Term Sheet Agreement Template free printable template

Show details

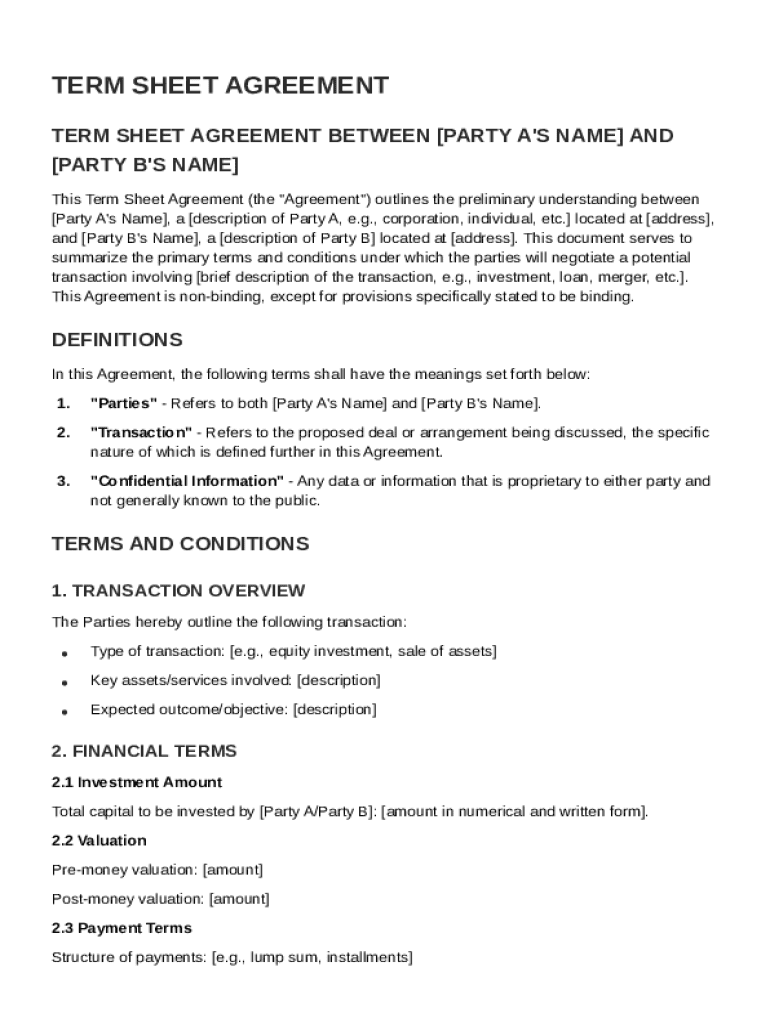

This document outlines the preliminary understanding between two parties for a potential transaction and summarizes the primary terms and conditions under which they will negotiate.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

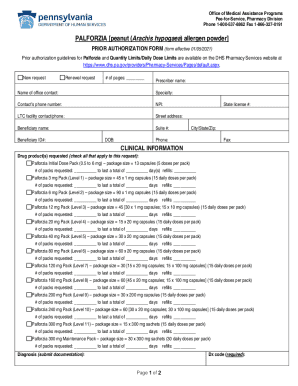

What is Term Sheet Agreement Template

A Term Sheet Agreement Template is a preliminary document outlining the key terms and conditions of a business agreement before its finalization.

pdfFiller scores top ratings on review platforms

PDF Filler is great. I started with the free trial, then went to the pro, but now I've switched to Basic. I got this for signing contracts on buying and selling my home. Awesome!

great service but had difficulties reloading docs

It has helped me with all my needs! I have no complaints!!

So far my overall experience has been pretty great. The only thing I would recommend would be having more of a collection of pdf's to compare on certain subjects. Other than that, I am one happy customer!

ES MI PRIMERA EXPERIENCIA Y ES MUY FACIL DE USAR. GRACIAS.

easy to use, but the pop-up was VERY ANNOYING!

Who needs Term Sheet Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Term Sheet Agreement Template

What is a term sheet?

A term sheet is a non-binding agreement that outlines the basic terms and conditions of a business agreement. It serves as a starting point for negotiations and is crucial in various business transactions, including investments and mergers. Understanding the purpose and structure of a term sheet can help individuals and teams navigate complex agreements with ease.

-

Definition and purpose: A term sheet provides an overview of essential deal points in a clear format.

-

Importance: Term sheets play a vital role in defining expectations, responsibilities, and timelines among parties.

-

Binding vs. Non-binding: Knowing whether your term sheet is binding is crucial for understanding its implications.

What are the key components of a term sheet?

A well-structured term sheet contains several pivotal components that clarify the agreement between involved parties. Knowing these components aids in crafting effective agreements tailored to specific scenarios.

-

Parties involved: Clearly identify the entities or individuals (Party A and Party B) entering into the agreement.

-

Transaction overview: Provide a succinct summary of the type of transaction, such as investment or partnership.

-

Confidential Information: Specify what data is proprietary and ensure it's protected throughout the negotiation process.

