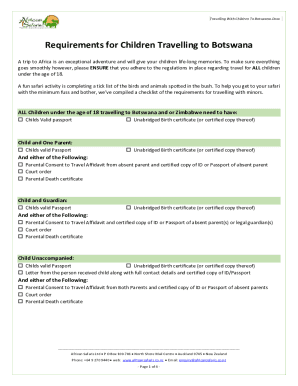

Superannuation Salary Sacrifice Agreement Template free printable template

Show details

This document outlines the terms and conditions under which an employee agrees to sacrifice part of their salary for contributions to their superannuation fund.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Superannuation Salary Sacrifice Agreement Template

A Superannuation Salary Sacrifice Agreement Template is a document that enables employees to agree with their employer to contribute a portion of their pre-tax salary to their superannuation fund.

pdfFiller scores top ratings on review platforms

easy to use. very useful. Works quickly.

It is very easy and intuitive. Saves a lot of time by bypassing printing, signing and scanning activities.

no problems. easy to navigate and understand

I have been looking for a good program like this for years. Thank you

I've been able to edit documents and reorder pages easily which is exactly what I wanted to do.

I need help figuring out how to scribe my signature and using it for my docs. I have to use your text signature feature.

Who needs Superannuation Salary Sacrifice Agreement Template?

Explore how professionals across industries use pdfFiller.

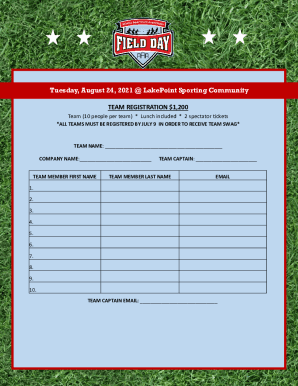

Superannuation Salary Sacrifice Agreement Template Guide

Filling out a Superannuation Salary Sacrifice Agreement form requires understanding key components of the agreement and careful attention during completion. This guide will empower you to create an effective document that aligns with both employee and employer needs.

What is superannuation and salary sacrifice?

Superannuation refers to a retirement savings account designed to help individuals accumulate funds for their retirement. Salary sacrifice is an arrangement where an employee agrees to receive less take-home pay in exchange for increased contributions to their superannuation fund. This can be advantageous for retirement savings, tax benefits, and financial planning.

-

It functions as a long-term savings strategy to ensure financial security in retirement.

-

Involves redirecting a portion of pre-tax salary to a superannuation fund.

-

Can lead to tax reductions and increased retirement savings.

What are the key components of the agreement?

A well-structured Superannuation Salary Sacrifice Agreement outlines crucial details that govern the relationship between employers and employees. It's essential to clearly identify both parties and articulate the terms and conditions of the agreement.

-

Clearly state the names and details of the parties involved.

-

Include specifics about how the salary sacrifice amounts are calculated and managed.

-

Clarify how contributions will be compounding over time and any conditions tied to these contributions.

What are employee obligations and rights?

Employees entering a salary sacrifice arrangement have specific responsibilities and rights. Understanding these is crucial to making informed decisions about retirement savings.

-

Employees must ensure they comprehend the agreement and its implications on their salary and taxes.

-

Employees have the right to amend or discontinue the arrangement, usually with prior notice.

-

A salary sacrifice will reduce taxable income, potentially lowering tax liabilities.

What are employer responsibilities and compliance?

Employers also have significant responsibilities when it comes to handling salary sacrifice agreements. They must ensure compliance with taxation regulations and the accurate management of contributions.

-

Employers should provide clear, honest information about the agreement to employees to ensure understanding.

-

Keep updated with ATO regulations to manage contributions responsibly.

-

Ensure timely processing of contributions to superannuation funds as agreed.

How do manage salary sacrifice arrangements?

Managing salary sacrifice agreements requires careful consideration of the amount and duration of the sacrifice. Proper planning can lead to significant retirement savings.

-

Consider methodologies for both fixed amounts and percentage contributions of salary.

-

Establish clear agreement terms for the length and review processes of the sacrifice period.

-

Regularly assess the salary sacrifice to adapt to changes in income or personal circumstances.

What are important notes for employers and employees?

Understanding the broader context of superannuation and salary sacrifice is vital for both parties. Certain mandatory elements must be observed.

-

Understand the minimum contribution rates required by law.

-

Review all conditions that could impact the agreement's validity.

-

Be aware of what can cause changes or cessation of the agreement.

How do fill out the template step-by-step?

Filling out the Superannuation Salary Sacrifice Agreement form is straightforward if approached methodically. Following best practices will help ensure a successful submission.

-

Follow a step-by-step process to fill out each part of the template.

-

Utilize tools like pdfFiller for easy document management.

-

Facilitate better communication by using cloud features to share and edit.

How can pdfFiller enhance document management?

pdfFiller provides an intuitive platform for managing various documents, including salary sacrifice agreements. Its cloud-based features streamline the creation, editing, and signing processes, making it easier for both employees and employers to maintain compliance.

-

Classes and templates guide users, reducing the time spent on document preparation.

-

Access documents anytime, anywhere, ensuring that users can stay organized.

-

Invite others to review or edit documents in real time for better efficiency.

How to fill out the Superannuation Salary Sacrifice Agreement Template

-

1.Download the Superannuation Salary Sacrifice Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling out the employee's full name and employee ID in the designated fields.

-

4.Enter the superannuation fund name and the fund's ABN in the appropriate sections.

-

5.Specify the percentage or fixed amount of salary the employee wishes to sacrifice.

-

6.Review the terms and conditions outlined in the agreement carefully.

-

7.Add the date of the agreement in the provided field.

-

8.Both the employee and employer should sign the document in the signature fields.

-

9.Save the completed document to your device or upload it directly to your employer's payroll system.

-

10.Ensure a copy is kept for both employee and employer records.

How to set up super salary sacrifice?

Step 1: Ask your employer if they offer salary sacrifice, what your options are and any impacts it might have on your salary and benefits. Step 2: Complete and provide the Add to your super through your employer form to your employer or payroll department.

What is an example of salary sacrifice super?

An example of salary sacrificing Terry earns $7,500 per month and decides that he can comfortably live off just $7,000 of that. He therefore asks his employer to pay $500 from his salary each month into his super account as a salary sacrifice.

What is the maximum you can salary sacrifice into superannuation?

What is the maximum salary sacrifice? Salary sacrifice is a before-tax contribution, so the maximum salary sacrifice is $30,000 per financial year, but remember, this cap also includes any contributions your employer has made to your superannuation and any contributions you claim a deduction for.

What happens if I put more than $25,000 into super?

Any contributions you make over the cap will be taxed at your marginal rate, less a 15% tax rebate. You may also be charged interest. At the end of the financial year, the ATO will give you the option to: withdraw up to 85% of your excess contributions for the financial year.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.