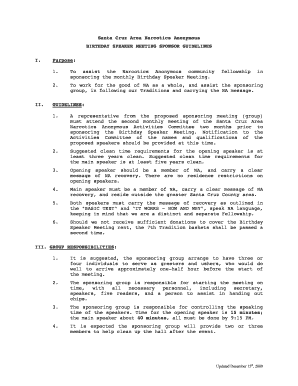

Vested Equity Agreement Template free printable template

Show details

This document outlines the terms of an agreement between a company and an individual regarding the grant and vesting of equity interests as compensation for services.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

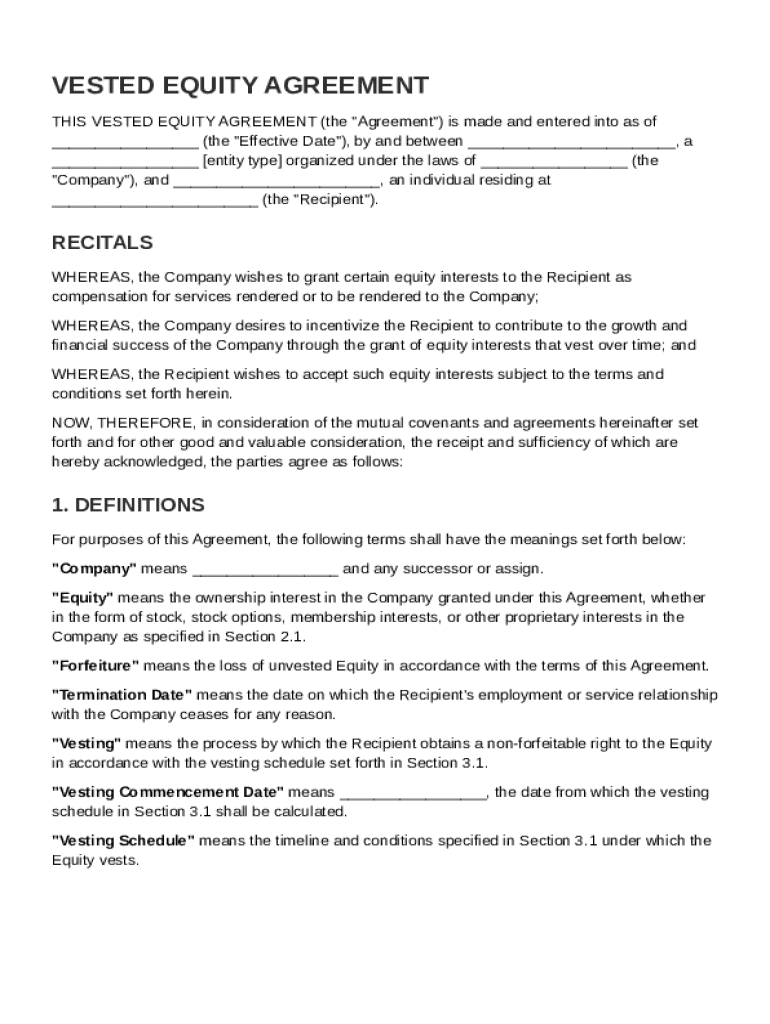

What is Vested Equity Agreement Template

A Vested Equity Agreement Template is a legal document that outlines the terms and conditions of equity ownership granted to an employee or stakeholder, often relating to stock options or shares that become fully owned over time.

pdfFiller scores top ratings on review platforms

This is my first experience with PDFiller.....so far, it is good. However, I do not like that there is not a contact # to speak to someone in customer support. .

Too many going back and forth tasks to complete a form. You need to make this more friendly for the user not experienced. Make it like MS Word with what is available from the subscription, as for example: when I needed to use the eraser, it brought me to a screen to purchase to get, even though I have a monthly subscription. Not fair.

so far so good. Looks like a good program

Needs more county legal, medical, and personal reports

Its great, easy to use. I just had a little trouble finding a doc that I needed so I used google to find it (Under PDFfiller).

