Unsecured Directors Loan Agreement Template free printable template

Show details

This document serves as a legally binding agreement outlining the terms and conditions under which a lender provides a loan to a company without security. It includes details on loan amount, repayment

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Unsecured Directors Loan Agreement Template

An Unsecured Directors Loan Agreement Template is a legal document outlining the terms of a loan provided by a director to their company without requiring collateral.

pdfFiller scores top ratings on review platforms

This site has saved me so much time! Love it!

Just what I needed. Saved time when time was short.

This is a Great service and I appreciate the Amazing Customer Service

It's not a hassle to use. Straight forward, up and functional immedately

VERY EASY TO FIND AND PRINT FORM, JUST LOVE IT

The process was easy and the forms where exactly what I needed

Who needs Unsecured Directors Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

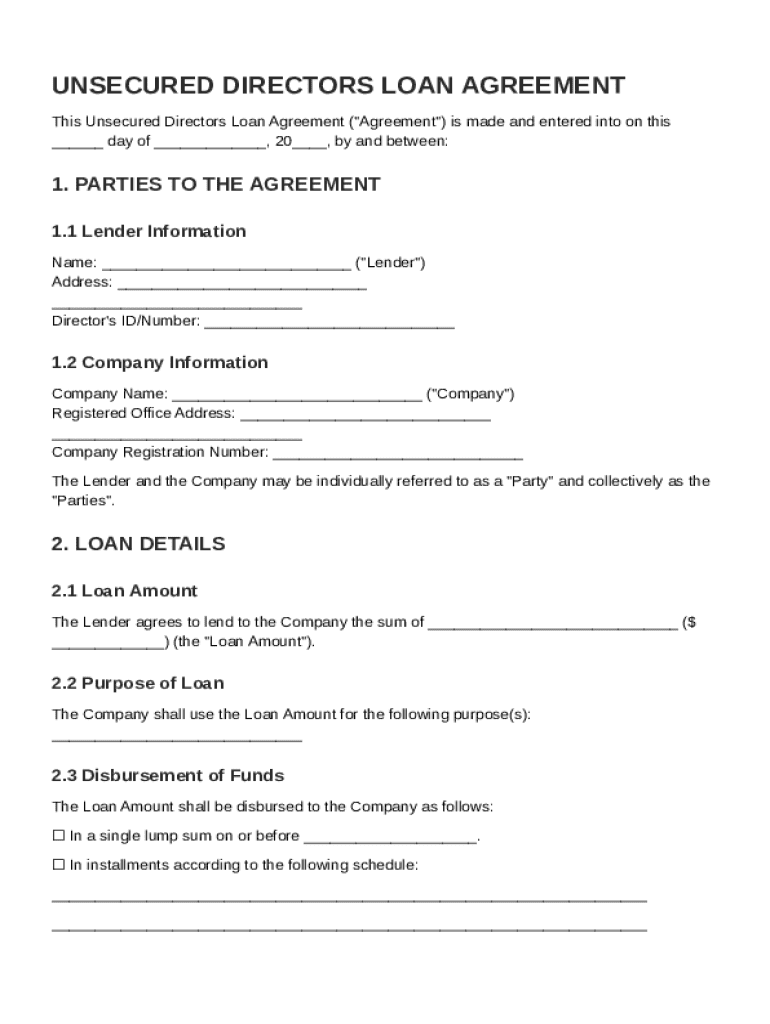

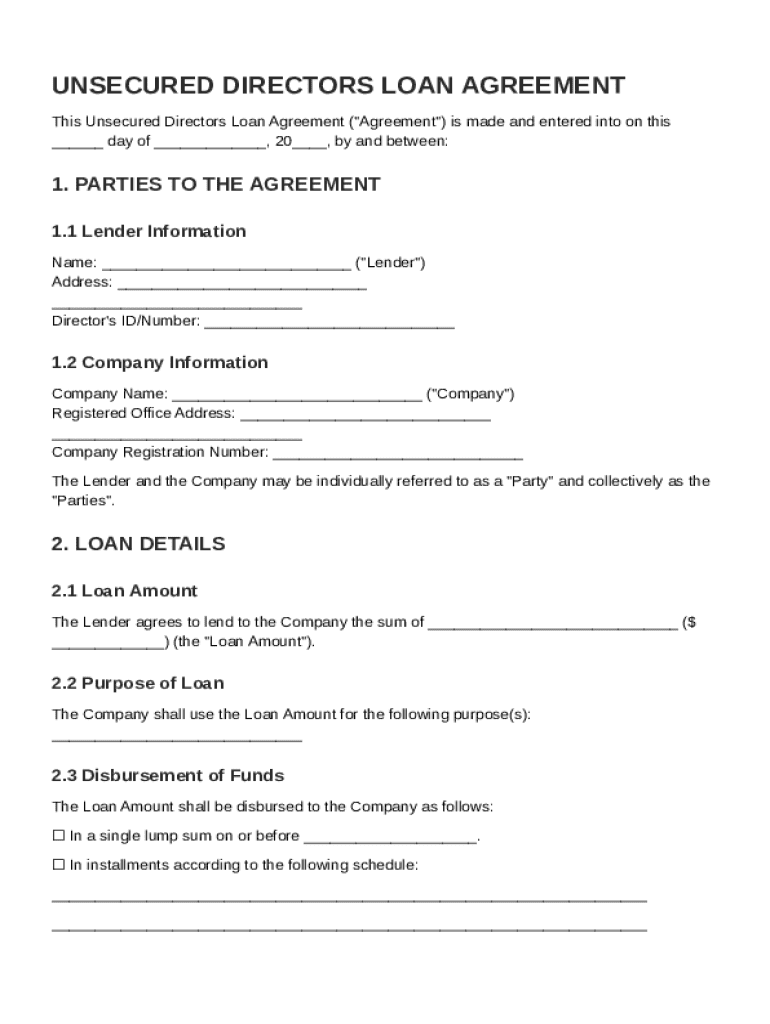

Unsecured Directors Loan Agreement: A Comprehensive Guide

An unsecured directors loan agreement is a crucial financial document that outlines the terms under which a company directors can borrow from or lend to their business. Understanding how to fill out this form properly is essential for both parties to ensure clarity and protect their interests.

What is an unsecured directors loan agreement?

An unsecured directors loan agreement serves as a legal document that stipulates the terms of the loan between a director and their company without any collateral backing the loan. This type of loan can provide directors with quick access to necessary funds while minimizing risk for the company.

