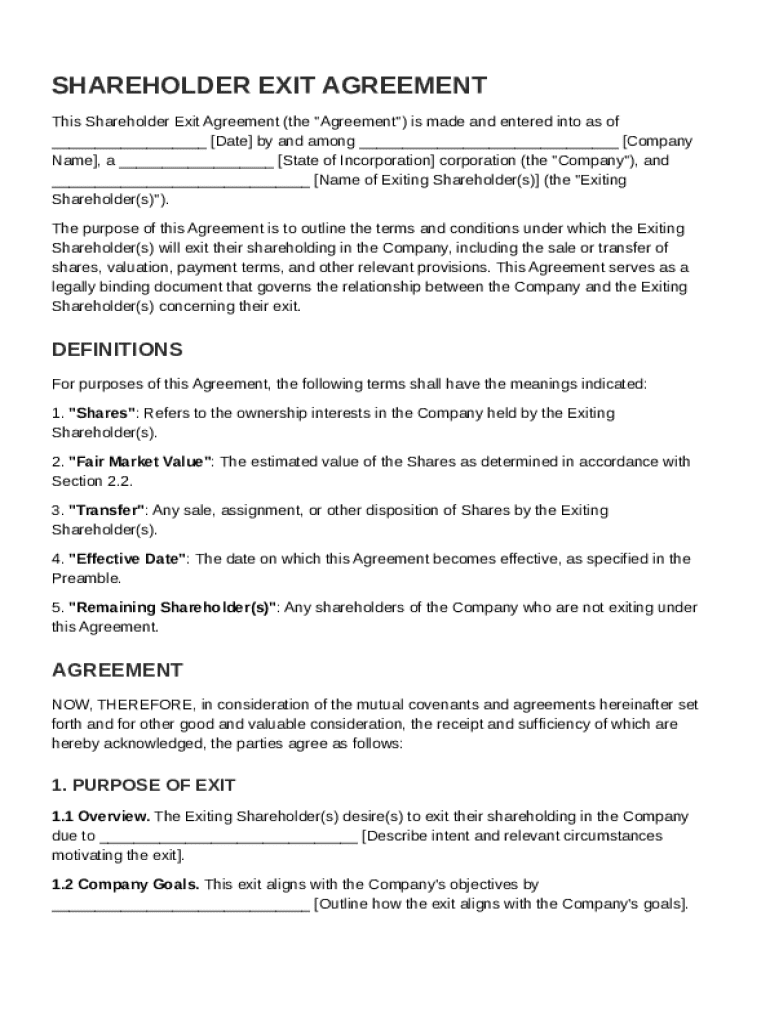

Shareholder Exit Agreement Template free printable template

Show details

This document outlines the terms and conditions under which exiting shareholders will exit their shareholding in a company, including details on the sale or transfer of shares, valuation, and payment

We are not affiliated with any brand or entity on this form

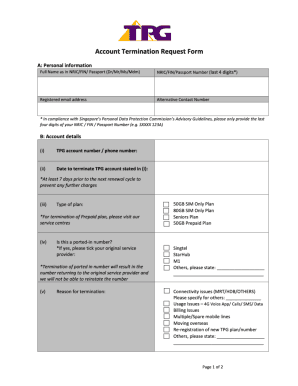

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Shareholder Exit Agreement Template

A Shareholder Exit Agreement Template is a legal document outlining the terms and conditions under which a shareholder can exit a company, including the sale or transfer of their shares.

pdfFiller scores top ratings on review platforms

I had a great experience but I wish there was a one month free trial before I tried anything

I like it, but I don't like that there's a hidden charge you don't find out about until after you've filled in a form.

GOOD BUT CONFUSED ABOUT ADDING NEW FORMS

This is a great help...don't want to pay an extraordinary amount just to fill in forms, thanks for this! :)

I love it!! I able to do the job that was requested of me right from home.

It is not easy to find supporting schedules or work sheets

Who needs Shareholder Exit Agreement Template?

Explore how professionals across industries use pdfFiller.

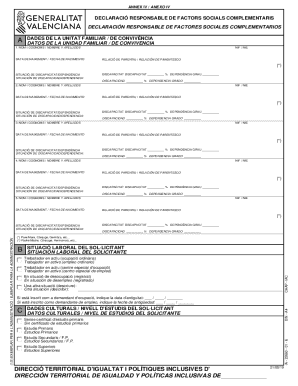

Comprehensive Guide to the Shareholder Exit Agreement Template on pdfFiller

Filling out a Shareholder Exit Agreement Template form provides a structured approach to managing shareholder exits efficiently. To fill out this form, ensure you clearly understand the required sections, legal implications, and how to utilize digital tools like pdfFiller effectively.

What is a Shareholder Exit Agreement?

A Shareholder Exit Agreement is a legal document that outlines the terms and conditions under which a shareholder can exit a company. This agreement is essential as it protects the rights of all parties involved, ensuring a clear, structured process during transitions.

-

A legally binding document that dictates the conditions of a shareholder's exit.

-

It provides legal rights, clarifies obligations, and reduces ambiguity, thus facilitating a smoother transition.

