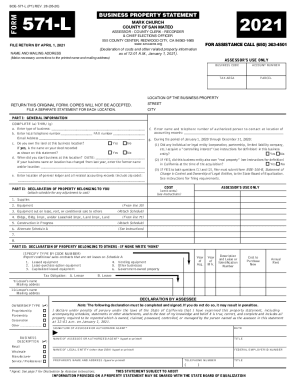

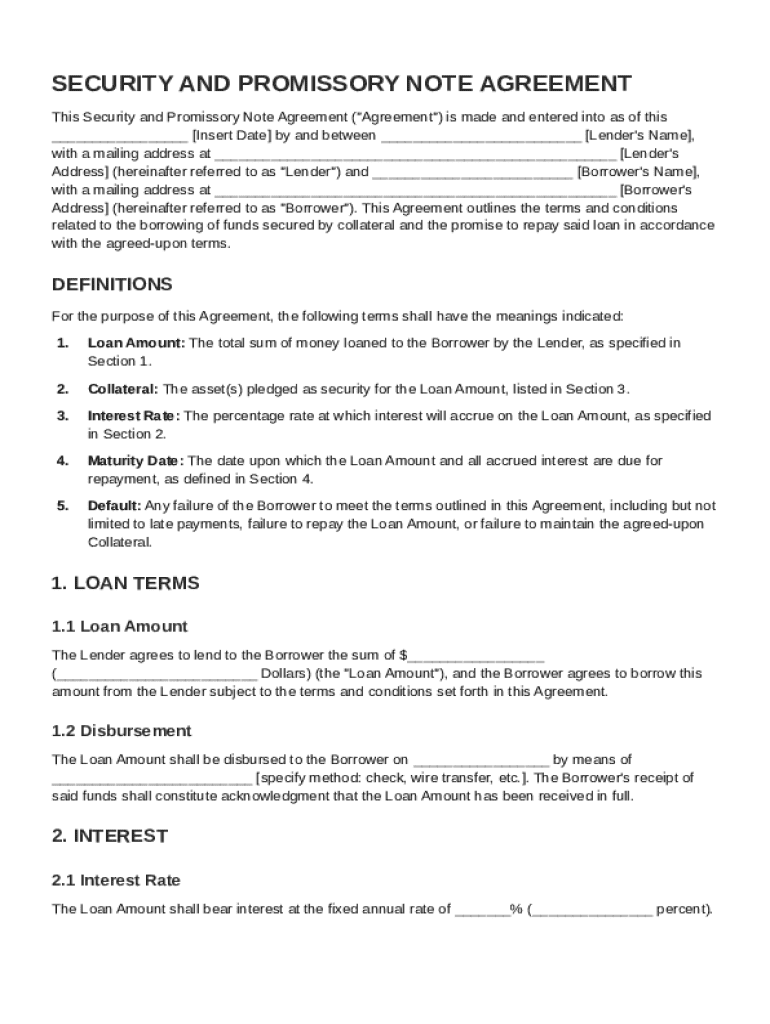

Security and Promissory Note Agreement Template free printable template

Show details

This document outlines the terms and conditions related to the borrowing of funds secured by collateral, including loan amount, interest rate, repayment terms, and remedies in case of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Security and Promissory Note Agreement Template

A Security and Promissory Note Agreement Template is a legal document that outlines the terms under which a borrower agrees to repay a debt secured by collateral.

pdfFiller scores top ratings on review platforms

It's easy to use and, has a lot of options. I would recommend this software if you work a lot with pdfs.

PDF Filler is great - I will not use it enough to keep a subscription.

It could be a little more user friendly. If I did not have the experience with computers that I have I would have just quit. But I got the job done as needed

I appreciate the ease of downloading a PDF and being able to fill it in. For me, it is worth the money, even if I don't use it very often, simply because I now have the completed form saved, and easy to edit, as needed.