How is a term sheet structured?

A term sheet is typically broken down into several key sections that detail the agreement's terms and conditions. Understanding how to fill out each part is essential for clarity and legal compliance.

-

Sections breakdown: The main areas usually include Definitions, Terms, and Conditions.

-

Using pdfFiller tools: Utilize the features for accurate completion of each section.

-

Common terms: Familiarity with terms such as 'valuation' and 'subscription' can enhance the precision of the document.

How do you fill out a term sheet agreement?

Filling out a term sheet effectively requires step-by-step guidance to ensure that all necessary fields are addressed. Adopting a systematic approach can streamline the process and minimize errors.

-

Step-by-step instructions: Follow a clear sequence when entering information using pdfFiller for efficient input.

-

Editing features: Explore customization options available on pdfFiller to tailor the document to your needs.

-

eSign functionalities: Utilize electronic signing features to formalize the agreement swiftly.

What financial terms should you know?

Understanding financial terms within a term sheet is crucial for both parties as these terms dictate the financial obligations and benefits derived from the agreement.

-

Investment Amount: Accurately calculate the total investment being made in the transaction.

-

Valuation metrics: Grasp concepts like pre-money and post-money valuations to assess the deal’s worth.

-

Payment terms: Establish a clear structure for payments and their timelines to avoid future disputes.

What are key milestones in term sheet negotiation?

Achieving successful negotiation outcomes requires awareness of critical milestones. Tracking these steps can significantly enhance the process.

-

Timeline: Note key dates for due diligence, agreement finalization, and closing.

-

Tracking methods: Utilize pdfFiller to monitor progress towards these crucial milestones.

-

Importance of deadlines: Timely adherence to these dates fosters trust and smoother negotiations.

What are conditions precedent and their implications?

Conditions precedent are critical requirements that must be satisfied before the agreement is executed. Understanding these conditions prevents unexpected complications.

-

Regulatory approvals: Identify necessary legal approvals that must be obtained prior to finalization.

-

Third-party consents: Recognize the importance of securing agreements from relevant third parties.

-

Additional conditions: Be aware of any other stipulations impacting the term sheet agreement.

What are practical use cases and examples of term sheets?

Examining real-world examples and templates can enhance understanding of how to adapt a term sheet for various business situations. Practicality is essential when choosing template designs.

-

Sample templates: Look for templates tailored to various scenarios, including investments, mergers, and loans.

-

Real-life applications: Analyze how term sheets are utilized within different industries for clarity and effectiveness.

-

Customization: Learn how to alter templates to comply with specific regional regulations.

How can you utilize resources on pdfFiller?

pdfFiller offers a plethora of resources to assist users in effectively managing their term sheets and other documents. Leveraging these tools can streamline the document creation process.

-

Template access: Discover various templates available on pdfFiller to simplify document preparation.

-

Community feedback: Engage with other users to refine your documents utilizing collaborative tools.

-

Document management: Keep all your forms organized on a single, cloud-based platform for easy access.

How to fill out the Term Sheet Agreement Template

-

1.Download the Term Sheet Agreement Template from pdfFiller.

-

2.Open the downloaded PDF in pdfFiller's editor.

-

3.Begin by filling in the 'Parties Involved' section with the names and addresses of all parties.

-

4.Next, clearly outline the 'Investment Amount' or other financial terms in the corresponding section.

-

5.Specify 'Ownership Percentages' to indicate shares or stakes each party will have.

-

6.Describe the 'Use of Funds' to outline how the investment will be utilized by the receiving party.

-

7.Include key 'Dates' such as effective date and any deadlines in the terms outlined.

-

8.Make sure to detail any 'Conditions Precedent' that must be met before the agreement is binding.

-

9.Review the entire document for accuracy and ensure all necessary areas are filled out completely.

-

10.Finally, save the completed document and either print it for signatures or distribute it electronically for signing.

What is a term sheet agreement?

A term sheet is a bullet-point document outlining the material terms and conditions of a potential business agreement, establishing the basis for future negotiations between a seller and buyer. It is usually the first documented evidence of a possible acquisition.

How to make a term sheet legally binding?

Key Takeaways: Binding Clauses: Include confidentiality, exclusivity, legal fees, and governing law. Clear Terms: Avoid vague phrases like "best efforts" or "as soon as possible." Use specific, measurable language. Legal Review: Get legal counsel involved early and often to spot risks and ensure enforceability.

What are 5 key points of a term sheet?

The five key points of a term sheet are the investment amount, which specifies the capital the investor contributes, the valuation of the company, the equity ownership that the investor receives, the liquidation preferences that define how exit proceeds are distributed, and voting rights, which determine investor

What is the difference between a loi and term sheet?

A Letter of Intent is, as its name suggests, often prepared in the form of a letter from one party (typically the would-be Buyer) to the other (the Seller or target company). On the other hand, a Term Sheet is generally crafted in a sort-of outline format, sometimes even in bullet points.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.