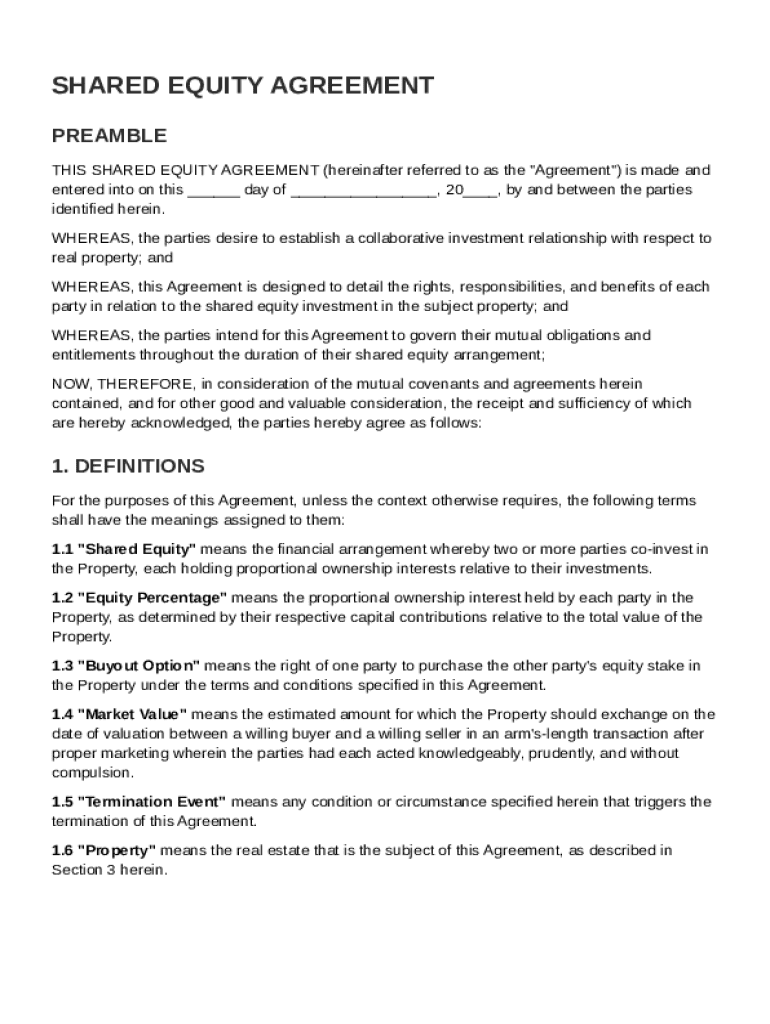

Shared Equity Agreement Template free printable template

Show details

This document outlines the terms of a shared equity investment agreement between parties regarding real property, detailing rights, responsibilities, and benefits.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

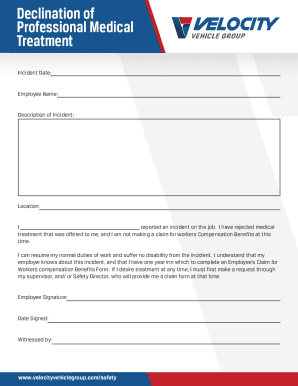

What is Shared Equity Agreement Template

A Shared Equity Agreement Template is a legal document outlining the terms of a shared equity arrangement between parties regarding property ownership.

pdfFiller scores top ratings on review platforms

Good experience

Good experience

I love this platform

I love this platform. It has been helpful for things I have had to complete or produce.

Good editor

Good editor

5-star

Easy to use. Quick, reliable.

When I was in a bind and needed to just…

When I was in a bind and needed to just change a few things on a document, it saved me.

I should have purchased the pdfFiller…years ago!!!

I should have purchased the pdfFiller long ago? I always thought that there was something wrong with my computer?

Who needs Shared Equity Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Shared Equity Agreement Template on pdfFiller

Filling out a Shared Equity Agreement Template can be simplified using pdfFiller. This guide will provide you with essential insights into shared equity agreements and how to effectively manage them.

