Unsecured Loan Agreement Template free printable template

Show details

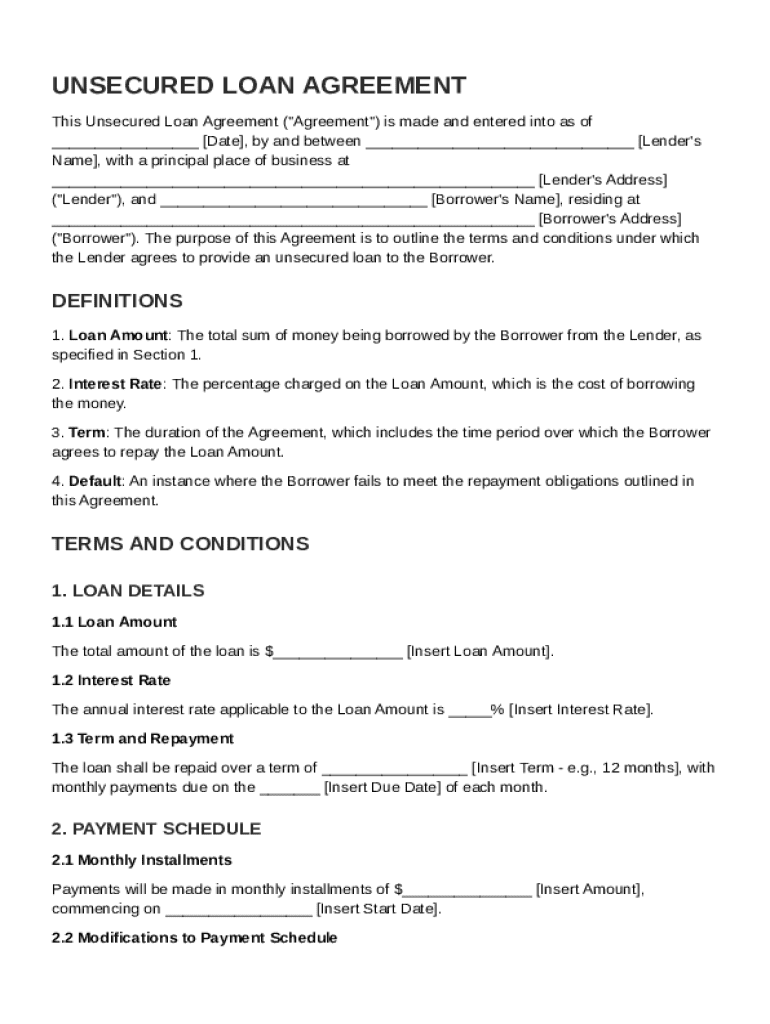

This document outlines the terms and conditions under which an unsecured loan is provided by a lender to a borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Unsecured Loan Agreement Template

An Unsecured Loan Agreement Template is a legal document outlining the terms and conditions for a loan that is not backed by collateral.

pdfFiller scores top ratings on review platforms

ok, searching is sometimes confusing, but over all great

I really like this because I was filling the forms out by hand.

This is the easiest program I have ever used.

DOCS ARE UP TO DATE AND ARE EASILY ACCESSIBLE

Super easy to use and very convenient. I would highly recommend to anyone.

Terrific so far! Looking forward to utilizing more options! Thanks!

Who needs Unsecured Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

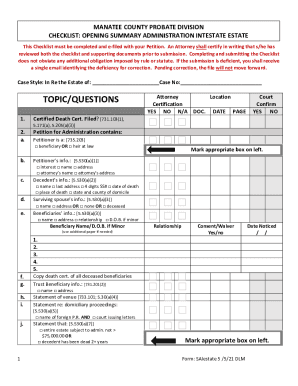

How to fill out an Unsecured Loan Agreement Template form

What is an unsecured loan agreement?

An unsecured loan agreement is a contract between a lender and borrower that does not require collateral to secure the loan. This type of loan allows individuals to borrow money based on their creditworthiness, promising to repay the loan under specified terms.

-

A defined framework: Establishes responsibilities and expectations between parties.

-

Legal binding: Protects both lender and borrower under contract law.

What are the essential components of the unsecured loan agreement?

