Borrow Money Contract Template free printable template

Show details

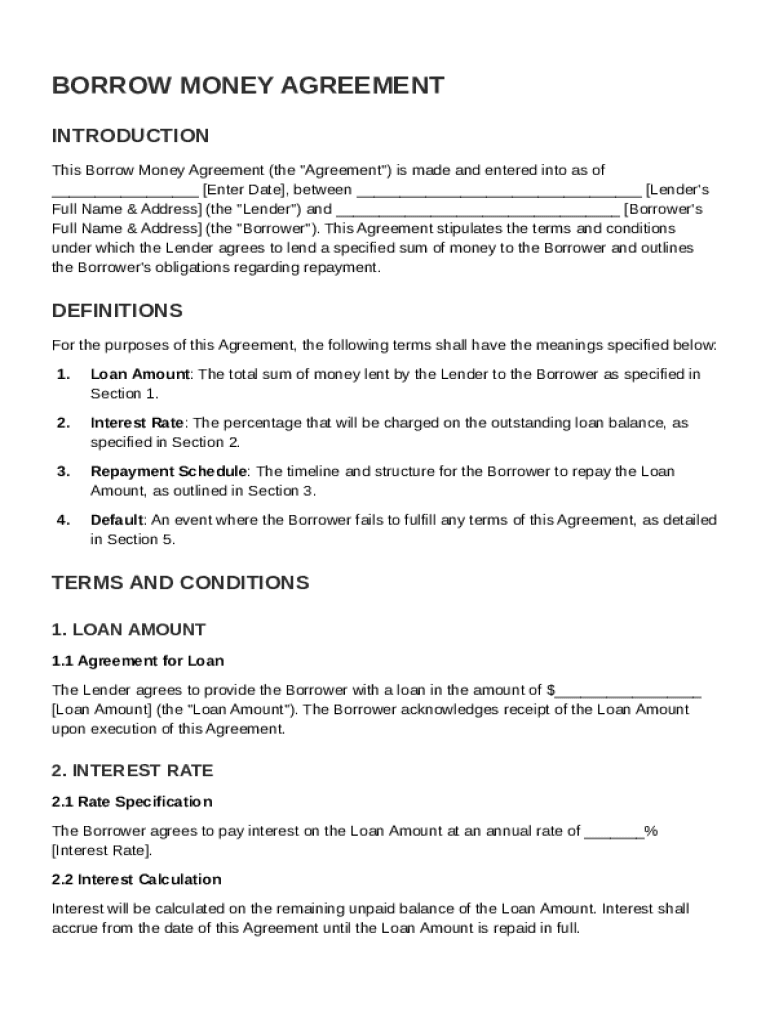

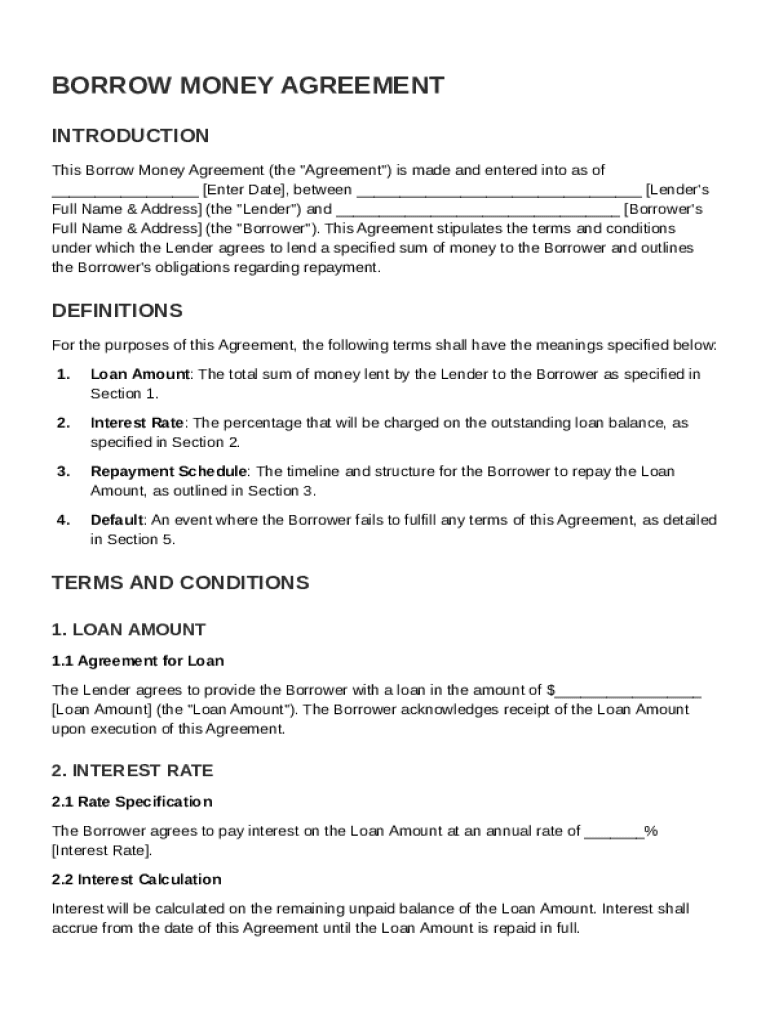

This document outlines the terms and conditions for a loan agreement between a lender and a borrower, including loan amount, interest rate, repayment schedule, and consequences of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Borrow Money Contract Template

A Borrow Money Contract Template is a legal document outlining the terms and conditions under which one party lends money to another party.

pdfFiller scores top ratings on review platforms

its a very easy and fast way to edit photos documents and other papers its an app that allows you to print or edit in any way.

