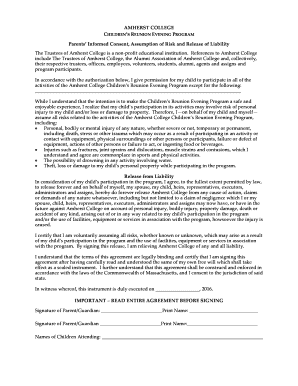

Sibling Home Buyout Agreement Template free printable template

Show details

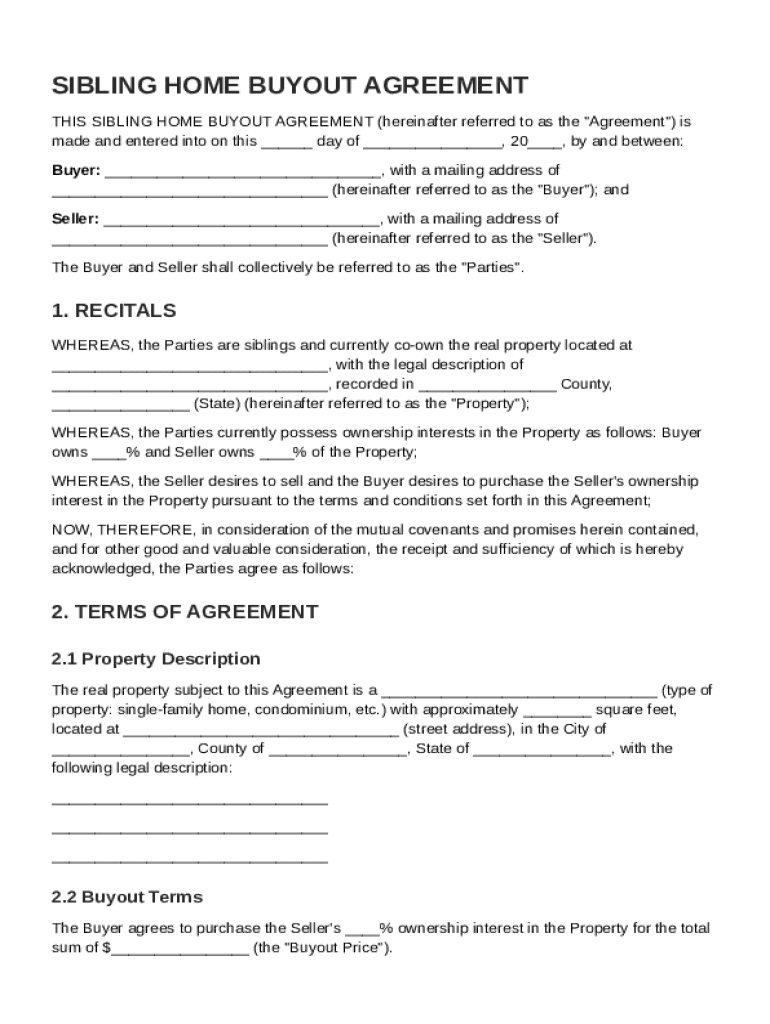

This document outlines the terms and conditions under which one sibling agrees to buy the ownership interest of another sibling in a coowned property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Sibling Home Buyout Agreement Template

A Sibling Home Buyout Agreement Template is a legal document that outlines the terms and conditions for one sibling to buy out the share of another sibling in a jointly owned property.

pdfFiller scores top ratings on review platforms

I like the ease of filling out the documents and being able to go back and retrieve them...love it

On a learning curve,so it has been slow but I really like the ease of putting in my own form and filling in my data. Helps with creating readable Dues Notices

I used pdffiller to complete some important documents for the County. It was easy and gave the form a professional look.

I tried another service first and was extremely disappointed. Your controls are easy to use and I was very satisfied!

Accurate, Easy to navigate, sign, and fill forms

Minor delays in saving and processing forms once complete

This has been a great experience using this PDF filler.

Who needs Sibling Home Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

Sibling Home Buyout Agreement Guide

What is a sibling home buyout agreement?

A Sibling Home Buyout Agreement outlines the terms under which one sibling can purchase the ownership interest of another in a family-owned property. These agreements are particularly important in scenarios such as inheritance, divorce, or simply choosing to reside in a property independently. Having a formal document helps ensure clarity, prevent disputes, and manage expectations among siblings.

