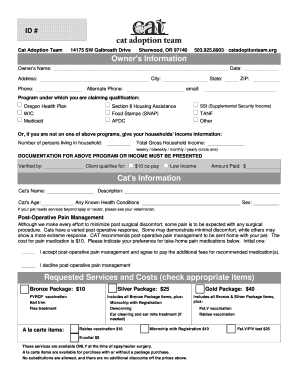

Third Party Payment Agreement Template free printable template

Show details

This document outlines the terms under which one party authorizes another party to make payments to a third party on their behalf, detailing definitions, obligations, payment terms, dispute resolution,

We are not affiliated with any brand or entity on this form

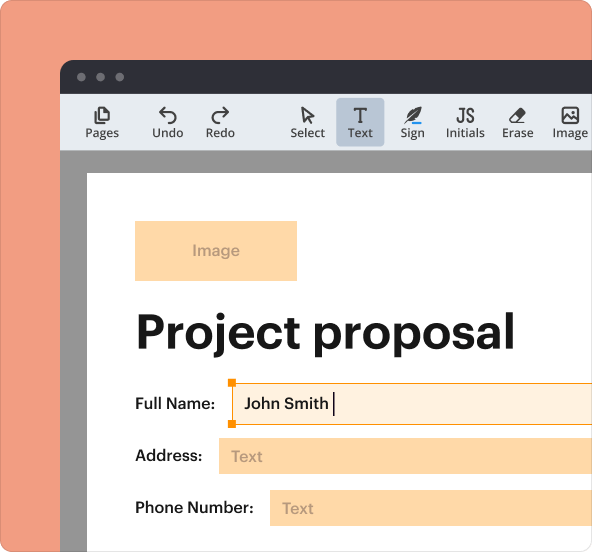

Why pdfFiller is the best tool for managing contracts

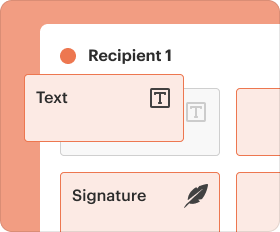

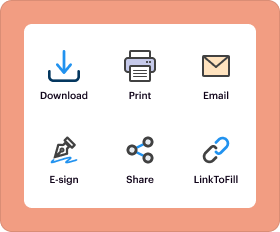

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

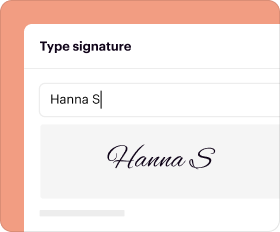

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

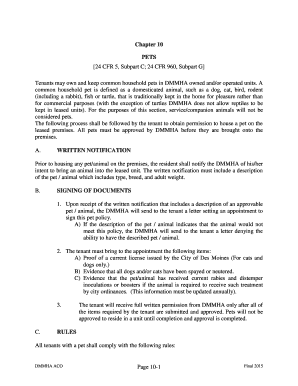

What is Third Party Payment Agreement Template

A Third Party Payment Agreement Template is a legal document outlining the terms under which a third party is authorized to make payments on behalf of another party.

pdfFiller scores top ratings on review platforms

Easy to use, keeps my business mobile and allows me to work remotely.

Very helpful tool, was able to do all that I needed using it. Rate 5/5, recommend to everyone who needs to edit/sign PDF files and quickly share them.

THIS IS MY FIRST TIME USING THIS APP BUT I FIND IT AMAZING

Moves very smoothly but never tried it on a actual computer so I’m not sure of its full potential. But otherwise works great.

only problem was i had to redo the document because of signup

For doing signatures electronically this is fantastic! As a transplant patient, it's not a good idea to leave the house during this corona virus time, so this work as a great method to get this done.

