Last updated on Feb 17, 2026

Single Case Insurance Agreement Template free printable template

Show details

This document establishes insurance coverage for a specific case, detailing the obligations and rights of both the insurer and the insured.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

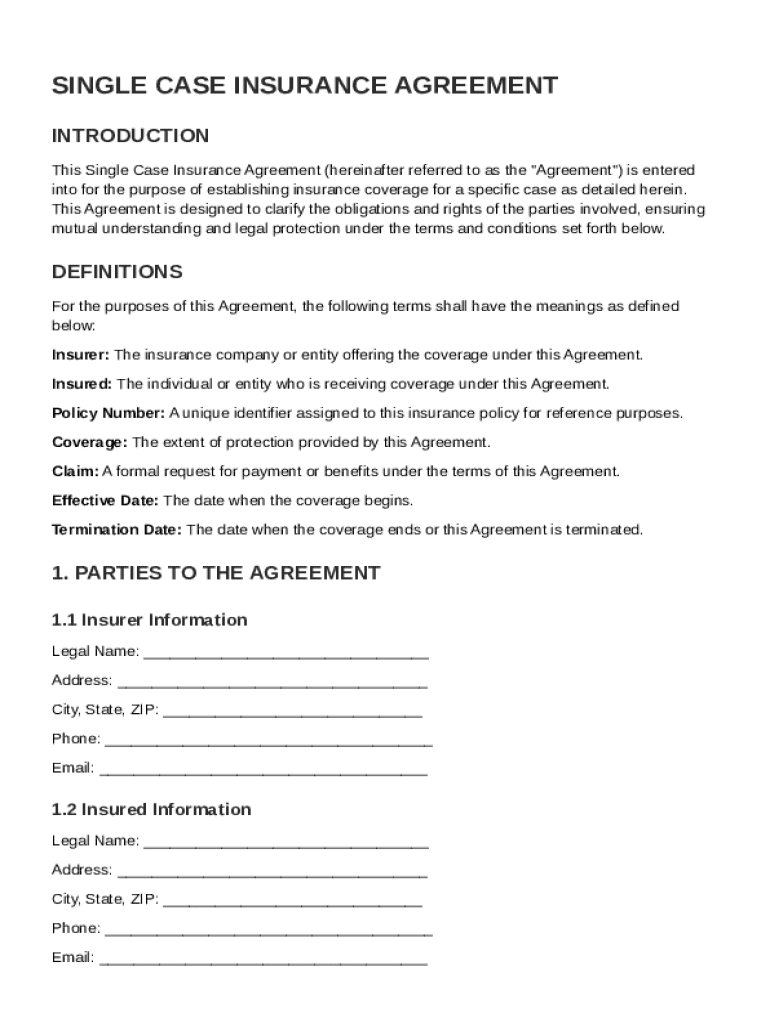

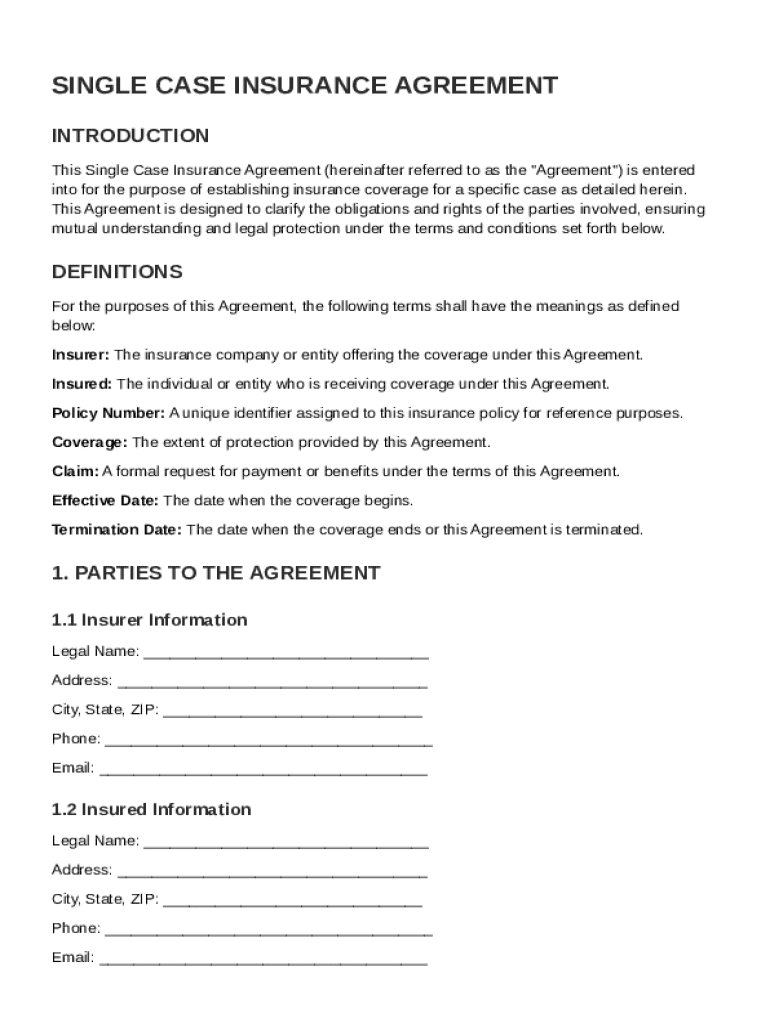

What is Single Case Insurance Agreement Template

A Single Case Insurance Agreement Template is a legal document outlining the terms of insurance coverage for a specific situation or individual.

