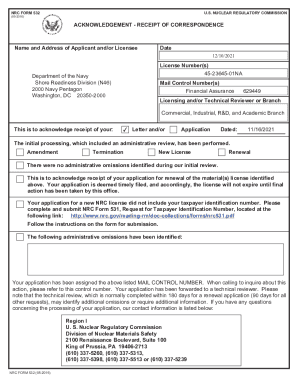

Vesting Startup Agreement Template free printable template

Show details

Este acuerdo de vesting establece los trminos y condiciones bajo los cuales se otorgan derechos de equidad a un destinatario por parte de una empresa, incluyendo detalles sobre el proceso de vesting,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Vesting Startup Agreement Template

A Vesting Startup Agreement Template is a legal document outlining the terms under which equity in a startup is allocated over a period of time to co-founders or employees.

pdfFiller scores top ratings on review platforms

pdf filler was kinda a letdown

3/5 it was cool and yea sometimes know when to say no

I use it for specific content for signature and pdf

just didnt like the feel of the software so im moving on

John has been very efficient

John has been very efficient. He solved my problem.

So far so good

So far so good. Easy to use anywhere since it is web based and I don't have to worry about which computer I'm using, whether at home, office, or other.

Payment issue dealt with swiftly

After both my cards being declined to register my subscription, I went onto the online support chat. Kara was super helpful and quick to deal with my issue - very professional and friendly. Kara was very generous in giving me three free days and advised within that time to try my payment again after 24 hours. Thank you Kara for taking the stress away and resolving my issue fast. Morven

Navigating how to save/ download could…

Navigating how to save/ download could be a bit easier.

Great service and easy to use!

Who needs Vesting Startup Agreement Template?

Explore how professionals across industries use pdfFiller.

Vesting Startup Agreement: Comprehensive Guide

What is a founder vesting agreement?

A founder vesting agreement is a contract that outlines how and when equity is granted to founders and key team members of a startup. It is vital for ensuring that all contributors are significantly invested in the long-term success of the company. Without such an agreement, founders risk losing their shared equity contributions, potentially leading to misunderstandings and conflict within the team.

-

A vesting agreement outlines the terms under which ownership of equity is granted over time.

-

It protects founders’ interests and promotes continued contribution to the startup.

-

Failure to create one may lead to division of shares that is neither fair nor aligned with contributions.

What are the key elements of a Vesting Startup Agreement?

A well-crafted vesting startup agreement contains specific components that clarify the roles of all parties involved. These elements ensure that both the company and the equity recipients understand their rights and responsibilities, thus reducing the possibility of disputes.

-

This marks when the vesting process begins; its significance cannot be overstated as it sets the countdown for the vesting schedule.

-

Clearly identify the company and the equity recipient to reduce ambiguity.

-

Detail the purpose and business model of the startup along with specifics about the equity recipient.

-

These statements provide context for the agreement, elaborating on the motivations behind establishing the vesting terms.

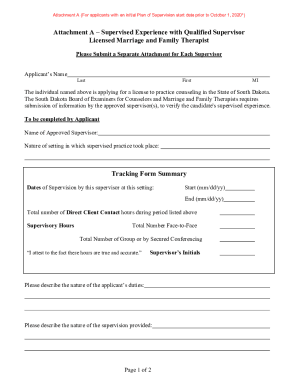

How to break down the form fields?

Understanding and properly completing the form fields of a Vesting Startup Agreement is crucial for legal compliance and efficient management of equity stakes. Each form field should capture the necessary information to facilitate a smooth vesting process.

-

Provide details including the legal structure and principal place of business to identify the company legally.

-

Ensure that detailed identifying information of the recipient is accurately recorded to enforce clarity.

-

Specify the types of equity being granted, including options or common stock, to avoid confusion later.

What are the key terms in the agreement?

Technical terms associated with a vesting startup agreement require clear definitions to guarantee mutual understanding. Familiarity with these terms will make it easier for the involved parties to navigate the terms and conditions.

