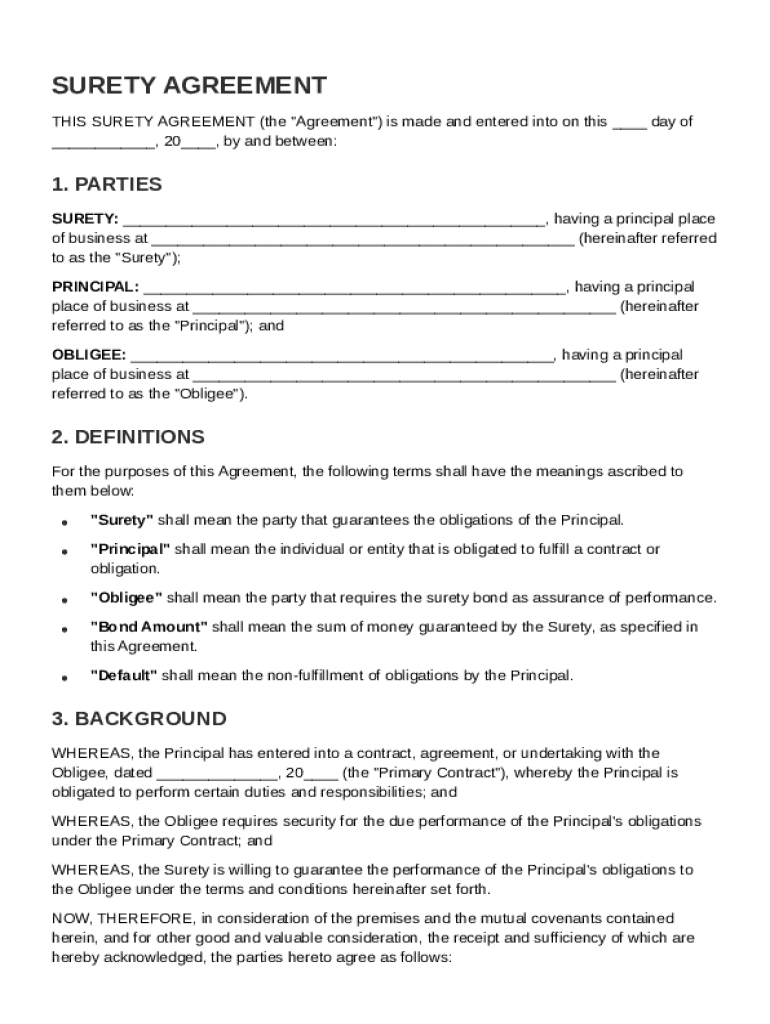

Surety Agreement Template free printable template

Show details

This document serves as a guarantee agreement where the Surety agrees to secure the obligations of the Principal toward the Obligee.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Surety Agreement Template

A Surety Agreement Template is a legal document that outlines the responsibilities and obligations of the surety, principal, and obligee in a surety bond arrangement.

pdfFiller scores top ratings on review platforms

EASY AND QUICK TO USE LOVE IT

EASY AND QUICK TO USE LOVE IT

a little pricey but worth every penny!

a little pricey but worth every penny!

GLAD I SIGNED UP

GLAD I SIGNED UP, MAKES IT EASIER FOR EDITING FLIES

Amazing

Amazing, great and i will always use it.

I would change the interface

I would change the interface, to make it more friendly, the location of the buttons, and things like that, but the tool is very powerful and honestly very very helpful! Thanks a lot!

A little hard to find the right…

A little hard to find the right fillable form!

