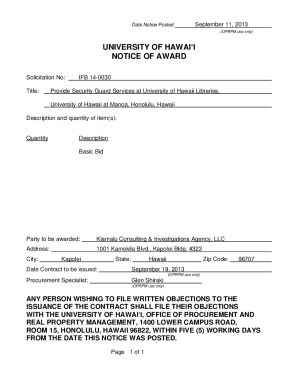

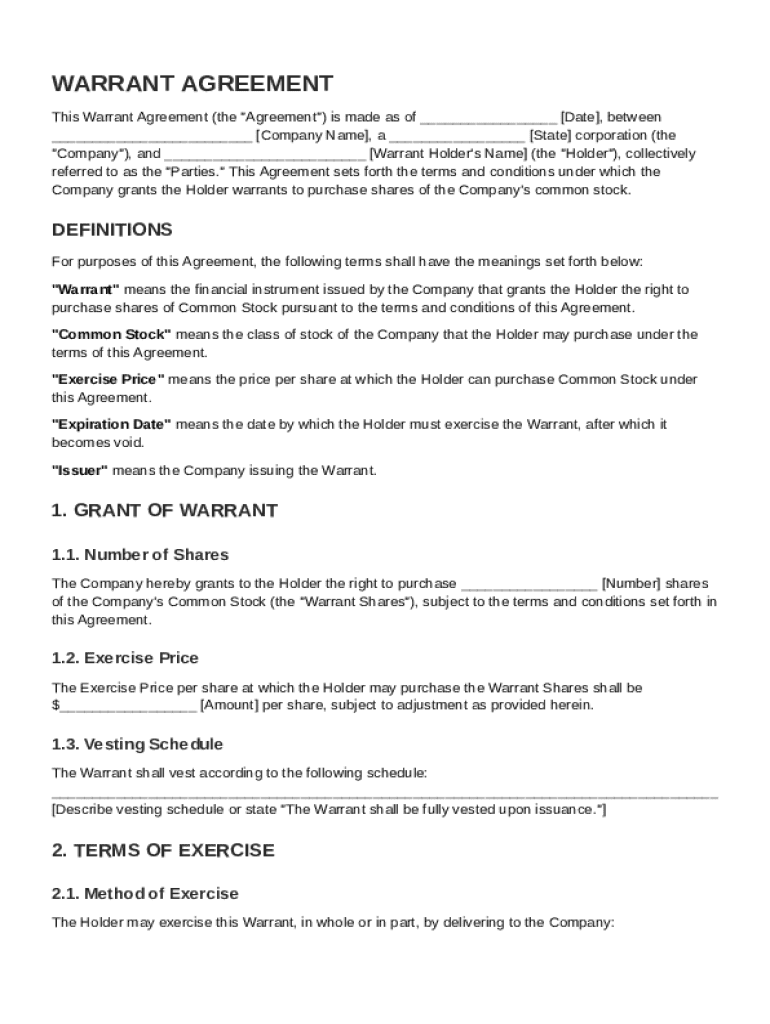

Warrant Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a company grants warrants to a holder for purchasing shares of common stock.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Warrant Agreement Template

A Warrant Agreement Template is a legal document outlining the terms under which a warrant can be exercised to purchase a company's stock.

pdfFiller scores top ratings on review platforms

Allowed me to prepare recipient and employer copies of a 1099 without the need for the main payroll program.

I think the form should be a guide & allow you to edit the entire form hassel free if necessary.

So far this is exactly what I need to eliminate printing. Saving me money.

I love how easy it is to use great for our companys paperwork.

Excellent. Makes the process of filling out PDF forms easy. Would recommend.

I did not realize how much help it would be, it is great to fill out government documents.

Who needs Warrant Agreement Template?

Explore how professionals across industries use pdfFiller.

Warrant Agreement Template Guide

If you're looking to understand how to fill out a warrant agreement template form, this guide takes you through every important aspect needed for successful document management. From understanding the purpose of a warrant agreement to practical advice for completing templates, we cover a range of topics to support your needs.

What is a warrant agreement?

A warrant agreement is a financial instrument that allows the holder to purchase a company's stock at a predetermined price, known as the exercise price. This type of agreement serves various purposes, such as providing companies with a means to incentivize employees or raise capital.

-

Warrant agreements are contracts that give investors the right, but not the obligation, to purchase shares of a stock at a specified price within a certain timeframe.

-

While warrants and options are similar, warrants are usually issued by the company itself, which means they can dilute existing shareholders' ownership.