The essential components include the loan amount, interest rate, term, and conditions surrounding default. Each term has significant implications; thus, understanding them is vital for both parties.

-

The sum of money borrowed, typically requires clarity and precision in the document.

-

The cost of borrowing expressed as a percentage; essential for determining total repayment.

-

The time frame over which the loan must be repaid, which can affect monthly payments.

-

Events like missed payments that can trigger penalties or additional fees.

How do you fill out the unsecured loan agreement template?

Filling out the template correctly is crucial. Start by providing the personal details of both the lender and borrower, followed by the specifics of the loan such as amounts and terms.

-

Include names, addresses, and contact details.

-

Detail the loan amount, interest rate, and payment term.

-

Outline payment schedules and any penalties for late payments.

-

Double-check all information for accuracy.

What are the terms and conditions you need to know?

Understanding the repayment terms and conditions of the unsecured loan is essential. This includes clarity around interest rates, due dates, and any conditions under which these terms may change.

-

Defines monthly payment amounts and due dates.

-

May vary based on credit scores and lender requirements.

-

Conditions that allow for payment adjustments as needed.

How to manage your payment schedule?

Establishing a payment schedule is critical to managing debt. Allocating monthly installments and employing tools for tracking payments can prevent defaults and maintain good credit health.

-

Dividing total loan repayment into manageable monthly payments.

-

Use applications like pdfFiller for reminders and budgeting.

-

Options should be evaluated based on changing financial situations.

What should borrowers know about prepayment?

Prepayment refers to paying off a loan before the scheduled due date. Knowing the conditions for prepayment, including any penalties, can save money and shorten debt duration.

-

Many lenders allow prepayment without penalties; check terms.

-

Some lenders require written notice before prepayment.

-

Pros include reduced interest payments; cons may involve fees.

What are the implications of defaulting?

Defaulting on an unsecured loan can have serious consequences. Understanding events of default and available remedies can prepare borrowers for worst-case scenarios.

-

Includes missed payments or violating any terms.

-

Options can include court actions or collections.

-

Breach of contract can lead to legal disputes.

How to customize your loan agreement?

Customize your unsecured loan agreement to meet specific needs. pdfFiller provides tools for editing templates, allowing you to adjust fields and terms efficiently.

-

Allows personal adjustments for clarity and precision.

-

Tailoring the agreement meets unique borrowing needs.

-

Teams can edit and review agreements simultaneously.

What are the final steps after completing the agreement?

After filling out the unsecured loan agreement template, the final steps involve signing and managing the document. Utilizing electronic signature options simplifies the process significantly.

-

Legally binding signatures can be collected digitally for convenience.

-

Use pdfFiller’s cloud services to store and manage your agreements.

-

Maintain updates and amendments efficiently through the platform.

How to fill out the Unsecured Loan Agreement Template

-

1.Download the Unsecured Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller platform.

-

3.Fill in the required borrower information, including name and contact details.

-

4.Input the lender's information, ensuring all contact details are accurate.

-

5.Specify the loan amount clearly in the designated field.

-

6.Outline the repayment terms, including interest rate, repayment schedule, and the total duration of the loan.

-

7.Include clauses addressing penalties for late payments and defaults, if applicable.

-

8.Review all filled information for accuracy and completeness.

-

9.Add signatures for both borrower and lender to finalize the agreement.

-

10.Save and download the completed agreement for distribution and record-keeping.

What is an unsecured loan agreement?

Unsecured loans do not require collateral and rely on the borrower's creditworthiness. While they may be easier to arrange for smaller sums, they come with: Higher interest rates and fees. Stricter credit requirements. Limited borrowing capacity.

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What are the requirements for an unsecured loan?

Qualifications for an unsecured loan Generally, they look for a history of responsible credit use (typically one or more years), on-time payments, low credit card balances and a mix of account types. They'll also check your credit scores, which are calculated based on the information in your credit reports.

What is the unsecured loan clause?

In practice, this means the lender relies solely on the borrower's creditworthiness and promise to repay, rather than having a claim on specific assets if the borrower defaults. Such clauses typically outline the loan amount, repayment terms, and interest rates, but do not reference any pledged property.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.