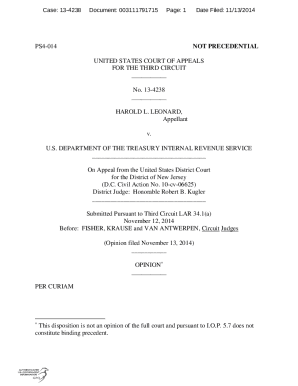

Shareholder Buyout Agreement Template free printable template

Show details

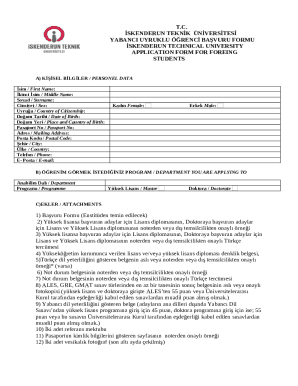

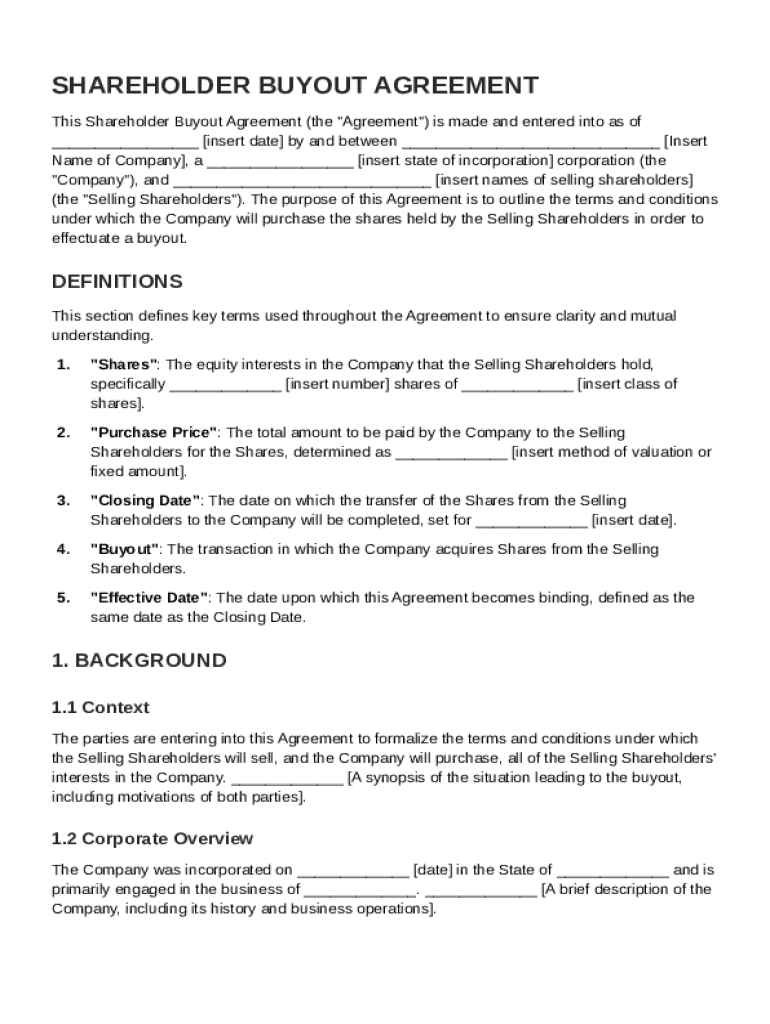

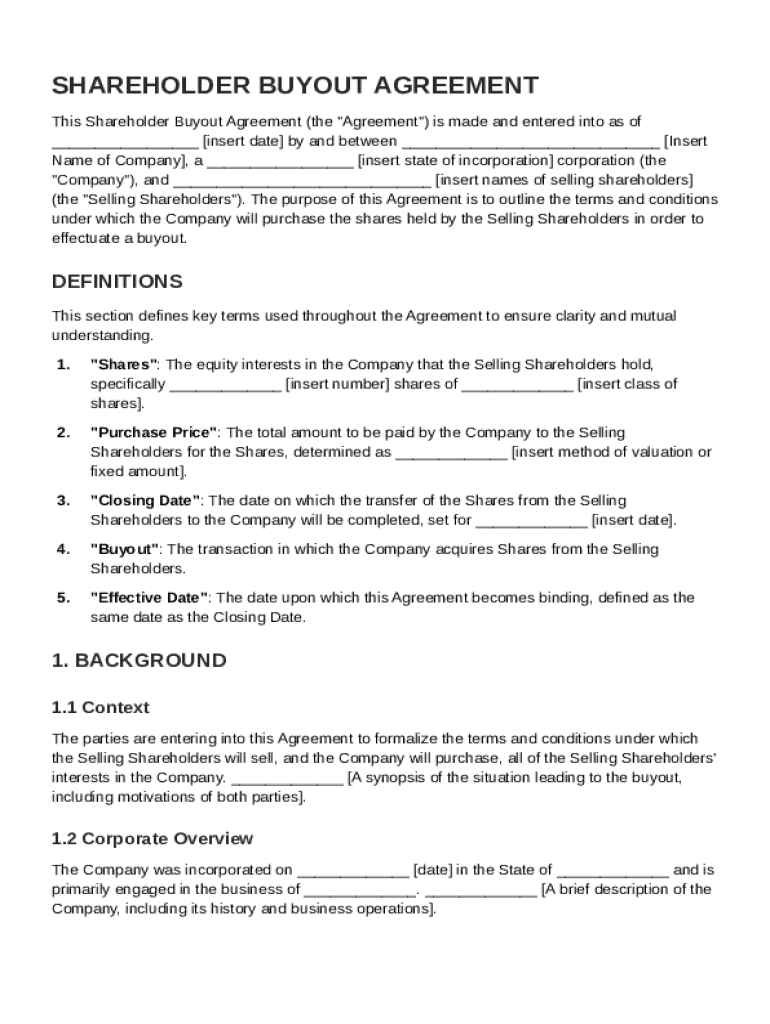

This document outlines the terms and conditions under which a company will purchase shares held by selling shareholders to effectuate a buyout.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

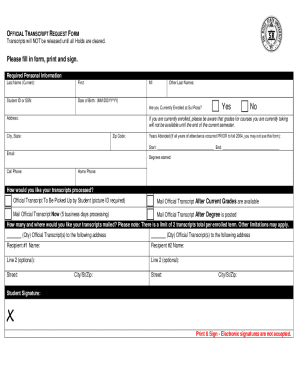

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Shareholder Buyout Agreement Template

A Shareholder Buyout Agreement Template is a legal document outlining the terms and conditions under which one shareholder can buy out another shareholder's shares in a corporation.

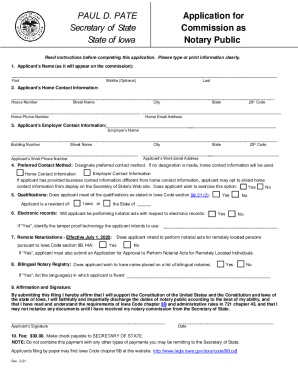

pdfFiller scores top ratings on review platforms

It was good. Hard to edit one document due to not being able to insert words. It was a lot easier & more convenient than finding a typewriter or printing the form having to use white out for goofs.

I am admittedly a novice, but I am having to redo things much more often than usual for me.

works well, but I wish things were ONE step

I really like using PDF filler, sometimes it's a little hard to find what im looking for. But one I find it everything works well

The price is kind of crazy, I am a single mother of 3 and I am on a limited budget. The program itself is fantastic, but the price is hard for me to justify buying. :(

So far, it's saved me from having to completely re-due forms and have clients resign. Thanks.

