Self Directed Ira LLC Operating Agreement free printable template

Show details

This Operating Agreement regulates the rights, responsibilities, and obligations of the members regarding the operation and governance of the Company as a SelfDirected IRA.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

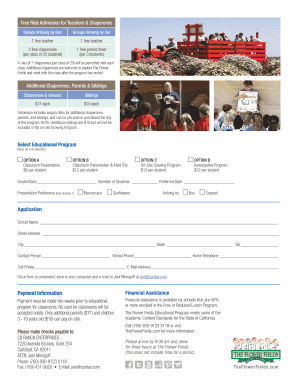

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Self Directed Ira LLC Operating Agreement

A Self Directed IRA LLC Operating Agreement is a legal document that outlines the management and operation of an LLC created for holding assets within a self-directed individual retirement account (IRA).

pdfFiller scores top ratings on review platforms

So easy ro create documents, fill documents for others, sign, initial, highlight, etc. PDFfiller is my extra secretary! Thank you!

I love PDFfiller so I can fill out my forms fast and neat

Extremely user friendly. Its the best template program Ive seen yet

Just starting with it and its good so fa

Very interactive, easy navigation and helpful

Very good. It allows me to fill in and print the needed documents.

Who needs Self Directed Ira LLC Operating Agreement?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Self-Directed IRA Operating Agreement

What is a Self-Directed IRA ?

A Self-Directed IRA LLC provides individual investors with control over their retirement funds, allowing them to invest in various assets like real estate or commodities. Unlike traditional IRAs, which limit investment choices to stocks and bonds, this structure opens up a wider array of investment alternatives, including alternative assets. Understanding this framework is essential for maximizing your retirement fund's potential.

-

A Self-Directed IRA LLC allows individuals to manage their own retirement accounts, facilitating direct investments in diverse assets.

-

Utilizing an LLC can provide liability protection and simplified management of various investments, along with tax advantages.

-

The IRS designates specific regulations governing Self-Directed IRAs, emphasizing the importance of compliance to avoid penalties and ensure taxation is deferred.

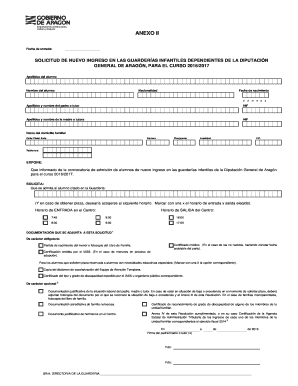

What are the key components of the Operating Agreement?

The Operating Agreement is fundamental in establishing how your LLC will operate. It defines essential terms and responsibilities of all members involved. Each component ensures that everyone is aware of their duties and the rights associated with their investments.

-

The individual or entity that holds an ownership interest in the LLC.

-

Refers to the LLC itself, which holds the IRA assets.

-

Indicates the retirement account protected under IRS regulations.

-

Refers to the funds or assets contributed by members into the LLC.

-

Describes the allocation of profits or disbursements to members from the LLC.

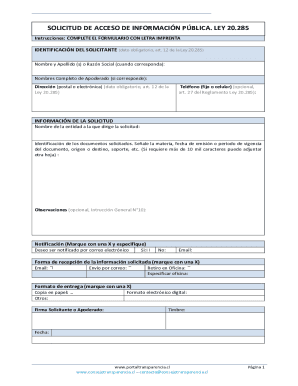

How do you form your Self-Directed IRA ?

Forming a Self-Directed IRA LLC involves several important steps that adhere to state laws. It is essential to file the Articles of Organization with the state and provide all necessary documents to establish your company legally.

-

Select a unique name for your LLC that complies with state regulations.

-

Submit the required documents to your state’s Secretary of State office.

-

Formally establish the governance framework of your LLC through an Operating Agreement.

How do you establish the 's governance structure?

Defining the governance structure of your LLC is critical for operational clarity. This section outlines the roles of members in decision-making and how profits and losses are distributed.

-

Each member should have clearly defined roles to ensure accountability and streamline decisions.

-

Establish how major decisions will be made within the LLC, whether by majority vote or consensus.

-

Clarify how profits and losses will be shared among members to prevent disputes.

What are the practical considerations in operating your ?

Running your Self-Directed IRA LLC requires careful attention to compliance with IRS regulations. Regular documentation and record-keeping are pivotal to maintaining the integrity of the investments.

-

Ensure meticulous records of all transactions and communications related to your LLC.

-

Schedule regular meetings and document the decisions made for transparency.

-

Be prepared to update your Operating Agreement as circumstances change.

How does pdfFiller enhance document management?

pdfFiller offers robust tools for managing your Operating Agreement efficiently. Users can edit documents seamlessly, eSign contracts for quicker processing, and collaborate effectively with other team members.

-

Use pdfFiller to easily modify the Operating Agreement to align with your current business needs.

-

Securely sign documents electronically, expediting the agreement process.

-

Invite team members to work on documents simultaneously, improving workflow.

What additional resources are available for operators?

Utilizing supplementary resources can aid in the effective management of your Self-Directed IRA LLC. From IRS guidelines to practical templates, these tools can enhance your operational efficiency.

-

Access links to IRS resources specifically addressing compliance for Self-Directed IRAs.

-

Utilize customizable templates for various business documents to save time.

-

Seek expert advice for navigating complex investment scenarios and compliance issues.

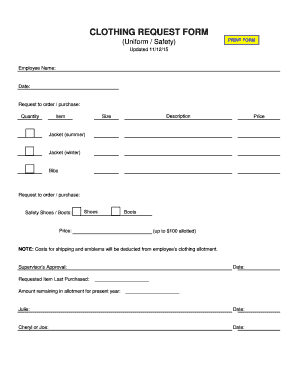

How to fill out the Self Directed Ira LLC Operating Agreement

-

1.Download the Self Directed IRA LLC Operating Agreement template from pdfFiller.

-

2.Open the PDF in pdfFiller and review the blank fields that require your information.

-

3.Start by entering your LLC's name and address in the designated sections.

-

4.Fill in details regarding the members of the LLC, including their names and percentage interests.

-

5.Complete the management structure by specifying whether it’s member-managed or manager-managed.

-

6.Provide any necessary information regarding the initial capital contributions made by members.

-

7.Review the clauses about profit sharing, distribution of assets, and other operational procedures.

-

8.Make sure to sign the document where indicated and date it appropriately.

-

9.Save the completed document and consider printing a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.