen with equity agreements.

-

A SAFE is not a debt; it allows investors to convert their investment into equity upon certain triggering events.

-

In investment contexts, SAFEs can be ideal for companies that seek to defer valuation negotiations.

-

SAFEs differ from convertible notes as they do not have a maturity date or interest rate.

What are the key components of a SAFE Agreement?

-

A SAFE involves two parties: the company seeking investment and the investor providing funds.

-

Key terms include the 'Conversion Event' (the occurrence triggering conversion to equity), 'Valuation Cap' (the maximum valuation considered for conversion), and 'Discount Rate' (the percentage discount on future share pricing offered to the investor).

-

A SAFE might cover various forms of equity like common stock or preferred stock, depending on the agreement.

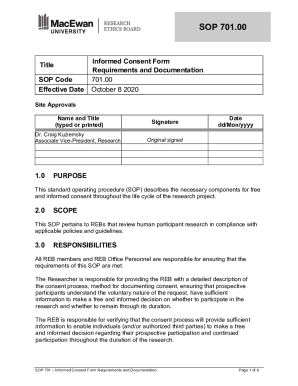

How do fill out the SAFE Agreement Template?

Filling out the SAFE Agreement Template can seem daunting, but it can be simplified into a few key steps. Begin by gathering necessary information about the parties involved, defining essential terms, and ensuring compliance with regulatory requirements.

-

Follow a guided approach for filling out each section. Start with the Company’s legal name and proceed to the Investor's details.

-

Inputs needed include the Effective Date, Company Name, and Investor information. Ensure these are accurately filled out.

-

Watch for incomplete information, especially in defining essential terms which can lead to misunderstandings later.

How can utilize interactivity tools on pdfFiller?

pdfFiller provides a user-friendly interface that allows you to edit and customize your SAFE Agreement effortlessly. You can maximize collaboration and document management through the platform's interactive tools.

-

Use pdfFiller's intuitive editor to amend terms or adjust clauses directly within the SAFE Agreement.

-

Share the document with team members for real-time collaboration and input, ensuring all stakeholders have their voice.

-

Manage your documents securely from anywhere, allowing for smoother transitions in business processes.

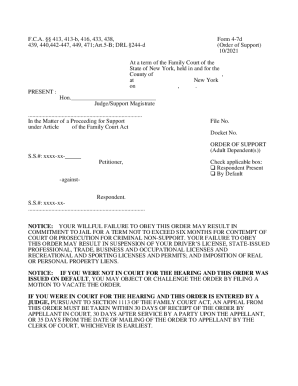

What are the legal and compliance considerations for SAFEs?

It is vital to be aware of the regulatory landscape when issuing SAFEs to ensure legal compliance. Each region may have specific laws governing the issuance and execution of these agreements.

-

Certain jurisdictions require specific filings, approvals, or disclosures when launching a SAFE. Research local laws to stay compliant.

-

Ensure that your SAFE announcement adheres to regional regulatory standards to avoid penalties.

-

Engaging with legal advisors can help navigate complexities in your region's financial regulations.

When should a SAFE Agreement be used?

Utilizing a SAFE Agreement can be beneficial across several situations for startups seeking funding. Common scenarios include early-stage fundraising or when equity negotiations could hinder timely funding.

-

Startups often opt for SAFEs during seed rounds or when they anticipate a significant increase in valuation.

-

SAFEs can expedite fundraising processes compared to traditional methods, simplifying terms and reducing transaction costs.

-

Numerous companies such as Airbnb and Dropbox initially used SAFEs in their funding rounds, demonstrating its effectiveness.

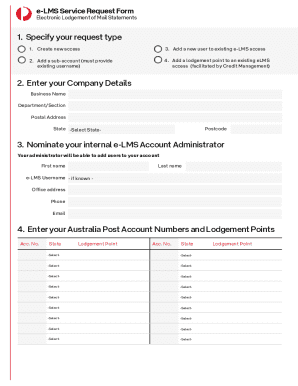

How to fill out the Safe Agreement Template

-

1.Download the Safe Agreement Template from pdfFiller.

-

2.Open the PDF in the pdfFiller editor.

-

3.Fill in the details in the designated fields: Start with the date and names of both parties involved.

-

4.Specify the investment amount and terms of the agreement and include any specific conditions.

-

5.Add information regarding the valuation cap and discount rate, if applicable.

-

6.Include any other relevant clauses or conditions.

-

7.Review the completed document for accuracy and completeness.

-

8.Save the filled-out agreement to your account or download it as a PDF.

-

9.If needed, share the document directly from pdfFiller or print it for signatures.

What is the SAFE agreement?

A SAFE (Simple Agreement for Future Equity) is a legal contract between a startup and an investor that allows the investor to purchase equity in the company at a future date (typically during your company's next priced round or during a liquidity event).

Are SAFE agreements legally binding?

SAFEs are neither equity nor debt instruments, they do not have a maturity date, and do not carry an obligation to pay interest. However, they are legally binding agreements that represent a contractual right for investors to receive shares at some point in the future, usually the next financing round.

What is the difference between a SAFE agreement and a convertible note?

SAFEs have no maturity date, there's no obligation for startups to repay the invested amount. In convertible notes, investors can demand repayment if the startup fails to raise a qualified financing round by the maturity date. On the other hand, SAFEs do not allow for this demand, as no maturity or debt is involved.

Is a SAFE agreement good for investors?

For investors, the primary attraction of a SAFE is the potential for high returns. If the startup succeeds, its equity could appreciate substantially. Since SAFEs are used primarily in early-stage startups, the initial investment is typically lower than in later funding rounds.

What is an example of a SAFE agreement?

Example - SAFE with Discount raises $100,000 pursuant to a SAFE with Investor X. The SAFE has a discount of 20%. Two years later, Blue Jeans Inc. agrees to raise $250,000 in funding from Venture Capital Group at a total company valuation of $5,000,000 for which it will receive 5% of the company's shares.

What are the disadvantages of SAFEs?

For instance, SAFEs typically do not include provisions for debt repayment in the event of company liquidation, leaving investors with little to no recourse if a startup fails. This lack of security can deter investors who are risk-averse or those who prefer to have some form of downside protection.

What is the YC SAFE term?

YC SAFE is a Simple Agreement for Future Equity designed by Y Combinator to simplify early-stage startup financing. It allows investors to fund startups in exchange for future equity without an immediate valuation. The agreement features valuation caps and discounts, influencing equity conversion.

What is the MFN SAFE note?

What is an MFN? The Most Favored Nation clause (MFN) allows early SAFE investors to receive as favorable terms as future SAFE Investors. The MFN-only SAFE has no discount or valuation cap. Instead, it gives the SAFE investor the right to participate on the same terms as future SAFE investors.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.