Underwriting Agreement Template free printable template

Show details

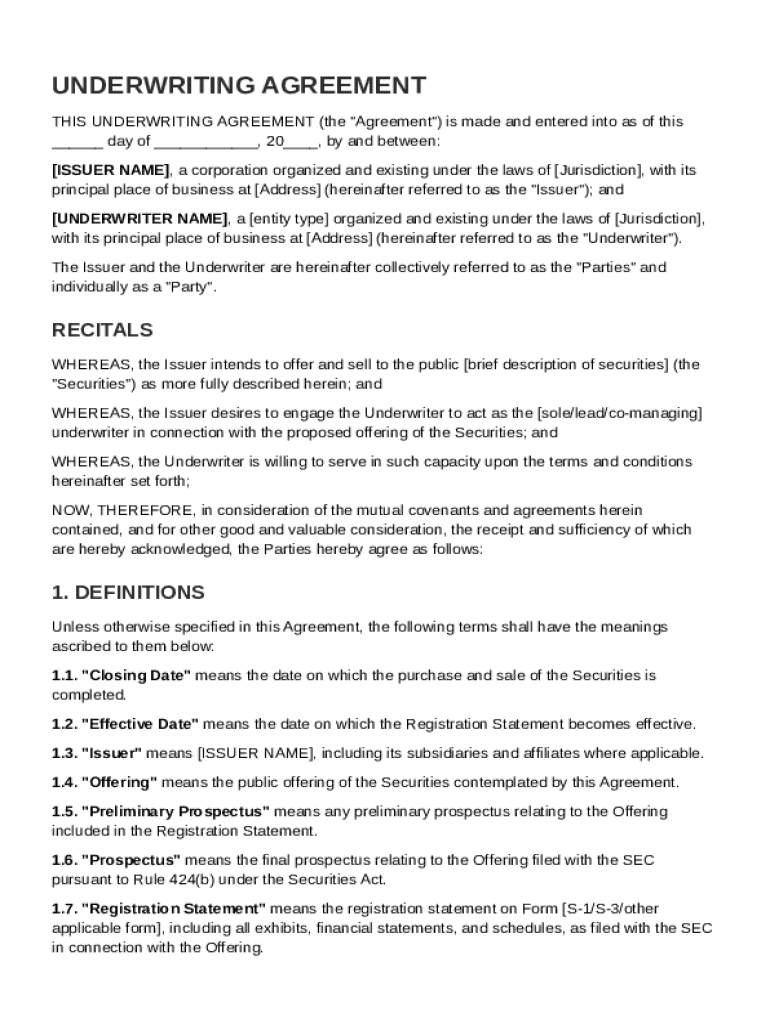

This document serves as an agreement between an issuer and an underwriter regarding the offering and sale of securities to the public. It outlines the terms and conditions under which the underwriter

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Underwriting Agreement Template

An Underwriting Agreement Template is a formal document outlining the terms and conditions between an issuer of securities and underwriters involved in a public offering or private placement.

pdfFiller scores top ratings on review platforms

I was having difficulty finding the legal documents I needed fillable copies you provided the access I needed. and my software wasn't allowing me to just fill in the documents online, I am finding my way around but if I can make it easier I am all in.

so far it's worked out well. But there aren't that many forms that I need to fill out to make it worth the annual fee.

So far so good. I have just begun using it, however it seems like it will be a very good tool to have available.

Great not to have to repeat forms by hand!!

I was able to do what I needed but I am not sure about future applications. Also, I thought I received a 70% Discount for signing up annually but I did not receive this.

Pretty straight forward but when you want to print multiple forms of the same type I don't see a way to easily clear the info, I have to overwrite or clear each field manually. Thank you, Fred McFaddin

Who needs Underwriting Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the underwriting agreement template

How do you define an underwriting agreement?

An underwriting agreement is a key financial document that outlines the terms between an issuer of securities and an underwriter. This legally binding agreement ensures that the underwriter agrees to buy undistributed shares and is crucial in securities offerings. Engaging an underwriter means understanding the complex legal implications, including the responsibility for securities sold and the rights and obligations each party assumes.

-

An underwriting agreement's main purpose is to facilitate a structured approach to securities offerings.

-

It is an essential mechanism in capital raising for companies looking to expand and develop.

-

The agreement involves various legal obligations and compliance requirements that must be met by both parties.

What are the key components of the underwriting agreement?

The effectiveness of an underwriting agreement heavily depends on its components. This agreement usually begins with the identification of the parties involved, specifically the issuer and the underwriter. Key elements include recitals which establish the purpose and definitions of critical terms, providing clarity on the specifics such as the closing date and offering details.

-

Clearly defines who the issuer and underwriter are.

-

Outlines the purpose of the agreement and the context of the offering.

-

Provides clarity on key terms like Effective Date, which is crucial for contract enforcement.

-

Details what securities are involved in the agreement.