It was very efficient and easy to use! I highly recommend using this product!

Later. So far so good. I will have more comments after I attempt to print the form.

Who needs Security and Promissory Note Agreement Template?

Explore how professionals across industries use pdfFiller.

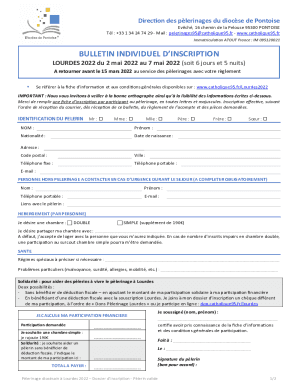

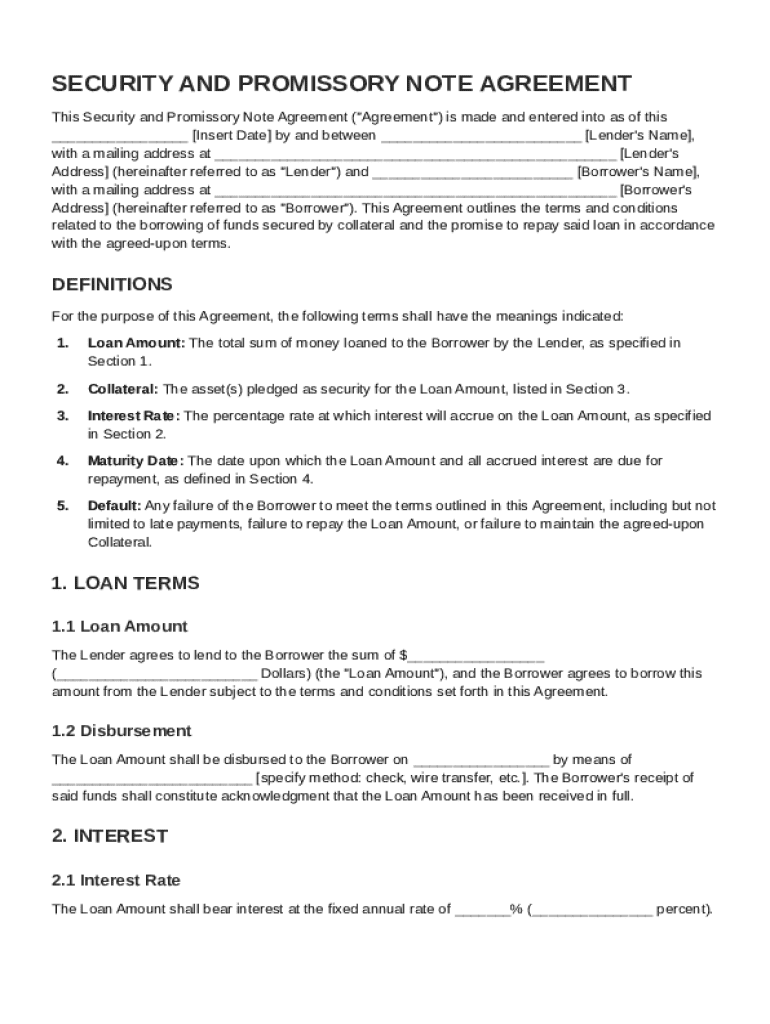

How to fill out a Security and Promissory Note Agreement Template form

Filling out a Security and Promissory Note Agreement Template form requires careful attention to detail, as this document outlines the terms of a loan between a borrower and a lender. It typically includes important elements such as the loan amount, collateral, interest rate, and repayment terms.

Understanding the Security and Promissory Note Agreement

A Security and Promissory Note Agreement is a legal document that confirms a borrower’s promise to repay a loan with interest, while also detailing the collateral backing the loan. These agreements are crucial in financial transactions, as they help protect the lender's investment by specifying the recourse in case of default.

-

These agreements ensure that both parties understand their responsibilities and the terms of the loan, which can help prevent legal disputes in the future.

