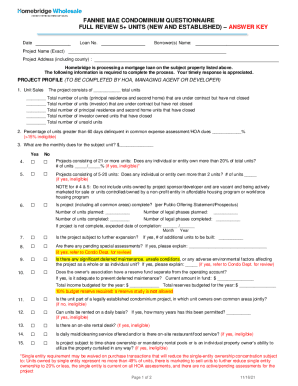

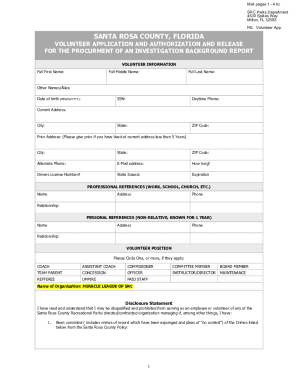

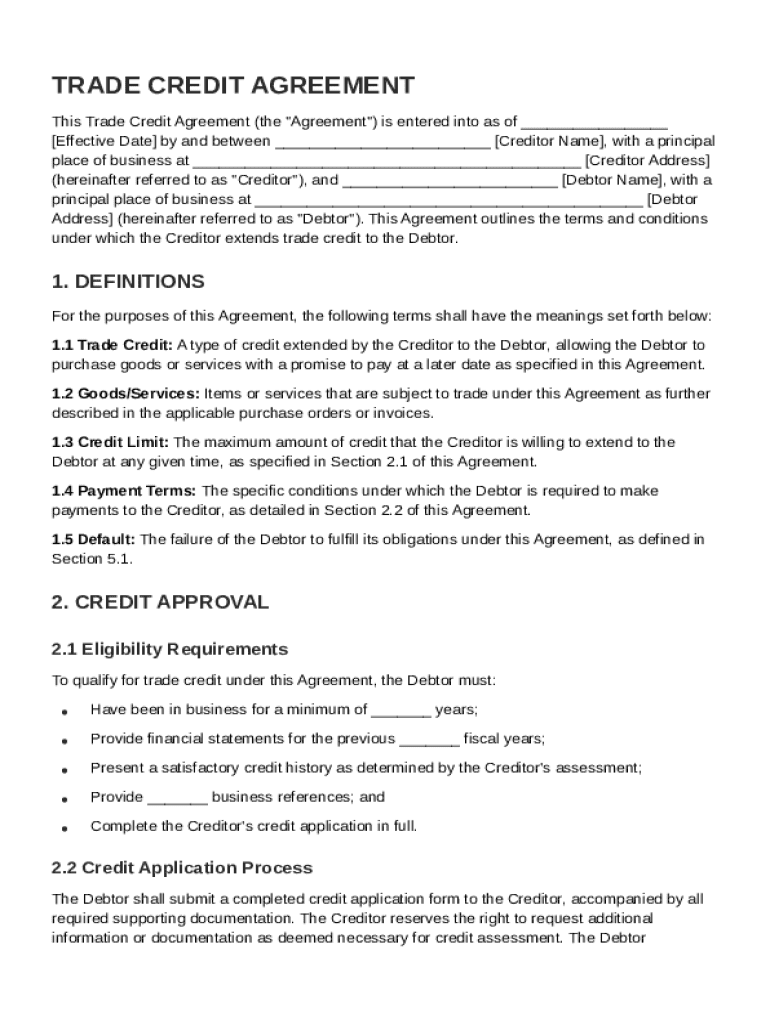

Trade Credit Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a creditor extends trade credit to a debtor, including definitions, credit approval process, credit limit and payment terms, delivery of

We are not affiliated with any brand or entity on this form

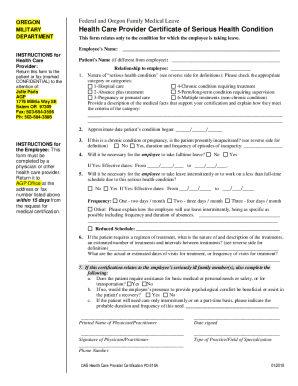

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Trade Credit Agreement Template

A Trade Credit Agreement Template is a formal document outlining the terms and conditions under which goods or services are provided on credit between a supplier and a buyer.

pdfFiller scores top ratings on review platforms

omg

This is so easy....

Jessica A. Smith

+

Brian A. Karla

Surprised with all that it can do

tiene buen menu

Good product for PDF edit

The product itself was great for my needs. Especially was useful the client support, the responce was swift and satisfactory.