-

This agreement formalizes the terms of the loan and protects both the lender and borrower, ensuring that all parties are clear about their rights and obligations.

-

Unlike secured loans, which require collateral, unsecured loans rely solely on the reputation and ability of the borrower to repay the loan.

-

Having a written agreement prevents misunderstandings and disputes by detailing repayment terms and responsibilities.

Who are the parties involved in the agreement?

The primary parties involved in an unsecured directors loan agreement are the lender, typically the director or an associated individual, and the company receiving the loan. Each party has specific legal responsibilities and rights under the agreement.

-

The lender provides the funds, while the company is obligated to repay the loan as per the terms outlined in the agreement.

-

To identify each party, include full legal names, addresses, and relevant company registration numbers.

-

Understanding the legal identities of both parties is crucial for enforcing the terms of the agreement.

What key loan details should you include?

When crafting your unsecured directors loan agreement, specific loan details must be clearly defined to avoid confusion or disputes down the line.

-

Specify the total amount being borrowed, ensuring that both parties agree on this figure.

-

Clarifying how the loan will be utilized can help prevent misuse of funds.

-

Detail how and when the funds will be provided to ensure timely access.

-

Important clauses include interest rates, repayment modalities, and other financial considerations.

How can you craft the terms of the loan?

Best practices in setting the terms of your unsecured directors loan agreement are essential for creating a mutually beneficial financial arrangement.

