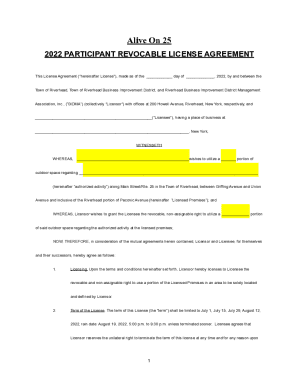

Vesting Vesting Certificate Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a company grants certain rights or assets to an individual participant, detailing the vesting schedule and the rights of both parties involved.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Vesting Vesting Certificate Agreement Template

A Vesting Certificate Agreement Template is a legal document that outlines the terms under which an individual's rights to receive shares or benefits vest over time.

pdfFiller scores top ratings on review platforms

Good!

I think it is a great product. I use it for filling in insurance forms

This site has helped with so many documents. User friendly and super helpful. Thank you.

Easy to use and happy with the service provided. Very useful for filling out important forms.

DDDDDDDDDDDDDDDDDDDDDAQHHFBBVBNNND

PRACTICAL AND FAST.

Who needs Vesting Vesting Certificate Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Vesting Vesting Certificate Agreement Template form

Understanding the Vesting Certificate Agreement

A Vesting Certificate Agreement serves as a foundational document in establishing ownership rights over shares or assets over time. It plays a crucial role in defining how and when the participant earns their rights to the asset, hence the importance of agreeing on a vesting schedule. Key parties involved typically include the Grantor, who offers the equity, and the Participant, who earns the equity based on predetermined conditions.

-

The Vesting Certificate Agreement is designed to formalize the conditions under which an individual earns rights to shares or assets.

-

It ensures clarity on how long a participant must remain with the organization to earn their shares.

-

The Grantor typically represents the company providing the shares, while the Participant is the employee or stakeholder.

Key components of a Vesting Certificate Agreement

Each Vesting Certificate Agreement must include crucial details to safeguard the rights and responsibilities of involved parties. Full legal names and entity types of the parties establish clarity, while the effective date signifies when the agreement takes effect. Moreover, addresses ensure that all legal communications are sent to the appropriate locations, and a clear description of the assets involved is vital to prevent ambiguity.

-

Both parties should clearly specify their legal identities to avoid disputes.

-

Often indicated at the beginning of the agreement to finalize the start of the vesting period.

-

Mandatory for maintaining clear and legal communication through the duration of the agreement.

-

A specific outline of assets being granted helps stakeholders understand their value and rights.

The Vesting Process: Definitions and Terms

Understanding the vesting process is paramount, as it determines how assets are allocated over time. The term 'vesting' refers to the process where an employee earns the right to their shares according to the predefined schedule. This includes critical terms such as the 'vesting period,' representing the duration over which these rights mature, and the 'vesting schedule,' which delineates specific milestones and conditions required for earning these rights.

-

A legal term representing the process through which an individual earns rights to assets.

-

The set timeframe during which the participant must meet requirements to earn rights.

-

A timeline with conditions that determines when an individual earns their rights.

-

A provision meaning that participants won't receive any vested benefits until a certain date or condition is met.

Navigating the Grant of Vesting

When issuing a Grant of Vesting, it is critical to provide thorough descriptions of the assets involved. This not only clarifies rights for the Participant but also protects the Grantor. Important clauses must be included, outlining conditions related to the vesting schedule, such as performance metrics and timelines which can influence the outcomes of the vesting agreement.

-

Each asset's description must be clearly defined to avoid misunderstandings.

-

Critical language must be included to ensure all parties understand the implications of the agreement.

-

Clear conditions must be laid out, covering performance measures and timelines.

Types of Vesting Agreements and Their Importance

There are several types of vesting agreements, each with unique features that suit different situations. Share Vesting Agreements are commonly used in startups, allowing employees to earn shares over time. Similarly, reverse vesting is particularly relevant during corporate acquisitions, where vested shares may need to be forfeited if the employee leaves prematurely. Understanding these types is crucial for companies to maximize talent retention and ensure clarity.

-

Typically awarded in startups to reliably retain talent while providing incentives.

-

Used in mergers where the acquired employees may have to forfeit shares if they leave.

-

These agreements help mitigate risks associated with employee turnover.

Incorporating Acceleration Clauses

Acceleration clauses can significantly alter the dynamics of a vesting agreement. These provisions can either accelerate the vesting schedule or signal that shares become immediately vested under specific conditions, such as a company sale. Understanding acceleration clauses ensures that both the Grantor and Participant are aware of when they apply and their implications, allowing for better decision-making.

-

Provisions that affect the timeline or conditions under which shares may vest.

-

Usually applied during events like mergers, acquisitions, or company restructurings.

-

Can result in both unexpected benefits and risks for Grantors and Participants.

How to Effectively Create a Share Vesting Agreement

Creating an effective Share Vesting Agreement can be streamlined through tools such as pdfFiller. This platform offers a step-by-step process to assist users in filling out the agreement, ensuring all necessary information is included in a structured manner. Furthermore, editable templates are available for those who prefer to customize their agreements, alongside examples of completed agreements for reference.

-

Using pdfFiller provides guidance through structured prompts, reducing errors in drafts.

-

pdfFiller offers templates that can be easily modified to fit unique needs.

-

Access to previously completed agreements fosters a better understanding of structure and requirements.

Managing Your Vesting Documentation

Managing documentation related to your vesting agreement is essential for ensuring compliance and easy access. Utilizing features from pdfFiller allows users to securely store their documents in the cloud, making them readily available. The eSigning feature supports seamless execution, and various collaborative tools enhance teamwork during the agreement's creation and maintenance.

-

pdfFiller allows for cloud-based storage of important legal documents.

