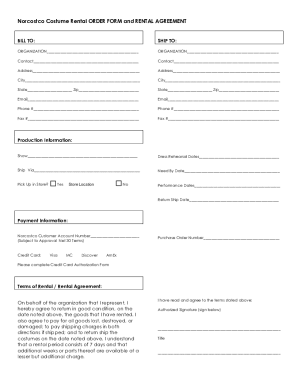

Startup Equity Agreement Template free printable template

Show details

This document outlines the terms and conditions regarding the allocation of equity among founders, investors, and other stakeholders in a startup company.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Startup Equity Agreement Template

A Startup Equity Agreement Template is a legal document outlining the terms and conditions of equity ownership among co-founders, employees, and investors in a startup.

pdfFiller scores top ratings on review platforms

Took me a bit to figure it out

Took me a bit to figure it out but I like the way it works now. Switched from Adobe Acrobat.

Everything I needed.

Everything I needed.

love this app

love this app! really is heaven sent

Easy to use and affordable

Easy to use and affordable

This is great!

This is great!

Helpful

Helpful app.Thank you

Who needs Startup Equity Agreement Template?

Explore how professionals across industries use pdfFiller.

Startup Equity Agreement Template - Comprehensive Guide

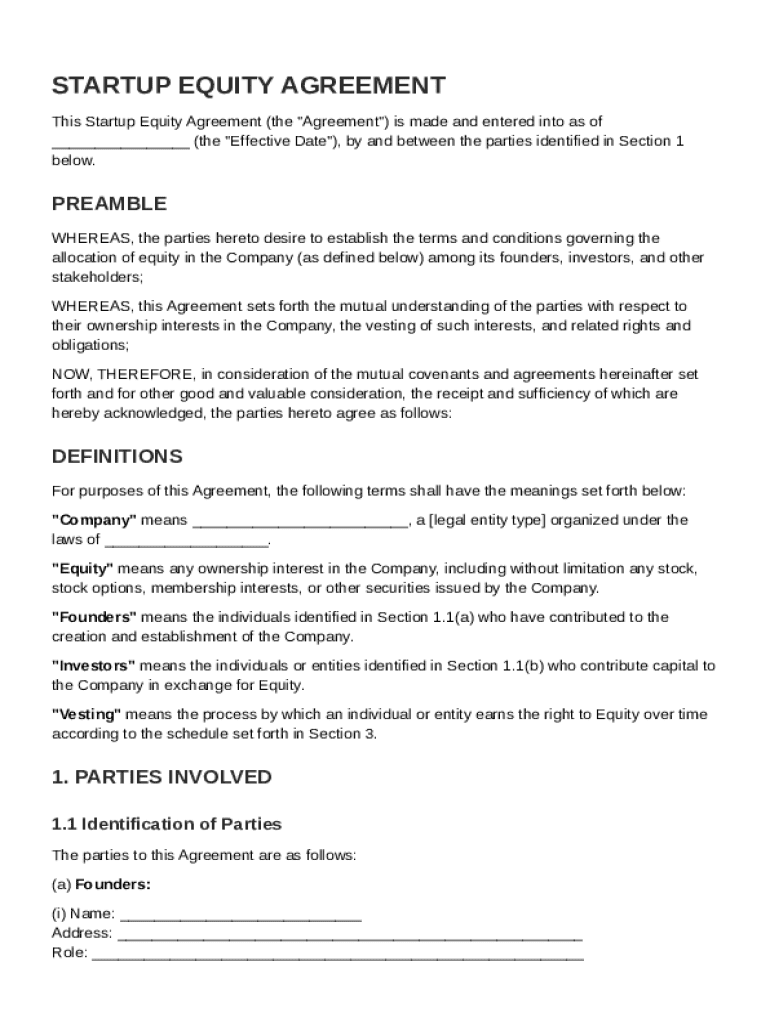

What is a Startup Equity Agreement?

A Startup Equity Agreement is a legal document that outlines ownership shares amongst founders, investors, and the company. Not only does it establish clear terms for equity distribution, but it also serves to protect the interests of all parties involved. Understanding these agreements is crucial, as they have significant implications for both startup founders and their investors.