-

Warrant agreements are prevalent in industries such as venture capital, startups, and corporate finance to enhance funding opportunities.

The importance of a warrant agreement

Warrant agreements can be vital tools for companies aiming to raise capital. By offering warrants, businesses can attract investments while providing potential upside to investors who might want to buy stock later. For both issuers and holders, these agreements offer distinct advantages.

-

Companies often issue warrants to make their investment propositions more attractive, thus facilitating capital influx during fundraising rounds.

-

Issuers can secure funds without immediate stock issuance, while holders get potential equity stakes at predetermined prices, particularly beneficial if stock prices rise.

-

Investors must be aware of expiration dates and market fluctuations, as failing to exercise warrants on time can result in loss of investment potential.

Key components of a warrant agreement

Each warrant agreement contains critical components that define the rights and obligations of both parties involved. Understanding these specific clauses is paramount for effective use.

-

Key definitions include 'Warrant', which represents the right to buy stock, 'Common Stock', which refers to shares that carry voting rights, and 'Exercise Price', the price per share the warrant holder pays.

-

These clauses outline when the warrant expires and the conditions under which benefits are realized, impacting financial planning.

-

Clear definitions of how and when the holder may exercise their rights to purchase shares are crucial to preventing disputes.

Filling out the warrant agreement template

Completing a warrant agreement template is a straightforward process when approached systematically. pdfFiller provides a user-friendly platform for this purpose.

-

Follow the logical steps outlined in the template to ensure accurate completion. Users may find guidance through online resources and tutorials.

-

Mandatory information includes the Company Name, Warrant Holder's Name, and Number of Shares to ensure validity.

-

Review entries for accuracy and ensure all necessary signatures are obtained prior to submission. Consistent formatting also helps in document clarity.

Editing and customizing your warrant agreement

Adjusting the standard warrant agreement template to suit specific needs can enhance flexibility. With pdfFiller's cloud-based tools, this process becomes easier.

-

pdfFiller offers comprehensive editing capabilities, allowing you to adjust text, formats, and clauses in the template seamlessly.

-

Tailor specific clauses to address particular business situations or agreements, ensuring relevance.

-

Real-time feedback and team collaboration on the document can result in better-informed decision-making.

Signing and managing your warrant agreement

After preparing a warrant agreement, efficient management and signing are next steps. pdfFiller facilitates this process effortlessly, bolstering document security and compliance.

-

The eSigning feature allows multiple stakeholders to sign the warrant agreement, making the process swift and secure.

-

Once finalized, securely store the completed warrant agreement on pdfFiller’s cloud platform for easy access and management.

-

Understand and ensure compliance with laws and regulations regarding warrants to protect business interests.

Comparing warrant agreements with competitor options

When selecting a platform for your warrant agreements, understanding the competitive landscape can offer insights into the best solutions available.

-

Investigate common headings and clauses found in competitor warrant agreements to locate industry standards.

-

Utilizing pdfFiller simplifies the document management process through user-friendly tools and excellent customer support.

-

Learn from businesses leveraging warrant agreements effectively to drive growth, keeping an eye on prevalent methods in your industry.

Understanding stock warrants in the business context

Stock warrants are integral to corporate finance and investment strategies. Understanding how these instruments work in business transactions helps in strategic planning.

-

Investors and companies can negotiate the terms under which stock warrants are issued, paving the way for strategic partnerships.

-

When exercised, stock warrants lead to the issuance of shares, affecting equity structure and potentially leading to dilution of existing ownership.

-

Familiarize yourself with terms like 'exercise price', 'expiration date', and 'vesting schedule' to navigate discussions concerning warrants.

How to fill out the Warrant Agreement Template

-

1.Open the Warrant Agreement Template in pdfFiller.

-

2.Fill in the 'Company Name' field with the legal name of your company.

-

3.Enter the 'Investor Name' who will be receiving the warrants.

-

4.Specify the 'Warrant Price' which is the price per share for the warrants.

-

5.Indicate the 'Total Number of Warrants' being issued to the investor.

-

6.Fill in the 'Exercise Period' to specify when warrants can be exercised.

-

7.Review the 'Terms of Warrant' section to ensure all conditions are accurately stated.

-

8.If applicable, fill in any additional provisions such as transfer restrictions or rights of first refusal.

-

9.Double-check all details for accuracy and completeness before finalizing.

-

10.Save the template to your device or send it directly for electronic signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.