Last updated on Feb 17, 2026

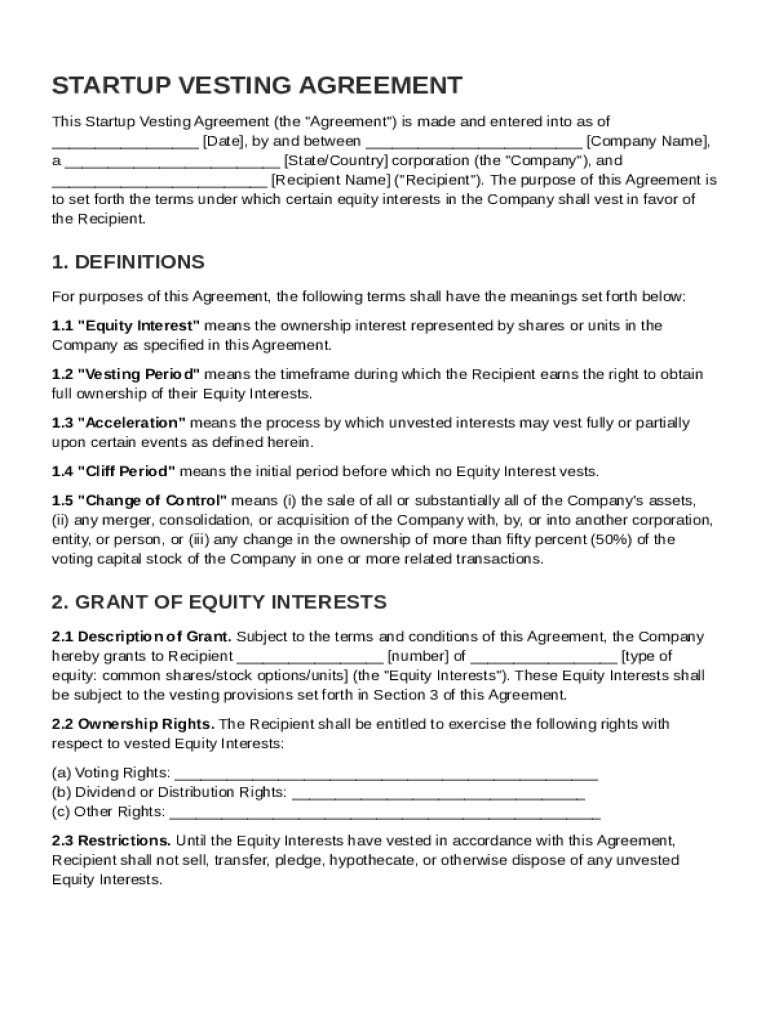

Startup Vesting Agreement Template free printable template

Show details

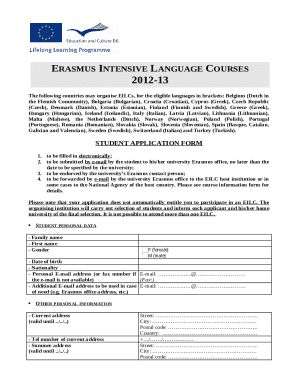

This document outlines the terms under which equity interests in a company will vest in favor of a recipient, detailing definitions, grant of equity interests, vesting schedule, termination of vesting,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Startup Vesting Agreement Template

A Startup Vesting Agreement Template is a legal document that outlines the terms under which startup equity will be vested over time for founders and employees.

pdfFiller scores top ratings on review platforms

PDFfiller has been very useful to fill in forms.

great app

very satisfied

easy to access

easy to upload ,easy to edit

Honesty and integrity are not something…

Honesty and integrity are not something I align with online trial subscription. Most will hope you forget so they can charge you anyway. But PDFfilIer holds to a higher standard. I am NOT an employee forced to write a review. This for real just happened like 10 minutes ago.

I signed up for a trial to complete a job for my employer. Forgot to cancel before the trial ended. I don't make much, so $96 was a hit I wasn't expecting or able to pay. Support had already approved and completed the refund and cancelation of my subscription before I had even finished explaining my situation to the rep in chat (Aiden). The email came from "Sarah from PDFfiller" explaining that it was taken care of while I was still chatting with the rep.

I was expecting a battle. Now I expect to either sign up with PDFfiller when I have a more consistent need or get my boss to pay for the service. The platform was quick and easy to navigate. Based solely on this experience, I would recommend this platform if you are in need of creating these types of documents.

The only thing I would change is that I couldn't find my payment options in my account info to see what card was used. Nor could I find an avenue to change my payment options.

It worked for what I needed it for.

It worked for what I needed it for.

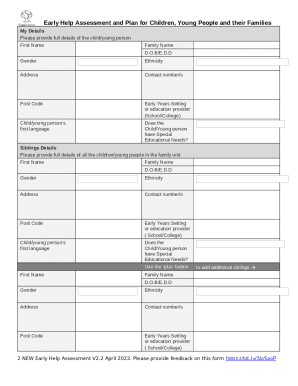

Who needs Startup Vesting Agreement Template?