Who needs Third Party Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

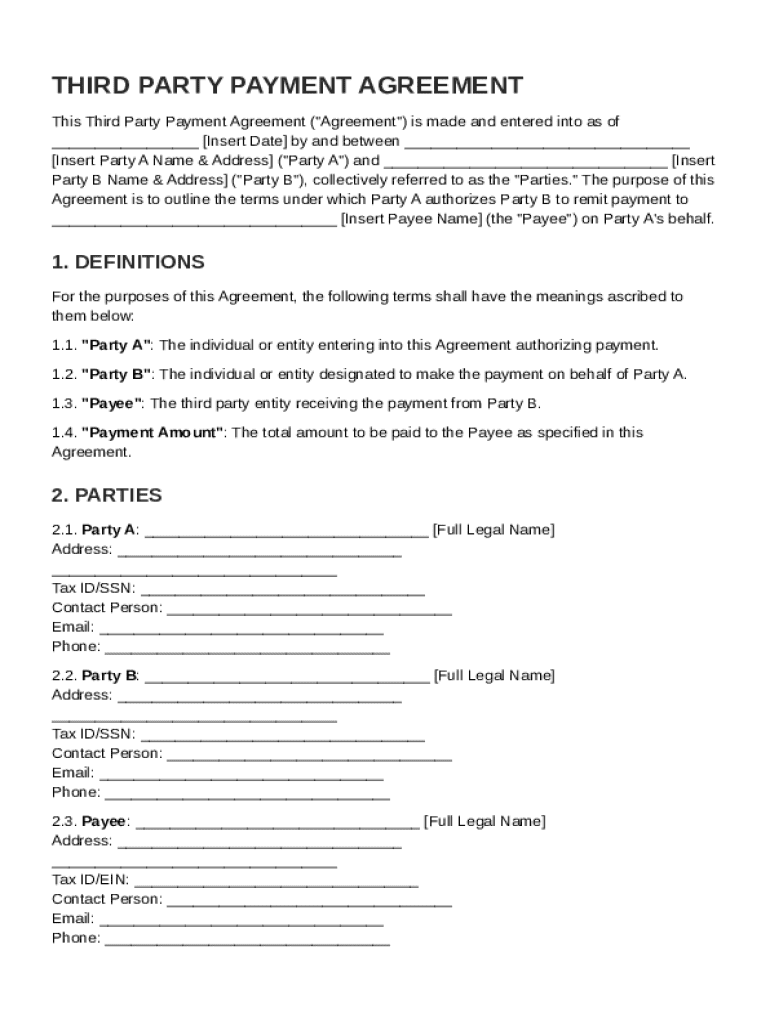

Third Party Payment Agreement Guide

How to fill out a Third Party Payment Agreement Template form

Filling out a Third Party Payment Agreement Template form involves providing specific information about all parties involved, the payment terms, and authorization processes. Ensure that all details are correct and precise to avoid any future disputes.

What is a Third Party Payment Agreement?

A Third Party Payment Agreement is a formal document that outlines the terms under which one party authorizes another party to make payments on their behalf. This agreement is essential in various financial transactions, ensuring clarity and legal accountability.

-

This template serves as a legally binding contract that specifies the obligations and rights of each involved party.

-

Written agreements provide a clear reference that aids in preventing misunderstandings related to the payment process.

-

Any individual or organization looking to authorize payments to a third party should utilize this form to outline specifics.

What are the key terms defined in the agreement?

Each party's role is fundamentally important in a Third Party Payment Agreement. Clear definitions help ensure that all parties understand their responsibilities.

-

This is the sender or payer who authorizes the third party to make payments.

-

This refers to the third party granted the authority to handle payment transactions.

-

The individual or entity receiving the payment must be clearly identified for proper processing.

-

Specifying the payment amount avoids disputes and ensures compliance with financial obligations.

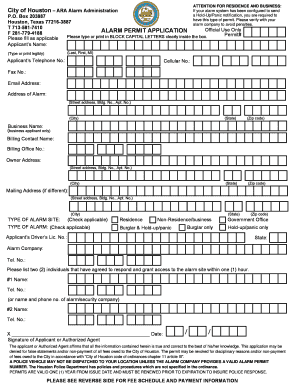

What parties are involved in the agreement?

