Vehicle Loaner Agreement Template free printable template

Show details

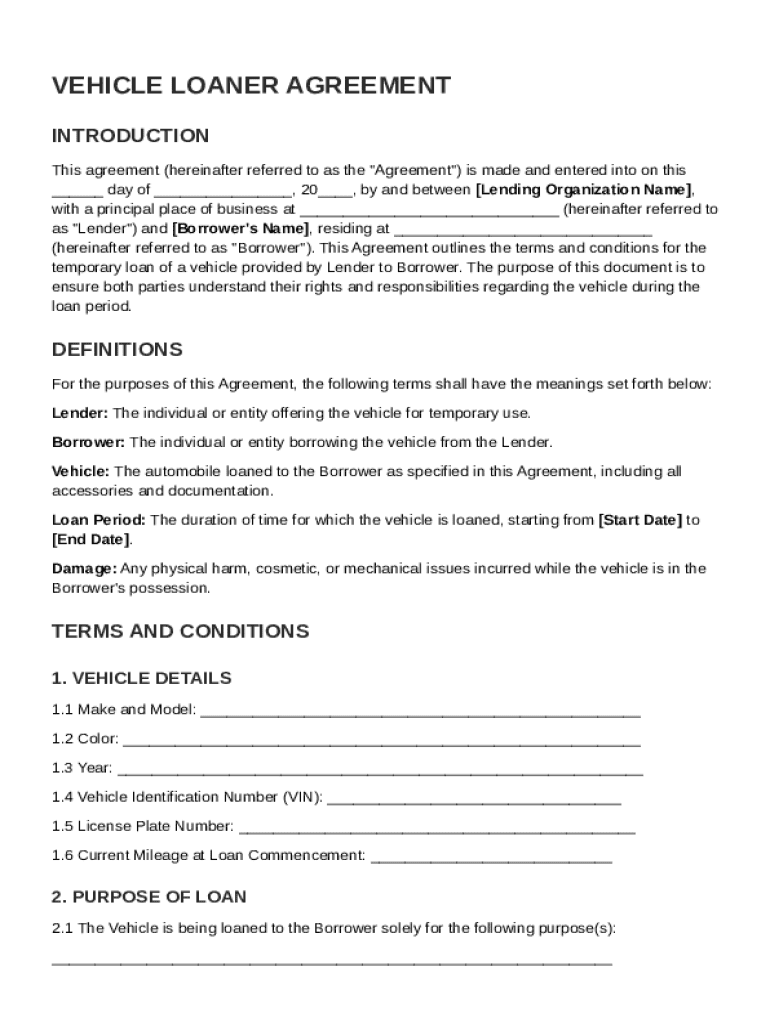

This document outlines the terms and conditions for the temporary loan of a vehicle from Lender to Borrower, detailing obligations, responsibilities, and terms for both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Vehicle Loaner Agreement Template

A Vehicle Loaner Agreement Template is a legal document that outlines the terms and conditions for borrowing a vehicle from a dealership or rental company.

pdfFiller scores top ratings on review platforms

The PDFfiller saves me time on edits.

just a learning curve, but figuring it out is not hard

Very user friendly. I would just like to know how to enlarge, say the circle.

Its helpful and easy to navigate.

I recently started using it for Ancestry research and have been quite pleased with the ease of using the Pedigree sheets.

very easy to use.

Who needs Vehicle Loaner Agreement Template?

Explore how professionals across industries use pdfFiller.

Vehicle Loaner Agreement: Comprehensive Guide

How to fill out a vehicle loaner agreement form?

Filling out a Vehicle Loaner Agreement Template form involves collecting essential vehicle details, specifying the loan period, and outlining the roles and responsibilities of both the lender and borrower. Ensure that all terms are clearly defined to prevent misunderstandings.

What is a vehicle loaner agreement?

A Vehicle Loaner Agreement is a legal document that outlines the terms under which a vehicle is lent to a borrower. It is essential for protecting the interests of both the lender and borrower by specifying obligations, responsibilities, and liabilities.

-

The agreement details how a vehicle can be used, terms for damages, and the duration of the loan.

-

It serves as a safeguard, ensuring both parties understand their rights and responsibilities.