Explore how professionals across industries use pdfFiller.

All you need to know about Startup Vesting Agreement Template

Here you will find essential guidance on how to effectively edit and fill out the Startup Vesting Agreement Template to suit your needs.

How to edit Startup Vesting Agreement Template

Editing the Startup Vesting Agreement Template with pdfFiller is a seamless process that allows you to make any necessary modifications quickly and easily:

-

Click on ‘Get form’ on this page to access the PDF.

-

Create your pdfFiller account if you do not have one. You can sign up using your email or social media accounts for quick access.

-

Once you're logged in, upload the Startup Vesting Agreement Template from your device to the platform.

-

Use the intuitive editing tools available to make necessary changes, including adding text, images, or annotations.

-

After editing, save your changes. You can choose to download the edited document or share it directly with others via a link.

This section covers the vital aspects of the Startup Vesting Agreement Template, including its purpose, definitions, and essential components.

What is a Startup Vesting Agreement Template?

A Startup Vesting Agreement Template is a legal document designed to outline the terms under which startup equity is distributed among employees and founders over a specified duration. This agreement helps define ownership rights and incentivizes team members to contribute to the company's success over time.

Definition and key provisions of a Startup Vesting Agreement

This section highlights the critical elements that characterize a Startup Vesting Agreement Template:

-

Vesting schedule: Timing and dates for equity distribution.

-

Termination clauses: Conditions under which vesting ceases.

-

Acceleration provisions: Special circumstances that may expedite vesting.

-

Equity allocation: Details about the percentage of equity each stakeholder receives.

When is a Startup Vesting Agreement used?

A Startup Vesting Agreement is used when a startup company wants to legally document the commitment and compensation of its key contributors, ensuring that all parties understand their equity rights and responsibilities. It is typically employed during the early stages of a startup when initial equity arrangements are negotiated.

Main sections and clauses of a Startup Vesting Agreement

The Startup Vesting Agreement Template consists of several primary sections which may include:

-

Introduction: Defines the parties involved and the context of the agreement.

-

Vesting terms: Specifics about the vesting schedule and equity distribution.

-

Termination conditions: Criteria for ending the agreement and ceasing vesting.

-

Miscellaneous provisions: Legal considerations that apply to the agreement.

What needs to be included in a Startup Vesting Agreement?

To ensure the applicability and enforceability of a Startup Vesting Agreement, it should include the following key components:

-

Names and details of all involved parties.

-

Clear definition of the vesting schedule.

-

Details of what happens to unvested equity upon termination.

-

Any acceleration provisions related to timing of vesting.

-

Signature lines for all parties to formally agree to the terms.

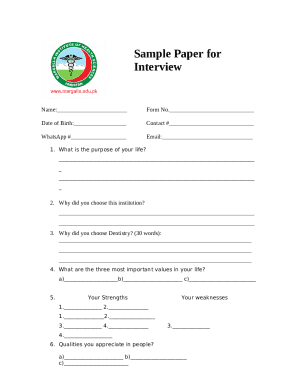

How to fill out the Startup Vesting Agreement Template

-

1.Open the Startup Vesting Agreement Template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and roles of the parties involved, which typically include the startup and the individual receiving equity.

-

4.Specify the total amount of equity to be vested and the percentage of that equity which each individual will receive.

-

5.Outline the vesting schedule, including the start date and duration of the vesting period, usually over four years with a one-year cliff.

-

6.Include any special terms related to accelerated vesting or termination conditions as applicable.

-

7.Once all fields have been filled out, review the document for accuracy to ensure all information is correct.

-

8.Finally, save and download the completed agreement in your preferred format or send it directly for signatures.

What is the standard vesting schedule for a startup?

Standard vesting schedule A common vesting period is four years, often with a one-year cliff. This means that the employee must remain with the startup for one year before any portion of the equity grant vests, after which the remaining equity vests over the next three years.

What is an example of founder vesting?

For example, a founder may get 1 million shares. The founder's shares are initially all unvested. This means the shares are at risk of being forfeited if the founder leaves. Over the vesting period (e.g. 4 years), a portion of the shares vest each month or quarter.

What is a vesting agreement?

A vesting agreement is an agreement entered into between a corporation and a shareholder (usually an employee) that restricts the vesting of securities with the shareholder over a period of time or subject to other conditions.

How to write a co-founder agreement?

Below is an expanded discussion on the key clauses that should be included in a Co-founders Agreement. Equity Split. Roles and Responsibilities. Decision-Making Process. Vesting Schedule. Intellectual Property (IP) Assignment. Confidentiality. Non-Compete and Non-Solicitation. Exit Strategy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.