Standard Loan Agreement Template free printable template

Show details

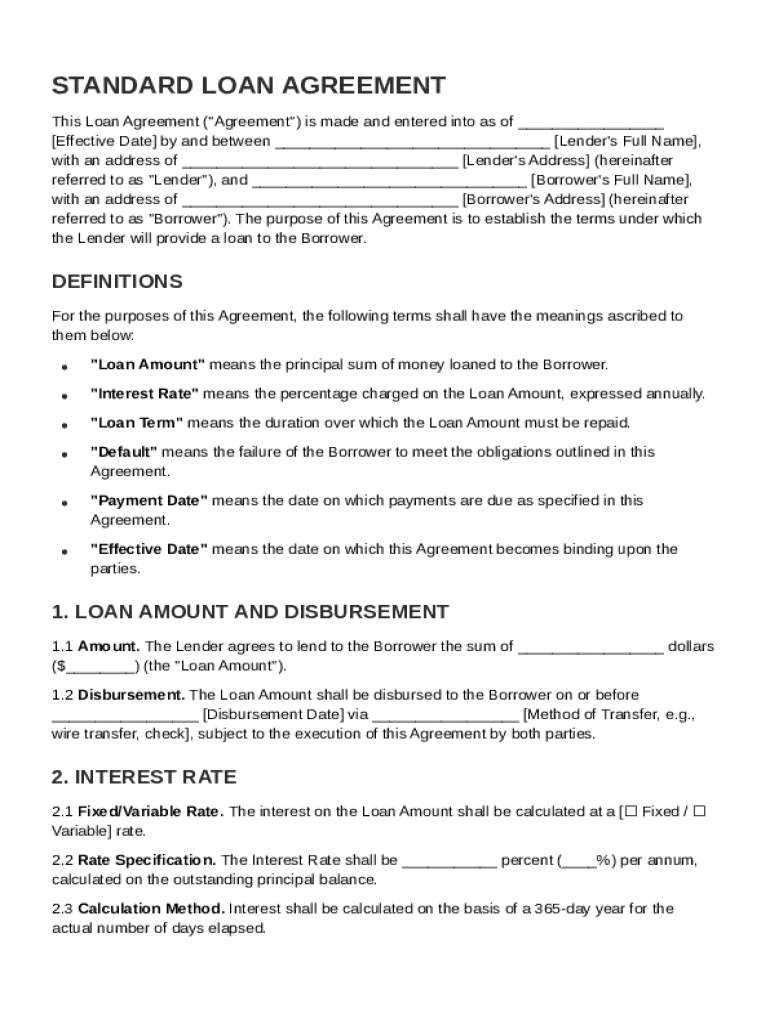

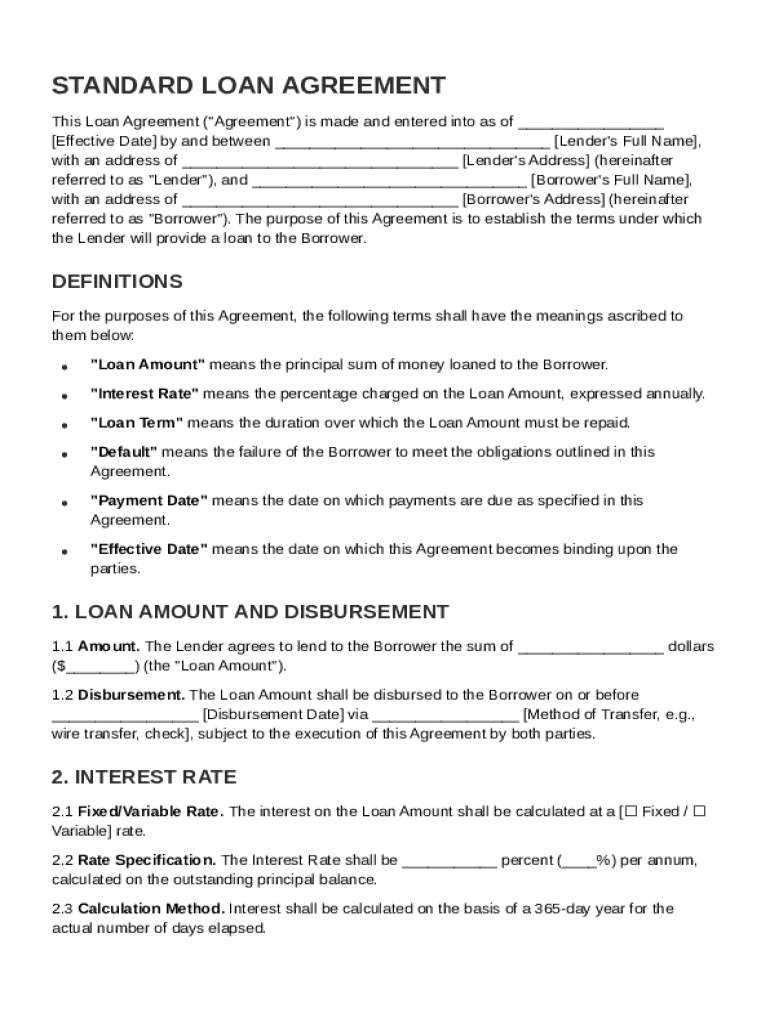

This document is a standard loan agreement outlining the terms, conditions, obligations, and rights of the lender and borrower regarding a loan provided by the lender to the borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Standard Loan Agreement Template

