Last updated on Feb 17, 2026

Stock Repurchase Agreement Template free printable template

Show details

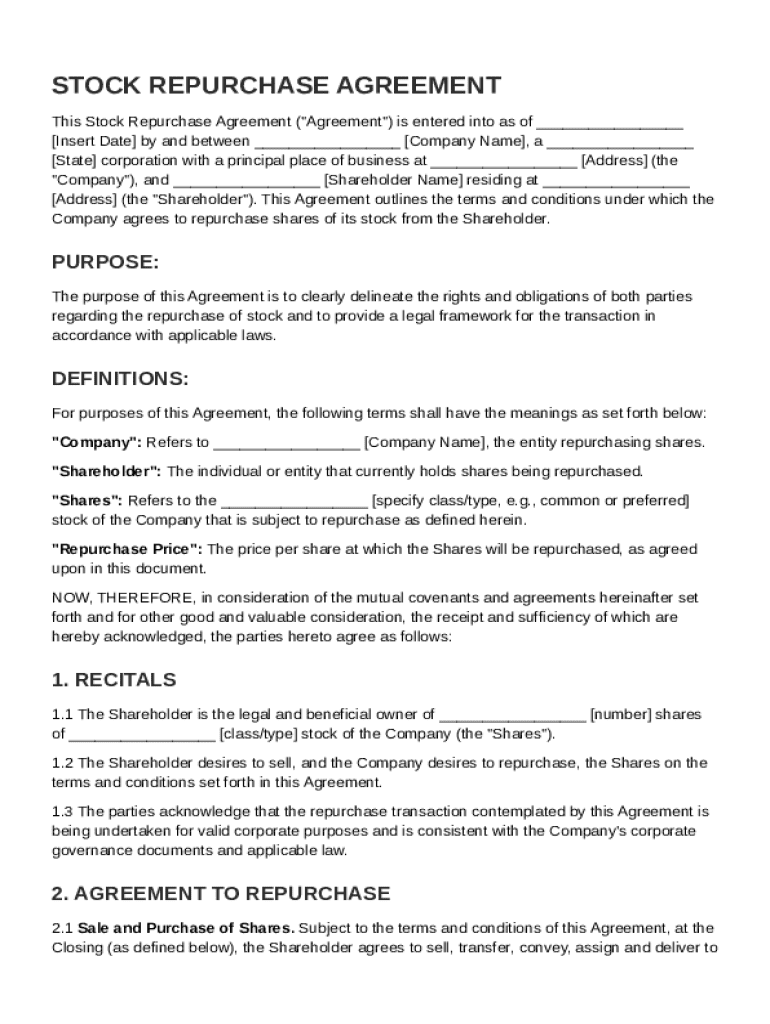

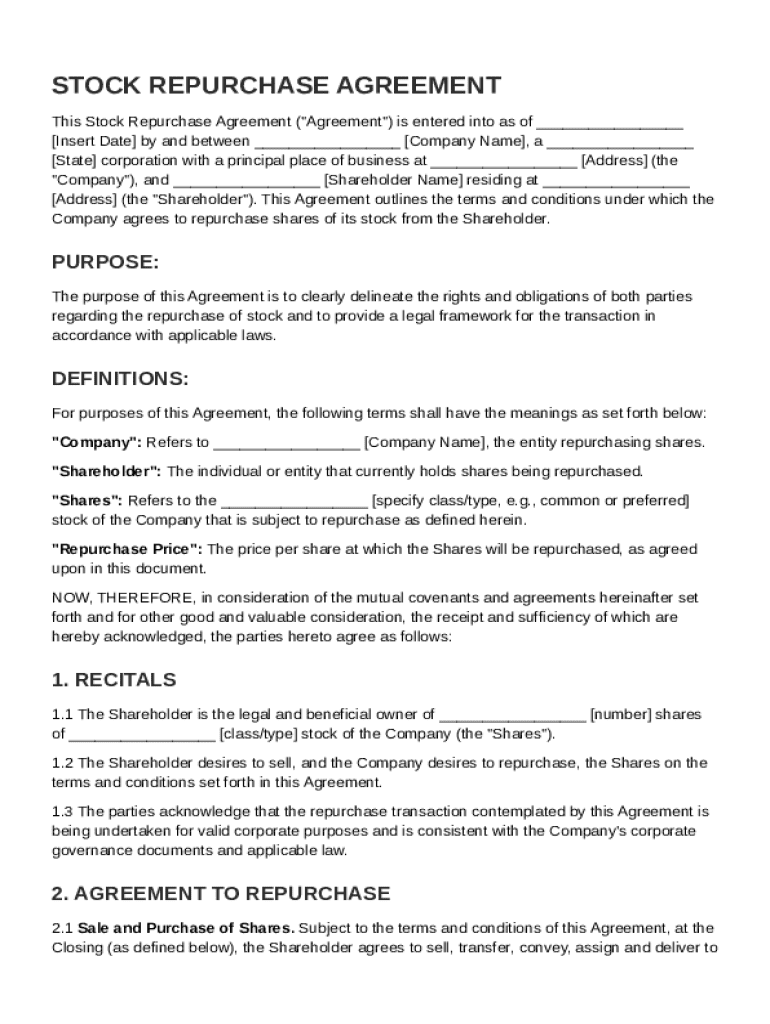

This document outlines the terms and conditions for the repurchase of shares of stock by a company from a shareholder, detailing the rights and obligations of both parties involved in the transaction.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Stock Repurchase Agreement Template

A Stock Repurchase Agreement Template is a legal document outlining the terms under which a company buys back its own shares from shareholders.

pdfFiller scores top ratings on review platforms

AT FIRST I WAS NERVOUS IN USING THIS PROGRAM AND I WAS NOT INTIMIDATED BY THIS PROGRAM

Realistically I would not have the financial capability nor want to pay for this reoccurring payment unless I had a business of my own.

i am able to complete everything i need with this program Great Jo

Very nice concept for typist with deadlines.

