Short Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions for a loan agreement between a Lender and a Borrower including loan details, repayment terms, and remedies for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Short Loan Agreement Template

A Short Loan Agreement Template is a legal document that outlines the terms of a loan between a lender and a borrower, including repayment details and interest rates.

pdfFiller scores top ratings on review platforms

PDFFiller is a great tool! I have been very happy being able to fill in documents without having to print the document, then handwrite the answers on the document, so I could then scan it back in to my computer to send it off via email.

Just starting but it looks like something I need.

Very busy so a recorded webinar would be the best.

i am just starting a new company and your service has been essential in that i have a way to edit our flyers our price list and being able to add things for the customer like check boxes and signature lines has been a god send thank you

so far it has been positive. I had one issue that your customer care specialist was able to resolve very quickly.

JUST LEARNING THE SYSTEM. WEBINAR WILL BE HELPFUL

Who needs Short Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

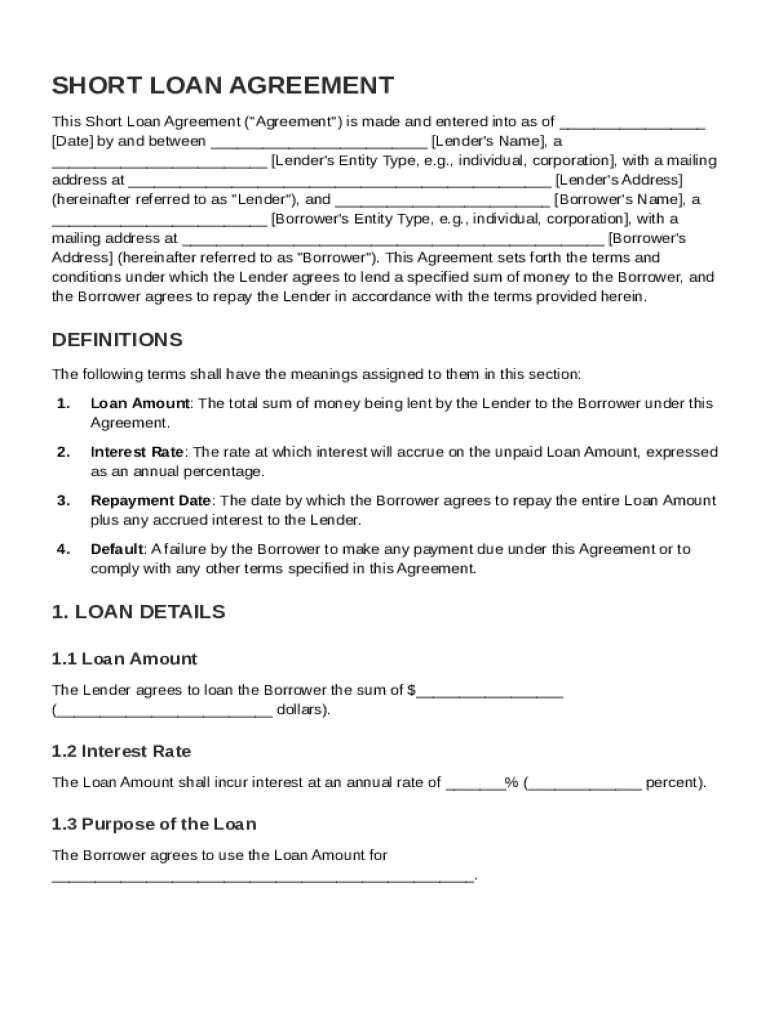

Guide to Crafting a Short Loan Agreement Template

What is a short loan agreement template?

A short loan agreement template is a pre-formatted document that outlines the terms and conditions of a loan between two parties: the lender and the borrower. This agreement provides a formal structure for the transaction, detailing key information such as the loan amount, interest rate, repayment terms, and the responsibilities of each party.

By using a template, individuals and teams can ensure that all critical elements are included, making the agreement easy to understand and legally binding. Overall, leveraging a short loan agreement template form from pdfFiller can streamline the document creation process, allowing users to access it from anywhere.

Understanding the structure of a short loan agreement

-

A valid loan agreement typically includes components such as loan amount, interest rates, repayment terms, and signatures from both parties to confirm consent.

-

The lender is the party providing the loan, while the borrower receives it and must adhere to the terms set forth in the agreement.

-

Clearly defined terms help prevent misunderstandings between parties and establish a legal framework to resolve disputes if they arise.

Essential definitions for clarity

-

This is the sum of money borrowed, which should be clearly stated to avoid confusion.

-

This rate determines how much additional money the borrower will pay along with the principal; it can be fixed or variable.

-

The specific date by which the borrower agrees to return the loan amount, critical for planning finances.

-

A default occurs when the borrower fails to meet the repayment conditions; this can have legal and financial implications.

How to fill out short loan agreement details

-

Explicitly specify the total amount to be lent; avoid vague amounts.

-

Set an appropriate rate based on market conditions; document how it’s calculated.

-

Define the intended use of the funds clearly; this can affect approval and repayment terms.

Repayment terms to structure payments

-

Outline when payments are due, whether monthly, quarterly, or based on another timeline.

-

Indicate acceptable forms of payment, such as bank transfer, check, or online payment methods.

-

Explain the conditions under which the borrower can repay the loan early and whether any penalties apply.

Understanding your legal rights in a loan agreement

-

Understand that a signed loan agreement serves as a binding legal document between parties.

-

Consult a lawyer if the loan amount is significant or if complex terms are involved.

-

Ensure the agreement adheres to local laws and regulations concerning lending.

Utilizing pdfFiller's online tools

-

With pdfFiller, users can easily edit their loan agreement directly in a user-friendly interface.

-

Enable signers to add their signatures digitally, which streamlines the agreement process.

-

Utilize cloud-based storage for easy access and organization of loan documents.

How to compare loan agreement templates

-

Look for templates that offer customizable fields and clear presentation of terms.

-

Generic templates may lack legal enforceability; ensure the template you choose complies with your local regulations.

-

Tailoring a template to specific situations can prevent future misunderstandings and disputes.

How to fill out the Short Loan Agreement Template

-

1.Open the Short Loan Agreement Template in pdfFiller.

-

2.Begin by entering the date the agreement is being made at the top of the document.

-

3.Fill in the full name and address of the lender followed by the borrower's details.

-

4.Specify the loan amount in clear figures, making sure to double-check for accuracy.

-

5.Indicate the interest rate, if applicable, and ensure clarity on how it is calculated.

-

6.Set the repayment schedule, including due dates, payment amounts, and methods of payment.

-

7.Outline any collateral, if required, and include details about its value and description.

-

8.Review the terms for default and ensure they are clearly articulated.

-

9.Have both parties read the entire document carefully before signing.

-

10.Finally, save the completed document and provide copies to both the lender and borrower for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.