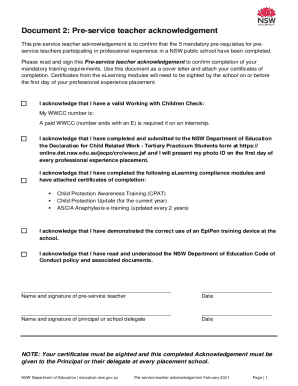

Syndicated Loan Agreement Template free printable template

Show details

This document is a legally binding agreement outlining the terms and conditions under which funds are lent from multiple lenders to a borrower, facilitated by an agent.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Syndicated Loan Agreement Template

A Syndicated Loan Agreement Template is a standardized document used to outline the terms and conditions of a loan extended by a group of lenders to a single borrower.

pdfFiller scores top ratings on review platforms

Could be more user friendly finding documents. However, filling is easy. Slightly pricey.

Je suis très satisfaite du fonctionnement de PDFfille

PDFfiller has been a great tool for me, one of the best things is it saves all of my work

great program, fast and easy to use and learn

I stumbled on to PDFiller for a project I was working on. Worked perfectly.

I had several legal documents to produce quickly and this was the answer.

Who needs Syndicated Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Syndicated Loan Agreement Template

How do syndicated loan agreements work?

A Syndicated Loan Agreement Template outlines the processes and responsibilities involved in securing a loan from multiple lenders, collectively known as a syndicate. The document serves as a standardized reference, facilitating smooth dealings among the involved parties. Using a template ensures that crucial elements are not overlooked, streamlining the execution of the loan.

What are the key components of a syndicated loan agreement?

Understanding the essential components of a Syndicated Loan Agreement is crucial for effective management and compliance. Each clause serves a specific purpose, helping both the borrower and lenders navigate the complexities of the loan.

-

These typically include the Borrower, the Agent who manages the loan on behalf of lenders, and the Lenders who provide the funds.

-

Key aspects include the Loan Amount, Interest Rate, Maturity Date, and Default Terms, which define the benefits and responsibilities of each party.

-

Understanding each element's legal ramifications ensures that all parties can protect their interests and mitigate risks effectively.

What steps are involved in completing your syndicated loan agreement?

Completing your Syndicated Loan Agreement requires extensive attention to detail and accurate information. Each step is paramount in ensuring clarity and mutual understanding among all parties.

-

Begin by inserting key details such as the Date, Borrower Name, and Address. Accuracy in these details is crucial for creating a valid agreement.

-

Articulate the loan's intended use, and any constraints associated with it to ensure all parties understand the funding's objective.

-

A thorough review process involving all parties is critical to confirm that the terms reflect the mutual interests and agreements.

How can you use pdfFiller to complete your agreement?

pdfFiller offers a range of interactive tools to simplify the Syndicated Loan Agreement process. By leveraging these features, you can create, customize, and collaborate on your documents efficiently.

-

The platform’s intuitive interface allows users to tailor each field as needed, ensuring precise data entry.

-

Utilizing the eSigning feature expedites the approval process, making it easier for all parties to finalize the agreement quickly.

-

Features designed to manage interactions among all parties streamline the communication process and enhance agreement transparency.

What are common mistakes to avoid when completing the agreement?

Avoiding common pitfalls during the Syndicated Loan Agreement process is vital for ensuring successful collaboration among all stakeholders and safeguarding interests.

-

Each party must understand their obligations to avoid potential conflicts and misunderstandings.

-

Mistakes in these figures can lead to disputes or financial loss; double-checking is essential.

-

Providing a vague or incomplete description can create confusion regarding the use of borrowed funds.

What are best practices for managing syndicated loan agreements?

Following effective practices ensures that your Syndicated Loan Agreements remain relevant and compliant over time. Regular updates and clear communication are key components of this process.

-

Keep documents up to date to reflect any changes in financial status or agreements.

-

Frequent and transparent interactions among parties reduce confusion and enhance trust.

-

Taking advantage of technology aids in compliance and efficient document handling.

What additional considerations should you have in mind?

Various external factors can influence Syndicated Loan Agreements, necessitating thorough consideration during the drafting process.

-

Awareness of local regulations is crucial to ensure that your agreement adheres to legal standards.

-

Understanding the broader economic environment can affect loan terms and interest rates.

-

Consulting with financial and legal experts helps mitigate risks and enhance the agreement's efficacy.

How to fill out the Syndicated Loan Agreement Template

-

1.Download the Syndicated Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller for editing.

-

3.Fill in the borrower’s details at the beginning of the document, including company name and contact information.

-

4.Input the lender details in the designated sections, including names and addresses for each participating lender.

-

5.Specify the total loan amount, interest rate, repayment schedule, and collateral information in the appropriate fields.

-

6.Review the terms and conditions outlined in the agreement, ensuring all parties understand their obligations and rights.

-

7.Add any additional clauses relevant to the loan, such as covenants or fees.

-

8.Once all sections are completed, save your changes and review the document for accuracy.

-

9.Final steps include obtaining signatures from authorized representatives of both the borrower and all lenders involved.

What is a syndicated loan agreement?

Syndicated loan is a form of loan business in which two or more lenders jointly provide loans for one or more borrowers on the same loan terms and with different duties and sign the same loan agreement. Usually, one bank is appointed as the agency bank to manage the loan business on behalf of the syndicate members.

How to structure a syndicated loan?

Structuring a syndicated loan deal involves several steps, from identifying the borrower's needs and objectives, to selecting the lead arranger and the syndicate members, to negotiating the terms and conditions, to closing and distributing the loan.

How to write a simple loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What are the three types of syndicated loans?

Below, we explore three common forms of loan syndication: underwritten syndicated loans, best-efforts syndicated loans, and club loans.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.