Business Investment Contract Template free printable template

Show details

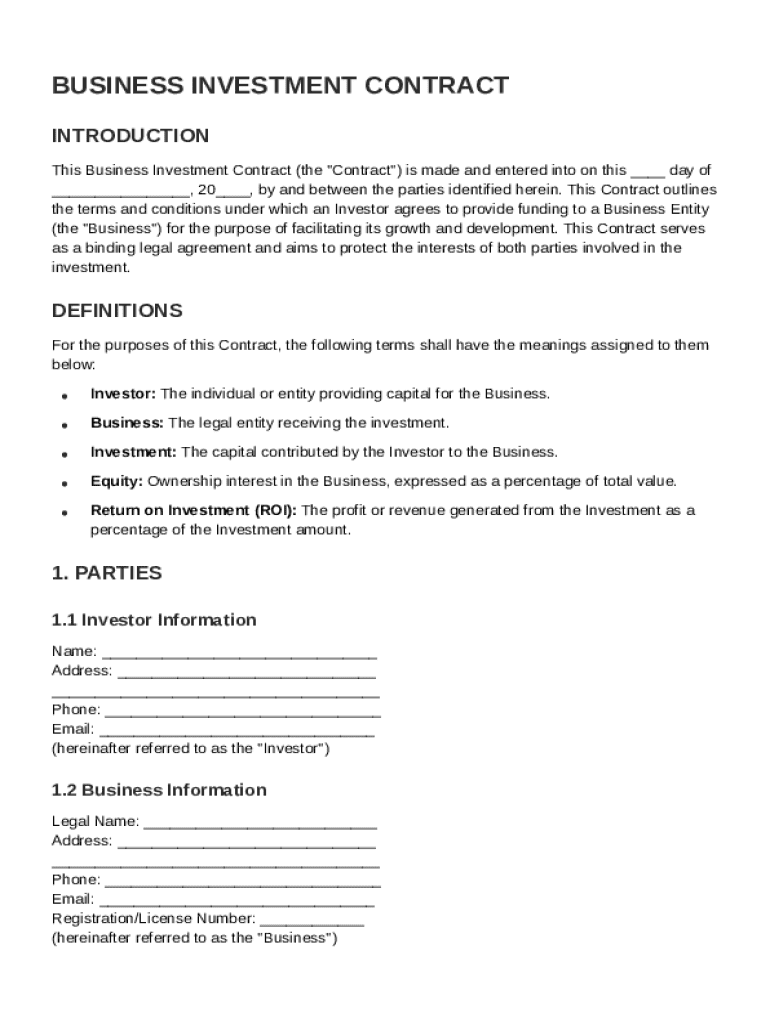

This document outlines the terms and conditions under which an Investor provides funding to a Business Entity for its growth and development, serving as a binding legal agreement.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Business Investment Contract Template

A Business Investment Contract Template is a legal document that outlines the terms and conditions of an investment agreement between parties.

pdfFiller scores top ratings on review platforms

Easy to use

Simplify your workload while taking care of the real deals

I like it

This is a great site, It has every document that is needed for many different things.

It takes a bit to figure out where everything is but it is a useful tool.

It's really good

Who needs Business Investment Contract Template?

Explore how professionals across industries use pdfFiller.

How to create a Business Investment Contract Template Form

Creating a Business Investment Contract Template form can streamline the investment process significantly for both the investor and the business seeking funds. This guide will walk you through the essential components and considerations needed to draft a comprehensive contract.

Understanding the purpose of a Business Investment Contract

-

A Business Investment Contract serves as a formal agreement to secure funding from investors, clearly defining terms and conditions.

-

It safeguards the interests of both the investor and the business, ensuring that all parties are aware of their rights and obligations during the investment process.

What are key definitions in the contract?

-

An Investor is defined as any individual or entity that provides capital to a business in exchange for equity or debt.

-

A Business refers to the legal entity seeking investment, which can be structured as a corporation, partnership, or limited liability company.

-

Investment signifies the capital provided to the business, which may include cash, assets, or other resources.

-

Equity represents ownership percentages granted to investors, directly impacting their influence and returns.

-

ROI is a performance measure used to evaluate the efficiency of the investment, often expressed as a percentage.

Who are the parties involved in the Business Investment Agreement?

-

The contract should include the investor's name, contact information including address, phone number, and email for effective communication.

-

The business should provide its legal name, address, contact details, and relevant registration or license numbers to substantiate its legitimacy.

-

Clarifying the roles of each party helps establish responsibilities and expectations within the investment process.

