Angel Investors Contract Template free printable template

Show details

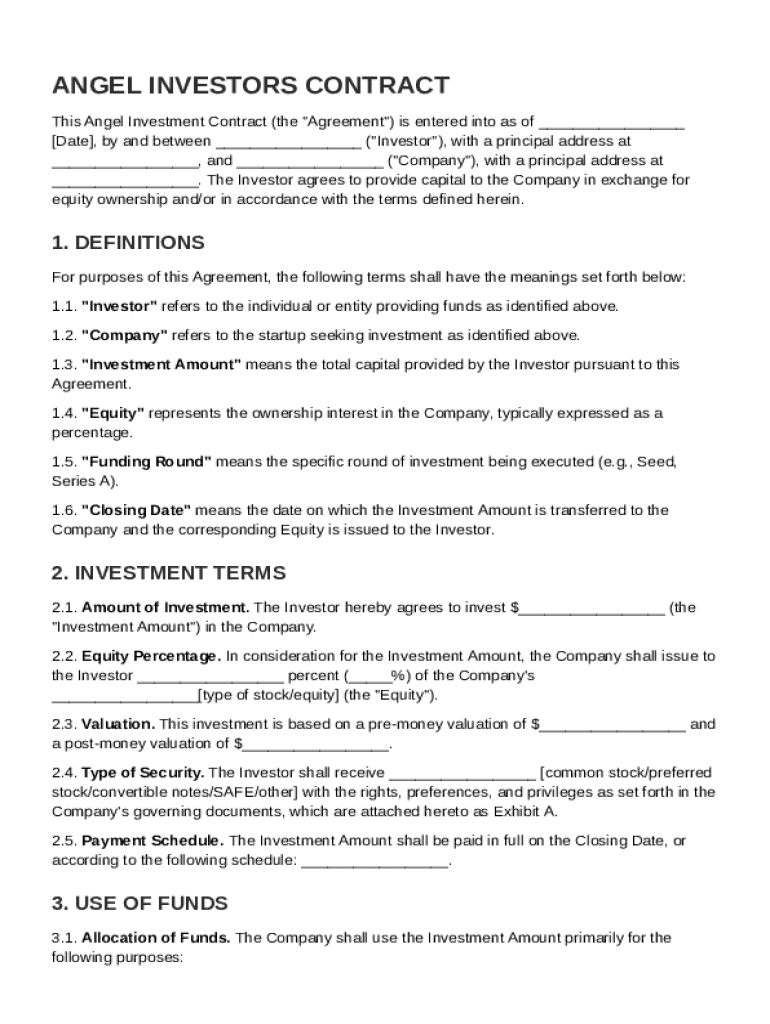

This document outlines the terms and conditions between the Investor and the Company for an investment exchange for equity ownership.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Angel Investors Contract Template

An Angel Investors Contract Template is a legal document used to outline the terms and conditions of investment by angel investors in a startup or early-stage business.

pdfFiller scores top ratings on review platforms

Beginner

they didn't give up on me :-) It's also really easy to use.

good product

good product, makes life easier

i have tried 3 other pdf software for…

i have tried 3 other pdf software for converting and this is by far the easiest one to use and being able to upload/merge 5 docs at time speeds up the process ....amazing - very impressed

Curious if you can straighten a doc

this is a pretty good soft ware i would…

this is a pretty good soft ware i would recommend it to anyone thanks for such a wonderful program.

Who needs Angel Investors Contract Template?

Explore how professionals across industries use pdfFiller.

Angel Investors Contract Template Form

Filling out an Angel Investors Contract Template form requires a clear understanding of the agreement's components and terms. This template will guide you through each section, ensuring that you cover essential elements such as investment amounts, equity ownership, and fund allocation.

What is an Angel Investors Contract?

An Angel Investment Contract is a legal agreement between startups and angel investors, detailing the terms of investment. These contracts are crucial as they help protect both parties' interests and outline the expectations for the investment. A well-crafted Angel Investors Contract Template form typically includes components like investor rights, funding details, and exit strategies.