Who needs Surety Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Surety Agreement Template on pdfFiller

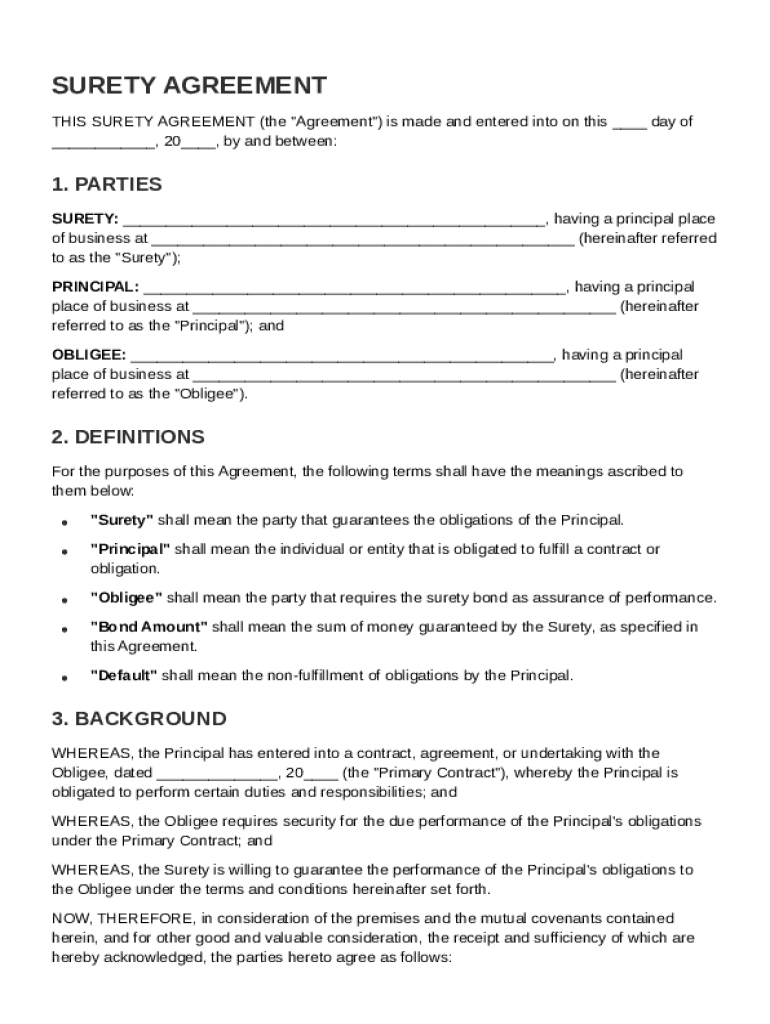

A Surety Agreement Template is essential for defining the roles and responsibilities between the surety, principal, and obligee in any contractual obligation. This guide covers how to effectively use these templates—available on pdfFiller—enabling you to create customized agreements with ease.

Filling out a Surety Agreement form involves understanding the various components it contains, knowing the legal implications in your region, and using proper document management tools like pdfFiller.

What is a surety agreement?

A Surety Agreement is a legal document in which one party, known as the surety, agrees to take responsibility for the debt or obligation of another party, referred to as the principal, to a third party, known as the obligee. This contract ensures that if the principal fails to meet their obligations, the surety will cover those obligations.

Who are the key parties involved?

-

The party that guarantees the performance or payment of the principal.

-

The party whose obligation is being guaranteed.

-

The party expecting performance or payment under the contract.

Why are surety agreements important in contracts?

Surety Agreements play a critical role in providing security and assurance that contractual obligations will be met. They are particularly important in construction, service contracts, and public projects where the risk of non-performance can lead to financial loss.

What are the components of a surety agreement?

-

Each agreement should clearly outline the terms, including the bond amount and conditions of performance.

-

Each party's responsibilities must be defined to avoid any ambiguity.

-

Key terms such as bond amount and default need explanations to ensure understanding.

How to fill out the surety agreement template

Filling out a Surety Agreement Template requires careful attention to detail. Start by gathering necessary information for all parties involved, followed by completing each section of the template step-by-step.

What is the step-by-step guide to completing the template?

-

Collect names, addresses, and relevant details of the surety, principal, and obligee.

-

Specify the amount the surety guarantees, ensuring it is adequate to cover potential risks.

