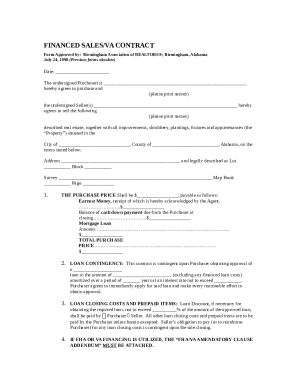

Stock Options Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a company grants stock options to an employee, including details about the number of shares, exercise price, vesting schedule, and rights

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Stock Options Agreement Template

A Stock Options Agreement Template is a legal document that outlines the terms under which stock options are granted to employees or investors.

pdfFiller scores top ratings on review platforms

I have not yet mastered all the ins and outs of the program, so I can't say how good it is, I have high hopes for it. Thank you.

It fulfills my needs. I use it on my pad, but becasue of the problem of an empty folder I am trying out the internet version. Still good. I can use both.

very easy to follow and love the step by steps

ONCE PRACTICED IT BECAME VERY EASY TO USE AND HELPFUL.

I've only had it for an hour. But I only need the ability to add text right now that's it. Let me use it a bit before I do another survey.

A great application that has saved me hours!

Who needs Stock Options Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to Stock Options Agreement Template on pdfFiller

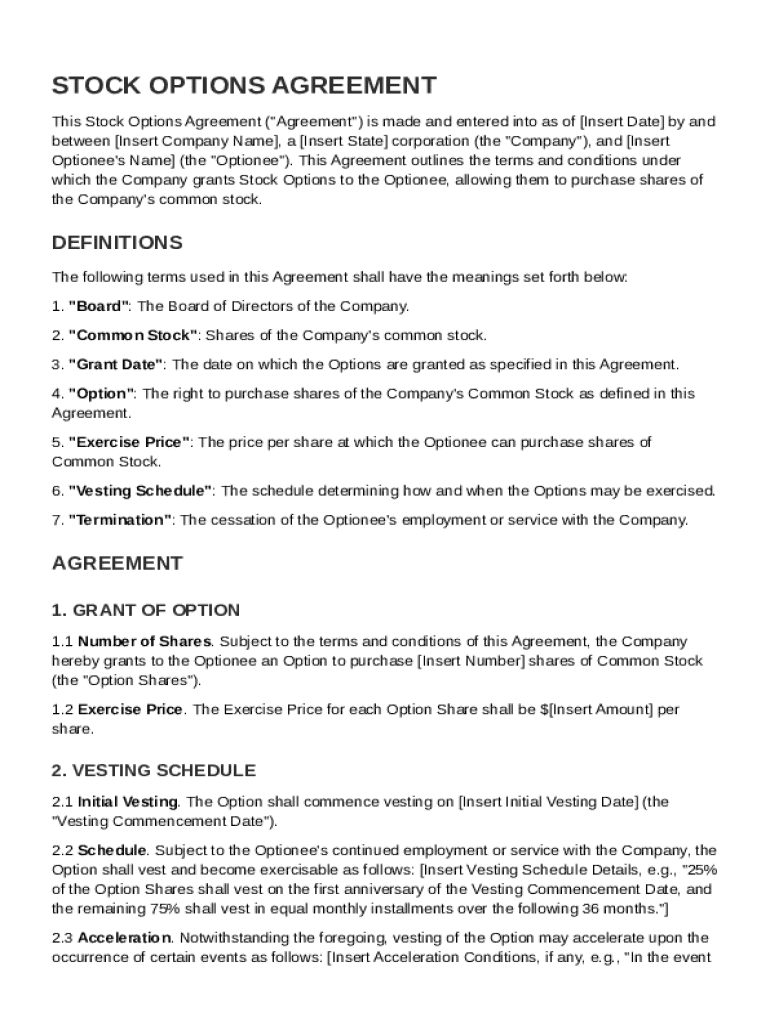

What is a Stock Options Agreement?

