Silent Investor Agreement Template free printable template

Show details

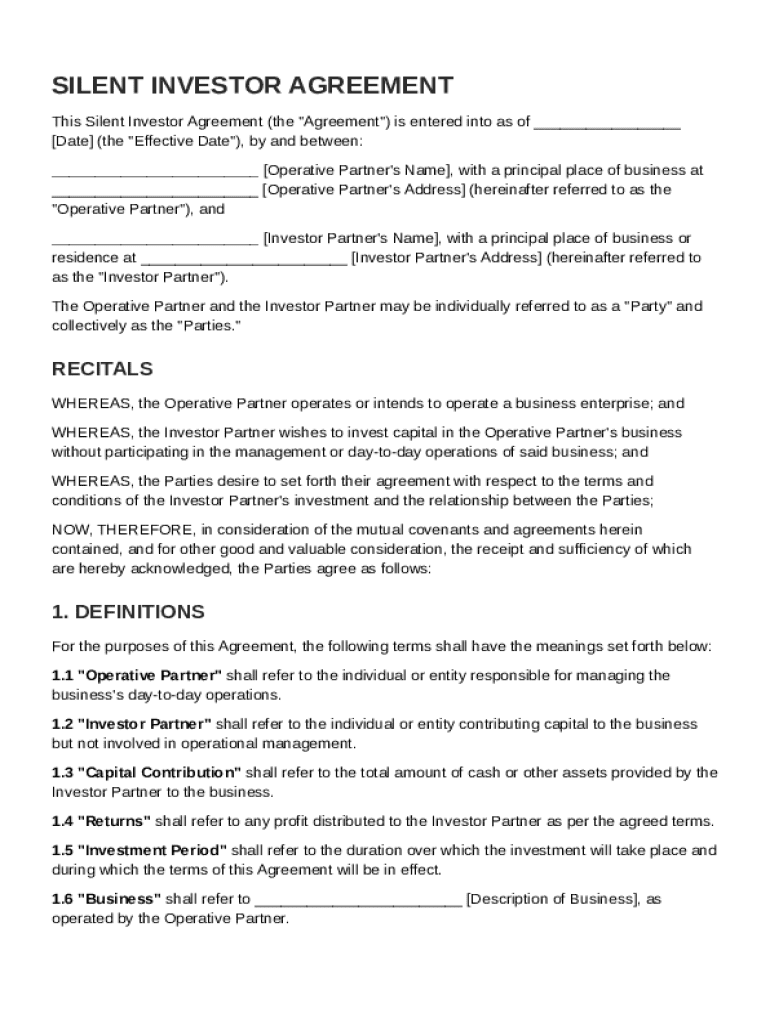

This document outlines the agreement between the Operative Partner and the Investor Partner regarding the investment and terms of participation in the business.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

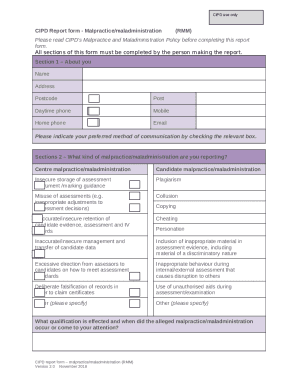

What is Silent Investor Agreement Template

A Silent Investor Agreement Template is a legal document outlining the terms between a business and its silent investors, who provide capital without participating in day-to-day management.

pdfFiller scores top ratings on review platforms

great for finding fillable online documents

Great says exactly what it does and wi do with your PDF's.

Just starting to use this - think it will work for me. Sometimes find it awkward to intuit what to do, so would really benefit from a webinar if offered free.

Please add multiple field selections and number formatting: SSN, Tele., etc.

I'm just starting with the program but I believe it's what I've been needing for years.

My very small office (staff of 9)!needed a professional looking and very easy to use application for filling and signing document. I downloaded 8'different apps/programs for trial and comparison. PDF Filler left every other program / app in its' dust.

Who needs Silent Investor Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Guide to a Silent Investor Agreement Template

How to fill out a Silent Investor Agreement form

To fill out a Silent Investor Agreement form, begin by identifying all parties involved, including the operative and investor partners. Clearly articulate the capital contributions, responsibilities, and profit-sharing terms. Utilizing a platform like pdfFiller can streamline the process with its user-friendly tools for editing, eSigning, and collaboration.

What is a Silent Investor Agreement?

A Silent Investor Agreement is a legal document that outlines the partnership between an investor and an operative partner in a business venture. Its purpose is to define the rights, responsibilities, and contributions of each party, ensuring clear expectations are set from the outset. This agreement is crucial for protecting the interests of both investors and entrepreneurs, and to facilitate smooth operational processes.

Who are the parties involved?

Typically, a Silent Investor Agreement involves two key parties: the operative partner (the individual managing the business) and the investor partner (the silent investor providing capital). Understanding their respective roles is vital to establish a supportive framework for the business.

-

This is the person responsible for the day-to-day management of the business.