What are shared equity arrangements?

Shared equity arrangements represent a collaborative investment strategy where two parties co-invest in a property. This method allows individuals to benefit from property ownership while sharing both the risks and rewards. Understanding shared equity is crucial for ensuring mutual understanding and commitment in such arrangements.

-

Shared equity refers to an arrangement where investment in a property is divided between two or more parties.

-

These agreements can offer reduced upfront costs, access to better properties, and shared financial risks.

-

Investors should be aware of risks such as market fluctuations and disputes over ownership rights.

What are the key components of a shared equity agreement?

A well-structured shared equity agreement contains essential components that define the terms clearly and protect the interests of all involved parties. Clarity in agreement terms helps in averting potential conflicts in the future.

-

Key terms such as Shared Equity, Equity Percentage, and Market Value should be clearly defined.

-

Each party's rights and responsibilities must be outlined to avoid misunderstandings.

-

The agreement should specify conditions for buying out equity, ensuring both parties understand their options.

How do navigate the Shared Equity Agreement Template?

Navigating the Shared Equity Agreement Template on pdfFiller is user-friendly; utilizing interactive features improves the efficiency of filling out forms. Following a systematic approach aids in reducing errors and enhances clarity.

-

Follow step-by-step instructions on pdfFiller to fill out the agreement accurately.

-

Explore interactive features that assist in document editing, filling, and signing.

-

Be aware of common mistakes, such as failing to define equity percentages, to avoid delays in agreement execution.

What interactive tools can help with editing and signing?

pdfFiller provides a suite of editing tools tailored to enhance the process of managing shared equity documents. These tools allow users to edit, sign, and share agreements with ease.

-

Utilize advanced editing tools to customize shared equity documents effectively.

-

Integrate eSignature capabilities for quick and secure document signing.

-

Engage collaborative features that promote teamwork among parties managing shared equity agreements.

What legal considerations should know?

Legal considerations in shared equity agreements can vary by region, making awareness of applicable laws essential. Understanding these regulations ensures that agreements meet legal standards.

-

Familiarize yourself with laws related to shared equity agreements specific to your region.

-

It’s crucial to ensure that the agreement complies with local regulations to avoid legal complications.

-

Be mindful of potential legal consequences that may arise from breaches or terminations of the agreement.

What are some use cases and examples?

Analyzing use cases and examples of shared equity agreements helps potential investors grasp their practical applications. Such insights can foster informed decision-making when considering shared equity investments.

-

Explore various examples of shared equity arrangements across different industries.

-

Review case studies that highlight successful shared equity partnerships and the benefits they brought.

-

Conduct a comparative analysis with other property agreements to understand the value of shared equity.

What are the final steps in managing my Shared Equity Agreement?

Managing a shared equity agreement requires ongoing communication and organized management of documents. Developing strong communication lines enhances relationships among parties and ensures smooth ownership transitions.

-

Continuously monitor the agreement terms and ensure both parties adhere to their respective obligations.

-

Implement strategies promoting effective communication among all parties involved.

-

Utilize pdfFiller for secure archiving and management of agreements.

How to fill out the Shared Equity Agreement Template

-

1.Begin by downloading the Shared Equity Agreement Template from pdfFiller's website.

-

2.Open the PDF document in pdfFiller.

-

3.Fill in the names of all parties involved at the top of the agreement.

-

4.Specify the property address and any relevant identification numbers.

-

5.Outline the contribution percentages of each party, detailing financial inputs as necessary.

-

6.Include terms detailing responsibilities for maintenance, taxes, and other costs associated with the property.

-

7.Set forth the duration of the agreement and conditions for termination or exit strategies.

-

8.Review the document for accuracy and completeness before final review.

-

9.Save your completed document and share it with the involved parties for signatures.

-

10.Ensure all parties keep a signed copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.