-

Clearly outline what the principal must perform under the agreement.

-

Double-check all entries to prevent errors, as mistakes can lead to legal complications.

What common mistakes should you avoid?

Common mistakes when filling out a Surety Agreement include failing to specify the bond amount, unclear performance obligations, and not having the agreement signed and dated. Ensure all parties review the agreement to avoid misunderstandings.

How to edit your surety agreement with pdfFiller

Using pdfFiller's editing tools, users can customize their Surety Agreements to better fit their needs. The platform also allows you to save your work in real time, preventing data loss during the editing process.

What editing tools does pdfFiller offer?

-

Alter or add text directly within the PDF, ensuring that all necessary information is clear.

-

Easily fill in form fields without needing to print the document.

-

Create designated areas for signatures to facilitate the signing process.

How to sign and manage your surety agreement

With pdfFiller, exploring e-signature options simplifies the signing process. You can share the signed document with relevant parties directly from the platform, ensuring all stakeholders have access.

What are the benefits of digital signatures?

-

Digital signatures expedite the review and signing process, reducing turnaround time.

-

They provide a secure way to validate commitment and protect documents from forgery.

-

Users can sign from anywhere, making it ideal for remote work situations.

What legal considerations and compliance aspects should you know?

Understanding legal requirements for Surety Agreements in your region is crucial. Compliance failures can lead to severe penalties or invalidated contracts, making it important to consult a legal professional if uncertainties arise.

What are the consequences of defaulting on the agreement?

Consequences may include monetary loss, legal action, and damage to reputations. Both the surety and principal should be fully aware of their obligations to mitigate risks associated with defaults.

Common questions about surety agreements

Even with a clear understanding, questions may arise about the practical implications of Surety Agreements. Familiarizing yourself with common inquiries can provide useful insights for effective contract management.

Where to find more resources and guidance?

-

Consult with legal experts who specialize in contract law.

-

Utilize websites that offer templates and examples for further clarity.

-

Attend educational programs focused on contract management.

How can pdfFiller enhance your document management experience?

pdfFiller provides an excellent ecosystem for document management, including collaborative tools for team use and integrations with other platforms. This helps streamline processes such as signing, sharing, and archiving your Surety Agreements.

What are some best practices for using pdfFiller?

-

Start with pre-made templates to save time and ensure compliance.

-

Collaborate with team members directly on the platform for seamless document adjustments.

-

Use folders and tags for easy retrieval of past agreements.

How to fill out the Surety Agreement Template

-

1.Download the Surety Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the date at the top of the document.

-

4.Next, fill in the name and address of the principal who is seeking the surety bond.

-

5.Continue by entering the name and address of the surety who will provide the bond.

-

6.Input the details of the obligee, which is the party requiring the bond.

-

7.Specify the bond amount that the surety is guaranteeing.

-

8.Include the obligations that the principal agrees to under the bond.

-

9.Clearly outline any terms and conditions that govern the agreement.

-

10.Review the filled document for accuracy and completeness.

-

11.Once all information is correctly entered, save the document.

-

12.Finally, print or share the completed Surety Agreement Template as needed.

What is the basic surety agreement?

Suretyship is a legal agreement where a third party, known as the surety, agrees to be responsible for the debt or obligation of a primary debtor if the debtor fails to meet their obligations. This arrangement provides assurance to the creditor that they will be compensated even if the debtor defaults.

How to write a surety form?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

How to write a surety bond?

KNOW ALL MEN BY THESE PRESENTS THAT I Son of of resident of in the District of at present employed as a permanent in the Government of India (hereinafter called "the Surety") am held and firmly bound up to the President of India (hereinafter called "the Government of India" which expression shall include his successors

What is a surety in a contract?

A surety is a person or party that takes responsibility for the debt, default, or other financial responsibilities of another party. A surety is often used in contracts in which one party's financial holdings or well-being are in question and the other party wants a guarantor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.