Very grateful for this service

it's an excellent program-service. I'd be happy to pay for it monthly.

Who needs Trade Credit Agreement Template?

Explore how professionals across industries use pdfFiller.

Trade Credit Agreement Template: Comprehensive Guide

A Trade Credit Agreement Template is essential for businesses that extend credit to their customers. This form outlines the terms and conditions governing the credit were extended, making it a critical document in trade relationships.

This guide will help you understand how to create, manage, and utilize a trade credit agreement effectively, ensuring financial security and clarity in transactions.

What is a trade credit agreement?

A trade credit agreement is a legal document that allows a buyer to purchase goods or services on credit. It specifies payment terms, limits, and obligations, differentiating it from other types of credit by its direct link to the purchase of goods.

-

The primary purpose of this agreement is to formalize the credit terms and ensure both parties are aware of their responsibilities.

-

Unlike traditional loans, trade credit is tied directly to purchases and not a lump sum disbursal, making it a unique financial instrument.

-

Trade credit is vital for maintaining smooth cash flow, especially for businesses that may need time before their sales revenue comes in.

What are the key components of a trade credit agreement?

-

This denotes when the agreement becomes active, crucial for both parties to mark responsibilities.

-

Clearly identifies the creditor and debtor, establishing legal responsibility.

-

Specifies the type of credit being extended and other relevant terms to avoid ambiguity.

-

Elucidates the items being purchased on credit, ensuring all parties have clarity on the transaction.

-

Discusses maximum amounts and timelines for repayment, essential for budgeting.

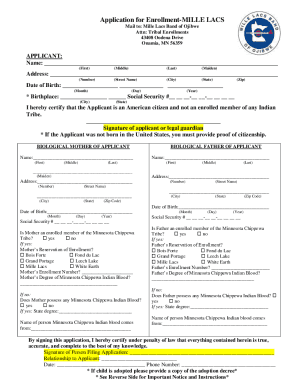

How can businesses ensure eligibility for trade credit?

-

Business credit history, revenue benchmarks, and debtor’s existing obligations typically determine eligibility.

-

Financial statements, tax returns, and proof of operational history are common prerequisites.

-

Utilizing platforms like pdfFiller, businesses can easily fill and submit their applications.

-

Not providing complete information can lead to delays or denial, so thoroughness is critical.

How do different payment options affect trade credit agreements?

-

Options may include upfront payments, installments, or deferred payment plans tailored to business needs.

-

Understanding payment terms helps businesses plan budgets and cash flow management efficiently.

-

Interactive features on pdfFiller allow businesses to adjust payment options easily based on cash flow.

What should businesses know about defaults and modifications?

-

Failure to meet payment terms constitutes a default, which can have severe consequences.

-

Defaults can lead to damage in credit rating and potential legal actions, making awareness crucial.

-

Utilizing pdfFiller tools allows parties to update agreement terms without starting from scratch.

-

Regular communication and adhering to payment schedules minimizes the risk of defaults.

How does local law impact trade credit agreements?

-

Understanding local laws governing trade credit can significantly impact enforceability and validity.

-

Establishing clear ownership rights related to goods provides clarity in transactions.

-

pdfFiller offers features that ensure documents meet local legal standards.

Where can businesses find sample trade credit agreement templates?

-

pdfFiller provides access to various editable trade credit templates tailored to different business needs.

-

These templates allow for modifications based on specific contract requirements, making them versatile.

-

Highlighting essential clauses in the agreement ensures that businesses cover all necessary legal bases.

What additional resources can assist with trade credit agreements?

-

Accessing various related templates for credit agreements through pdfFiller streamlines document preparation.

-

Recommendations for books and online resources can provide further insights into managing credit agreements.

-

pdfFiller's platform enables effective management across templates, simplifying document handling for businesses.

How to fill out the Trade Credit Agreement Template

-

1.Open the Trade Credit Agreement Template in pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and addresses of both the supplier and the buyer, ensuring correct spelling and contact information.

-

4.Specify the type of goods or services being provided, along with the total amount of credit extended.

-

5.Outline the payment terms, including the due date, interest rates, and any penalties for late payment.

-

6.Include any additional terms such as delivery schedules and warranty information if applicable.

-

7.Carefully review the completed agreement for accuracy and completeness.

-

8.Save the document in your preferred format or print it for physical signatures.

-

9.Ensure both parties sign and date the agreement before the trade credit can be established.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.