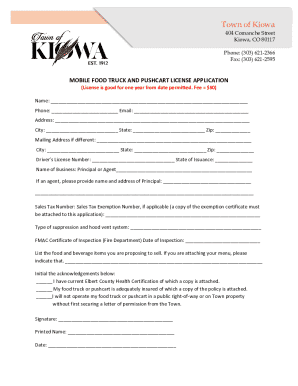

Short Term Personal Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender agrees to lend a specified amount of money to a borrower and the borrower agrees to repay the loan under agreed terms.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

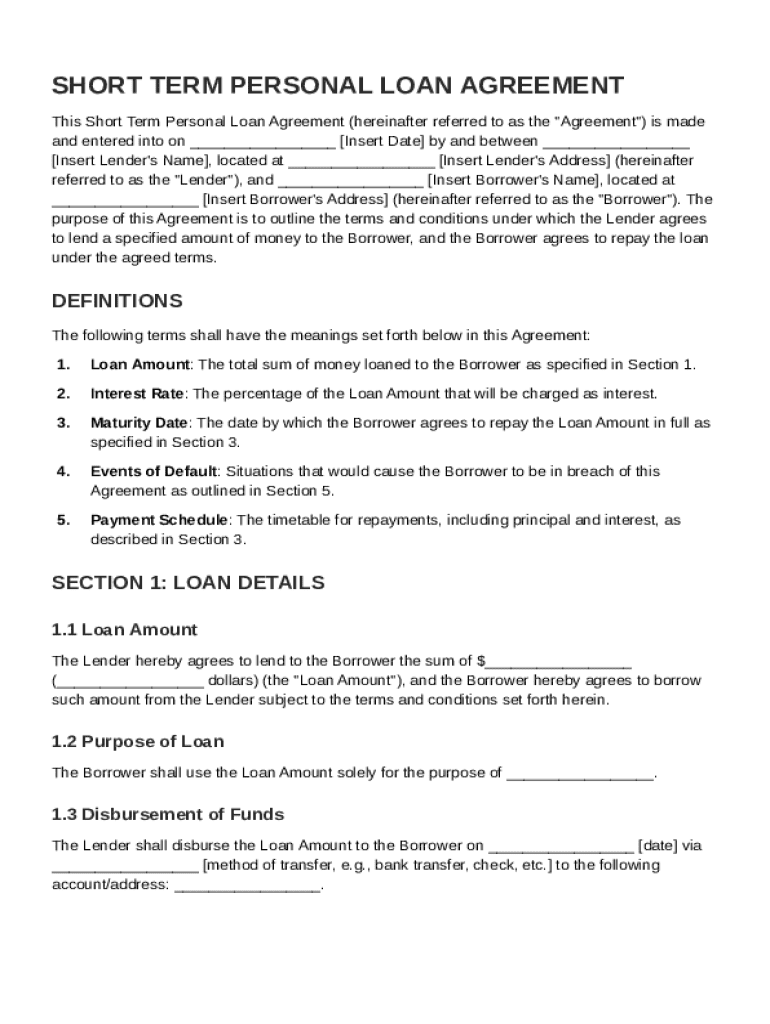

What is Short Term Personal Loan Agreement Template

A Short Term Personal Loan Agreement Template is a legal document that outlines the terms and conditions of a short-term loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

Great customer care service

Great customer care service. Friendly and helpfull staff. Really deserve 5 star.

EASY

EASY AND SATISFYING

Excellent software to use

Excellent software to use, works perfectly and really supports all the challenges I have.

Good

Good software and program

Excellent program for my business. I use it every week. My customers have blank forms that need to be filled in.

Easy to use

Who needs Short Term Personal Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Short Term Personal Loan Agreement Template

A short term personal loan agreement template streamlines the borrowing process, allowing individuals to outline the key terms of a loan. This guide will walk you through the essential components of creating such an agreement, ensuring that all parties know their rights and obligations.

Understanding short term personal loans

Short term personal loans are typically defined as borrowing options that are repaid within a year. They serve various purposes, such as covering unexpected expenses or consolidating debt, and provide quick access to funds. However, they come with unique benefits and risks that borrowers should consider before applying.

-

Short term personal loans are loans that are due for repayment within a shorter timeframe compared to traditional loans, often between a few weeks to a year.

-

These loans can be used for various needs, such as medical bills, auto repairs, or temporary cash flow issues.

-

Consider this type of loan when you need immediate funds and have a plan for repayment; however, assess your current financial health.

-

Pros include quick access to cash, while cons include high interest rates and potential for over-indebtedness.

Defining key terms in the agreement

Understanding key terms is crucial when drafting a short term personal loan agreement. Each term outlines the obligations of both the lender and the borrower, ensuring clarity and reducing misunderstandings.

-

This refers to the total sum of money being borrowed, which needs to be explicitly stated in the agreement.

-

This dictates the cost of borrowing and how it is calculated over the loan term, usually expressed as an annual percentage rate (APR).

-

The maturity date signifies when the loan must be fully repaid, outlining critical timelines.

-

This section defines actions that would constitute a breach of agreement, such as missed payments.

-

A clear repayment schedule details when and how payments are to be made throughout the loan term.

Components of a short term personal loan agreement

A comprehensive short term personal loan agreement covers various sections, each detailing specific elements of the loan transaction.

-

This includes specifying the Loan Amount, indicating the Purpose of the Loan, and outlining the Disbursement Method for fund transfer.

-

In this section, the agreement details the Interest Rate, repayment terms, and potential penalties for late payment.

How to fill out the short term personal loan agreement

Filling out the agreement involves a careful and structured approach. Following a step-by-step guide ensures that each section is completed accurately, reducing the chance of errors that may lead to disputes.

-

Begin by clearly stating the loan amount and its purpose. Follow the guidelines for each section to ensure completeness.

-

Leverage pdfFiller's tools to aid in document completion, making the process user-friendly.

-

Ensure all information is accurate and avoid vague terms to minimize confusion.

Modifying and managing the agreement with pdfFiller

Once you've completed the agreement, managing it effectively is pivotal for ongoing compliance. Utilizing tools like pdfFiller allows easy edits, signature integration, and collaborative management.

-

Should any changes be necessary, pdfFiller's editing tools make it easy to amend sections without starting over.

-

Finalizing agreements electronically through eSignatures helps streamline the approval process.

-

If your team needs to manage multiple agreements, pdfFiller's collaborative tools allow everyone to stay updated and involved.

Legal considerations and compliance

Legal compliance in personal loans is non-negotiable. Understanding local regulations helps avoid potential legal pitfalls and ensures that your agreements are enforceable.

-

Each region may have different laws regarding personal loans; familiarize yourself with these to ensure compliance.

-

Common issues to avoid include ambiguous language and missing clauses that may invalidate an agreement.

-

Always consult legal references or professionals when drafting or revising loan agreements to safeguard interests.

How to fill out the Short Term Personal Loan Agreement Template

-

1.Open the Short Term Personal Loan Agreement Template on pdfFiller.

-

2.Review the header section and enter the date of the agreement.

-

3.Fill in the lender's name and address in the designated fields.

-

4.Next, input the borrower's name and address as the recipient of the loan.

-

5.Specify the loan amount in the relevant field, ensuring accuracy.

-

6.Outline the repayment terms including the interest rate and loan duration.

-

7.Incorporate any fees or additional charges applicable to the loan.

-

8.Add any default clauses or penalties for late payments as needed.

-

9.Review the entire agreement for clarity and completeness before signing.

-

10.Finally, both parties should sign and date the agreement to make it binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.