A Stock Options Agreement is a legal document that outlines the terms and conditions under which a company grants stock options to an employee, board member, or consultant. This agreement is significant as it governs how and when options can be exercised, addressing vital aspects that impact both the company and the optionee. Understanding this agreement is crucial for effective equity compensation planning.

-

The main parties include the company granting the options and the optionee, who receives them.

-

Core components typically include the number of options granted, exercise price, vesting schedule, and expiration terms.

Key terms defined in the Stock Options Agreement

Understanding the key terms in a Stock Options Agreement is essential for both parties involved. Each term carries implications that can affect decision-making and the overall outcome of the agreement. Here's a closer look at important definitions.

-

The Board of Directors is responsible for overseeing the company and has a significant impact on stock option policies.

-

Common stock refers to shares that represent ownership in a company, providing shareholders with potential dividends and voting rights.

-

The grant date is the date on which options are awarded, essential for establishing the exercise price.

-

An option gives the holder the right but not the obligation to purchase stock at a predetermined price.

-

This is the price at which the optionee can purchase the underlying stock, typically set at the market price on the grant date.

-

The vesting schedule outlines when the optionee can begin to exercise their options, often based on length of service.

-

This defines the conditions under which the stock options may become invalid, such as when the optionee leaves the company.

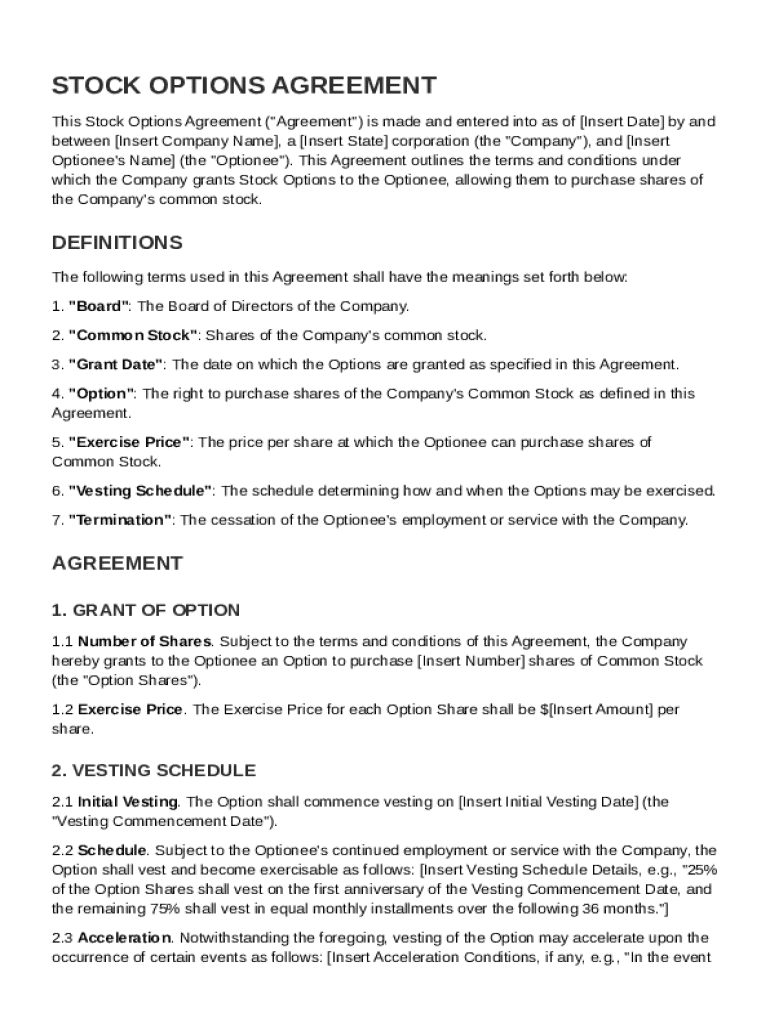

What are the details of granting stock options?

When drafting a Stock Options Agreement, it's crucial to detail the specifics of the granted options. This clarity avoids misunderstandings and ensures fair treatment of all parties involved.

-

Clearly stating the number of shares avoids confusion and establishes the equity compensation framework.

