Sale Leaseback Agreement Template free printable template

Show details

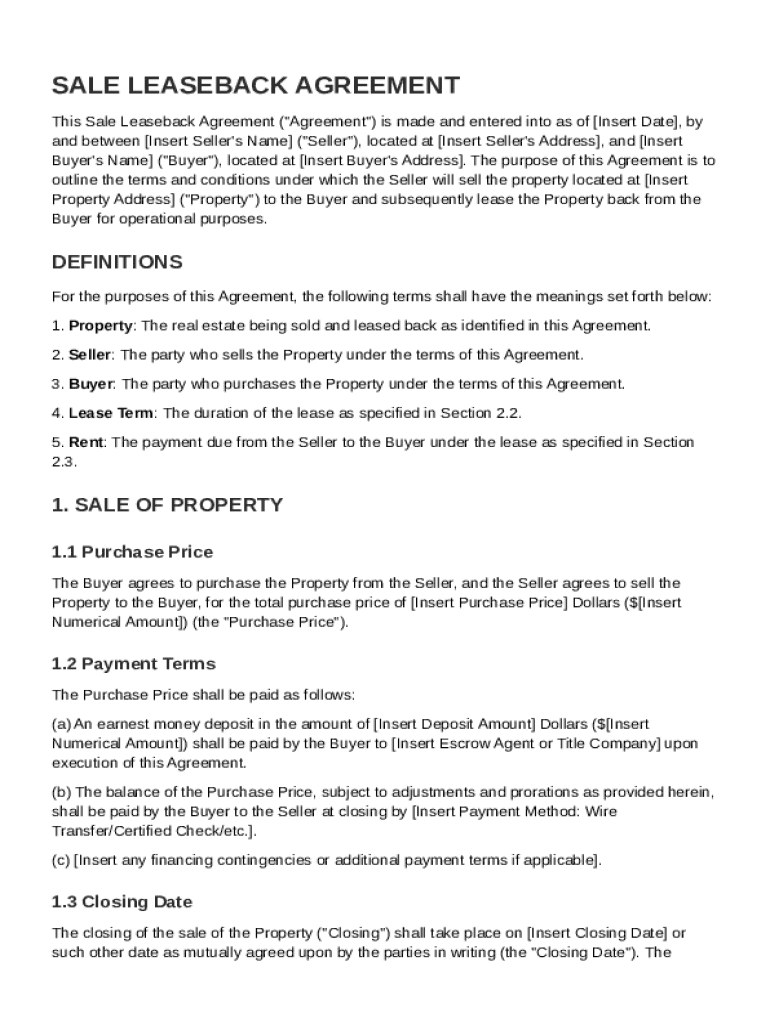

This document outlines the terms and conditions under which the Seller sells a property to the Buyer and subsequently leases it back for operational purposes.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Sale Leaseback Agreement Template

A Sale Leaseback Agreement Template is a legal document that facilitates the sale of a property by the seller, who then leases it back from the buyer for a specified period.

pdfFiller scores top ratings on review platforms

Es muy fácil de usar, además, que facilita el trabajo al que me dedico.

Easy to use on the pc. Would be nice if there was a mobile app!

very helpful. Have little issue here and there.

Easy to use, does what they say it does. Very Useful.

Love the "check" and "cross"function! So useful marking my students' worksheets on pdf!

Still getting used the program but like it a lot!

I love it -- it helped me fill in some VA medical forms and made them look very professional, plus I could go back and edit as needed. It also allows me to save, print, and email. There are many other features too!

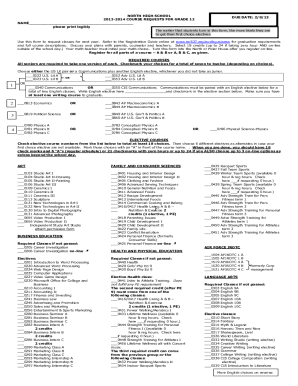

Who needs Sale Leaseback Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Sale Leaseback Agreement Template form form

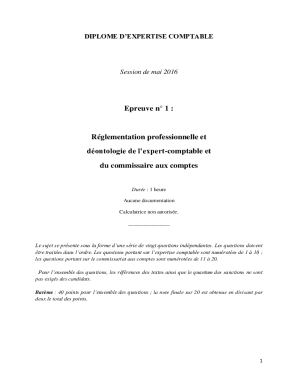

Understanding Sale Leaseback Agreements

A Sale Leaseback Agreement is a financial transaction in which the owner of a property sells it to a buyer and simultaneously leases it back. This arrangement provides the seller immediate capital while allowing them to continue using the property. The benefits of a Sale Leaseback include improved liquidity, tax benefits, and operational flexibility.

-

In essence, it combines the sale of a property with an ongoing rental agreement, creating a unique financial structure.

-

These agreements help sellers gain liquidity while retaining their operational space without the burden of ownership.

-

The seller, who is often a business needing cash, sells the asset, while the buyer becomes the new property owner and lessor.

What are the key terms and concepts?

Understanding key terms in a Sale Leaseback Agreement is crucial for all parties involved. For effective communication and legal clarity, it is vital to specify terms like property, rent, lease term, and parties involved in the document.