Who needs Shareholder Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Shareholder Buyout Agreement Template

TL;DR: To fill out a Shareholder Buyout Agreement Template form, identify the parties involved, define crucial terms like purchase price and effective date, and ensure compliance with local laws. Utilize tools like pdfFiller for streamlined editing and management.

What is a shareholder buyout agreement?

A shareholder buyout agreement is a legal document that outlines the terms under which a company's shareholders can sell their shares back to the company or to other shareholders. This structured agreement is essential as it facilitates fair and transparent buyouts, ensuring all parties understand their rights and obligations. Common reasons for initiating a buyout include resolving disputes among shareholders, retiring from active participation, or addressing financial constraints.

What are the key components of a shareholder buyout agreement?

-

Clearly state the names of the company and selling shareholders involved in the agreement.

-

Define critical terms including 'shares,' 'purchase price,' and 'closing date' to eliminate ambiguity.

-

Include an effective date to establish when the agreement becomes binding. This is crucial for legal enforceability.

How to structure the shareholder buyout agreement?

An effective shareholder buyout agreement includes a 'Purchase and Sale' clause detailing the transfer of shares. Drafting terms and conditions requires careful consideration of pricing, payment methods, and any contingencies. You may also want to include examples of common terms like warranties and representations to provide clarity.

What is the procedure for executing a buyout?

-

Both parties should follow a defined process that includes formal communication and documentation.

-

Legal counsel plays an essential role in reviewing the agreement to ensure compliance and protect shareholder rights.

-

Specify acceptable payment methods (e.g., lump sum, installment) and how shares will be transferred.

How to draft the shareholder buyout agreement: A step-by-step guide

Utilizing tools like pdfFiller helps streamline the drafting and editing of your agreement. Start by filling out essential fields and ensure compliance with local regulations relevant to your state. Additionally, utilize available templates on pdfFiller for optimal efficiency in document creation.

What are the legal considerations in shareholder buyout agreements?

-

Ensure the agreement adheres to state-specific laws and regulations, which can affect the validity of the buyout.

-

Avoid vague language and incomplete information during the drafting process to prevent disputes.

-

Having the agreement reviewed by legal professionals safeguards against legal challenges and ensures all parties are adequately represented.

What are best practices for managing shareholder buyouts?

-

Engage in open communication to preserve positive relationships with outgoing shareholders, which can benefit future cooperation.

-

Document all transactions accurately and retain records for future reference and compliance purposes.

-

Consider potential implications for future agreements and address shareholder involvement proactively.

What are the next steps in finalizing the buyout?

After drafting the Shareholder Buyout Agreement Template and reviewing all materials, the next steps include finalizing the agreement and ensuring all parties sign it. Utilizing pdfFiller simplifies the document management process, allowing you to edit, sign, and collaborate within a single platform. Take time to recap critical insights and finalize all agreements to ensure a smooth transition.

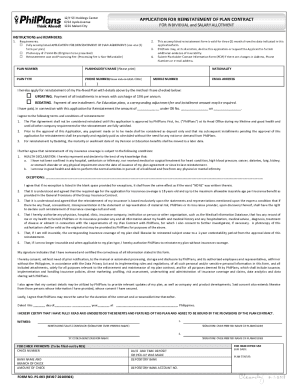

How to fill out the Shareholder Buyout Agreement Template

-

1.Download the Shareholder Buyout Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Review the pre-filled sections to understand the existing terms.

-

4.Enter the names and contact details of all parties involved.

-

5.Specify the number of shares being bought or sold.

-

6.Detail the purchase price for the shares being transferred.

-

7.Include payment terms, such as deadlines and methods.

-

8.Add any contingencies or conditions for the buyout.

-

9.Review the document for clarity and completeness.

-

10.Have all parties sign the agreement in the designated fields.

-

11.Save or print the completed agreement for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.