-

The exercise price should reflect the fair market value at the time of the grant, often determined through valuation.

-

Consider including performance-based metrics alongside time-based vesting to motivate the optionee further.

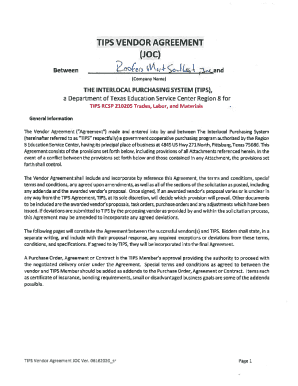

How to create your Stock Options Agreement?

Using pdfFiller to create a Stock Options Agreement can streamline the process significantly. With its intuitive interface and robust features, users can draft a legally sound agreement in no time.

-

Follow instructions on pdfFiller to input key data and customize your agreement to meet specific needs.

-

Utilize pdfFiller's interactive tools to make real-time edits and collaborate with team members on document content.

-

Downloadable templates can significantly reduce drafting time while ensuring compliance with standard practices.

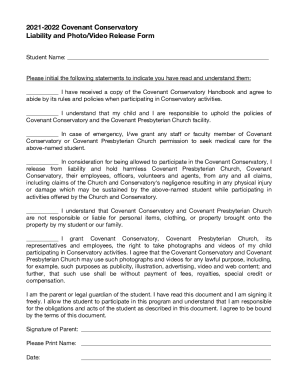

Common situations requiring a Stock Options Agreement

Various scenarios may prompt the need for a Stock Options Agreement. Identifying the context is crucial to understand the driving factors behind these agreements.

-

Startups often use stock options as a key part of their compensation to attract top talent without significant cash outflow.

-

More established companies may offer stock options to retain valuable employees, especially in competitive industries.

-

In special scenarios such as mergers, stock options can be crucial in negotiations and employee retention strategies.

What are the legal compliance considerations?

Legal compliance is a critical aspect of drafting a Stock Options Agreement. Understanding the regulations specific to your region can mitigate risks and ensure effective implementation.

-

Compliance requirements can vary greatly by region and are essential for minimizing liabilities.

-

Avoiding vague language and unclear terms can lead to legal disputes and misunderstandings.

-

Seek legal advice when drafting agreements, particularly in complex situations that may have unique implications.

Empowering document management with pdfFiller

pdfFiller enhances the management of Stock Options Agreements by providing a suite of tools designed for ease of use and flexibility. This cloud-based platform supports document editing, collaborative tools, and secure eSigning.

-

The ability to edit documents and add eSignatures in real time makes pdfFiller an invaluable tool for document management.

-

Features that support teamwork ensure that multiple stakeholders can be involved in managing Stock Options Agreements effectively.

-

Access your Stock Options Agreements from anywhere, making it ideal for remote which is essential for modern businesses.

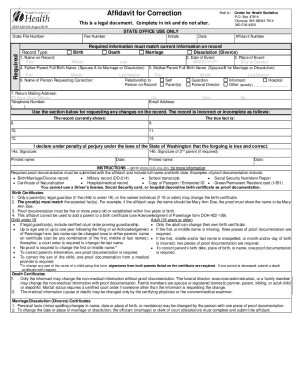

How to fill out the Stock Options Agreement Template

-

1.Obtain the Stock Options Agreement Template from a reliable source or your legal advisor.

-

2.Open the template in pdfFiller or upload it if necessary.

-

3.Begin by filling in the name of the company and the date of the agreement at the top of the document.

-

4.Input details of the option holder, including their name and relevant employee identification.

-

5.Specify the total number of stock options being granted and the price per share.

-

6.Fill in the vesting schedule, outlining when the options can be exercised.

-

7.Complete any sections related to the terms of exercising options, including expiration date and any conditions.

-

8.Review all filled sections to ensure accuracy and completeness.

-

9.Save your changes in pdfFiller and download the document for signatures as needed.

-

10.Follow up with the concerned parties to ensure all signatures are obtained and the agreement is fully executed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.