-

Consider market rates and your company's financial stability when setting this rate to ensure fairness.

-

Options may include monthly, quarterly, or annual repayments; clear terms help manage expectations.

-

Outline the conditions under which early repayment may occur, which provides flexibility for the borrower.

What are the rights and obligations in the agreement?

Clearly understanding the rights and obligations of both parties within the unsecured directors loan agreement is crucial for a successful financial relationship.

-

Protects against non-payment, outlining actions that can be taken in case of default or late payments.

-

The company must adhere to the payment schedule and other obligations outlined in the agreement.

-

Establish procedures for defaults, including recovery measures and potential legal actions.

How can you customize your unsecured directors loan agreement?

Customizing the unsecured directors loan agreement to fit your specific needs is essential for addressing unique circumstances.

-

Make adjustments to existing templates to ensure they meet your particular context and requirements.

-

Know which sections of the agreement are flexible and what must remain unchanged.

-

Utilizing pdfFiller for easy customizations enables you to edit, sign, and share documents quickly.

Getting started: your unsecured directors loan agreement template

Finding the right unsecured directors loan agreement template is the first step towards creating a legally binding document. pdfFiller provides numerous resources for individuals and teams looking to create, edit, and manage their agreements seamlessly.

-

Search for specific templates related to your needs on the pdfFiller platform.

-

Follow detailed guides provided by pdfFiller to fill out the agreement effectively.

-

Take advantage of collaborative tools embedded within pdfFiller for editing and eSigning online.

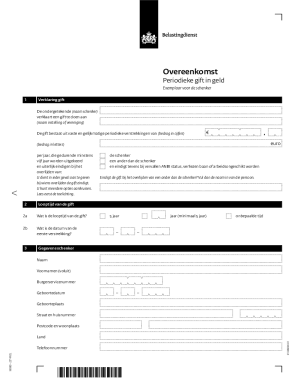

How to fill out the Unsecured Directors Loan Agreement Template

-

1.Download the Unsecured Directors Loan Agreement Template from a trusted source or access it on pdfFiller.

-

2.Open the template in pdfFiller and familiarize yourself with the available fields.

-

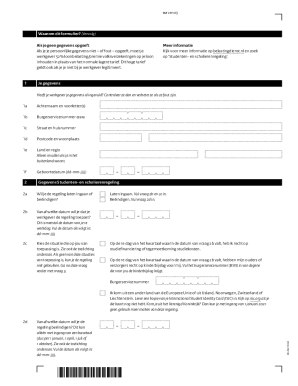

3.Begin filling in the date at the top of the document to specify when the agreement is made.

-

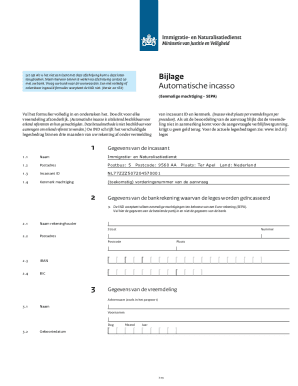

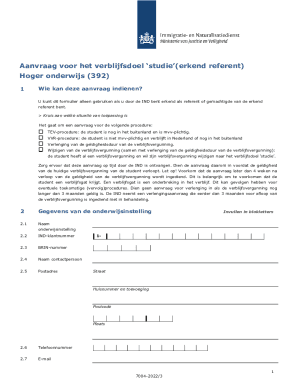

4.Enter the details of the lender (director), including full name, address, and any relevant identification numbers.

-

5.Provide the company name and registered address to clearly identify the borrowing entity.

-

6.Specify the loan amount being provided by the director to the company.

-

7.Outline the repayment terms, including interest rate (if any), payment schedule, and due dates.

-

8.Include any conditions related to the loan, such as consequences for defaults or late payments.

-

9.Review all the entered details for accuracy and completeness before finalizing the document.

-

10.Save or print the agreement for both parties to sign and keep a copy for the company’s records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.