Just started using it and I love it so far

Was good for someone with no training. So far satisfied.

great!

good

great

Who needs Borrow Money Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Borrow Money Contract Template

How to fill out a Borrow Money Contract Template form?

To fill out a Borrow Money Contract Template form, start by clearly defining the loan amount, interest rate, and repayment schedule. Include essential terms and customize the template using tools like pdfFiller. Once completed, ensure both parties eSign the document for legal validity.

Understanding the borrow money agreement

A Borrow Money Agreement outlines the terms of a loan between a borrower and lender. This essential document helps protect the interests of both parties. It provides a framework that defines the responsibilities associated with the loan, including repayment and interest, making it crucial for formal lending relationships.

-

A Borrow Money Agreement is a lawful contract outlining loan terms. It is often used in personal and business finance.

-

Having a formal agreement reduces misunderstandings and provides clear guidelines for repayments.

-

This agreement is prevalent among friends, family, or business associates lending or borrowing money.

What are the key terms in a borrow money agreement?

Understanding key terms is essential when drafting a Borrow Money Agreement. Familiarizing yourself with these concepts can prevent potential disputes and enhance clarity in the agreement.

-

This refers to the total sum of money being borrowed, which must be explicitly stated to avoid future confusion.

-

The percentage charged on the loan amount, indicating how much extra the borrower must repay over time.

-

This specifies when payments are due, helping borrowers budget their finances efficiently.

-

Failure to fulfill the loan terms, typically resulting in adverse consequences like interest penalties or legal action.

How do you complete a borrow money agreement?

Completing a Borrow Money Agreement involves several critical steps that ensure all parties involved understand their obligations. Each step must be executed carefully to avoid errors or omissions.

-

Assess your financial needs realistically and ensure you factor in ability to repay without strain.

-

Research typical rates to avoid charging excessively high or low rates which could lead to disputes.

-

Outline specific payment dates and amounts to simplify the repayment process.

-

Consider including clauses regarding default, late fees, or changes in interest rates.

How to use pdfFiller for your borrow money agreement?

pdfFiller streamlines the creation and management of your Borrow Money Agreement. Utilizing its user-friendly platform simplifies the editing and eSigning processes significantly.

-

Navigate pdfFiller’s library to find customizable Borrow Money Contract Template that suits your needs.

-

Utilize various editing tools for filling out and personalizing the template efficiently.

-

Send your completed agreement for eSigning, ensuring all parties can sign conveniently online.

-

Use collaborative features to allow multiple users to edit or comment on the document, enhancing teamwork.

What legal considerations and compliance should you be aware of?

Legal compliance is crucial for the enforceability of your Borrow Money Agreement. Each region may have specific laws governing such contracts, making it essential to do thorough research.

-

Understanding your local laws can protect both the lender and borrower, ensuring the agreement holds up in court.

-

Include essential contractual elements like mutual consent and the purpose of the loan.

-

Be cautious of vague terms and conditions, as they may lead to misinterpretations in the future.

How to manage your borrow money agreement?

Managing your Borrow Money Agreement effectively can help maintain positive relations and ensure timely repayments. Awareness of the terms and proactive communication are key.

-

Use pdfFiller's management features to track payment statuses and remind borrowers of upcoming due dates.

-

If a borrower defaults, refer to the terms in your agreement regarding penalties or late fees.

-

Open communication is vital; discuss openly any changes in circumstances that may require renegotiation.

How to fill out the Borrow Money Contract Template

-

1.Download the Borrow Money Contract Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by filling in the lender's name and contact information at the top of the document.

-

4.Next, enter the borrower's name and contact information in the designated section.

-

5.Input the loan amount in the appropriate field to specify how much money is being borrowed.

-

6.Clearly state the interest rate, if any, that will apply to the loan.

-

7.Designate the repayment schedule, including due dates and any applicable penalties for late payments.

-

8.Include any collateral or guarantees that may be required for securing the loan.

-

9.Review the document for accuracy and completeness, ensuring all parties agree on the terms outlined.

-

10.Finally, print the document for both parties to sign, and consider keeping a copy for your records.

How to write a contract agreement for borrowing money?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How do you write a note to borrow money?

What do I need to write a promissory note? Names and contact information of the borrower and lender. Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. Loan details. Collateral (if applicable) Consequences of default. Governing law. Signatures.

What is a short term financing agreement?

A short term credit agreement is a contract between a lender and a borrower in which the borrower agrees to repay the loan within a set period of time. This type of agreement is typically used for short-term financing, such as bridge loans or lines of credit.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.