-

Includes terms on valuation, payment structure, and timing, which are crucial for all parties.

When should you utilize a Shareholder Exit Agreement?

Certain scenarios warrant the drafting of a Shareholder Exit Agreement. Whether due to retirement, unexpected resignation, or another form of exit, it's essential to be prepared to mitigate risks and ensure all parties understand their responsibilities.

-

Planning for these scenarios helps ensure the company's future direction is not jeopardized.

-

As roles within a company change, an Exit Agreement clarifies ongoing obligations and entitlements.

-

A suitable Exit Agreement can help maintain the company's value during transitions.

What are the components of the Shareholder Exit Agreement?

A Shareholder Exit Agreement typically includes several key components, which provide clarity and structure for the exit process. Understanding these components is critical to drafting a comprehensive agreement.

-

Includes purpose, ownership of shares, payment terms, and how transitions will be handled.

-

Defines how to fairly assess the value of shares being exited.

-

Specifies when the agreement comes into force and affects the shareholder.

How do you fill out the Shareholder Exit Agreement?

Filling out the Shareholder Exit Agreement Template on pdfFiller is straightforward. The platform provides interactive tools for easy completion, ensuring all necessary sections are adequately filled.

-

Start by gathering all necessary information related to the shareholder and the company.

-

Follow prompts on pdfFiller to fill in essential sections, ensuring accurate and complete data entry.

-

Utilize pdfFiller's editing capabilities to customize the agreement as needed based on specific circumstances.

How to collaborate and manage exit agreements with pdfFiller?

Using pdfFiller’s platform fosters collaboration among team members when managing exit agreements. Features such as eSigning and secure storage enhance user experience significantly.

-

Allow multiple stakeholders to work on the document simultaneously, enhancing efficiency.

-

Facilitates quick and secure approval without the need for physical meetings.

-

Organize all exit agreements in one location for easy access and review.

What are common challenges in drafting Shareholder Exit Agreements?

While drafting a Shareholder Exit Agreement, several challenges can arise, many of which stem from legal and transparency issues. It’s critical to address these to avoid disputes.

-

Ensure compliance with company laws and regulations to prevent future complications.

-

Maintaining communication among stakeholders to prevent misunderstandings.

-

Recognize that clear terms diminish chances of conflict amongst parties.

What related documents should you consider?

Associated documents play a crucial role in the success of the Shareholder Exit Agreement. Having all relevant paperwork ensures thorough preparations for the exit strategy.

-

These include bylaws, operating agreements, resolutions, or any other documents that clarify company ownership and operational procedures.

-

Outlining a clear exit strategy will bolster the effective execution of the agreement.

-

Helps in building a thorough record, which is beneficial for transparency and future reference.

How can you explore other pdfFiller features?

If you're looking for additional templates or tools on pdfFiller, the platform offers a variety of services beyond Exit Agreements. Navigating these resources can optimize your document management.

-

Browse categories related to corporate agreements to enhance your documentation capabilities.

-

Utilize pdfFiller’s other features for customized document creation and management.

-

pdfFiller serves as a one-stop-shop for various business documentation requirements.

What should you know about this page?

This page is designed to equip users with comprehensive insights on filling out the Shareholder Exit Agreement Template. It highlights the essential features pdfFiller provides to streamline this process.

-

Summarizes the functionalities of pdfFiller in managing different types of agreements.

-

Users are encouraged to utilize pdfFiller’s tools for seamless document management and signature collection.

-

Offers users assistance for any inquiries or issues related to the use of pdfFiller.

How to fill out the Shareholder Exit Agreement Template

-

1.Download the Shareholder Exit Agreement Template in PDF format.

-

2.Open the document using pdfFiller.

-

3.Begin by entering the date on which the agreement is being made.

-

4.Fill in the names and addresses of the exiting shareholder and the company.

-

5.Specify the number and type of shares being exited.

-

6.Detail the compensation or payment structure for the exiting shares.

-

7.Outline any obligations the exiting shareholder has post-exit.

-

8.Include a section for mutual non-disclosure agreements if applicable.

-

9.Have all parties involved review the document for accuracy.

-

10.Once completed, ensure all parties sign the agreement.

-

11.Save the document and distribute copies to relevant parties.

How do you exit a shareholder agreement?

The most straightforward way to manage a shareholder's exit is by transferring their shares. The exiting shareholder can sell their shares to another current shareholder or to a new third-party investor. This allows the company to maintain its ownership structure without disruption.

How do I terminate a shareholders agreement?

The first way you can terminate a shareholders agreement is by mutual agreement. This is when all of the shareholders decide that they no longer want to comply with the agreement due to various reasons.

How do I exit a company as a shareholder?

What exit options there are to consider? A sale of the shares in the company to an unconnected third party (also referred to as a “trade sale”). A sale of the shares in the company to a group of core management (or a new company formed by them). The establishment of an Employee Ownership Trust (EOT).

Can you write your own shareholder agreement?

There are templates available that can help you draft your own shareholders' agreement – but beware of doing this! A shareholders' agreement can be one of the most important documents you'll ever sign, so it's worth seeking professional legal assistance when drafting the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.