Angel Investor Contract Template free printable template

Show details

This document outlines the terms under which an investor provides financial support to a company in exchange for ownership equity.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Angel Investor Contract Template

An Angel Investor Contract Template is a legal document outlining the terms and conditions between an angel investor and a startup regarding investment and equity distribution.

pdfFiller scores top ratings on review platforms

It makes it easy to edit and sign documents for my business quickly!

I've been really happy with how easy it…

I've been really happy with how easy it is to find certain forms, then fill them in and print them, but I wasn't able to find a few forms I needed and had to look for them elsewhere. I'd be ecstatic if all the forms I needed were all in one place.

It works well

Very easy to use and affordable, hasn't ever caused me an issue yet. I would recommend to anyone who needs to constantly convert files like I do

Clear filling information and storage of information.

Not satisfied with inability to print from screen.

Easy to use fill-in function and dashboard easy to navigate.

Very convenient

Who needs Angel Investor Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Angel Investor Contract Template on pdfFiller

How do angel investment agreements work?

Angel investment agreements are contracts between startups and angel investors that outline the terms and conditions for investment. They serve a crucial purpose by defining the rights and responsibilities of both parties, ensuring clarity and legal protection. Understanding these agreements is vital for both founders and investors.

What key components are in an angel investor contract?

Key components of an angel investor contract include the investment amount, type of security (equity or debt), and valuation. Each element is essential for establishing a mutual understanding of the investment terms. Additionally, outlining rights concerning governance, dividends, and exit strategies is also crucial.

What’s the difference between convertible debt and equity financing?

Convertible debt allows investors to lend money to a startup, with the potential for conversion to equity at a later date, usually at a discount. In contrast, equity financing involves direct ownership in the company from the outset. Understanding these differences helps in choosing the most suitable funding strategy.

How do you create your angel investor contract?

Creating your angel investor contract involves a series of important steps, starting with determining the key parties involved in the agreement. This can include founders, co-founders, and legal representatives. Defining investment terms clearly follows, specifying the amount and type of security.

What steps should you take?

-

Identify all the stakeholders in the investment process, including investors and company executives.

-

Clearly outline the investment amount, purpose, and expectations from both parties.

-

Choose between equity or convertible debt; set the valuation for the investment.

-

Utilize pdfFiller to create and customize your template easily.

What essential terms should be included?

Essential terms in your contract should clearly define key concepts like 'angel investor', 'equity', 'investment amount', and 'valuation'. Each term should be presented in a manner that avoids confusion. Additionally, detailing the specific investment amount and type of security helps avoid disputes.

What are common legal pitfalls to avoid?

Common legal pitfalls in agreements often arise from vague language or ambiguous terms. Clarity is essential to avoid misunderstandings that could lead to disputes later on. Engaging legal counsel well-versed in startup funding can help navigate potential issues and establish negotiation strategies.

How can you customize your angel investment agreement?

Customizing your angel investment agreement is crucial for meeting unique business needs. Considerations like business structure and specific investment scenarios can influence the contract's wording. Including special terms that reflect your situation can protect your interests and align expectations.

What features does pdfFiller offer for managing your contract?

pdfFiller provides features that allow users to edit PDF contracts seamlessly, ensuring that all necessary details can be accurately captured. The platform includes eSignature tools for easy signing and offers collaborative options for teams, making it ideal for both founders and investors.

What do you need to know when wrapping up your investment agreement?

Before finalizing your investment agreement, conduct a thorough review to ensure all terms are understood. Clarity on contract specifics is essential to prevent future conflicts. Additionally, consider any legal and compliance notes relevant to your region to ensure adherence to legal standards.

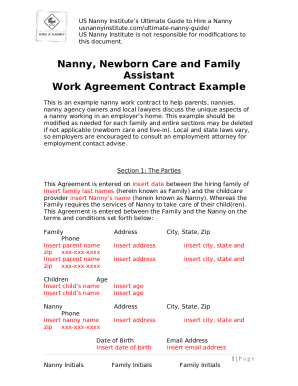

How to fill out the Angel Investor Contract Template

-

1.Download the Angel Investor Contract Template from pdfFiller.

-

2.Open the document in pdfFiller's editor.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the names and addresses of both the startup and the angel investor in the designated fields.

-

5.Specify the amount of investment that the investor is providing.

-

6.Outline the terms of the investment, including any equity stake or interest rate.

-

7.Include any special conditions, such as milestones or performance indicators that the startup must meet.

-

8.Review the payment terms, detailing when the investment will be made and how funds will be distributed.

-

9.Ensure to provide details regarding confidentiality and any non-disclosure agreements if necessary.

-

10.Lastly, both parties should sign and date the contract where indicated before finalizing the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.