Vehicle Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions of a loan provided by the Lender to the Borrower for purchasing a vehicle, detailing obligations, rights, repayment terms, and dispute resolution.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Vehicle Loan Agreement Template

A Vehicle Loan Agreement Template is a document outlining the terms and conditions of a loan for purchasing a vehicle.

pdfFiller scores top ratings on review platforms

It have been nice. The forms are easy to fill out, easy to print.

Just started so not a lot of feedback yet. It would be nice to be able to review who I sent documents for e-signatures too, so that if I can determine whether or not I made a mistake and have to redo the whole document, or if I have to tell the client to look in their spam folder, or what. Thanks!

I appreciate not having to use the old fashioned type writer!

Ovrall,vryufullbutabitcotlyandtillhaafwbug

It has been tremendously helpful to me in having to complete forms that require numerous drafts.

PDF Filler allows me to submit professionally prepared forms.

Who needs Vehicle Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Vehicle Loan Agreement Template Guide

Filling out a Vehicle Loan Agreement Template form is a straightforward process that establishes clear terms between a borrower and a lender for financing a vehicle.

What is a vehicle loan agreement?

A Vehicle Loan Agreement is a formal document that outlines the terms and conditions under which a loan is issued to purchase a vehicle. It serves to protect both the borrower and lender, as it details the obligations and rights of each party.

-

The primary purpose is to legally bind both parties to the agreed-upon terms related to the loan.

-

The borrower is the individual receiving the loan, while the lender is the financial institution or individual providing it.

-

Having a formal agreement helps prevent disputes and ensures clarity on repayment obligations.