-

It is a document establishing the relationship between a startup and its investors, outlining the conditions under which funds are provided.

-

Angel investments provide essential capital that can help launch a business, expand operations, or develop products.

-

These include the investment amount, equity stake, rights of the investor, and terms of repayment, if applicable.

What are the key elements of an Angel Investors Contract?

Key elements in an Angel Investors Contract include definitions of vital terms such as the 'Investor,' 'Company,' and 'Investment Amount.' The contract clarifies equity ownership for both parties, indicating how much stake each party receives in exchange for their investment. Furthermore, it highlights the importance of the closing date, noting when the contract becomes effective, and the implications of equity issuance.

-

Defining these terms ensures that both parties have a mutual understanding of their roles and responsibilities.

-

It's essential to specify how much ownership is given in exchange for investment and at what funding stages, ensuring transparency.

-

The closing date marks the contract's official starting point, while equity issuance details how and when equity shares are distributed.

How are investment terms explained?

Investment terms encompass several critical discussions, including the amount of investment, equity percentage, and types of securities offered. Investors need to know how the equity percentage is determined, as this will influence their share in the company during subsequent funding rounds. Furthermore, understanding pre-money vs. post-money valuation and payment schedules is vital for a successful investment.

-

Clarifies how much the investor is willing to put into the business and the anticipated returns.

-

Helps establish how much ownership the investor receives based on the company valuation.

-

Different security types, such as common or preferred stock, can influence investor rights and returns.

-

Details how and when the investment funds will be released to the startup.

How should funds be allocated?

Proper allocation of funds is critical to ensure operational success after investment. Clarifying the use of funds in the contract protects both investors and the startup. It’s essential to delineate budget requirements and expectations for how the capital will be spent on operational needs, product development, or marketing.

-

Clearly capturing where funds will be directed helps in maintaining accountability.

-

Include specific line items to give transparency about expenditure and financial planning.

-

Proper fund allocation fosters stability and growth, ensuring that the startup can meet its goals.

What negotiation strategies should founders and investors use?

Negotiation is a vital aspect of finalizing an Angel Investment Agreement. Founders should understand which points require negotiation and prepare for common pitfalls during the process. This includes discussing equity terms and control rights, ensuring fairness and clarity in intentions.

-

Key areas can include valuation, board representation, and future funding obligations.

-

Be aware of vague terms or unrealistic expectations that can impede agreement.

-

Both parties should enter negotiations seeking mutually beneficial terms, minimizing future conflicts.

How can you customize your Angel Investment Agreement?

While templates provide a solid framework, customizing the Angel Investment Agreement is crucial for unique circumstances. Factors such as the stage of the startup and investor expectations should influence the drafting process. Special clauses can be added to address particular needs between the startup and investor.

-

Customization allows for addressing unique business models, investor preferences, and industry requirements.

-

Consider voting rights, exit strategies, and preferred return terms when crafting your agreement.

-

Examples could include rights of first refusal and anti-dilution clauses.

How can pdfFiller help in managing your Angel Investment Contract?

pdfFiller provides a seamless platform for managing your Angel Investment Contract Template form. With its user-friendly interface, you can access the contract template, customize it as per your needs, and utilize eSign and collaboration features to finalize agreements efficiently.

-

Users can log in to pdfFiller, search for the Angel Investors Contract Template, and select it for editing.

-

With pdfFiller, users can quickly change any section in the templates to fit their unique agreement requirements.

-

Collaborative features allow for real-time updates and signing, ensuring efficient agreement finalization.

How to fill out the Angel Investors Contract Template

-

1.Download the Angel Investors Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the date of the agreement at the top of the document.

-

4.Provide the names and addresses of both the investor and the startup.

-

5.Specify the amount of investment and the form of equity to be issued.

-

6.Detail any stipulations regarding the use of funds by the startup.

-

7.Include terms regarding the investor's rights and obligations.

-

8.Add any conditions under which the investment may be refunded or terminated.

-

9.Review all filled sections for accuracy and completeness.

-

10.Save the completed document and consider seeking legal advice before signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.