-

The sibling home buyout agreement defines the terms and conditions for one sibling to buy out the share of another sibling in a jointly-owned family home.

-

This formal agreement is crucial to prevent misunderstandings and potential conflicts, ensuring all parties are on the same page regarding the transaction.

-

Home buyout agreements are often used during divorce situations, inheritance processes, or when one sibling decides to move out and sell their share.

What are the key components of a sibling home buyout agreement?

Each sibling home buyout agreement should include specific components that clarify the terms of the transaction. This ensures both parties are well-informed and helps in potential dispute resolution. Common elements include recitals, property description, buyout terms, and payment structure.

-

Recitals set the context of the agreement, explaining why the document has been created and what it aims to achieve.

-

Details about the property, including physical address and legal description, must be included for clear identification.

-

The document should explicitly state the terms of sale, including the price and conditions under which the buyout will occur.

-

It is vital to describe how payment will be made—lump sum, installment payments, or other structures—and relevant due dates.

How do you fill out a sibling home buyout agreement?

Filling out the sibling home buyout agreement template is a straightforward process, especially with helpful tools like pdfFiller. Users can follow a step-by-step process ensuring all necessary details are accurately provided. Clarity and accuracy in this document are vital to avoid future disputes.

-

Gather all necessary documents related to the property and siblings' ownership.

-

Use the pdfFiller platform to access the Sibling Home Buyout Agreement template and begin filling it out.

-

Carefully fill in common fields such as names, addresses, and payment structures.

-

Review the document for completeness and accuracy before finalizing.

-

Utilize pdfFiller’s tools for a smooth completion process, ensuring no detail is overlooked.

How can you edit and customize your sibling home buyout agreement?

Customization is essential for a sibling home buyout agreement to reflect the specific needs of the transaction. pdfFiller offers cloud-based features that allow you to edit your document easily and securely. Personalization ensures that the agreement meets the unique circumstances of the home buyout.

-

Users can edit text, add custom fields, and even insert signatures directly on the pdfFiller platform.

-

Personalize the agreement by including additional clauses or terms that reflect the unique arrangement between siblings.

-

Once customized, the document can be saved securely on pdfFiller and shared easily with the other sibling for review.

What are the legal considerations in a sibling home buyout agreement?

Legal considerations are vital in a sibling home buyout agreement to safeguard the interests of all parties. Understanding applicable laws ensures that the agreement is enforceable and compliant with local regulations. It's advisable for siblings to consult legal counsel to avoid potential pitfalls.

-

Each state may have its own laws regarding property transfer and real estate transactions.

-

Consulting with a legal expert can provide clarity on local regulations and help avoid common legal issues.

-

Being aware of common mistakes can help in drafting a more efficient agreement and ensuring a smooth transaction.

How do you sign and finalize the sibling home buyout agreement?

Signing a sibling home buyout agreement is an essential step that formalizes the transaction. Utilizing e-signature tools, such as those available through pdfFiller, guarantees security and legal standing for the document. A final review ensures all terms have been correctly agreed upon.

-

E-signatures provide a legally accepted format for signing documents, ensuring their validity.

-

The platform offers intuitive options for signing, making the process quick and efficient.

-

Before finalizing, ensure all details are correct, and the agreement has been thoroughly reviewed by both siblings.

What steps should you take to manage the post-agreement process?

Once the sibling home buyout agreement is signed, managing the post-agreement process is essential for maintaining accurate records and ensuring compliance. Using pdfFiller for document storage allows easy access to the agreement when needed. Keeping organized records can also provide clarity for any future transactions.

-

pdfFiller offers cloud-based storage solutions for easy access and security.

-

Implement a system for organizing key documents for future reference and legal compliance.

-

Consider any follow-up actions or agreements that may arise after the buyout to facilitate a smooth transition.

How to fill out the Sibling Home Buyout Agreement Template

-

1.Download the Sibling Home Buyout Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by inserting the date of the agreement at the top of the document.

-

4.Fill in the names and contact information of both siblings involved in the buyout.

-

5.Detail the property address and legal description of the property being bought out.

-

6.Specify the buyout amount being paid by one sibling to the other, including any terms related to payment installments.

-

7.Include a section for the signatures of both parties to confirm their agreement.

-

8.Review the completed document for accuracy and make any necessary changes.

-

9.Save the finalized template and consider printing copies for all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.