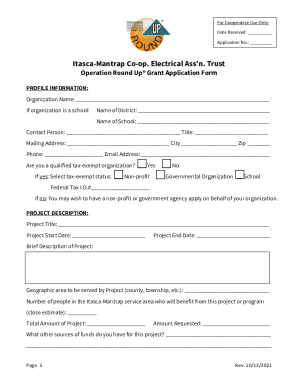

Service Level Financial Service Agreement Template free printable template

Show details

This document outlines the expectations, responsibilities, and agreements between a service provider and a client regarding financial services delivered.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Service Level Financial Service Agreement Template

A Service Level Financial Service Agreement Template is a formal document outlining the expectations, responsibilities, and service levels agreed upon between a financial service provider and a client.

pdfFiller scores top ratings on review platforms

Very helpful and dynamic

NICE AND EASY

its a litle dificult to send finished PDF out

This was a lifesaver. I don't know why I didn't start using this sooner. I can see this as my go-to for future documents.

NO TIME

fast editing, cool features

Who needs Service Level Financial Service Agreement Template?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to the service level financial service agreement form

Filling out a Service Level Financial Service Agreement Template form may seem complex, but it becomes straightforward when you break it down into manageable steps. This guide will walk you through understanding the agreement, defining key terms, and utilizing tools like PDFfiller to create a comprehensive document.

What is a Service Level Financial Service Agreement?

A Service Level Financial Service Agreement (SLFSA) is a formal document that defines the expectations and obligations regarding financial services between a service provider and a client. Its primary purpose is to establish clear guidelines and performance standards that both parties agree upon. Documenting these expectations is essential as it sets the tone for the relationship and helps mitigate potential disputes, ensuring legal clarity.

-

The agreement serves as a reference point for both parties, outlining what services will be provided and at what performance level.

-

It is essential for maintaining accountability and setting client expectations for financial service outcomes.

-

Failure to meet the specified service levels can have legal consequences, including penalties or damages.

What key terms should you know?

Understanding the terminology used in a Service Level Financial Service Agreement is crucial for both parties. Key definitions help clarify roles and establish performance measures, ensuring that both the service provider and the client are on the same page regarding their respective responsibilities.

-

The entity that provides financial services, whose roles and responsibilities must be clearly outlined in the agreement.

-

The recipient of the financial services, who has clear expectations from the service provider.

-

A critical component that stipulates the performance standards expected from the service provider.

-

Specific metrics that determine the success of the service levels, such as response times and accuracy rates.

-

Details that must be protected to maintain trust and compliance with regulations.

-

Clauses that excuse parties from obligations due to unforeseen circumstances.

What services are covered in the agreement?

Defining the scope of services is vital in an SLFSA. This section helps eliminate ambiguity regarding what is included or excluded in the agreement, thereby reducing misunderstandings.

-

The agreement should provide a comprehensive list of financial services to be rendered, leaving no room for ambiguity.

-

Any optional or extra services that may be offered should be listed to inform the client of their availability.

-

Clearly define what is not covered under the agreement to prevent disputes down the line.

What are performance standards and service level objectives?

Performance standards in an SLFSA establish benchmarks for the quality and timeliness of services provided. These standards are integral in assessing whether the service provider is fulfilling their obligations and enable the client to measure satisfaction effectively.

-

Specific examples could include turnaround times for financial reporting and error rates in transactions.

-

Goals should be set to be achievable, balancing ambition with practicality.

-

KPIs should be seamlessly incorporated into the service agreement to track and evaluate performance.

What legal considerations must be addressed?

Legal considerations are crucial for crafting a solid Service Level Financial Service Agreement. Including certain clauses ensures that both parties are aware of their rights and obligations, and understanding compliance with local laws is imperative.

-

Clauses may include dispute resolution procedures, confidentiality terms, and liability limitations.

-

Parties must be aware of specific regulations that govern financial services in their region.

-

Regular reviews and updates of the agreement can help maintain compliance and relevance.

How to manage your agreement using PDFfiller?

Utilizing tools like PDFfiller can significantly simplify the process of filling out and managing your Service Level Financial Service Agreement Template form. This platform offers features that enhance collaboration, document editing, and eSigning capabilities.

-

PDFfiller enables you to enter data directly into the Service Level Financial Service Agreement Template form, ensuring accuracy.

-

You can electronically sign documents and collaborate with others in real-time, speeding up the approval process.

-

Access your documents from anywhere, allowing for greater flexibility and convenience.

When should you seek professional legal advice?

While it is possible to draft an SLFSA independently, consulting with a legal expert can provide invaluable guidance, especially if your agreement involves substantial monetary amounts or complex services. Knowing when to seek professional help ensures that the document is thorough and legally robust.

-

Seek advice if you encounter complex terms or legal jargon that may affect your agreement.

-

Inquire about risks, regulatory compliance, and any industry-specific concerns related to your financial services.

-

Look for local legal aid offices or professional organizations that can assist you in your search for legal counsel.

Where to find related document templates?

Exploring additional document templates related to financial services can further enhance your understanding of agreements and their specific necessities. PDFfiller provides access to various templates that can serve different needs.

-

PDFfiller hosts a variety of financial service-related documents that cater to differing client requirements.

-

Evaluate different templates to identify which best fits your specific needs.

-

Utilize filters on PDFfiller to find templates tailored to your service requirements or personal preferences.

How to fill out the Service Level Financial Service Agreement Template

-

1.Download the Service Level Financial Service Agreement Template from pdfFiller's library.

-

2.Open the template using the pdfFiller editor.

-

3.Fill in the date at the top of the document where indicated.

-

4.Input the names and contact information of both parties involved: the service provider and the client.

-

5.Clearly state the scope of services to be provided in the designated section, including any specific financial metrics.

-

6.Detail the agreed-upon service levels, such as response times, availability, and support hours.

-

7.Include any penalties or remedies for non-compliance with agreed service levels.

-

8.Review the payment terms section and fill in the details regarding fees and payment schedules.

-

9.Make sure to specify the duration of the agreement and any renewal terms if applicable.

-

10.Finally, have both parties read through the document, sign, and date where indicated to finalize the agreement.

How to fill a service level agreement?

How to write an SLA in 5 steps Define the service. Your SLA will need to define and outline the service clearly. Verify service levels. Service levels quantify the performance or output of a service. Determine performance metrics. Prepare the service-level agreement document. Review the SLA with all stakeholders.

How to write a service agreement template?

How to write a Service Agreement Information about the service. First, specify how long services are needed (e.g., for a single job, a fixed term, or indefinitely) and where the work will be done (as this affects the laws that apply to your contract). Party details. Payment. Terms and conditions. Final details.

How to fill an agreement form?

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

What is a SLA template?

By Joseph Nduhiu, Laiba Siddiqui. Key takeaways. Service Level Agreements (SLAs) are formal contracts between service providers and customers that define the scope of services, performance metrics, responsibilities, and remedies for unmet targets.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.