A Standard Loan Agreement Template is a legal document outlining the terms and conditions of a loan between a borrower and a lender.

pdfFiller scores top ratings on review platforms

Great service, easy to use and completely reliable.

its making my life and my small business a lot simpler & smooth. Thanks pdffille

Great helper in filling our government forms.

I need to talk to someone I find it difficult to enter data 925 708 6501 Bert

It's good but I would like to be able to change existing text colour.

the editing function with text could be improved

Who needs Standard Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Standard Loan Agreement Template Guide

This guide walks you through the essential aspects of crafting a Standard Loan Agreement Template form, ensuring both lenders and borrowers are protected and informed.

What is a Standard Loan Agreement?

A Standard Loan Agreement is a formal document outlining the terms and conditions of a loan between a lender and a borrower. It is crucial for ensuring clarity and legality in the lending process.

-

This document specifies the loan amount, interest rate, repayment terms, and responsibilities of both parties.

-

It protects the interests of both parties, reducing the likelihood of disputes.

-

Both parties must understand their obligations outlined in the agreement.

What are the key components of the agreement?

Key components ensure a comprehensive understanding of the obligations involved in a loan. Each component must be transparently defined.

-

Clearly define the total loan amount being borrowed.

-

Specify whether the interest rate is fixed or variable, and how it will be applied.

-

Set the repayment duration agreed upon by both parties.

-

Clarify what constitutes a default and the specific payment schedule.

-

The date when the agreement becomes binding.

How do you fill out the Loan Agreement template?

Filling out the template accurately is vital to ensure legality and clarity between lender and borrower.

-

Begin by entering personal details of both parties followed by loan specifics.

-

Collect all relevant financial data before starting to fill out the form.

-

Ensure no blanks are left in mandatory fields to avoid ambiguity.

-

pdfFiller can assist with editing, eSigning, and sharing the document securely.

What is the loan amount and disbursement process?

Detailing the loan amount clearly in the agreement prevents misunderstandings. The disbursement process also plays a critical role.

-

Specify the exact sum being lent and outline how it will be distributed.

-

Identify the method of disbursement, such as wire transfer or check.

-

Ensure the disbursement process is clearly defined in the agreement.

How are interest rate specifications defined?

Interest rates are crucial as they determine the total cost of the loan. Understanding their calculation is essential.

-

Fixed rates remain constant while variable rates may fluctuate based on market trends.

-

Consider borrower credit scores, market conditions, and loan duration.

-

Providing examples helps borrowers understand their payment responsibilities based on different interest rates.

What should you know about term and repayment obligations?

The term and repayment specifics outline how and when payments are to be made, which is a fundamental part of the agreement.

-

Loans typically have terms defined in months or years.

-

These schedules dictate when payments are due and are crucial in maintaining clear expectations.

-

Outline the repercussions for missed payments, including penalties and legal action.

How can you edit and manage the Loan Agreement using pdfFiller?

pdfFiller offers robust features for efficiently managing your Loan Agreement Template.

-

Use pdfFiller to allow multiple users to work on the document simultaneously.

-

Utilize editing and organization features to keep your agreements streamlined.

-

Sign documents electronically to expedite the process while ensuring security.

How to navigate regulatory compliance for loan agreements?

Understanding local regulations is crucial to ensure the enforceability of your Loan Agreement.

-

Stay informed about regulations specific to your region to maintain compliance.

-

Regularly revise the agreement as laws evolve to keep it enforceable.

-

Consult legal expertise if unsure about the wording or terms used in your agreement.

How to fill out the Standard Loan Agreement Template

-

1.Open the Standard Loan Agreement Template on pdfFiller.

-

2.Fill in the 'Borrower' section with the complete name and address of the person receiving the loan.

-

3.Complete the 'Lender' section with the name and address of the entity providing the loan.

-

4.Input the loan 'Amount' being borrowed in the designated field.

-

5.Specify the 'Interest Rate' applicable to the loan as agreed by both parties.

-

6.Set the 'Loan Term' to indicate the duration for repayment.

-

7.Fill in the 'Payment Schedule' to detail how payments will be made (monthly, quarterly, etc.).

-

8.Include any 'Collateral' to secure the loan if applicable.

-

9.Review all provided information for accuracy and completeness.

-

10.Sign and date the agreement in the designated signature areas by both parties.

-

11.Save the filled agreement and share or print it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.