Your website is very user friendly even for non tech savvy people like myself.

i like how the team at PDFfiller make things happen. The recipient box is useful and suddenly the email is ready to be sent to a certain school. Also how you helped me to create a cover letter relating to the Teacher for Science vacancy Very professional. Thank you Brent Walton 2 June 2019

Who needs Stock Repurchase Agreement Template?

Explore how professionals across industries use pdfFiller.

Stock Repurchase Agreement Guide

How does a stock repurchase agreement work?

A Stock Repurchase Agreement (SRA) essentially outlines the conditions under which a company can buy back its shares from shareholders. This agreement serves multiple purposes, including boosting shareholder value and allowing corporations to adjust their equity structure. In this section, we will delve into the definition and significance of SRAs in corporate governance.

What prompts a stock buyback?

Circumstances prompting a stock buyback can vary, but common scenarios include surplus cash, undervalued shares, and enhancing financial ratios. Companies seek to benefit both themselves and their shareholders through buybacks, as this can lead to increased stock price and favorable investor sentiment. However, it is crucial to remain compliant with regulations surrounding such transactions.

-

Surplus cash, market conditions, and strategic financial maneuvers often trigger buybacks.

-

Buybacks can return value to shareholders, decrease outstanding shares, and leverage tax structures.

-

Companies need to adhere to securities laws and regulations governing buybacks.

What are the essential components of a stock repurchase agreement?

A comprehensive Stock Repurchase Agreement includes critical details such as the parties involved, specifically the company and the shareholder. Additionally, it should clearly state the date, location, and quantum of shares being repurchased, as well as pricing mechanisms that define how the repurchase price will be determined.

-

Identification of the Company Name and Shareholder Name is crucial for clarity.

-

Key specifics such as the date, location, and number of shares must be explicitly documented.

-

Defining how the Repurchase Price will be established is a legal necessity.

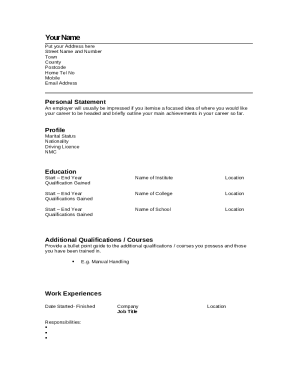

How to fill out your stock repurchase agreement?

Filling out your stock repurchase agreement requires gathering essential information such as names, addresses, and share details of all parties involved. You can streamline this process by utilizing interactive tools on pdfFiller, which allows for easy editing and formatting of your document. Once you've constructed the agreement, signing and finalizing can be done seamlessly through eSign functionalities.

How to manage stock repurchase agreements effectively?

Best practices for managing stock repurchase agreements involve tracking compliance with corporate governance and ensuring all documentation is accurate and accessible. Proper record-keeping is essential for future audits and legal scrutiny. Collaborating with legal counsel is advised for complex transactions, ensuring all regulatory aspects are adequately addressed.

-

Monitoring adherence to corporate governance standards is essential for risk management.

-

Reliable record-keeping facilitates efficient retrieval and legal protection.

-

Engaging with legal professionals can help navigate the complexities of repurchase agreements.

What related documents and resources should you consider?

When dealing with stock repurchase agreements, it’s beneficial to understand related forms such as Shareholder Agreements and Board Resolutions. pdfFiller offers a database where you can access relevant templates and forms tailored to meet your needs. Furthermore, consider seeking specific resources aligned to your state regulations for compliance assurance.

-

Understanding related documents can provide a comprehensive view of corporate governance.

-

Accessing a variety of templates simplifies the drafting process.

-

Utilize local resources to ensure compliance with state-specific regulations.

How to optimize your document management with pdfFiller?

In the digital age, utilizing cloud-based functionalities like those offered by pdfFiller can enhance your document management. You can collaborate and manage documents efficiently by leveraging real-time editing tools. The platform's user-friendly interface simplifies the process of editing, signing, and sharing your stock repurchase agreements.

-

Cloud solutions provide seamless access and collaboration capabilities.

-

Enhanced ability to manage, edit, and share documents fosters a more productive workflow.

-

Simple features allow for quick edits and signing, streamlining the entire process.

How to fill out the Stock Repurchase Agreement Template

-

1.Start by downloading the Stock Repurchase Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and review the pre-filled sections to understand the structure.

-

3.Begin filling in your company's name in the appropriate fields, usually indicated at the top of the document.

-

4.Input the date of the agreement in the designated spot.

-

5.Specify the number of shares the company intends to repurchase, along with the price per share.

-

6.Fill in the shareholders' names and the number of shares each is selling back to the company.

-

7.Make sure to include any necessary payment terms, detailing how and when shareholders will receive payment.

-

8.Review the terms and conditions section, ensuring all agreements and obligations are clearly stated.

-

9.Once filled out, double-check for any errors or missing information.

-

10.Save your completed document, and if needed, print it for physical signatures or to keep a record.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

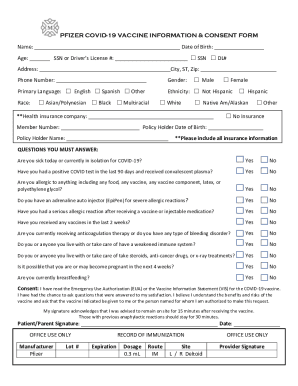

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.