Term Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a loan to a borrower, serving as a legally binding contract to facilitate repayment and protect the interests of both

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Term Loan Agreement Template

A Term Loan Agreement Template is a legal document outlining the terms and conditions under which a borrower agrees to repay a loan over a specified period.

pdfFiller scores top ratings on review platforms

Works great but $20 a month is way too expensive.

This is my second time using PDF Filler as I am returning to the real estate business and they continue to not only provide an excellent and useful product but they continue to improve it.

I had an emergency and had to down load the program I wasn't expecting it to be as user friendly as it is. Thank you very much! so far so good!!

I really like the application a lot. I am finding the fact that you do not have a field value setting which comes in handy for allowing a Check Mark to have a Value and Calculate costs based on Check Marks or Drop Down Menus. I also would love a copy and paste a single field, this comes in handy for repetitive drop down menus. Prepopulating a field from an earlier field value would be great in helping people not have to enter same information more than once.

makes life much easier when I can type information into forms

Today is first time using, so far so good!

Who needs Term Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Term Loan Agreement Template form

Filling out a Term Loan Agreement Template form accurately ensures all key components are addressed, providing clarity to both the lender and the borrower. This guide will walk you through the essential elements and best practices required for filling out an effective agreement.

Understanding the Term Loan Agreement

-

A Term Loan Agreement is a legal document outlining the terms of a loan between a lender and a borrower, usually with a fixed repayment schedule.

-

Having a formal agreement protects both parties by clearly stating the loan conditions, thus minimizing misunderstandings.

-

The lender provides the funds, while the borrower agrees to repay the loan along with any interest within an agreed timeframe.

What are the core components of a Term Loan Agreement?

-

The date on which the agreement becomes effective should be clearly stated to avoid confusion.

-

Specify the total amount being borrowed, as this is critical for both parties.

-

Defining the interest rate ensures transparency regarding the cost of borrowing.

-

Establishing repayment deadlines help in managing financial expectations.

-

Discussing security for the loan can protect the lender's interests.

-

Outlining conditions under which a borrower defaults ensures both parties are aware of potential risks.

How do you fill out a Term Loan Agreement?

-

Follow the outlined sections carefully, ensuring all pertinent details are filled in accurately.

-

Be diligent about entering correct data for loan amounts and terms; common errors can lead to financial discrepancies.

-

Utilize pdfFiller's editing and signing resources to streamline the document completion process.

What are the different types of term loans?

-

Fixed loans maintain the same interest throughout, whereas variable loans may fluctuate based on market conditions.

-

Short-term loans typically have repayment periods of less than a year, while long-term loans span several years.

-

Secured loans are backed by collateral, whereas unsecured loans rely solely on the borrower's creditworthiness.

When should you use a Term Loan Agreement?

-

Use a Term Loan Agreement when borrowing a substantial amount or when formalizing terms between parties.

-

Without a legal document, enforcing loan terms can be difficult, leading to potential disputes.

-

Unlike Promissory Notes, Term Loan Agreements typically involve detailed terms regarding interest and repayment.

How to write an effective Term Loan Agreement?

-

Ensure clarity on all repayment terms and the obligations of each party.

-

Include clauses on interest rates, payment schedules, and consequences of defaults to safeguard interest.

-

pdfFiller offers various templates that can simplify the drafting process.

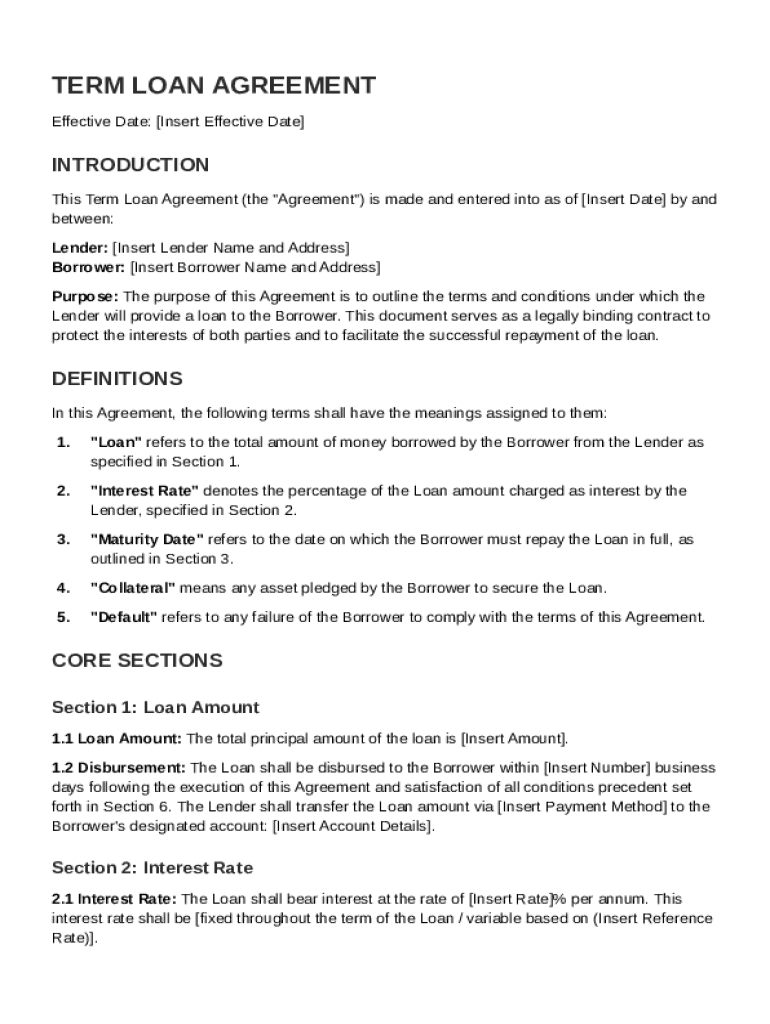

What does a sample Term Loan Agreement look like?

-

A well-crafted agreement typically includes defined terms for interest rates, payment schedules, and default conditions.

-

Sections must be clear and easily identifiable for efficient reference.

-

Using pdfFiller's tools, you can customize templates as per your requirements easily.

How are payment plans structured in Term Loans?

-

Payment plans may vary but typically include periodic installments until the loan is repaid.

-

Clearly defining payment schedules helps avoid late payments and ensures both parties are aligned.

-

pdfFiller offers interactive tools that help borrowers visualize their payment obligations over time.

In conclusion, filling out a Term Loan Agreement Template form is crucial for establishing a formal understanding between lenders and borrowers. Understanding its core components and having a clear structure can prevent most financial misunderstandings. By utilizing tools available on pdfFiller, you streamline the process, making it easier to manage loan agreements.

How to fill out the Term Loan Agreement Template

-

1.Open the Term Loan Agreement Template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and contact details of both the borrower and the lender in the respective fields.

-

4.Specify the loan amount in the designated section, ensuring it is clearly stated.

-

5.Indicate the interest rate, whether fixed or variable, and detail how it will be applied.

-

6.Enter the repayment schedule, including start date, end date, and frequency of payments (monthly, quarterly, etc.).

-

7.Include any collateral or security interests if required, detailing what is to be secured.

-

8.Outline any covenants, conditions, or requirements that the borrower must adhere to during the loan period.

-

9.Finally, review all entered information for accuracy, and save the completed document as either PDF or another preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.