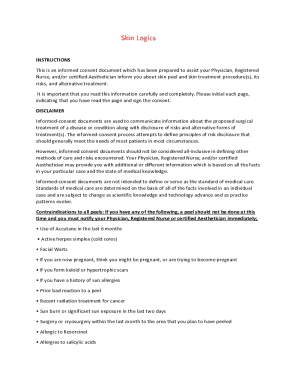

Startup Equity Compensation Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a Participant will receive equity compensation from a Company, detailing the types of equity compensation, vesting schedule, tax implications,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Startup Equity Compensation Agreement Template

A Startup Equity Compensation Agreement Template is a legal document outlining the terms by which a startup grants equity to employees or contractors as part of their compensation package.

pdfFiller scores top ratings on review platforms

Product has been working great for me. It would be nice if I could pay per document download or something rather than a subscription.

Excellent. Super easy to use and makes filling out PDFs a breeze, saving time and effort.

Just starting out, but I am impressed with the functionality and short learning curve.

No, I think its a good program. Just a few things I need to learn how to use. Although, it's a bit costly, I would like to keep using, but it may be expensive for my business.

Awesome service, clean and easy to use interface.

It is helping me with some very difficult documents and has help speed the process for me.

Who needs Startup Equity Compensation Agreement Template?

Explore how professionals across industries use pdfFiller.