-

Definition of a Startup Equity Agreement: A formal contract detailing equity stakes of founders and investors.

-

Importance: It clearly delineates ownership and ensures all parties know their rights and responsibilities.

-

Legal implications: Non-compliance can lead to disputes, loss of rights, and financial penalties.

What are the main components of a Startup Equity Agreement?

The main components of a Startup Equity Agreement set the stage for the equity allocation process. Each section plays an integral role in ensuring parties understand their commitments and the nature of the agreement.

-

Preamble: Brief introduction providing context for the agreement.

-

Definitions: Clarifies key terms to avoid ambiguity during interpretation.

-

Identification of Parties: Specifies all parties involved - founders, investors, and the company for clear accountability.

How to fill out the template: Step-by-step guide

Filling out the Startup Equity Agreement Template efficiently entails following structured sections. Each section captures essential information that ensures compliance and clarity.

-

List the names and roles of all founders to establish accountability.

-

Include the names and contributions of investors to formalize their rights.

-

Provide basic details about the company, such as its name, registration number, and location.

-

Document the specific contributions of each party and describe their expected relationships to prevent future disputes.

How is equity distributed and what are vesting schedules?

Equity distribution is critical in fostering investment trust and ownership commitment among founders. Vesting schedules detail how the ownership stake accrues over time and under what conditions.

-

Equity allocation: Clearly delineates how equity is divided, often through percentage shares based on contribution.

-

Vesting explanation: Vesting refers to the condition under which founders earn their ownership shares over time.

-

Common vesting schedule: Typically, a four-year schedule with a one-year cliff gives investors assurance of commitment.

-

Legal considerations: Confirm compliance with regional laws, such as those in Ontario, to avoid legal pitfalls.

What does the sample template include?

A comprehensive overview of the Startup Equity Agreement Template can greatly assist in customizing your own document. Understanding its components is essential for effective completion.

-

Detailed breakdown: Includes all indispensable clauses and their implications.

-

Interactive tools: Tools available via pdfFiller for easy customization and generation of the template.

-

Implications understanding: Gain insights on the outcomes of each section and clause for informed decision-making.

How to manage changes in equity agreements?

Managing changes in equity agreements is critical in the dynamic startup environment. Using platforms like pdfFiller simplifies the process, allowing for speedy updates.

-

Editing existing agreements: Utilize pdfFiller to make necessary changes quickly and efficiently.

-

Electronic signing: Facilitate smoother execution of changes by utilizing electronic signatures.

-

Collaboration tools: Engage teams in discussions regarding equity changes seamlessly through collaborative features.

What are compliance and best practices for equity agreements?

Compliance with local laws is paramount for startups to avoid legal challenges. Best practices enhance clarity and protect all parties involved.

-

Local compliance: Understand specific regulations governing equity distribution in Ontario.

-

Best practices: Define clear terms in agreements to avoid confusion and miscommunication.

-

Common pitfalls: Be wary of vague terms that can lead to disputes among stakeholders.

How can pdfFiller enhance document management?

Utilizing pdfFiller for document management streamlines the process of creating and managing your Startup Equity Agreement. Its innovative tools offer substantial benefits for startups.

-

Functionalities overview: pdfFiller offers editing, eSigning, and collaboration within a single platform.

-

Cloud-based benefits: Access agreements from anywhere, enhancing flexibility and responsiveness.

-

Integration capabilities: Works well with legal and accounting platforms, ensuring streamlined workflows.

How to fill out the Startup Equity Agreement Template

-

1.Download the Startup Equity Agreement Template from a reliable source or create a new document in pdfFiller.

-

2.Open the template in pdfFiller and review the pre-filled terms to ensure they align with your startup's equity structure.

-

3.Begin by entering the names and contact details of all parties involved in the agreement, including founders and investors.

-

4.Specify the total equity percentage being offered and the breakdown for each stakeholder, including any vesting schedules or performance milestones.

-

5.Fill in any additional clauses or provisions that are relevant, such as rights of first refusal or buyback options.

-

6.Review the completed template to ensure all information is accurate and complete, looking for any areas that may need clarification or revision.

-

7.Once you are satisfied with the information, use pdfFiller's tools to save the document and electronically sign it, or prepare it for printing and manual signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.