Termination of Loan Agreement Template free printable template

Show details

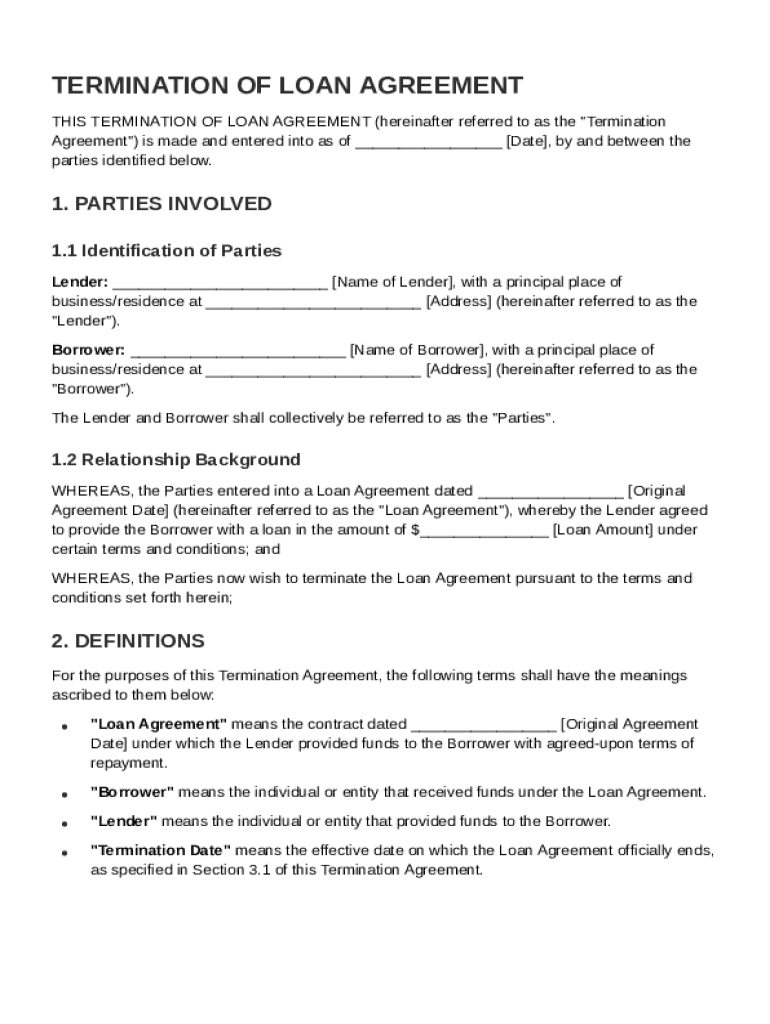

This document outlines the terms and conditions for the termination of a loan agreement between a lender and a borrower, detailing the parties involved, reasons for termination, and mutual releases.

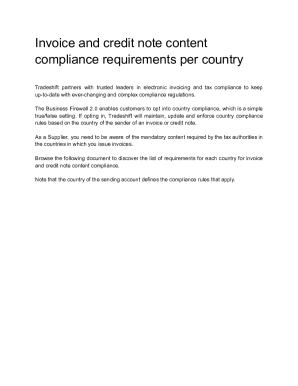

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

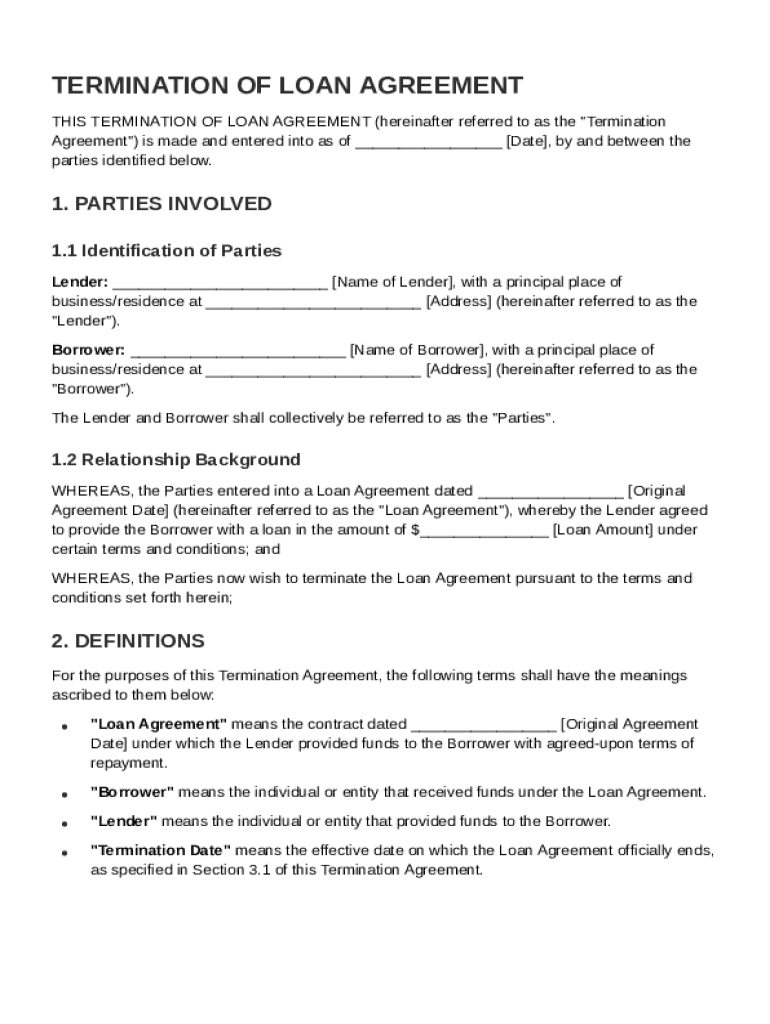

What is Termination of Loan Agreement Template

A Termination of Loan Agreement Template is a legal document used to formally end a loan agreement between parties.

pdfFiller scores top ratings on review platforms

I was immediately asssited and my question was answered. Thank you.