I love it so far, a little confusing in some aspects

Who needs Vested Equity Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide on the Vested Equity Agreement template

Filling out a Vested Equity Agreement template involves defining critical terms and ensuring mutual understanding between companies and recipients. Such agreements play a vital role in establishing equity ownership and fostering commitment among stakeholders in the business.

What is a vested equity agreement?

A Vested Equity Agreement is a contract between a company and an individual (often an employee or contractor) that outlines the conditions under which equity shares are granted over time. These agreements are significant in the corporate landscape as they not only incentivize employees but also align their goals with the company's long-term success.

-

A vested equity agreement specifies the terms under which employees earn shares in the company.

-

Equity ownership encourages employees to remain with the company and contribute to its growth.

-

Companies use these agreements to attract and retain talent while nurturing a sense of ownership.

What are the key components of a vested equity agreement?

Understanding the key components of a vested equity agreement is crucial for both companies and recipients. These components define the relationship between equity providers and recipients, specifying obligations and benefits.

-

Clearly delineates the obligations of both the company and the employee involved.

-

Crucial terms such as equity, forfeiture, and vesting must be clearly defined.

-

Describes the types of equity and grants involved.

How does the vesting process work?

The vesting process is essential for understanding how and when equity becomes available to recipients. A well-defined vesting schedule helps in managing expectations and aligning interests.

-

A timeline over which an employee earns their shares.

-

The date when the vesting process begins, which is crucial for determining the timeline.

-

Specifies what happens to unvested shares if the employment is terminated.

What are common aspects of share vesting?

Understanding common questions about share vesting can help clarify its significance, especially for startups. It ensures that all parties involved comprehend the intricacies of these agreements.

-

Share vesting is vital for aligning team incentives with corporate performance.

-

A formal agreement can protect both the company and its stakeholders.

-

This concept pertains to the return of shares, which can be critical under circumstances such as employee exits.

What considerations are important when issuing share vesting agreements?

Issuing share vesting agreements requires careful thought about various critical components that can affect both the company and its employees. It is important to incorporate aspects that ensure equitable treatment and legal compliance.

-

Discussing the importance of clauses that allow shares to vest more quickly under certain conditions.

-

Understanding the implications of forfeiting equity when obligations are not met.

-

Examining the need for compliance with regional laws relevant to equity agreements.

How can you create a vested equity agreement using pdfFiller?

Creating a Vested Equity Agreement using pdfFiller is a straightforward process that enhances document management. The platform is designed to facilitate ease of use, making the setup efficient.

-

A structured approach to create your document using the pdfFiller platform.

-

The platform provides comprehensive tools for editing your agreement.

-

Available features ensure your document complies with necessary legal requirements.

What strategies can help manage vested equity agreements effectively?

Effective management of vested equity agreements is essential for maintaining transparency and stakeholder satisfaction. Understanding best practices can significantly enhance communication and tracking.

-

Strategies for discussing equity agreements openly with employees.

-

Best practices for monitoring the vesting progress of employees.

-

Utilizing pdfFiller's features for collaborating on multiple agreements.

Why is understanding vested equity agreements important?

Understanding the significance of Vested Equity Agreements is critical for both parties involved. It ensures a mutually beneficial arrangement that can drive company growth and employee satisfaction.

-

Summarizing the essential elements covered in this guide.

-

Emphasizing pdfFiller's importance in streamlining document management.

How to fill out the Vested Equity Agreement Template

-

1.Open pdfFiller and upload the Vested Equity Agreement Template.

-

2.Review the template sections including the parties involved, equity details, and vesting schedule.

-

3.Begin filling in the ‘Employee Name’ field with the name of the recipient of the equity.

-

4.Proceed to the ‘Company Name’ section and enter the legal name of the company providing the equity.

-

5.Fill in the ‘Equity Details’ section, specifying the type of equity (e.g., shares, stock options) along with the quantity being granted.

-

6.In the ‘Vesting Schedule’ section, outline the time frame for vesting (e.g., 4 years with a 1-year cliff).

-

7.Ensure you include any additional terms specific to the agreement (e.g., termination clauses).

-

8.Have both parties review the agreement to ensure accuracy and completeness.

-

9.Once finalized, download the filled agreement and ensure both parties sign the document as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.