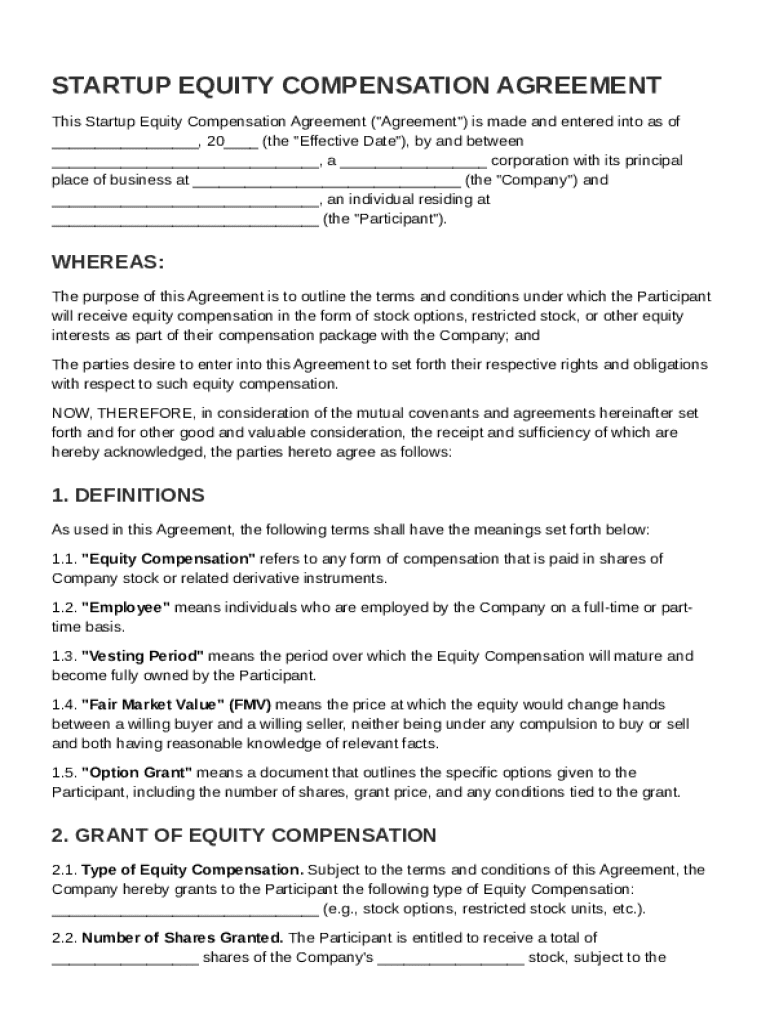

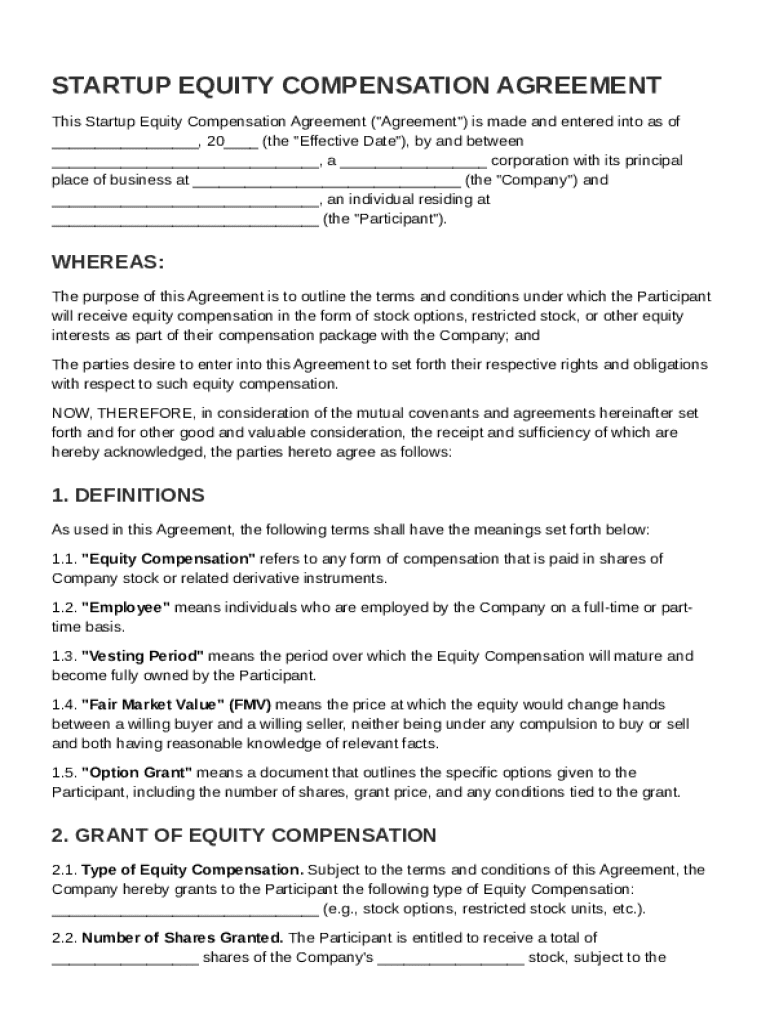

Startup Equity Compensation Agreement Template Guide

How to fill out a Startup Equity Compensation Agreement Template form

Filling out a Startup Equity Compensation Agreement Template form requires clear input of your company’s details and the specific terms of equity compensation. Access the template on pdfFiller to edit and customize it with participant information and equity specifics. Don't forget to digitally sign the document for legality.

What is equity compensation?

Equity compensation is a non-cash payment that provides employees with an ownership interest in the company. This type of compensation is particularly significant in transformative roles within startups, aligning employees' financial success with the company's performance. Stock options and restricted stock are common forms of equity compensation.

-

Gives employees the right to purchase stock at a future date at a set price, usually lower than market value.

-

Shares granted to employees that are subject to vesting requirements, which means they become fully owned only after certain conditions are met.

-

Includes convertible notes or warrants that give employees future ownership stakes.

Offering equity can motivate employees to perform at their best, synthesizing their ambitions with the company's growth objectives.

What are the key components of a Startup Equity Compensation Agreement?

-

It is vital to set a clear start date for the agreement, which marks when the terms become active.

-

Define roles for the Company and Participant to ensure legal clarity and accountability.

-

Clearly articulate the intentions behind the agreement to eliminate ambiguity for all parties.

These components are critical for avoiding disputes and misunderstandings, making it easier for both parties to align on the purpose and terms of the agreement.

What key terms should be defined in the agreement?