It solved a problem with PDF applications that didn't allow for information to be saved. Once I figured it out, it works well.

PDFfiller is great I often have pdf documents that I need to complete and do not want to write on the document using this program makes it looks more professional

PDF Filler was very easy to use. The site is user friendly and self explanatory.

It would have been more pleasant if you would have stated in the beginning that one cannot print unless you buy subscription.

This program made it possible to fill out an application that I would have otherwise had to do by hand.

Who needs Termination of Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Termination of Loan Agreement Guide

Navigating the termination of a loan agreement requires understanding the appropriate steps and documentation.

A Termination of Loan Agreement Template form is a crucial tool which outlines the procedures and stipulations required when such an agreement comes to an end.

What is a termination agreement?

A termination agreement is a formal document that nullifies the obligations defined in an existing loan agreement.

-

It serves as the legal instrument to end the borrower-lender relationship, ensuring both parties' rights are considered.

-

Proper termination helps avoid legal disputes and clarifies the expectations post-termination.

-

Reasons may include full repayment, dissatisfaction with loan terms, or reaching a mutual decision.

Who are the parties involved in a termination agreement?

Identifying the parties involved in the termination is vital to the agreement's validity.

-

The lender is the individual or institution that provided the loan, and their specified consent is crucial.

-

This refers to the individual or organization who received the loan and is now seeking termination.

-

Clearly delineating the roles ensures each party's responsibilities and rights are addressed throughout the process.

What background context should you consider for loan agreements?

Understanding the background of the original loan agreement is essential before proceeding with termination.

-

Reviewing the key details helps set the stage for the termination process.

-

Pay attention to the terms that may influence the termination process, such as penalties or fees.

-

This knowledge can prevent future complications and legal debates.

How do you define key terms in the termination agreement?

Defining critical terms at the outset is paramount for clarity in a termination agreement.

-

This is a legal document which specifies the borrower’s obligations to repay the lender.

-

Clearly articulated roles help anticipate any disputes during the termination.

-

Specifying this date is crucial, as it marks the formal end to the obligations.

What steps are involved in executing the termination agreement?

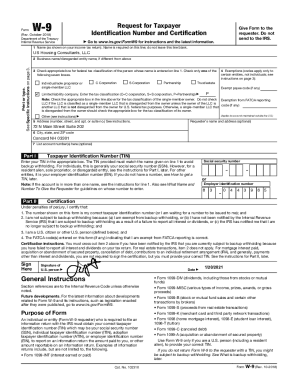

Proper execution of a termination agreement includes meticulous attention to documentation.

-

This includes drafting the agreement, securing signatures, and filing necessary paperwork.

-

Gathering all pertinent documents is crucial to substantiate the termination.

-

Utilizing electronic signatures, such as those provided by pdfFiller, ensures efficiency and security.

What reasons might lead to terminating a loan agreement?

Understanding the rationale behind termination can facilitate an amicable conclusion between parties.

-

This occurs when both parties agree on ending the loan agreement.

-

Reasons may include the loan being fully repaid or changes in financial circumstances.

-

It's important to articulate clear reasons within the agreement to avoid misunderstandings.

What legal considerations and compliance matters should you address?

Legal considerations are paramount when terminating a loan agreement.

-

Many jurisdictions have certain laws regarding loan terminations that must be adhered to.

-

Being aware of regional laws can prevent costly mistakes during the termination process.

-

Consulting with an attorney can help navigate complex termination scenarios.

How can you manage post-termination affairs?

Post-termination processes are critical to wrapping up responsibilities.

-

Handle any final paperwork and ensure all financial obligations are settled.

-

Keep all related documents organized for record-keeping.

-

Clearly understand any ongoing obligations even after termination to avoid future disputes.

How to use pdfFiller for your termination agreement?

pdfFiller offers an intuitive platform mastering document management seamlessly.

-

Easily modify your agreement with user-friendly editing tools.

-

Follow a step-by-step guide for signing electronically, ensuring security and speed.

-

pdfFiller assists teams in managing agreements collaboratively, making it easier to reach consensus.

How do I terminate a loan agreement?

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

What is the Termination clause of a loan agreement?

Terminating a Loan Agreement By using a Termination Agreement, the borrower is released from their obligation to repay the initial loan amount, and the lender is no longer entitled to charge any agreed-upon interest amounts.

How do you write a Termination contract agreement?

Write a termination contract letter Include your heading information. This includes the date of creation and recipient and sender information. Get specific. Create your statement of intent for contract cancellation. End with an end date. Explicitly state the date that you intend to halt the contract.

What is the end of the loan agreement?

A personal loan agreement can be settled at any time by the customer by paying the balance outstanding to the lender, although a fee may be charged for early settlement. The agreement ends when all the contracted repayments have been made to the finance company.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.