-

The main components of a Security and Promissory Note include the loan amount, collateral (assets pledged as security), and the interest rate that determines the cost of borrowing.

What are the key definitions in the Agreement?

Understanding the terminology used in a Security and Promissory Note Agreement is essential for both borrowers and lenders.

-

This is the total sum that the borrower is borrowing, which must be clearly stated in the agreement.

-

Collateral refers to the assets that the borrower pledges to secure the loan, which the lender can claim if the borrower defaults.

-

The interest rate is the percentage of the loan amount that the borrower must pay in addition to repaying the principal.

-

The maturity date is the agreed-upon date by which the borrower must repay the loan in full.

-

Default occurs when the borrower fails to meet the terms of the loan agreement, potentially resulting in penalties or loss of collateral.

How do fill out the Security and Promissory Note?

Filling out the agreement correctly is crucial for ensuring that all parties are protected. Here's a step-by-step guide.

-

Specify the date when the agreement is executed to establish a clear timeline.

-

Collect and enter the full names and contact information of both the lender and borrower.

-

Clearly state the total loan amount and the applicable interest rate for transparency.

-

List the assets being used as collateral, ensuring they are clearly identified.

-

Set a repayment date and specify how the funds will be disbursed to the borrower.

What are effective loan terms?

When crafting the terms of a loan, clarity is vital to prevent misunderstandings. Effective terms establish responsibilities, including when payments are due and any penalties for late payments.

-

Detail payment schedules, interest calculations, and late fees to ensure both parties have clear expectations.

-

Be clear about all terms to avoid disputes that can arise from vague agreements.

-

Ensure all terms comply with local laws to avoid any potential legal issues.

-

Utilize pdfFiller to format and edit your terms easily, ensuring a professional appearance.

What types of Secured Promissory Notes are there?

Secured promissory notes are classified as either secured or unsecured based on collateral. Recognizing the difference is crucial when assessing risk.

-

These notes are backed by collateral, which reduces the lender’s risk in case of borrower default.

-

These do not require collateral, making them riskier for lenders and often resulting in higher interest rates.

-

Examples include mortgages secured by property or personal loans secured by vehicles.

Exploring a sample of a Secured Promissory Note

Examining a completed example of a secured promissory note can clarify how the agreement is structured and what sections are vital.

-

Important sections typically include the loan amount, payment schedule, and collateral specifications.

-

Customize the sample using pdfFiller to meet your specific needs and ensure it adheres to your state's regulations.

When should use a Security and Promissory Note Agreement?

Understanding when to use a secured agreement is pivotal for risk management. Secured loans are typically more viable when the borrower has assets to pledge.

-

Consider secured agreements for larger loans or when collateral can be legally pledged.

-

Explore alternatives like unsecured loans, but be aware of higher interest rates.

-

Assess borrower creditworthiness and collateral value to gauge risks associated with the loan.

How can pdfFiller help in managing your agreements?

pdfFiller simplifies document management through its cloud-based platform allowing users to edit PDFs, eSign, and collaborate efficiently.

-

Easily edit and sign your documents online from any device, ensuring accessibility and convenience.

-

Work collaboratively with your team on document preparation and revisions, enhancing productivity.

-

Access and store your agreements from any location with secure cloud storage.

How to fill out the Security and Promissory Note Agreement Template

-

1.Download the Security and Promissory Note Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling in the names of the lender and borrower at the top of the document.

-

4.Clearly state the loan amount in the appropriate section.

-

5.Specify the interest rate and payment terms, including due dates for repayments.

-

6.Incorporate details about the collateral being used to secure the loan.

-

7.Include any additional clauses that may be necessary, such as default penalties or early repayment options.

-

8.Review the completed document for accuracy and completeness.

-

9.Sign the agreement electronically using pdfFiller's signature tool.

-

10.Download or share the signed agreement with all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.