-

This term defines the type of equity involvement employees receive as part of their compensation.

-

Clarifies who qualifies as an employee under the terms, differentiating entre regular staff and contractors.

-

Details how long employees must work at the company before they fully own their stocks.

-

Discusses how the FMV is determined to ensure fair practices in equity distribution.

-

Specifies what an option grant includes, including potential metrics for valuation and allocation.

Defining these terms at the outset is essential for establishing clarity regarding the rights and expectations of all parties.

How to structure the grant of equity compensation

Structuring the grant effectively involves detailing the types of equity that will be offered and the conditions attached to these grants. Understanding the diverse forms of equity compensation allows you to tailor the agreement to the company's and employees' needs.

-

Include stock options, restricted shares, or performance shares based on company goals.

-

Outline any stipulations related to the vesting periods or conditions that must be met for employees to retain their shares.

-

Be specific about how many shares are being granted and at what valuation, as this directly impacts employee motivation.

Proper structuring ensures mutual understanding and compliance, reducing the potential for disputes in the future.

How to fill out the agreement: step-by-step instructions

-

Open the Startup Equity Compensation Agreement Template on pdfFiller for easy editing.

-

Ensure all necessary information regarding both parties is correctly inputted, including roles.

-

Fill in the terms regarding the type and number of shares being offered, as well as FMV.

-

Utilize pdfFiller’s eSigning feature to ensure both parties have legally signed the agreement.

-

Use pdfFiller’s tools to store, manage, and track the signed document for future reference.

What are the compliance and legal considerations?

Legal compliance is critical when creating a Startup Equity Compensation Agreement. This involves understanding securities regulations and ensuring adherence to relevant employment laws. Key compliance issues such as disclosure requirements should not be overlooked.

-

Ensure the agreement complies with local regulations which can vary significantly by state.

-

Address issues related to stock grants and the tax implications that may arise for both the company and employees.

-

Consider variations in state laws that might affect the equity agreement’s structure and enforceability.

What are common pitfalls and best practices?

-

Ensure clarity regarding vesting schedules that affect employee retention rates.

-

Maintain open communication to ensure employees understand their equity compensation and any potential risks.

-

Create documentation that is accessible and understandable to prevent lengthy disputes.

Implementing these best practices can enhance employee satisfaction and retention, and reduce potential legal complications.

What additional tools are available for managing equity compensation?

Utilizing pdfFiller’s document management capabilities enhances efficiency. The platform offers features designed for tracking employee equity compensation, ensuring that all stakeholders can access necessary records and updates.

-

Use pdfFiller’s robust tools for editing and storing all employee agreements together.

-

Effectively monitor the equity distribution amongst employees to maintain overview.

-

Facilitate communication within your team regarding any equity-related discussions or changes.

How to fill out the Startup Equity Compensation Agreement Template

-

1.Download the Startup Equity Compensation Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the sections to understand the required information.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the name of the employee or contractor receiving the equity compensation.

-

5.Specify the type of equity being offered (e.g., stock options, restricted stock) and the number of shares or units.

-

6.Include the vesting schedule details, indicating how the equity will be earned over time.

-

7.Add any performance criteria that must be met for the equity to vest, if applicable.

-

8.State the conditions under which the equity can be exercised or sold.

-

9.Include spaces for signatures from both parties to agree to the terms outlined in the agreement.

-

10.Review all the information for accuracy, then save and download the completed agreement for both parties to sign.

Is 1% equity in a start-up good?

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

How to write up an equity agreement?

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

What is the founders agreement for startups?

A Founders' Agreement is a contract that a company's founders enter into that governs their business relationships. The Agreement lays out the rights, responsibilities, liabilities, and obligations of each founder. Generally speaking, it regulates matters that may not be covered by the company's operating agreement.

What is the standard equity compensation for startups?

Calculating Startup Equity Compensation On average, startups are reserving a 13% to 20% equity pool for employees. This is important for startups to consider before they pursue series funding or other investments, in which they may be offering percentages of equity to investors.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.