Bank Loan Contract Template free printable template

Show details

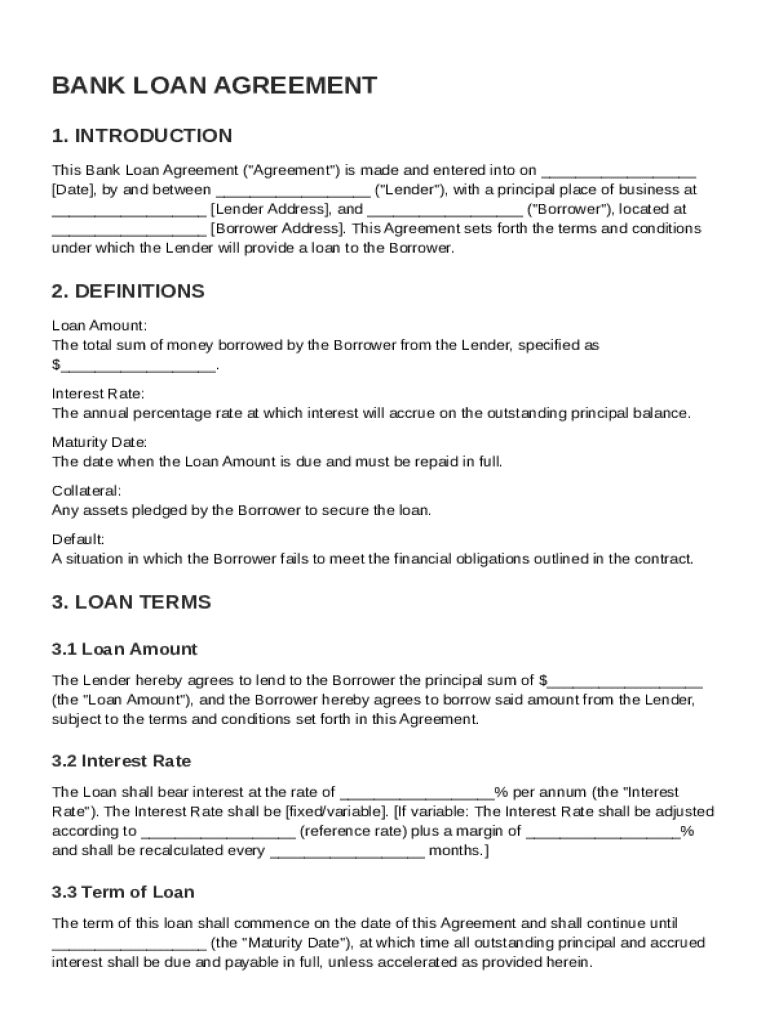

This document outlines the terms and conditions under which a lender provides a loan to a borrower, including loan amount, interest rate, repayment schedule, collateral, and default conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Bank Loan Contract Template

A Bank Loan Contract Template is a formal document outlining the terms and conditions of a loan agreement between a borrower and a lending institution.

pdfFiller scores top ratings on review platforms

so far so good

so far so good! Seems very well done and professional.

great tool

great tool. very intuitiv

Excelent Tool the best tha I test

Excelent Tool the best tha I test

It was much easier organizing the…

It was much easier organizing the pages. I did not have the function to crop.

very powerful and very user-friendly.

very powerful and very user-friendly.

Easy and useful

easy, effective and very useful. Great sales collateral tool.

Who needs Bank Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on Bank Loan Contract Template Forms

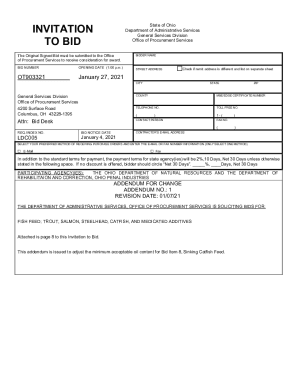

What is a bank loan agreement?

A bank loan agreement is a legally binding contract between a lender, typically a bank or financial institution, and a borrower. This document outlines the terms of the loan, including the amount borrowed, the interest rate, repayment schedule, and penalties for non-compliance. Having a formal bank loan contract is crucial, as it protects both parties and ensures clarity regarding obligations.

What are the key components of a bank loan agreement?

-

This section includes the names and contact information of both the lender and borrower.

-

The total amount being borrowed, which is critical for determining repayment terms.

-

Specifies whether the loan has a fixed or variable rate, impacting how much the borrower will pay over time.

-

The date on which the loan must be fully repaid, signifying the loan's term length.

-

Assets pledged by the borrower to secure the loan, which can be seized in case of default.

-

Outlines borrower obligations and the consequences of failing to meet them.

How do you fill out a bank loan agreement?

-

Gather details such as the lender and borrower information. This ensures accurate representation.

-

Accurately document the loan amount and interest rate type to avoid future disputes.

-

Include specific assets referenced as collateral to secure the loan.

-

Clearly state the maturity date, as this establishes the loan repayment timeline.

-

Choose a repayment plan that fits both parties' needs, detailing payment frequency and amounts.

How to edit and customize your bank loan agreement?

-

Take advantage of pdfFiller to easily modify your bank loan agreement online.

-

Personalize your contract by including or excluding clauses based on specific needs.

-

Clearly state terms that are essential to your agreement to avoid confusion.

-

Utilize eSigning and sharing features to facilitate collaboration with relevant parties.

What to do after completing your bank loan agreement?

-

Leverage pdfFiller to manage and securely store your completed bank loan agreement.

-

Monitor due dates and payment compliance to avoid penalties.

-

Understand your rights and remedies in case of a default to protect your interests.

What legal and compliance considerations should you keep in mind?

-

Familiarize yourself with local laws governing loan agreements to ensure legal compliance.

-

Be aware of potential mistakes that can lead to disputes or invalid contracts.

-

Seek expert advice when drafting complex agreements or when uncertainties arise.

How to fill out the Bank Loan Contract Template

-

1.Start by accessing the Bank Loan Contract Template on pdfFiller.

-

2.Review the template to understand the sections included, such as loan amount, interest rate, repayment schedule, and borrower obligations.

-

3.Click on the text fields to enter necessary information, including personal or business details, loan purpose, and terms.

-

4.Fill in the loan amount you are requesting, ensuring it fits your financial needs and repayment ability.

-

5.Specify the interest rate, ensuring it is in line with market rates and lender policies.

-

6.Outline the repayment schedule detailing how often payments will be made and the length of the loan.

-

7.Include any collateral information if applicable, to secure the loan with an asset.

-

8.Read through the entire document carefully, checking for any errors or missing information before finalizing.

-

9.Once completed, save your document and download or print it for signing and submission to the lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.