-

Vesting refers to earning an ownership stake over time, while equity relates to the shares owned in a company.

-

The cliff period denotes the minimum amount of time before any shares begin to vest, incentivizing commitment.

-

This is when unvested shares vest immediately upon certain conditions being met, offering potential advantages.

-

Describes what happens to the vesting schedule if there is a merger or acquisition, crucial for all parties' preparedness.

How to craft a vesting schedule?

Creating a vesting schedule requires a careful approach to balance equity distribution and incentivization. The schedule should reflect the company's growth strategy and its operational objectives.

-

Common lengths include 3-4 years, with different structures tailored to the startup's needs.

-

An example could be 25% after the first year, with the remainder vesting monthly thereafter.

-

Considerations may include market conditions, founding team stability, and financial forecasts.

What are acceleration provisions?

Acceleration provisions can enable rapid vesting of shares under specific scenarios, such as acquisition. Understanding these provisions allows stakeholders to negotiate effectively.

-

This indicates when shares vest sooner due to triggering events, which can benefit stakeholders substantially.

-

While they create security for recipients, they may deter potential investors seeking control over company share distribution.

-

Each startup's context is unique, so it’s vital to customize acceleration provisions to suit specific situations.

How to ensure termination provisions safeguard rights?

Termination provisions in a vesting agreement need to be fairly written to protect the interests of both parties. They serve as a safeguard for equitable rights in various termination scenarios.

-

Establishing a just cause for termination can impact rights to vested and unvested equity.

-

Detailing the outcomes of termination on equity ensures transparency and pre-empts potential disputes.

-

Strategies involve offering a grace period or severance for vested individuals.

How can pdfFiller enhance your Vesting Startup Agreement experience?

Utilizing pdfFiller’s tools allows startups to manage their Vesting Startup Agreement forms seamlessly. Whether it’s uploading, editing, or signing, every function is designed to enhance collaboration in document management.

-

Effortlessly upload your template and make necessary changes before sending it for signature.

-

Easily share the document with team members and stakeholders to ensure everyone is on the same page.

-

Utilize eSign features for a legally binding signature, ensuring security throughout the process.

-

With pdfFiller, handle various drafts of your agreement without losing track of edits and updates.

What are common pitfalls in vesting agreements?

Recognizing and avoiding common mistakes in creating vesting agreements is imperative for the longevity of equity arrangements. Ensuring clarity and compliance can save significant legal hassles.

-

Leaving out critical terms can lead to disputes and violations in agreements.

-

Every jurisdiction has specific legal requirements; failing to comply could invalidate the agreement.

-

Open dialogue is essential; misunderstandings can quickly escalate into larger issues.

What are final notes and considerations?

In conclusion, a vesting startup agreement serves as a foundational document that strengthens relationships between stakeholders. A successful agreement will require thorough consultations with legal professionals and a focus on best practices.

-

Reviewing each part of the agreement is critical to ensure understanding among stakeholders.

-

Professional advice is essential when drafting your agreement to suit legal requirements effectively.

-

Make equity management a priority as it impacts your startup's culture and motivation.

How to fill out the Vesting Startup Agreement Template

-

1.Download the Vesting Startup Agreement Template from pdfFiller.

-

2.Open the template and review the sections such as parties involved, equity percentages, and vesting schedule.

-

3.Fill in the names and contact details of all parties: founders, employees, and investors if applicable.

-

4.Define the vesting schedule: Specify the total duration of the vesting period (e.g., 4 years) and any cliff period (e.g., 1 year).

-

5.Input the agreed-upon equity percentages for each party based on their contributions.

-

6.Include any specific conditions or milestones that will impact the vesting process, such as performance targets.

-

7.Review the document for accuracy and completeness, ensuring all required fields are filled correctly.

-

8.Save changes and prepare for any necessary signatures from involved parties. Use the e-signature feature on pdfFiller if needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.