-

Ensures fast turnaround time on agreement execution without physical signatures.

-

Enhances teamwork capabilities, allowing multiple users to work together on documents.

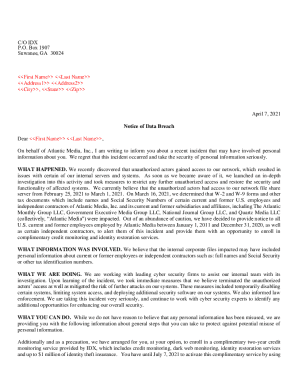

Legal Considerations and Compliance for Vesting Agreements

When drafting a Vesting Certificate Agreement, it is critical to keep in mind local compliance requirements that may affect the agreement. Understanding legal language is key in drafting such agreements to ensure they adhere to regulations and protect rights. Resources for additional legal advice can also be beneficial for parties looking for clarity on complex legal conditions.

-

Consider local laws that might impact equity and vesting agreements.

-

Key legal phrases that might need to be included in drafting to ensure enforceability.

-

Engagement with legal advisors can provide additional insights and protections.

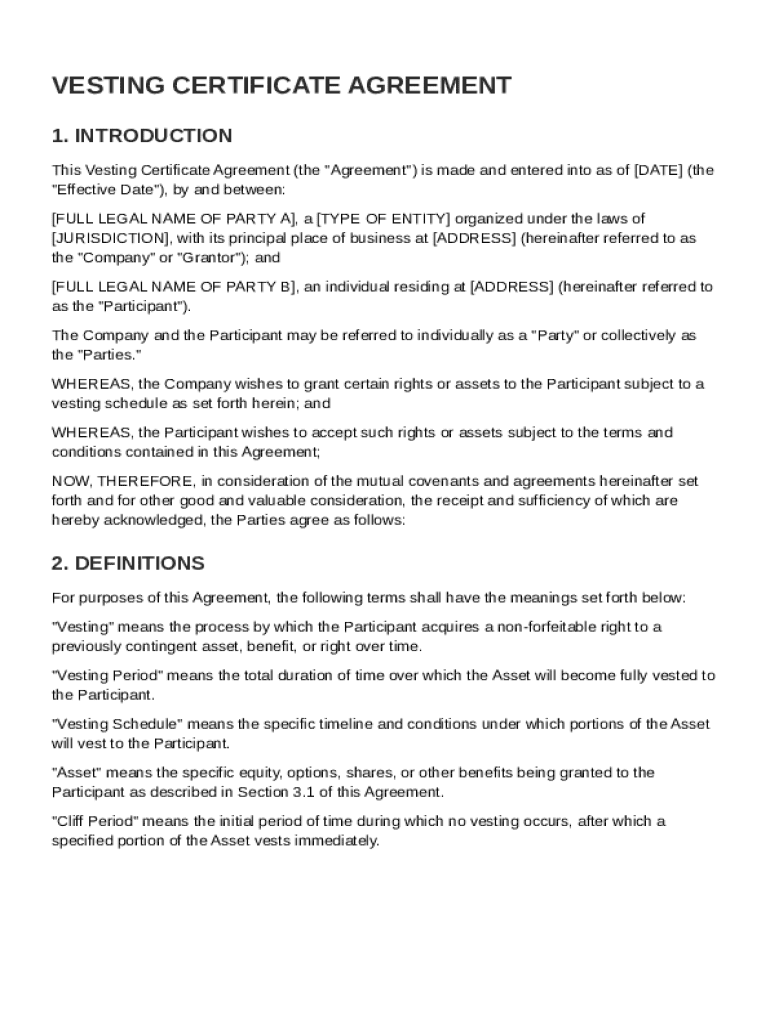

How to fill out the Vesting Vesting Certificate Agreement Template

-

1.Open the Vesting Vesting Certificate Agreement Template in pdfFiller.

-

2.Begin by filling out your name and the date of the agreement at the top of the document.

-

3.Locate the section specifying the number of shares to be vested and input the correct figure.

-

4.Next, enter the vesting schedule details, including the start date and the duration of the vesting period.

-

5.If applicable, input any specific conditions under which the shares will vest, such as performance milestones.

-

6.Review the terms of the agreement to ensure all information is accurate and complete.

-

7.Finally, sign the document electronically at the designated signature field and save your changes.

-

8.Download or print the finalized agreement for your records and distribute copies to relevant parties.

What is a vesting agreement?

A vesting agreement is an agreement entered into between a corporation and a shareholder (usually an employee) that restricts the vesting of securities with the shareholder over a period of time or subject to other conditions.

What is a vesting certificate in Ireland?

The Vesting Certificate is evidence that you have bought out your ground rents. IT IS A NEW TITLE DEED TO YOUR PROPERTY AND, AS SUCH, IT IS A VERY IMPORTANT DOCUMENT.

What does it mean to be vested in the contractor?

Vesting involves an agreement between the supplier, intermediary (i.e. a contractor / subcontractor) and the client. Goods to be vested are to be identified, separated / clearly marked, insurance and free from encumbrance.

What is the vesting schedule for a shareholder agreement?

The vesting period is the time it takes for an employee or co-founder to earn their full equity stake in the company. It is often over a four year vesting schedule, but it can be longer or shorter depending on the company.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

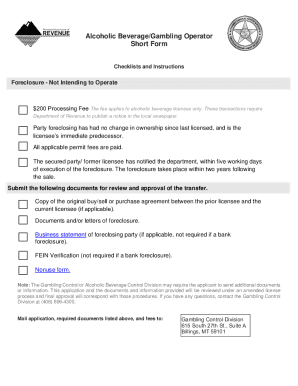

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.