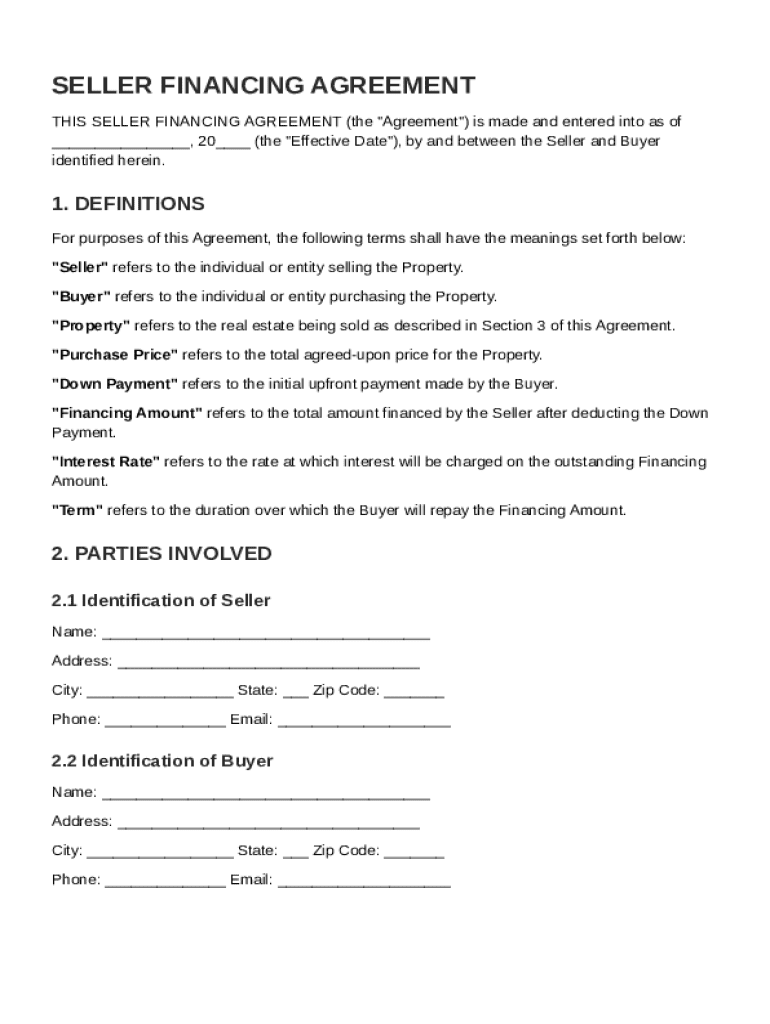

Seller Financing Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a seller provides financing to a buyer for the purchase of property, including definitions, parties involved, property description, financial

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Seller Financing Agreement Template

A Seller Financing Agreement Template is a legal document outlining the terms under which a seller agrees to provide financing to a buyer for the purchase of real estate, without involving traditional lenders.

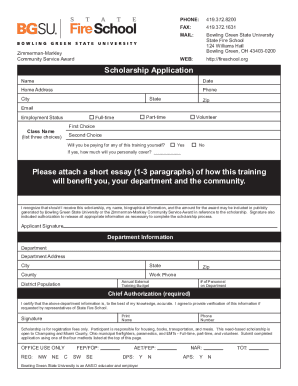

pdfFiller scores top ratings on review platforms

GOOD JOB

The process was extremely easy to understand and forward for signature. Thank you very much

Great customer service

Great customer service. No hassle refund when I forgot to cancel before my free trial ended, I very much appreciate a company that operates this way!

The only feature I don't see (maybe…

The only feature I don't see (maybe I've missed it) that would be helpful is the ability to spilt a document.Otherwise, it's super easy to use.

So easy to use and intuitive

So easy to use and intuitive. Loving this tool.

EXCELLENT SITE

Great app

Great app. Would recommend it for anyone

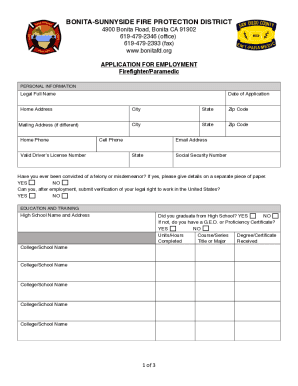

Who needs Seller Financing Agreement Template?

Explore how professionals across industries use pdfFiller.