-

Vehicle loans are governed by contract law, and failure to adhere can lead to legal repercussions.

-

Not following the terms can result in financial liability and loss of trust.

What are the key terms in the agreement?

Understanding the key terms is critical when entering into a Vehicle Loaner Agreement. These terms define the duties and rights of both parties and ensure a smoother process.

-

The lender is responsible for providing a vehicle in a safe and operable condition.

-

The borrower must use the vehicle responsibly and return it in the agreed condition.

-

This includes details like make, model, and any known issues.

-

The agreed duration that the borrower has the right to use the vehicle.

-

Clearly outlines who is responsible for damages that occur during the loan period.

What specific information is required about the vehicle?

Providing detailed vehicle information in the agreement helps prevent any disputes regarding the condition and identity of the vehicle.

-

This helps establish liability and insurance rates.

-

Useful for identification and may be part of registration requirements.

-

Legal considerations mandate these identifiers for accurate documentation.

-

These are necessary for record-keeping and condition assessment before and after the loan.

How to define the purpose of the loan?

Clearly outlining the purpose of the loan can mitigate risks and ensure compliance.

-

Defining why the vehicle is needed helps in monitoring usage.

-

Outline specific uses that are not allowed without prior consent.

-

Misusing the vehicle can lead to legal ramifications and financial penalties.

How is the loan period set?

Establishing a clear loan period is vital for both parties to maintain expectations.

-

Clearly specify these dates to avoid confusion.

-

Highlight the importance of timely returns.

-

Outline the process for requesting an extension and obtaining approval.

What insurance considerations are there?

Both lender and borrower must have appropriate insurance coverage during the loan period to avoid liability issues.

-

Both parties should ensure they have liability and comprehensive insurance.

-

Prompt reporting of incidents can help mitigate loss and manage liabilities.

-

Failures in insurance can lead to out-of-pocket expenses for damages.

What is the process for signing the agreement?

The signing process is crucial as it legally binds both parties to the terms of the agreement.

-

Systematically fill out the agreement to ensure clarity.

-

With pdfFiller, users can easily edit, sign, and save their documents.

-

Electronic signatures are legally recognized and can streamline the process.

How to maintain documentation and records?

Keeping thorough documentation of the agreement is essential for accountability.

-

Both parties should retain copies of the signed agreement for reference.

-

Documenting the vehicle's state before and after the loan helps in managing liabilities.

-

Keeping a log of communication between lender and borrower can prevent disputes.

How to handle disputes and resolution?

Disputes can occur, and having a clear resolution process can help amicably settle conflicts.

-

Understanding potential issues that may arise can help in proactive resolution.

-

Engaging in open communication and negotiation can often resolve disputes.

-

Knowing when to seek legal representation is critical for serious disputes.

How to utilize pdfFiller for your loaner agreement?

pdfFiller provides a cloud-based platform that enhances the document management experience, allowing for easy editing and collaboration.

-

Users can sign up and gain access to tools for document management.

-

pdfFiller offers features such as collaborative editing and document sharing.

-

Users can utilize additional features such as templates and versions for enhanced workflows.

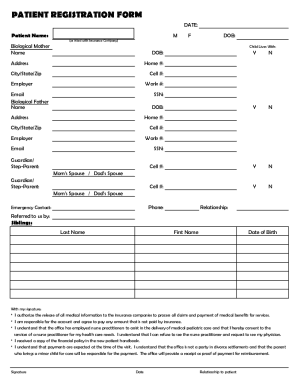

How to fill out the Vehicle Loaner Agreement Template

-

1.Open the Vehicle Loaner Agreement Template in pdfFiller.

-

2.Fill in the borrower's personal information, including name, address, and contact details.

-

3.Enter the vehicle information, including make, model, year, and VIN (Vehicle Identification Number).

-

4.Specify the loan period starting and ending dates for vehicle use.

-

5.Outline any fees or charges associated with the loan, including insurance requirements.

-

6.Detail the terms of use, including restrictions such as mileage limits or prohibited uses.

-

7.Ensure both parties understand the responsibilities, such as vehicle maintenance and fuel policies during the loan period.

-

8.Have both the lender and borrower sign and date the agreement electronically.

-

9.Save a copy of the completed agreement for both parties to retain.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.