Working Capital Loan Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which a lender provides a working capital loan to a borrower to support its operational needs.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

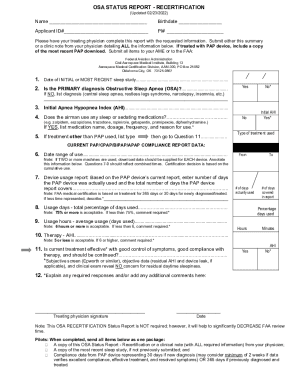

What is Working Capital Loan Agreement Template

A Working Capital Loan Agreement Template is a document that outlines the terms and conditions under which a lender provides a working capital loan to a borrower.

pdfFiller scores top ratings on review platforms

This program is awesome. So easy to fill out any document. Makes my job so much easier.

So far, PDF Filler not only meets, but it exceeds my expectations.

It's easy to use, never tried it anyone can do it, thank you

So far I like the program, I cannot figure out how to select a line item (draw a box around it) and select all to delete. If I am missing something, please let me know. Thanks

The forms are easy to fill out and it makes doing business with someone long distance easy.

A LITTLE CONFUSING. ALSO, NOT CLEAR THAT YOU NEED TO PAY TO PRINT --

Who needs Working Capital Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Working Capital Loan Agreement Template Guide

How can you quickly fill out a working capital loan agreement form?

Filling out a working capital loan agreement form can be streamlined by understanding each required section, such as the lender's name and the borrower's details. Utilizing templates can help ensure that you include all necessary information and avoid common errors. Online tools, like those provided by pdfFiller, allow for easy editing and compliance, making the process more efficient.

Understanding working capital loans

A working capital loan is a financing solution specifically designed to cover a business's short-term operational needs. These loans help businesses maintain cash flow, invest in inventory, or meet unforeseen expenditures. Unlike traditional bank loans, working capital loans often feature quicker approval times and less stringent requirements.

-

Working capital loans provide necessary funds to finance day-to-day operations.

-

They offer flexibility in finance, allowing businesses to seize immediate opportunities.

-

When compared to traditional loans, working capital loans are often easier to obtain and quicker to process.

What are the key components of a working capital loan agreement?

A well-structured working capital loan agreement should encompass key components such as the loan amount, interest rate, maturity date, and security provisions. These terms provide clarity on what both parties agree upon and help prevent misunderstandings. It’s critical to specify the loan amount based on business needs, ensuring it aligns with operational costs.

-

The total funds you are borrowing, informed by immediate operational needs.

-

The cost of borrowing, which can vary based on creditworthiness and market conditions.

-

The date by which the loan must be fully repaid.

How to accurately fill out a working capital loan agreement?

Filling out the loan agreement requires careful attention to detail. You must include accurate information such as the lender's and borrower's names, addresses, and the specific financial terms agreed upon. For convenience, using pdfFiller’s interactive tools can facilitate the process, ensuring you meet legal and regulatory requirements.

-

Include the complete name and address of the lender.

-

Provide accurate details about the borrower, ensuring all contact information is correct.

-

Clearly outline the loan amount, interest rate, and other essential terms.

What legal considerations should you keep in mind?

A working capital loan agreement carries significant legal obligations for both the lender and borrower. Understanding regional regulations and compliance issues is crucial to avoid future disputes. Consulting legal professionals can help navigate these complexities and personalize agreements to reflect unique business needs.

-

Both parties have to fulfill through agreed terms in the contract.

-

Regional regulation around business loans can impact loan approval and terms.

-

Engaging with a legal advisor can ensure your agreement is thorough and compliant.

How to manage your working capital loan agreement effectively?

Keeping detailed records of loan usage and payments is essential for effective management. Establishing a system for tracking repayments helps avoid missed deadlines and can provide insight into the overall financial health of the business. Utilizing pdfFiller’s document management tools allows for seamless collaboration and eSignatures, enhancing the management process.

-

Maintain accurate records of how loan funds are utilized and when payments are made.

-

Establish reminders and a clear schedule to handle repayments efficiently.

-

Use features offered by document management systems for better organization and workflow.

What common mistakes should you avoid?

Common errors when completing loan agreements can lead to potential disputes and unfavorable terms. Borrowers often overlook critical information or provide incomplete details, which can have significant consequences. Always review your agreement before submission to ensure every detail is accurate.

-

Leaving out critical fields can delay the loan approval process.

-

Not fully grasping loan terms and obligations can lead to financial stress.

-

Failing to review the agreement thoroughly can result in overlooking crucial errors.

What are your next steps?

In conclusion, understanding the nuances of a working capital loan agreement is essential for any business owner. Download the Working Capital Loan Agreement Template from pdfFiller to simplify the process. Explore additional tools provided by pdfFiller for comprehensive document management to effectively manage your finances.

How to fill out the Working Capital Loan Agreement Template

-

1.Download the Working Capital Loan Agreement Template from pdfFiller's library.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the borrower's legal name and contact information at the top of the document.

-

4.Fill in the lender's name and address in the designated sections.

-

5.Specify the loan amount requested and the interest rate agreed upon.

-

6.Indicate the repayment terms, including the duration and installment frequency.

-

7.Include any additional fees or charges that may apply to the loan.

-

8.Consult with a legal advisor to ensure all terms comply with applicable laws and regulations.

-

9.Review the completed document for accuracy to ensure all fields are filled correctly.

-

10.Save the filled-out agreement and either print it for signatures or send it electronically.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.