-

Terms such as 'Property' refer to the asset being sold, while 'Seller' and 'Buyer' define the transaction parties.

-

Ambiguous terms can lead to disputes, highlighting the need for precision in legal documents.

-

Real-world examples help illustrate how specific terms impact the agreement.

What are the key considerations when selling property?

Selling a property in a Sale Leaseback Agreement requires careful attention to critical aspects such as purchase price, payment terms, and closing dates. Each consideration plays a significant role in ensuring a smooth transaction.

-

Determined through market analysis and appraisals, it should be well-documented to avoid future disputes.

-

Clear breakdowns of earnest money and the balance due at closing should be included to safeguard interests.

-

The closing date marks the transaction's conclusion and is vital in coordinating the property's transfer.

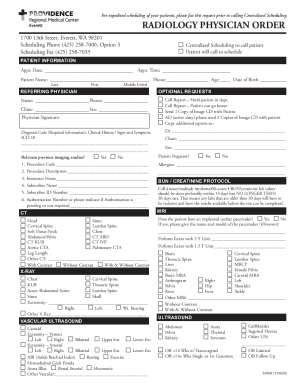

How to fill out the Sale Leaseback Agreement Template?

Filling out the Sale Leaseback Agreement Template requires attention to detail, following a structured approach to avoid errors. By utilizing tools like pdfFiller, users can streamline this process effectively.

-

Start by filling in the necessary property details, agree on terms, and ensure both parties' signatures and dates are recorded.

-

Utilize pdfFiller’s editing and signing tools for an efficient completion process.

-

Double-check all fields and avoid vague terms to enhance clarity and prevent future disputes.

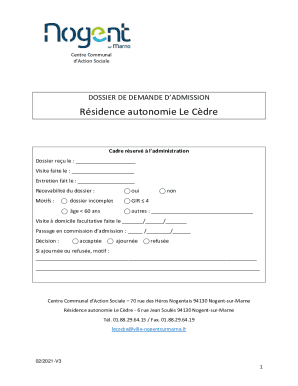

How to edit and customize your agreement?

Customizing your Sale Leaseback Agreement is vital for addressing specific transaction requirements. pdfFiller offers features to make this process user-friendly and efficient.

-

The platform enables extensive modifications to templates, ensuring they fit specific needs.

-

Engage team members effortlessly and track changes in real-time for a collaborative editing process.

-

Ensure all changes adhere to legal standards and do not alter the essence of the original agreement.

How to manage your leaseback agreement?

Managing a Sale Leaseback Agreement requires ongoing diligence to maintain compliance and track obligations. Best practices can help streamline this complex process.

-

Regular reviews of terms and monitoring lease payments ensure smooth operations.

-

Use pdfFiller to keep thorough documentation of payments, enhancing accountability.

-

Stay informed of lease terms and any changes in law to uphold agreement standards.

What resources and tools are available on pdfFiller?

pdfFiller offers a variety of resources and templates to assist users in creating and managing their Sale Leaseback Agreements. These tools simplify the leaseback process seamlessly.

-

Access a rich library of related documents to ensure all needs are covered.

-

Helpful guides on various lease agreements are available to provide users with necessary insights.

-

For personalized assistance, pdfFiller provides reliable customer support ready to help.

How to fill out the Sale Leaseback Agreement Template

-

1.Begin by downloading the Sale Leaseback Agreement Template from pdfFiller.

-

2.Open the template file in pdfFiller's editor.

-

3.Provide the seller's full legal name and address in the designated fields.

-

4.Enter the buyer's full legal name and address next.

-

5.Fill in the property details, including the address and description of the property.

-

6.Specify the sale price and the terms of the sale in the corresponding sections.

-

7.Indicate the leaseback duration and monthly rental amount agreed upon.

-

8.Include any additional clauses or specifics relevant to the agreement in the placeholders provided.

-

9.Review all entered information for accuracy and completeness.

-

10.Save the completed document and choose to either print it out or send it electronically as needed.

What is a sale and leaseback agreement?

In sale-leaseback agreements, an asset that is previously owned by the seller is sold to someone else and then leased back to the first owner for a long duration. In this way, a business owner can continue to use a vital asset but ceases to own it.

What is an example of a sale and lease back?

Example 1 – Sale and leaseback SellCo sells a building to BuyCo for cash of CU1,800,000, which is its fair value at that date. The previous carrying value of the building is CU1,000,000. At the same time, SellCo enters into a lease with BuyCo conveying back the right to use the building for 18 years.

What are the disadvantages of a sale-leaseback?

Disadvantages of using a sale leaseback Cause a lack of control of the asset at the end of the lease term. Require long-term financial commitments with fixed payments. Create loss of operational flexibility (e.g., ability to move from a leased facility in the future)

What is the structure of a sale and leaseback transaction?

In the context of commercial real estate, a sale and leaseback transaction involves the sale of a property to a third party investor for a lump sum payment, immediately after which the investor then leases the property back to the seller for an agreed period in return for the payment of rent by the seller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.