Correctly identifying the parties involved is crucial for the legality of the agreement. All relevant information must be included to avoid confusion.

-

It is important to provide full legal names and contact information to validate the agreement.

-

Party B's details should also be clearly articulated, including their role and authority regarding the agreement.

-

Every payment should be directed to the right payee whose contact information needs to be included.

How does the authorization process work?

The authorization process is pivotal in establishing trust between the parties involved. It defines how Party A grants rights to Party B for making payments.

-

A designated procedure must be followed to formally notify Party B of the granted privileges.

-

This specifies how long the granted rights will be valid, fostering transparency.

-

Knowing when and how the agreement can be terminated is essential for protecting all parties.

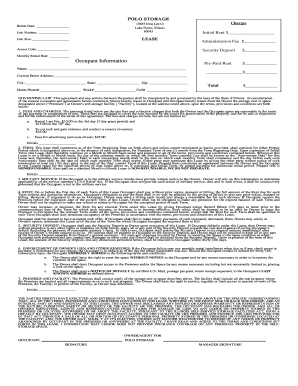

What are the payment terms and methods?

Establishing clear payment terms and methods is essential to guarantee adherence to financial agreements.

-

Common methods include bank transfers, checks, and other electronic payment systems.

-

Payments can either be one-time or recurring, which must be clearly articulated in the agreement.

-

If applicable, detail the payment schedule to ensure all parties are on the same page.

How to fill out the Third Party Payment Agreement?

Completing the Third Party Payment Agreement Template requires attention to detail to ensure that all necessary information is accurately filled.

-

Follow the instructions carefully for each section to ensure compliance.

-

Double-check details like names and payment amounts to prevent errors.

-

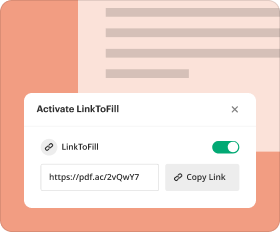

Leverage pdfFiller for easy editing, signing, and sharing to streamline the agreement process.

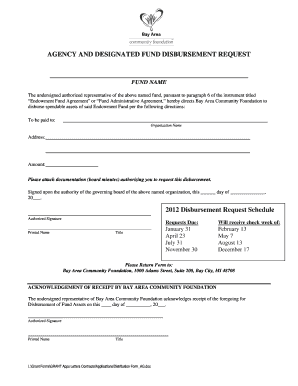

What are the steps for review and finalization?

Once the form is filled, a thorough review is necessary to validate its accuracy and completeness. Stakeholders should collaborate to ensure clarity.

-

Engage involved parties in checking the document to catch any discrepancies.

-

Effective communication among stakeholders can expedite agreement finalization.

-

Utilize pdfFiller’s eSigning features to finalize and securely manage the agreement.

How to fill out the Third Party Payment Agreement Template

-

1.Download the Third Party Payment Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the date at the top of the document to indicate when the agreement is being executed.

-

4.Fill in the full names and contact information of the involved parties: the payer, the payee, and the third-party payment provider.

-

5.Clearly specify the payment amount, currency, and the frequency of the payment schedule.

-

6.Detail any specific conditions or terms for the payments, including deadlines and penalties for late payments.

-

7.Include a section for signatures, where all parties must sign to acknowledge their agreement to the terms outlined.

-

8.Review the entire document to ensure all information is accurate and complete.

-

9.Save the finalized agreement in pdfFiller and share it with all parties for their records.

How to write a payment agreement between two parties?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

What is a third party payment?

A third-party payment is a payment that you make to a supplier on behalf of another supplier. This figure provides an example of a third-party payment.

What is a 3rd party agreement?

Third party contracts are agreements that involve a person who isn't a party to a contract but is involved with the transaction. This person may be a buyer representing one of the parties.

What is a third party payment plan?

With third-party financing or lending, an external financier offers payment options to your customers, enabling them to purchase now and pay later. This setup means you get paid immediately while your customers enjoy flexible payment terms.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.