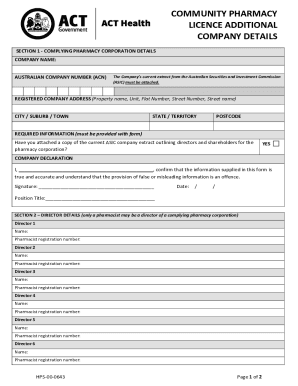

Auto Payment Contract Template free printable template

Show details

This document establishes the terms and conditions for automatic payments authorized by the customer to the company for goods or services.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Auto Payment Contract Template

An Auto Payment Contract Template is a legal document that outlines the terms and conditions for automated payment arrangements between a service provider and a client.

pdfFiller scores top ratings on review platforms

pdf filler does not desktop version to drop the files in the desktop intead of uploading all the times

Enjoying PDFFiller, but need to learn more about features

So far it's been pretty good although I haven't figured everything out yet as far as the features but I'm working on it. I like it so far though for what I needed it for. I will continue to pay for my subscription and continue using the service. Thanx your service has been and will continue to be a BIG HELP to me.

great help.. used it more than anticipated!

Needed it for filling in a form. Worked as well as could be expected.

It is so "user friendly!" Thank you.

Who needs Auto Payment Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Auto Payment Contract Templates

How do auto payment contracts work?

An auto payment contract is a legal document that authorizes recurring payments from a customer's account to a company for services or goods. Such agreements streamline financial transactions, ensuring that payments are made on time without the need for manual intervention. This is especially common in industries like utilities, subscriptions, and financial services.

Having a clear auto payment contract is vital to outline the terms of the agreement, protect the interests of both parties, and facilitate smooth transactions. These contracts are commonly used in situations such as automatic bill payments or subscription services where regular payments are essential.

What are the key components of an auto payment agreement?

-

It should include clear terms outlining payment amounts, frequency, and duration, which help avoid misunderstandings.

-

The contract should delineate the responsibilities of both the customer and the company in the payment process.

-

Define crucial terms such as 'Customer' and 'Company,' including their responsibilities and rights within the agreement.

-

Specify the type of payments accepted, whether through bank transfers, credit cards, or other means.

-

Clearly establish the payment timing and amounts to avoid disputes related to payment processing.

How can you craft your auto payment contract step-by-step?

-

Start with the effective date and both parties' names and addresses to clarify who is involved.

-

Specify how payments will be made, including relevant bank or credit card details.

-

Define how often payments will occur—weekly, monthly, etc.—and when the first payment is due.

-

Decide whether the amounts will be fixed or variable and indicate this in the agreement.

What is the customer authorization process?

Authorized consent is a critical step in activating auto payment contracts. This process requires customers to provide clear, unambiguous consent within the document itself, ensuring they understand and agree to the payment obligations.

-

Detailing the acceptable payment methods within the contract helps prevent future complications.

-

It's essential to inform customers of any updates or changes to the payment terms to maintain trust and compliance.

How to ensure payment details clarity?

-

Detail the intervals between payments, clearly outlining recurring charges to ensure no confusion arises.

-

Include definitions for both fixed and variable amounts to help customers keep track of their financial commitments.

-

Provide procedures within the contract to change the withdrawal amounts or schedules when necessary.

How do you update payment information in your contract?

-

Outline the steps a customer must take to notify their payment method changes, such as filling out a new form.

-

Specify how much notice is necessary before a payment method can change to help prevent missed payments.

-

Explain what could happen if a payment method isn't updated—e.g., late fees or service interruptions.

How can pdfFiller assist in creating your auto payment contract?

pdfFiller provides a comprehensive platform for creating and managing auto payment contracts. It enhances the process by allowing users to collaborate in real-time and use eSignature capabilities, making it easy to finalize agreements without the need for physical paperwork.

-

A cloud solution fosters collaboration and helps track changes efficiently, ensuring that all parties are on the same page.

-

The platform offers tools for editing, signing, and managing contracts effectively, streamlining document handling.

How to fill out the Auto Payment Contract Template

-

1.Open the Auto Payment Contract Template on pdfFiller.

-

2.Begin by entering the name of the service provider at the top of the document.

-

3.Next, fill in the client's name and contact information in the designated fields.

-

4.Specify the details of the service or product that requires automatic payment.

-

5.Set the payment amount and specify the frequency (weekly, monthly, etc.) in the respective sections.

-

6.Indicate the start date for the auto payments and the duration of the contract.

-

7.Review the terms outlined in the template regarding cancellation and modifications to the contract.

-

8.Include any stipulations regarding late payments or fees as needed.

-

9.Ensure both parties sign and date the document at the bottom before finalizing.

-

10.Save the completed contract and consider sending copies to all signatories.

How do I write a payment plan agreement template?

A Payment Plan Agreement should include the following details: Names and contact information of both the creditor and debtor. Description of the debt being repaid. Total amount owed. Payment schedule, including due dates and amounts. Interest rate (if applicable) Consequences of late or missed payments.

How do you write a contract agreement for payment?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How to make a payment plan agreement?

Drafting the payment plan agreement Brainstorm payment plan parameters and write them down. Identify key terms and conditions applicable to both parties. Draft a payment plan agreement with all the details noted in the previous step. List the payment plan schedule and payment amounts.

How to write up a contract for payment template?

A well-crafted payment agreement template should include the following key elements: Identification of parties: Clearly state the full legal names and contact information of the debtor and creditor. Loan details: Specify the loan amount, interest rate (if applicable), and the purpose of the loan.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.