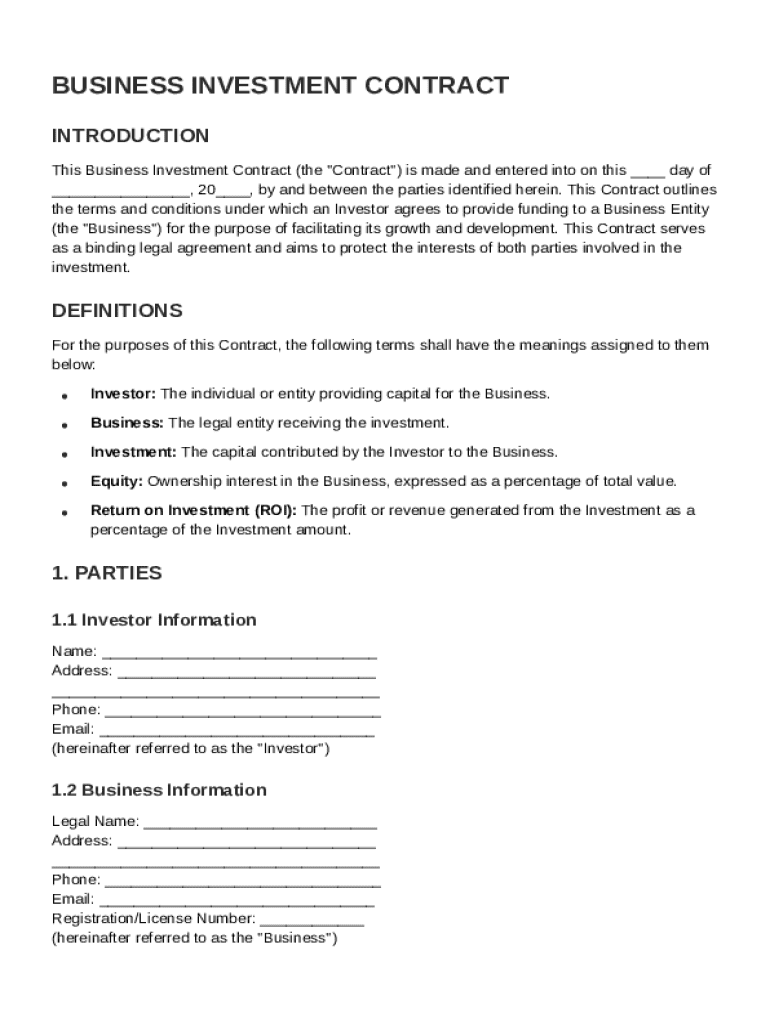

What are the investment details and outline of terms?

-

Clearly state the amount of investment to avoid misunderstandings and set financial expectations.

-

Different investment types include equity, debt, or convertible notes; understanding these options is critical for informed decision-making.

-

Outline the payment structure, whether it be a lump sum or installment payments, including timelines for each disbursement.

How is ownership structure defined and rights distributed?

-

Detail the ownership percentages after the investment is made, which impacts control over the business.

-

Discuss the implications of ownership percentages on decision-making processes within the business.

-

Clarify how profits and distributions will be shared among shareholders to avoid future conflicts.

What are the dissolution and termination clauses?

-

Detail the specific conditions that would warrant the dissolution of the Business Investment Contract.

-

Explain the procedures involved in terminating the contract, as well as the potential impacts on all parties.

What are non-disclosure and non-competition agreements?

-

Non-disclosure agreements protect sensitive business information from being disclosed to unauthorized parties.

-

Non-competition clauses help maintain business interests by preventing investors from engaging with competitors.

Why is signature and legal binding important?

-

Signing the Business Investment Contract indicates that all parties agree to the terms and are legally bound by them.

-

Digital signature options through platforms like pdfFiller simplify the signing process and maintain legal validity.

In conclusion, a well-structured Business Investment Contract Template form is essential for ensuring clarity and protection for all parties involved in an investment. By following this guide and utilizing tools from pdfFiller, you can create an effective contract that meets your specific needs.

How to fill out the Business Investment Contract Template

-

1.Download the Business Investment Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the names and contact details of all parties involved in the investment in the designated fields.

-

4.Specify the total investment amount in the relevant section.

-

5.Detail the terms of the investment, including any repayment timelines and interest rates if applicable.

-

6.Outline the roles and responsibilities of each party in the investment agreement.

-

7.Include any additional terms and conditions that apply to the investment as necessary.

-

8.Review the completed template to ensure all information is accurate and complete.

-

9.Save your changes and download the document, or share it directly with the involved parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.