Angel Investment Contract Template free printable template

Show details

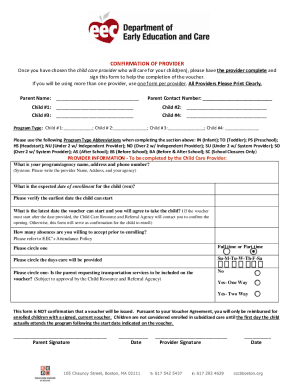

This Agreement outlines the terms and conditions of an investment made by an Investor into a Company in exchange for equity or convertible debt.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Angel Investment Contract Template

An Angel Investment Contract Template is a legal document that outlines the terms and conditions of an investment made by an angel investor in a startup or early-stage company.

pdfFiller scores top ratings on review platforms

so user friendly.

awesome

It's really good and convenient

Very helpful & User friendly

So Easy to make the chnges I need.

Awesome!

Who needs Angel Investment Contract Template?

Explore how professionals across industries use pdfFiller.

Your guide to understanding and utilizing an angel investment contract template form

Navigating the complexities of startup funding agreements can be daunting. An angel investment contract template form serves as a foundational document that outlines the terms of an investment arrangement between angel investors and startups. This guide will empower you with the knowledge to create, edit, and validate your agreements effectively.

What are angel investment agreements?

An angel investment agreement is a contract that defines the relationship between an investor and a startup. These agreements clarify the roles and responsibilities of each party, ensuring that both sides understand their rights and obligations. The importance of detailing terms cannot be overstated, as it sets the foundation for a smooth investment process later.

-

Clarifies what an angel investment agreement is and why it is essential for both investors and companies.

-

Identifies the primary participants in the agreement: the angel investors and the startup company.

-

Stresses the importance of transparency in outlining terms and conditions to avoid future disputes.

What are the essential components of an angel investment agreement?

-

The date on which the agreement becomes effective. This date is critical in marking the start of obligations and rights.

-

Includes the full legal name and contact details of the investor to ensure open communication.

-

Specifies the legal name of the company, its registration details, and other relevant corporate information.

-

Articulates what type of investment is being made (e.g., cash, resources) and how that corresponds to equity stakes.

How do the investment terms break down?

Understanding the financial commitments in an angel investment is imperative for both parties. The contract must clearly state the amount being invested, the types of securities offered, and how the purchase price is determined.

-

Establishes clarity on the dollar figure designated for the investment, which is essential for budgeting and planning.

-

Explains the different forms that investment can take, such as common stock, preferred stock, or convertible notes.

-

Details how the price is calculated based on the pre-money valuation, which helps set expectations around ownership stakes.

What are the closing conditions for a successful transaction?

Closing conditions are vital as they ensure that all steps leading up to the transaction's completion are met. They protect investors' interests while fostering trust between the investor and the company.

-

Specifies obligations that must be fulfilled before the investor is required to provide funding.

-

Ensures that the company’s claims about its business and financial health are accurate.

-

Lists all legal and regulatory standards that the company must meet before the deal closes.

Why are legal essentials important for angel investments?

Legal documentation plays a significant role in protecting both investors and companies from potential conflicts. Failure to comply with legal standards can result in costly disputes or investments going awry. Properly tailoring agreements to individual circumstances can greatly enhance their effectiveness.

-

Reinforces the need for formal paperwork to avoid misunderstandings or legal issues down the line.

-

Highlights frequent mistakes such as vagueness in terms or lack of necessary legal provisions.

-

Encourages adjusting standard templates to suit specific investment scenarios for better relevance.

How can pdfFiller help with document management?

pdfFiller offers a suite of tools that enhance the process of managing your angel investment agreements. Users can efficiently edit, eSign, and collaborate on documents—all from a single, cloud-based platform, facilitating seamless interaction between stakeholders.

-

Provides functionality for users to modify and electronically sign documents, improving turnaround times.

-

Allows teams to work together effectively, ensuring that everyone is on the same page throughout the investment process.

-

Users can easily find templates and guides, helping streamline the drafting process for the agreements.

What are some negotiation strategies for founders and investors?

Negotiation in the context of angel investments can determine the future success of a startup. Both parties should come prepared, with founders advocating for their business needs while investors ensure they get adequate returns on their investments.

-

Advises founders on how to effectively present their needs during discussions with potential investors.

-

Outlines critical points investors should think about to secure favorable investment terms without stifling growth.

-

Encourages a middle ground where both investor goals and company aspirations can thrive.

How to fill out the Angel Investment Contract Template

-

1.Download the Angel Investment Contract Template from pdfFiller.

-

2.Open the PDF document in pdfFiller and begin with the 'Investor Information' section, filling in the name and contact details of the angel investor.

-

3.Next, complete the 'Company Information' section by providing the startup’s name, address, and relevant details.

-

4.Proceed to the 'Investment Details' section, specifying the investment amount, equity percentage, and any other financial terms.

-

5.Move to the 'Terms and Conditions' section, ensuring that all pertinent conditions regarding the investment and rights are clearly stated.

-

6.Include any additional clauses unique to the investment, such as voting rights or exit strategy, under 'Additional Clauses'.

-

7.Review the entire document for accuracy and completeness.

-

8.Finally, save the filled contract and prepare it for signatures from both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.

![[PDF] FILLABLE - 2020 Fire Inspector Exam Application.pdf](https://www.pdffiller.com/preview/614/23/614023315.png)