pdfFiller scores top ratings on review platforms

Thanks for the help, PDF filler was easy to use.

I LOVE IT ALREADY...MAKES LIFE SO MUCH EASIER.

I do like this helper. Easy to use. I will try this tool for a couple of months.

Great for finding almost any document you need to file!

Amazed at the accessibility and ease of use! Thank you for the free trial. Having the free trial gives me a chance to determine if this is something I can utilize on a regular basis before expending the cost. Thank you.

1099 INFO DID NOT COPY TO THE OTHER PAGE

Who needs Single Case Insurance Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide on Single Case Insurance Agreement Template Form

What is a Single Case Insurance Agreement?

A Single Case Insurance Agreement is a specialized insurance contract that provides coverage for specific instances outside standard policies. These agreements are important as they ensure both the insurer and the insured have a mutual understanding of terms, coverage details, and responsibilities. Typically used in healthcare and insurance sectors, these agreements serve to protect the interests of both parties.

What key definitions should you know?

-

The entity providing the insurance coverage.

-

The individual or entity that is covered by the insurance.

-

A unique identifier for referencing the specific insurance policy.

-

Refers to the scope and extent of protection offered under the agreement.

-

The process for the insured to request payment or benefits from the insurer.

-

Indicates when the policy begins and ends, respectively.

Who are the parties involved in the agreement?

The two main parties involved in a Single Case Insurance Agreement are the insurer and the insured. It's essential to provide accurate information, including legal names, addresses, and contact details of both parties. Each party has specific roles and responsibilities, ensuring clarity and legal protection in the event of disputes.

What are the coverage terms and conditions?

-

Includes detailed descriptions of what is covered, along with any exclusions and limitations that may apply.

-

Clear identification of policy numbers, effective dates of the coverage, and termination dates.

-

Outlines the situations under which coverage begins and when it may not apply.

How are premium payments structured?

Premium payments for a Single Case Insurance Agreement involve understanding the total amount due, payment schedules, and acceptable methods. Timely payments are crucial, as failures may result in policy cancellation or lapses in coverage. Typical payment methods include credit cards, bank transfers, or automated deductions, each with its own implications.

How do you navigate the claim process?

-

Follow a structured step-by-step guide on how to file a claim effectively.

-

Ensure you have all necessary information and documents ready for the insurer to process the claim.

-

Tips to help speed up the claim review process and improve your chances of approval.

What are best practices for requesting a Single Case Agreement?

-

Recognize scenarios where a Single Case Agreement would be beneficial for coverage.

-

Establish clear communication with insurers regarding your needs for a Single Case Agreement.

-

Make sure to include all essential information in your request for clarity.

Why should providers pursue Single Case Agreements?

Providers often find Single Case Agreements advantageous compared to standard in-network agreements. These agreements can offer improved patient care options and potentially increase provider revenue by expanding covered services. Additionally, they often enable providers to maintain flexibility in patient coverage decisions.

What additional considerations are there for Single Case Agreements?

-

Understand the legal responsibilities that come with entering into a Single Case Agreement.

-

Be aware of compliance requirements specific to your state that may affect the agreement.

-

Stay informed about changes in insurance policies that could impact existing agreements.

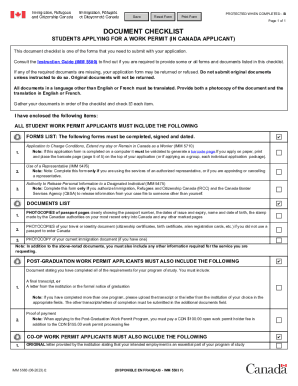

How to fill out the Single Case Insurance Agreement Template

-

1.Start by downloading the Single Case Insurance Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller allowing you to edit the document.

-

3.Fill in the insured person's full name and contact information in the designated fields.

-

4.Specify the insurance coverage details, including the type of insurance and the specific case being covered.

-

5.Include the policy number and any relevant identifiers that pertain to the case.

-

6.Indicate the coverage start and end dates to clarify the duration of the insurance.

-

7.Add any special terms or conditions as needed, making sure they align with the case requirements.

-

8.Review all the information filled out for accuracy and completeness before finalizing it.

-

9.Once reviewed, save the completed document and either print it or share it electronically with the relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.