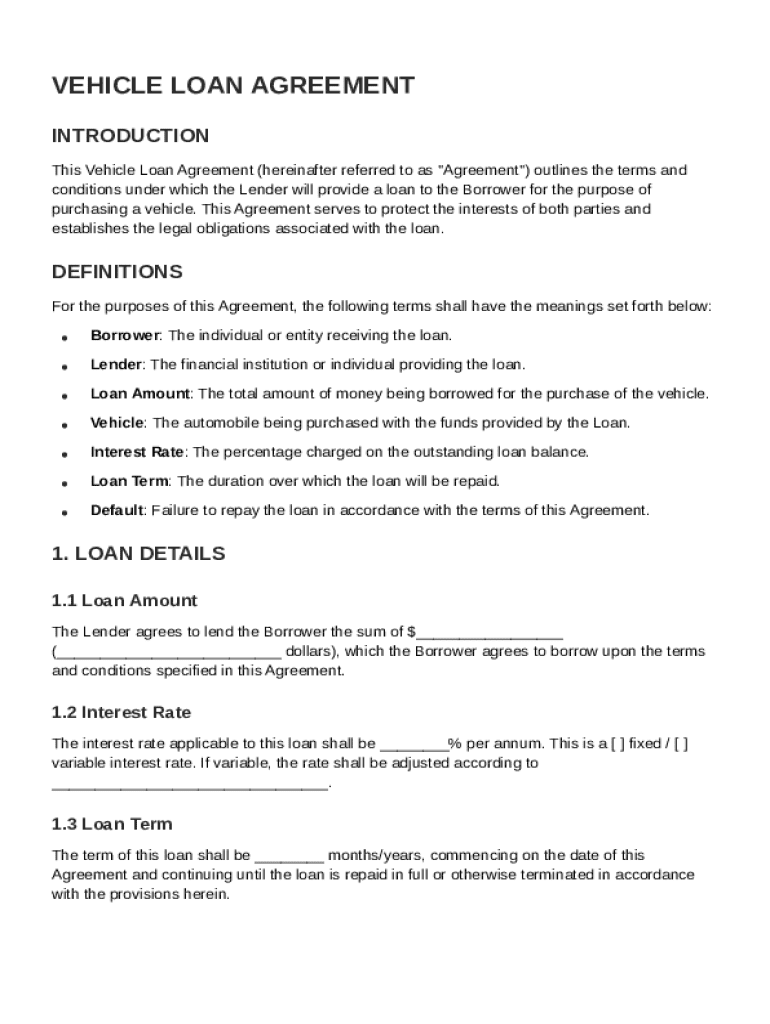

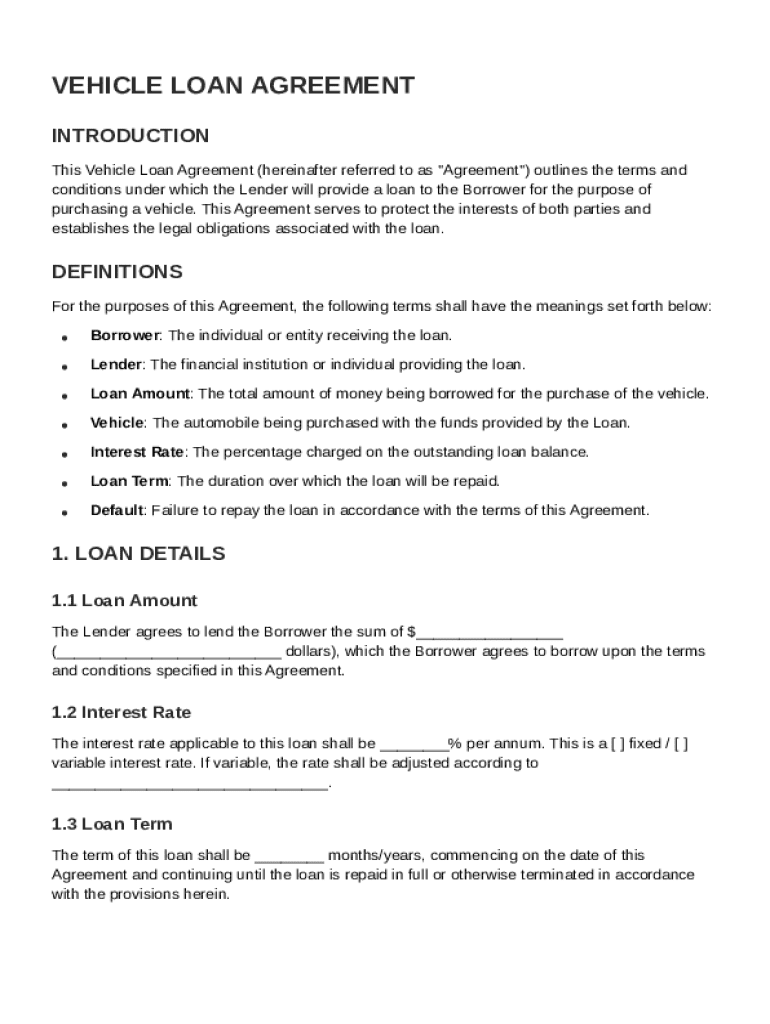

What are the essential components of the agreement?

-

This is the total amount borrowed, which may include taxes and fees.

-

It's crucial to understand whether the rate is fixed or variable, as it impacts overall cost.

-

This outlines the duration of the loan, including how long the borrower has to repay it.

-

Details on monthly installments and when they are due help the borrower prepare for payments.

How do you fill out the vehicle loan agreement?

-

Begin by clearly stating the loan amount, interest rate, and personal details of both parties.

-

Watch for miscalculations and ensure all required fields are filled accurately to avoid delays.

-

Double-check information to ensure accuracy and clarity; seek assistance if unsure about any terms.

How do you edit and customize your loan agreement?

Utilizing pdfFiller allows users to modify the Vehicle Loan Agreement Template seamlessly. The platform offers various tools for collaboration and ensures compliance with local regulations.

-

Easily change text and fields to match specific needs.

-

Share documents with other parties securely for feedback or adjustments.

-

Ensuring your agreement meets local laws protects against future disputes.

What are the options for signing the agreement?

You can sign the agreement electronically or opt for traditional handwritten methods. With electronic signatures becoming more prevalent, understanding their validity is crucial.

-

Using pdfFiller, you can sign documents quickly and efficiently without printing them.

-

Electronic signatures offer convenience but may have different legal status depending on jurisdiction.

-

Most jurisdictions accept eSignatures, but verifying local regulations is key.

How to manage and store the loan agreement?

Effective document management is crucial for easy retrieval and protection of sensitive information. Best practices include digital storage and utilizing tools like pdfFiller.

-

Keep backed-up records both digitally and physically to prevent loss.

-

pdfFiller offers solutions for ongoing document management and security.

-

Implement privacy measures to protect sensitive financial details from unauthorized access.

How to fill out the Vehicle Loan Agreement Template

-

1.Open the Vehicle Loan Agreement Template in pdfFiller.

-

2.Start by entering the date at the top of the document.

-

3.Fill in the borrower's name and contact information in the designated fields.

-

4.Provide details about the vehicle, including make, model, year, and VIN.

-

5.Specify the loan amount being requested.

-

6.Indicate the interest rate and the duration of the loan in months.

-

7.Fill in the repayment schedule, detailing monthly payment amounts.

-

8.Include any additional fees or charges associated with the loan.

-

9.Ensure both parties sign and date the agreement at the end.

-

10.Review the completed document for accuracy before submitting.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

What is a short term financing agreement?

A short term credit agreement is a contract between a lender and a borrower in which the borrower agrees to repay the loan within a set period of time. This type of agreement is typically used for short-term financing, such as bridge loans or lines of credit.

How to set up a formal loan agreement?

Loan agreements between family members or friends should include: Details of who is lending the money and who is borrowing it. The exact amount of money being lent. The purpose of the loan. How and when the loan will be repaid. If interest will be charged on the loan, the interest rate, and how it will be calculated.

What is the agreement for returning money?

The 'Return of money' clause establishes the obligation for one party to refund payments or deposits to the other party under specified circumstances. Typically, this clause outlines the conditions under which money must be returned, such as contract cancellation, failure to deliver goods or services, or overpayment.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.