-

This partner invests capital but does not partake in the business's daily operations.

How to establish capital contributions?

Determining capital contributions is a critical step that defines the monetary commitment made by each partner. This can include cash, property, or other assets. Contributions directly influence profit-sharing ratios and overall control within the investment. Transparency regarding contributions helps minimize potential disputes down the line.

What are roles and responsibilities?

Clearly defining the roles and responsibilities of each partner helps distinguish the boundaries of involvement. The operative partner typically handles management duties, while the silent investor focuses on financial support without interfering in operations. Understanding these roles is critical to maintaining a harmonious and effective partnership.

How are profits and losses distributed?

The Silent Investor Agreement should clearly articulate how profits and losses will be shared between partners. Different approaches, such as proportional sharing based on capital contributions, can be adopted. This section should also discuss strategies for reinvesting profits or allocating them to partners.

-

Establishes how profits from the business will be distributed among partners.

-

Outlines how losses will be addressed to protect each party's financial interests.

How to create a decision-making framework?

A defined decision-making framework empowers both partners to access a structured process for making significant business choices. It should clarify the rights of the investor regarding decision-making and include protocols for resolving disputes. Establishing this upfront can prevent misunderstandings during critical business moments.

What conditions lead to dissolution?

The Silent Investor Agreement must include conditions under which dissolution can occur, ranging from mutual consent to external factors. Detailing the procedures for asset and liability management post-dissolution is crucial. Clarity in this section ensures that both parties are aware of the implications of ending the partnership.

Why is maintaining confidentiality important?

Confidentiality clauses are essential in Silent Investor Agreements to protect sensitive business information. They serve to prevent unauthorized sharing of operational plans, financial data, or proprietary techniques. Breaching confidentiality can lead to legal repercussions, making it imperative to include robust clauses within the agreement.

What are the governing law considerations?

Choosing the appropriate jurisdiction for your Silent Investor Agreement can greatly impact legal compliance. This section should detail the local laws that govern the agreement, helping partners understand their rights and liabilities better. It’s advisable to consult legal experts for guidance on navigating regional legalities.

How can pdfFiller assist in filling out your agreement?

pdfFiller optimizes document management through its enhancing features for editing, eSigning, and collaboration. Utilizing its platform allows for a streamlined process in filling out the Silent Investor Agreement form, ensuring accuracy and efficiency. Users can also benefit from step-by-step guides to effectively navigate through the document.

How to fill out the Silent Investor Agreement Template

-

1.Download the Silent Investor Agreement Template from the pdfFiller website.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling out the names and contact information of all parties involved, including the silent investor and the business entity.

-

4.Clearly outline the investment amount, equity share, and any other financial obligations expected from the investor.

-

5.Specify the role of the silent investor, emphasizing their non-participatory nature in the daily operations of the business.

-

6.Detail the terms regarding profit distribution, including how and when returns will be paid to the investor.

-

7.Include confidentiality clauses to protect sensitive business information shared with the investor.

-

8.Review all completed sections for accuracy and clarity before proceeding to the signing process.

-

9.Save your document and then send it to all parties for signatures electronically via pdfFiller's e-signature feature.

What percentage should a silent investor get?

Unlike angel investors, who often expect to cash out with a substantial return during an exit, silent partners usually earn a fixed percentage of the business's profits based on their ownership share. For example, if a silent partner owns 10% of the business, they typically receive 10% of the profits.

How to write a contract for a silent partner?

A well-crafted silent partnership agreement should include: Identification of parties. Capital contribution. Profit and loss distribution. Duration of the partnership. Management and voting rights. Exit strategy. Governing law.

How do I ask someone to be a silent investor?

Steps to Secure the Commitment of a Silent Investor Present a Strong Business Plan. Demonstrate Expertise. Outline Potential Return on Investment. Maintain Transparent Communication. Negotiate Terms that Benefit Both Parties.

How to be a silent investor?

If you want to be a silent partner in a business, you only need to invest money in the business, while staying uninvolved in management activities. Typically, your name will be in the partnership agreement, but you will have no say in the business's operation.

How to write a contract for a silent partner?

A well-crafted silent partnership agreement should include: Identification of parties. Capital contribution. Profit and loss distribution. Duration of the partnership. Management and voting rights. Exit strategy. Governing law.

How do silent investors get paid?

Silent partners are typically paid based on the amount of money they invest in a business and their equity in that organization. For example, if they invest a certain amount of money to secure a 10% ownership of the company, they would likely be entitled to 10% of any profits the business generates over time.

What are the terms and conditions of a silent partner?

DUTIES OF THE SILENT PARTNER. The Partners agree that the Silent Partner(s) shall be “silent” in the Partnership. The Silent Partner(s) shall not participate in or interfere in the operation of the Partnership and are not restricted from engaging in any other business or from entering into any other partnerships.

How do I find silent investors?

To find a silent investor/partner, search for individuals or entities willing to earn investment returns with limited involvement. Connect with potential investors through networking, industry events, and investor groups.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.