How do you fill out the underwriting agreement template?

Filling out an underwriting agreement template can seem daunting, but it becomes manageable with clear instructions. Start by entering details for both the issuer and underwriter. Specify the terms and conditions carefully to mitigate errors that could lead to issues later, and consider using interactive tools available on pdfFiller to ensure a smooth editing process.

-

Enter the issuer's and underwriter’s details accurately.

-

Specify the necessary terms and conditions including payment and shares.

-

Watch out for inaccuracies in names, amounts, and dates to avoid legal issues later.

-

Utilize pdfFiller's editing tools for an effective experience.

How can you edit and customize the template?

Customizing the underwriting agreement template is a critical step for tailoring the document to fit specific needs. pdfFiller's cloud-based platform enables users to edit documents elegantly while ensuring compliance with local regulations. Personalization goes beyond filling in blanks; it also includes adapting language and formats to suit particular industry standards.

-

Allows for remote access and collaborations with team members.

-

Ensure the template reflects your personal or company brand while meeting legal standards.

-

Always verify that the document adheres to local laws applicable in your region.

-

Protect sensitive information during the editing process with security features.

What are the steps to e-sign the underwriting agreement?

E-signing the underwriting agreement is a vital part of making it legally binding. Using pdfFiller, you can follow a simplified e-signing process. Furthermore, understanding the legal validity of eSignatures in your region ensures compliance and reinforces the security of your signed agreement.

-

Follow the prompts on pdfFiller to initiate the e-sign process.

-

Review the document carefully before adding your signature.

-

Always save a backup of the signed document to avoid future complications.

-

Utilize pdfFiller’s features to easily share the signed document with relevant stakeholders.

How do you manage your underwriting agreements effectively?

Efficient management of underwriting agreements is crucial for any organization that engages in securities. pdfFiller offers document management features that streamline tracking and collaboration. Tools such as reminders and workflows help to ensure every agreement is up to date and renewals are handled promptly.

-

Keep all agreements in one easily accessible location using pdfFiller.

-

Set up automated reminders for contract renewals and reviews.

-

Facilitate team efforts on underwriting deals through shared document features.

-

Refer to examples of successful management strategies for insights.

What are best practices for drafting an effective underwriting agreement?

Creating a robust underwriting agreement requires careful consideration of various factors. Engaging industry experts can provide valuable insights into drafting effective documents that comply with regulations. Moreover, navigating negotiations with underwriters skillfully can foster better terms and outcomes.

-

Include insights from industry professionals to improve agreement quality.

-

Understand specific compliance requirements applicable to your industry.

-

Be aware of common negotiation issues to avoid unfavorable terms.

-

Use well-structured templates to streamline the drafting process.

How does the underwriting agreement compare to others?

Understanding the differences between various underwriting agreement forms is essential for selecting the appropriate documentation for your needs. This section will explore variations across industries and provide insights into why certain templates may be favored in specific contexts.

-

Recognize the distinct elements that can exist across different underwriting templates.

-

Consider your specific needs and circumstances when selecting a template.

-

Evaluate examples of popular agreements used by competitors in the market.

-

Discover reasons why pdfFiller may provide superior features compared to other platforms.

How to fill out the Underwriting Agreement Template

-

1.Access pdfFiller and upload your Underwriting Agreement Template.

-

2.Begin by entering the issuer's name in the designated area where it requests company details.

-

3.Next, provide the underwriter's information, including name and contact information, in the specified fields.

-

4.Fill out the section detailing the type of securities being offered, including quantity and price.

-

5.Clearly outline the terms of the agreement, including the underwriting fees and any conditions that apply.

-

6.Include agreed dates for the public offering and any prerequisite filings required for the offer.

-

7.Review all details to ensure accuracy and completeness, making any necessary adjustments before finalizing.

-

8.Once satisfied, save the document and either print it for signatures or share it electronically with relevant parties.

What is the underwriting agreement?

The underwriting agreement contains an agreement by the underwriter(s) to purchase the offered securities from the issuer or other seller and to resell them to the public, the underwriting discount, representations and warranties of the parties, certain covenants, expense allocation and indemnification provisions.

What are the two types of underwriting agreements?

The following types of underwriting contracts are the most common: In the firm commitment contract, the underwriter guarantees the sale of the issued stock at the agreed-upon price. In the best efforts contract, the underwriter agrees to sell as many shares as possible at the agreed-upon price.

What is the difference between an underwriting agreement and an agency agreement?

An agency agreement is substantially similar to an underwriting agreement, the difference is that the underwriters have not agreed to purchase the securities for their own account in the event purchasers are not found.

What is an example of underwriting?

Underwriting is the process of evaluating potential risks and mitigating them by tailoring the terms of the agreement governing the deal. For example, before issuing a home loan, a mortgage lender must complete the underwriting process to assess the risk in lending funds to the borrower for that property.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.