Seller Financing Agreement Template Guide

How to fill out a Seller Financing Agreement form

To fill out a Seller Financing Agreement form, start by providing accurate identification for both the seller and buyer, along with detailed descriptions of the property. You’ll need to outline the financial terms, including the purchase price, down payment, and interest rate. Finally, follow the step-by-step instructions provided in our guide to ensure proper completion.

Understanding seller financing agreements

A Seller Financing Agreement is a type of transaction where the seller provides financing to the buyer. This method allows buyers who might not qualify for traditional bank loans to acquire property. Unlike conventional financing through banks, seller financing can be more flexible, making it an attractive option in various scenarios.

-

Seller financing often allows for more flexible terms tailored to both parties.

-

Buyers can bypass strict credit checks commonly required by banks.

-

Seller financing often expedites the sales process, reducing the time until the buyer can move in.

What are the key terms in the Seller Financing Agreement?

Understanding the key terms in a Seller Financing Agreement is crucial for both parties involved. The main terms include the buyer's and seller's names, the property being sold, the purchase price, the down payment amount, the financing amount, the interest rate, and the repayment term.

-

The individual or entity selling the property.

-

The individual or entity purchasing the property.

-

The total amount the buyer agrees to pay for the property.

-

The percentage charged on the financing amount, which influences monthly payments.

What parties are involved in the agreement?

In a Seller Financing Agreement, the main parties involved are the seller and the buyer. Proper identification is essential to ensure all legal responsibilities are met. Both parties must provide necessary information that includes their complete names, addresses, and contact details.

-

Full legal name of both buyer and seller.

-

Complete mailing addresses for correspondence.

-

Phone numbers and email addresses to facilitate communication.

How do you describe the property?

The property description in a Seller Financing Agreement should include critical details such as location and legal descriptions. This ensures that everyone involved clearly understands what property is being financed. Condition disclosures are also vital as they can impact property valuation and buyer decisions.

-

The physical address where the property is situated.

-

A textual description that assists in clearly identifying the property.

-

The identification number assigned to the property by the local government.

Financial terms breakdown

Key financial terms in the agreement include the purchase price, down payment, financing amount, and interest rate. Understanding how these components interact is crucial for calculating monthly payments and informing financial decisions.

-

Total cost of the property as agreed by both parties.

-

The total amount financed by the seller, calculated by subtracting the down payment from the purchase price.

-

Detailed timeline on when the buyer will make payments, including principal and interest.

What steps are needed to complete the agreement?

Completing a Seller Financing Agreement involves several detailed steps. Begin by gathering all required information from both parties. Then, accurately fill in the financial terms and other relevant details according to our guide. Make use of interactive tools available on pdfFiller to streamline the process.

-

Collect details on the buyer, seller, and property.

-

Complete the Seller Financing Agreement template accurately.

-

Ensure that all the information is correct before finalizing.

How to edit and customize your agreement?

pdfFiller offers several features to edit and customize the Seller Financing Agreement template. Users can modify details to suit unique situations or preferences. This flexibility allows users to adjust terms, add clauses, or take advantage of convenient editing tools provided on the platform.

-

Utilize pdfFiller's editing tools to make necessary adjustments.

-

Add custom clauses or terms based on specific needs.

What are the signing and management processes for the agreement?

After filling out the agreement, it's time to sign and manage it. There are various electronic signature options available on pdfFiller to finalize the agreement. Additionally, users can easily store, share, and retrieve the document from the cloud, ensuring easy management throughout the agreement's lifecycle.

-

Explore multiple electronic signature options for convenience.

-

Utilize pdfFiller's features to manage the document effectively.

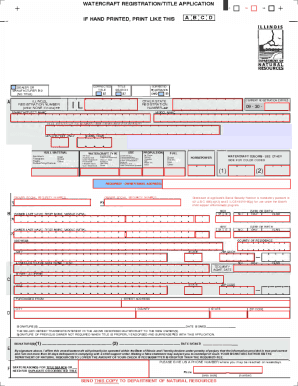

How to fill out the Seller Financing Agreement Template

-

1.Open the Seller Financing Agreement Template on pdfFiller.

-

2.Begin by filling in the seller's information, including name and contact details.

-

3.Next, provide the buyer's information in the designated sections.

-

4.Specify the property details including address, type, and description.

-

5.Fill in the financial terms such as purchase price and down payment amount.

-

6.Outline the interest rate, payment schedule, and loan term explicitly in the template.

-

7.Include any additional clauses or terms specific to the agreement that are needed.

-

8.Review the document for accuracy and completeness before finalizing.

-

9.Once all information is filled out correctly, save the document and consider printing it for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.